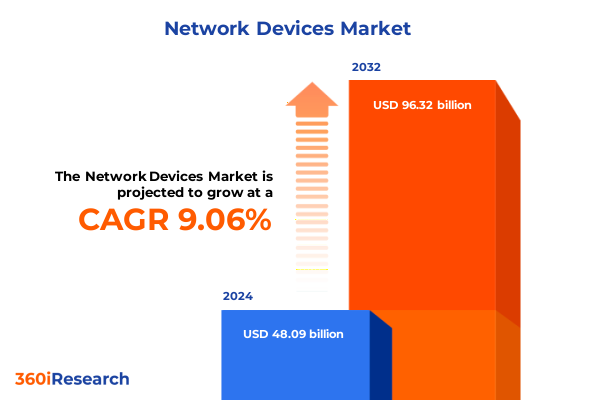

The Network Devices Market size was estimated at USD 52.38 billion in 2025 and expected to reach USD 57.05 billion in 2026, at a CAGR of 9.09% to reach USD 96.32 billion by 2032.

Unveiling the Strategic Imperative and Market Dynamics Shaping the Future of Network Devices Across Industry Verticals and Use Cases

In the current era of digital transformation, network devices serve as the critical backbone of enterprise connectivity, enabling seamless communication and data exchange across diverse industry landscapes. High-performance switches, routers, wireless access points, security appliances, and load balancers collectively form the infrastructure that supports cloud computing, edge services, Internet of Things deployments, and increasingly distributed workforce demands. The imperative for organizations to deliver reliable, scalable, and secure network environments has never been greater, as data volumes continue to surge and latency-sensitive applications become standardized across sectors.

Against this backdrop, the market dynamics governing network devices are shaped by converging pressures: the need for higher throughput, the demand for integrated security, the desire for simplified management, and the drive toward cost efficiency. As organizations leverage hybrid IT architectures, they require interoperable hardware and software solutions that can adapt to rapid changes in workload distribution. Consequently, vendors are innovating in programmable and software-defined networking to provide granular control and real-time analytics. In turn, decision-makers face the challenge of evaluating complex portfolios, aligning technical specifications with business outcomes, and ensuring that infrastructure investments deliver both performance headroom and long-term resilience.

Exploring the Profound Technological Advances and Market Disruptions That Are Reshaping the Network Devices Landscape for Modern Enterprises

The network device landscape is undergoing transformative shifts driven by technological breakthroughs and evolving operational paradigms. Software-defined networking and network function virtualization have decoupled control and data planes, allowing organizations to deploy services with unprecedented agility. This architectural shift is enhanced by the adoption of cloud-native networking frameworks, which enable dynamic scaling, automated policy enforcement, and seamless integration with containerized environments.

Furthermore, the proliferation of 5G connectivity and edge computing has extended network perimeters, prompting vendors to embed intelligence at access points and micro data centers. Simultaneously, the infusion of artificial intelligence and machine learning into network management is reshaping fault detection, traffic optimization, and predictive maintenance. These capabilities not only reduce human intervention but also unveil deeper insights into usage patterns and emerging security threats. Combined with the convergence of security functions into unified platforms, network devices are evolving into holistic enablers of digital transformation, ensuring that enterprises can respond swiftly to market disruptions and scale operations with confidence.

Assessing the Ripple Effects of 2025 United States Tariffs on Network Device Supply Chains, Pricing Structures, and Competitive Positioning Globally

Since the implementation of the 2025 tariff adjustments by the United States government, network device manufacturers and end-users have navigated a complex web of cost pressures and supply chain realignments. Tariffs applied to certain hardware components have led some vendors to reassess sourcing strategies, pivoting toward alternative manufacturing hubs or negotiating bulk purchase agreements to mitigate incremental expenses. Consequently, inventory management practices have evolved to emphasize just-in-time delivery and greater transparency across component origins.

Moreover, the ripple effects have extended to pricing structures, with organizations recalibrating total cost of ownership analyses to account for potential duty fluctuations. In parallel, some vendors have accelerated investments in localized production lines and collaborative partnerships with domestic suppliers to shield clients from future policy shifts. Despite these adjustments, long-term strategic roadmaps have prioritized value differentiation over cost competition, resulting in feature-rich product portfolios designed to deliver performance and security assurances. As a result, stakeholders across the ecosystem are finding that adaptive procurement models and proactive geopolitical risk assessments are essential to maintaining operational continuity and competitive agility.

Illuminating Key Segmentation Trends Across Switches, Routers, Wireless LAN Equipment, Security Appliances, and Load Balancers in Network Infrastructure

Network device offerings can be understood through multiple lenses, each revealing unique insights into buyer preferences and deployment scenarios. When examining switches, the landscape divides into managed and unmanaged variants, with the former category further defined by gigabit and ten-gigabit performance tiers while the latter class features both gigabit and ten-gigabit simplicity-focused products. This segmentation underscores the dual market need for robust traffic orchestration alongside plug-and-play connectivity in smaller or cost-sensitive environments.

Likewise, router solutions segment into enterprise-grade platforms that address complex policy, security, and traffic engineering demands, and service provider variants optimized for high-throughput backbone and edge routing tasks. Wireless LAN equipment splits into access points-tailored to indoor office or outdoor campus environments-and controllers, which can be deployed as cloud-based management systems or dedicated hardware units housed on-premise. Together, these elements facilitate the extension of seamless wireless coverage with centralized policy enforcement.

Security appliances further diversify the market into firewall, intrusion prevention system, and virtual private network devices, each offering specialized capabilities: next-generation and unified threat management within the firewall category; network-based and wireless intrusion prevention across IPS; and remote access alongside site-to-site capabilities in the VPN domain. Finally, load balancing solutions bifurcate into hardware appliances engineered for ultra-low latency and software-based platforms that integrate readily into virtualized or containerized environments. Each segment reflects a tailored response to the evolving performance, security, and management requirements of modern networks.

This comprehensive research report categorizes the Network Devices market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Device Type

- Application Area

- End User

Delving into Regional Market Nuances and Growth Drivers Across the Americas, Europe, Middle East and Africa, and Asia-Pacific Network Device Markets

Distinct regional characteristics drive network device demand, revealing strategic priorities and growth trajectories across global markets. In the Americas, digital infrastructure modernization and cloud migration initiatives remain central. Organizations prioritize high-capacity switches and advanced security appliances to support remote workforces and distributed data centers. Infrastructure investments in hyperscale cloud facilities continue to stimulate demand for scalable routers and load balancers capable of facilitating massive east-west traffic flows.

Conversely, Europe, the Middle East, and Africa present a mosaic of regulatory landscapes and technology adoption curves. Stringent data protection laws in Europe amplify the importance of built-in security and compliance capabilities, spurring investment in unified threat management and network intrusion prevention. At the same time, telecom-led digitalization efforts in the Middle East fuel demand for service provider routers and outdoor wireless access points to drive smart city and connectivity projects.

Meanwhile, Asia-Pacific remains a hotbed of rapid expansion and innovation. Accelerated 5G deployments and government-sponsored digital transformation programs are catalyzing purchases of gigabit-level switches, cloud controllers, and next-generation firewalls. The region’s diverse economic landscape, encompassing established markets such as Japan and emerging economies across Southeast Asia, continues to offer opportunities for both premium and cost-optimized network device solutions.

This comprehensive research report examines key regions that drive the evolution of the Network Devices market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Industry-Leading Network Device Manufacturers and Their Strategic Initiatives Driving Innovation, Differentiation, and Market Penetration

The competitive environment in network devices is characterized by a cadre of industry leaders advancing differentiated strategies. Leading vendors are deploying modular architectures that facilitate rapid feature upgrades, while investing heavily in artificial intelligence engines that automate configuration, anomaly detection, and performance optimization. Strategic acquisitions have further bolstered product ecosystems, enabling end-to-end portfolio integration-from campus networking to data center and multi-cloud environments.

In addition, many top firms are forging deeper partnerships with cloud service providers and systems integrators to co-develop turnkey solutions that accelerate time to value for end-customers. These collaborative models emphasize pre-validated designs that unify hardware and software stacks, reducing deployment complexity. At the same time, agile newcomers are carving out niches by specializing in open-source network operating systems and white-box hardware, appealing to organizations seeking to avoid vendor lock-in and gain greater cost control.

Concurrently, security-focused players are innovating at the intersection of networking and threat prevention, embedding intrusion prevention, sandboxing, and advanced threat intelligence directly into routers and switches. This convergence underscores the industry’s recognition that network devices must evolve from passive conduits into proactive guardians of digital assets.

This comprehensive research report delivers an in-depth overview of the principal market players in the Network Devices market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- A10 Networks, Inc.

- Adtran, Inc.

- Alcatel-Lucent Enterprise

- Allied Telesis, Inc.

- Arista Networks, Inc.

- Aruba Networks

- Brocade Communications Systems, LLC

- Check Point Software Technologies Ltd.

- Ciena Corporation

- Cisco Systems, Inc.

- Dell Technologies Inc.

- Extreme Networks, Inc.

- F5 Networks, Inc.

- Fortinet, Inc.

- Hewlett Packard Enterprise Company

- Huawei Technologies Co., Ltd.

- Juniper Networks, Inc.

- Mellanox Technologies, Ltd.

- MikroTikls SIA

- NETGEAR, Inc.

- Nokia Corporation

- Palo Alto Networks, Inc.

- Ruckus Networks

- TP-Link Technologies Co., Ltd.

- Ubiquiti Inc.

- ZTE Corporation

Presenting Action-Oriented Strategies and Tactical Recommendations for Industry Leaders to Capitalize on Emerging Network Device Opportunities and Mitigate Risks

To navigate the complexities of today’s network device ecosystem, industry leaders should prioritize the adoption of software-defined and programmable networking platforms. By implementing infrastructure with open APIs and controller-based management, organizations can achieve real-time policy enforcement and streamlined orchestration across hybrid and multi-cloud environments. In parallel, investing in AI-driven analytics will allow network operations teams to proactively identify bottlenecks and potential security risks before they impact performance.

Moreover, diversifying component sourcing and developing robust geopolitical risk frameworks will mitigate the impact of future tariff shifts or supply shortages. Establishing regional manufacturing or assembly capabilities can further strengthen resilience. Equally important is the integration of zero-trust security models into network architectures, ensuring that every device, user, and application is continuously validated and monitored.

Strategic alliances with hyperscale cloud providers, system integrators, and software vendors can accelerate go-to-market cycles and deliver differentiated, pre-integrated solutions to end-customers. Finally, focusing pilot deployments on edge computing use cases-such as micro-data centers, IoT gateways, and 5G-enabled applications-will position organizations to capture early mover advantages in emerging segments.

Detailing the Comprehensive Research Framework, Data Collection Methods, and Analytical Techniques Underpinning the Network Device Market Study

The research underpinning this study employs a multifaceted methodology to ensure comprehensive, reliable insights. It begins with an in-depth review of publicly available technical documents, regulatory filings, white papers, and patent databases to establish a detailed understanding of product architectures, feature roadmaps, and industry standards. Supplementing this secondary research, dozens of structured interviews were conducted with senior technical decision-makers, network architects, and supply chain specialists to validate findings and gain firsthand perspectives on investment priorities and operational challenges.

Quantitative data collection encompassed shipment and revenue figures sourced from vendor reports, industry associations, and shipment tracking services, with rigorous triangulation across multiple databases to enhance accuracy. Qualitative analysis involved vendor benchmarking, feature comparisons, and case study evaluations to highlight best practices and emerging solution patterns. Throughout the process, expert panels provided peer review, ensuring that interpretations reflected real-world deployment scenarios and evolving market dynamics. Finally, a continuous feedback loop integrated new data points and stakeholder inputs, allowing the research framework to adapt to rapidly changing technological and geopolitical landscapes.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Network Devices market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Network Devices Market, by Device Type

- Network Devices Market, by Application Area

- Network Devices Market, by End User

- Network Devices Market, by Region

- Network Devices Market, by Group

- Network Devices Market, by Country

- United States Network Devices Market

- China Network Devices Market

- Competitive Landscape

- List of Figures [Total: 15]

- List of Tables [Total: 2544 ]

Synthesizing Critical Insights and Conclusions to Empower Decision-Makers in Navigating the Evolving Network Device Ecosystem with Confidence

Drawing upon the insights presented, it is evident that the network device space stands at a pivotal juncture where heightened performance demands coincide with pervasive security imperatives. The convergence of programmable architectures, AI-enhanced management, and region-specific deployment drivers illustrates that success will depend on the ability to embrace agility while safeguarding digital assets. Segmentation analysis reveals that device selection is increasingly nuanced, requiring harmonization of performance tiers with operational complexity and budget constraints.

Equally, the evolving tariff landscape underscores the importance of supply chain resilience and proactive policy monitoring. Regional differences highlight that a one-size-fits-all approach is no longer tenable; instead, organizations must tailor their infrastructure strategies to align with local regulations, technology adoption rates, and growth projections. Competitive dynamics among leading vendors further suggest that partnerships and modular ecosystems will define the next wave of innovation.

Ultimately, decision-makers are called upon to integrate these multidimensional insights into coherent roadmaps-leveraging advanced research to guide procurement, architecture design, and service delivery. By doing so, they can unlock new value streams, enhance operational efficiency, and secure a competitive edge in the rapidly evolving network device arena.

Engage with Ketan Rohom, Associate Director of Sales and Marketing, to Secure In-Depth Network Device Research Insights and Propel Your Strategic Decisions

Engaging with Ketan Rohom offers unparalleled access to comprehensive network device intelligence tailored to your strategic objectives. With a proven track record in guiding high-impact decision-making, he can help you translate intricate market insights into practical business initiatives. By connecting directly with Ketan Rohom, you unlock the opportunity to refine your competitive positioning, optimize your technology roadmap, and accelerate revenue growth within the network devices domain.

Reach out today to secure your full market research report, gain a deeper understanding of segmentation dynamics, regional trends, and company strategies, and empower your organization with the actionable intelligence needed to thrive. Let Ketan Rohom be your trusted partner in navigating the complexities of the network device ecosystem and driving sustainable success across every layer of your infrastructure.

- How big is the Network Devices Market?

- What is the Network Devices Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?