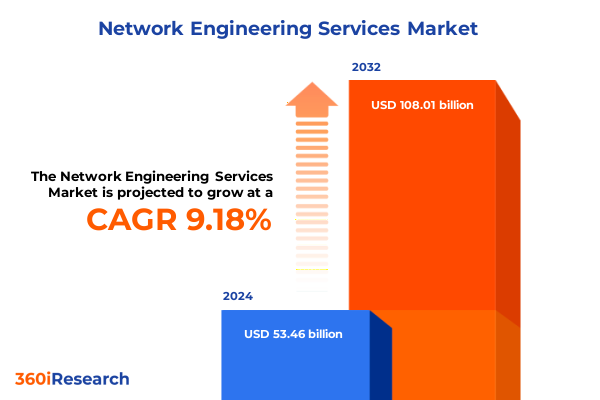

The Network Engineering Services Market size was estimated at USD 58.29 billion in 2025 and expected to reach USD 62.84 billion in 2026, at a CAGR of 9.21% to reach USD 108.01 billion by 2032.

Forging the Foundation of Next-Generation Network Engineering Services to Empower Enterprise Connectivity and Innovation

The network engineering services landscape is at a pivotal juncture, driven by relentless innovation and evolving enterprise requirements. Organizations across sectors are increasingly reliant on agile, scalable, and secure networks to support digital transformation initiatives. As cloud-native architectures mature, the demand for end-to-end connectivity solutions has skyrocketed, prompting service providers to expand their portfolios and capabilities. Consequently, network engineering has shifted from a purely technical discipline to a strategic imperative that underpins overall business agility and growth.

Moreover, the convergence of technologies-ranging from software-defined networking and edge computing to intent-based automation-has redefined traditional network architectures. This convergence demands a holistic approach, integrating consulting, design, implementation, and ongoing maintenance. As enterprises grapple with escalating traffic volumes, stringent compliance standards, and heightened security threats, they are seeking partners who can deliver comprehensive services and managed offerings. By addressing these challenges proactively, service providers can enable organizations to harness the full potential of their network infrastructures.

Navigating Pervasive Technological and Operational Shifts Reshaping the Network Engineering Services Ecosystem at Scale Across Global Enterprises

Technological breakthroughs and shifting operational paradigms are transforming the network engineering services ecosystem across global enterprises. The maturation of software-defined networking and network function virtualization has enabled unprecedented flexibility, allowing rapid deployment of new services without the delays inherent in traditional hardware-centric models. At the same time, the proliferation of edge computing is pushing processing power closer to data sources, reducing latency and enhancing user experiences for real-time applications.

In addition, artificial intelligence and machine learning are revolutionizing network management by automating routine tasks, predicting potential failures, and optimizing traffic flows. Security concerns have also intensified, with distributed denial-of-service attacks and sophisticated phishing campaigns necessitating integrated, end-to-end cybersecurity measures. The rise of multi-cloud environments further underscores the need for seamless interconnectivity and policy-driven governance. Together, these shifts are reshaping operational practices, compelling service providers to adopt agile methodologies and holistic frameworks that deliver both resilience and performance.

Evaluating the Comprehensive Ripple Effects of United States Tariff Policies Introduced in 2025 on Network Engineering Services Supply Chains

The introduction of new United States tariffs in 2025 has created significant ripple effects throughout network engineering services supply chains. Increased duties on imported networking hardware have elevated costs for service providers and end users alike, prompting many organizations to reevaluate their procurement strategies. Some providers have responded by diversifying supplier relationships or investing in nearshoring initiatives to offset higher tariffs, while others are renegotiating contracts with global manufacturers to maintain price stability.

Consequently, these tariff policies have accelerated the shift toward software-centric solutions, as enterprises seek to reduce capital expenditures on physical equipment. Cloud migration strategies have gained traction, driven by the desire to convert up-front hardware investments into predictable operational expenses. This dynamic has also fostered innovation in network virtualization and managed services, enabling organizations to maintain high levels of performance and security without the complexities of asset management. Ultimately, the tariff landscape is catalyzing a more adaptable, software-driven paradigm in network engineering services.

Uncovering Strategic Dimensions Across Service Types End User Industries Organization Sizes Technologies and Deployment Models for Network Optimization

A multifaceted analysis of network engineering services reveals critical dimensions that shape market dynamics and service adoption. Based on service type-encompassing consulting, design, implementation, maintenance & support, and managed services-providers are tailoring offerings to meet varied enterprise needs, from strategic advisory to fully outsourced network operations. Within end user industries such as BFSI, government & defense, healthcare, IT & telecom, and manufacturing, sector-specific compliance mandates and performance requirements drive specialized engagement models and security protocols.

Further granularity emerges when examining organization size, where large enterprises demand scalable, integrated solutions capable of supporting global footprints, while small and medium enterprises prioritize cost-effective deployments with simplified management interfaces. Technological segmentation highlights the rapid uptake of cloud networking and IoT networking alongside established LAN/WAN, SD-WAN, and wireless infrastructures, reflecting the growing importance of connectivity at the edge and within the IoT ecosystem. Finally, the choice between cloud and on-premises deployment models underscores divergent strategies: cloud solutions offer flexibility and reduced capital outlay, whereas on-premises systems deliver control and customization for mission-critical environments.

This comprehensive research report categorizes the Network Engineering Services market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Service Type

- Organization Size

- Technology

- Deployment Type

- End User Industry

Charting Distinct Trends Dynamics and Opportunities Across the Americas Europe Middle East and Africa and Asia Pacific in Network Engineering Services

Regional variations in network engineering services underscore unique market characteristics, regulatory environments, and technological maturity levels. In the Americas, enterprises benefit from mature cloud ecosystems and robust investments in SD-WAN and intent-based networking, driven by high digital adoption rates and flexible funding models. This region’s leading organizations are leveraging advanced analytics and AI-driven management platforms to optimize network performance and predict maintenance requirements.

Contrastingly, Europe, the Middle East & Africa present a mosaic of regulatory frameworks and infrastructure gaps, prompting service providers to focus on interoperability and compliance-centric solutions. Governments and defense agencies demand stringent security measures, while enterprises across diverse industries invest in IoT and edge compute capabilities to address localized challenges. In Asia-Pacific, rapid urbanization and the roll-out of 5G networks are fueling the expansion of wireless infrastructure and SD-WAN deployments. The cost-sensitive nature of many markets in this region has accelerated the adoption of managed services and virtualization strategies to achieve scalable connectivity.

This comprehensive research report examines key regions that drive the evolution of the Network Engineering Services market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Leading Innovators Strategic Partnerships and Competitive Differentiators Driving Growth in Network Engineering Services

Leading players in network engineering services continue to innovate through strategic partnerships, acquisitions, and technology integrations that enhance their competitive positioning. Industry giants are embedding AI-powered analytics into their core offerings, enabling predictive maintenance and real-time performance optimization. Collaborative alliances with cloud hyperscalers and cybersecurity firms are further strengthening end-to-end solution stacks, ensuring seamless connectivity and robust threat prevention.

Emerging specialists are also carving out niches by focusing on vertical markets and tailored use cases. Some firms excel in delivering ultra-low-latency solutions for financial trading floors, while others specialize in secure, high-availability networks for healthcare providers. Across the ecosystem, a common thread is the emphasis on service flexibility-bundling professional services with managed offerings under outcome-based contracts. This shift reflects a growing preference among enterprises for predictable cost structures and guaranteed service levels.

This comprehensive research report delivers an in-depth overview of the principal market players in the Network Engineering Services market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Accenture plc

- ARCADIS Sustainable Networks Solutions B.V.

- Black Box Corporation

- Ciena Corporation

- Cisco Systems, Inc.

- CommScope Holding Company, Inc.

- Dell Technologies Inc.

- ePlus Technology, inc.

- Ericsson

- Fujitsu Limited

- Fujitsu Network Communications, Inc.

- Hewlett Packard Enterprise Development LP

- Huawei Technologies Co., Ltd.

- Integris Global, LLC

- International Business Machines Corporation

- Juniper Networks, Inc.

- Nokia Corporation

- Presidio Networked Solutions Group, LLC

- World Wide Technology, LLC

- ZTE Corporation

Charting Proactive Strategies and Best Practices for Industry Leaders to Capitalize on Emerging Opportunities in Network Engineering Services

Industry leaders should adopt proactive automation strategies to enhance network agility and reduce operational overhead. Leveraging AI-driven AIOps platforms allows for the continuous monitoring and optimization of network performance, minimizing downtime and accelerating incident response. Equally important is the cultivation of hybrid cloud environments that seamlessly integrate on-premises assets with public and private cloud infrastructures, providing the flexibility to adapt to fluctuating workloads and emerging application requirements.

In tandem, establishing strong supplier ecosystems and diversifying vendor relationships can mitigate risks associated with geopolitical shifts and tariff fluctuations. Embedding sustainability criteria into network architecture-such as energy-efficient hardware and green data center practices-aligns with corporate responsibility goals and can unlock long-term cost efficiencies. Finally, investing in workforce development by upskilling engineers on cloud-native and cybersecurity competencies ensures that organizations can fully capitalize on the evolving network services landscape.

Ensuring Rigor and Transparency Through Comprehensive Research Methodology and Robust Data Collection Frameworks for Accurate Network Services Insights

This analysis is grounded in a rigorous research methodology that integrates both primary and secondary data sources. Primary research entailed in-depth interviews with senior network architects, CIOs, and procurement executives across key industries, supplemented by structured surveys to capture quantitative insights on deployment preferences and service priorities. Secondary research leveraged authoritative industry reports, regulatory filings, and technology whitepapers to contextualize trends and validate emerging use cases.

To ensure data accuracy and reliability, findings were triangulated through cross-verification with vendor disclosures, financial statements, and case study documentation. Proprietary frameworks were employed to map service maturity and technological adoption across segments, while quality assurance protocols-including peer reviews and data audits-safeguarded against inconsistencies. This comprehensive approach delivers robust, actionable insights that reflect the current state of the network engineering services market.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Network Engineering Services market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Network Engineering Services Market, by Service Type

- Network Engineering Services Market, by Organization Size

- Network Engineering Services Market, by Technology

- Network Engineering Services Market, by Deployment Type

- Network Engineering Services Market, by End User Industry

- Network Engineering Services Market, by Region

- Network Engineering Services Market, by Group

- Network Engineering Services Market, by Country

- United States Network Engineering Services Market

- China Network Engineering Services Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 954 ]

Concluding Strategic Imperatives and Synthesizing Key Takeaways to Steer Future Network Engineering Service Innovations and Investments

In summary, network engineering services represent a cornerstone for enterprise success in an era defined by digital transformation and connectivity demands. The convergence of cloud, edge, and AI technologies is driving unprecedented flexibility and performance, while emerging challenges-such as tariff-induced cost pressures and cybersecurity threats-necessitate strategic adaptation. Segment-driven insights underscore the importance of tailored service offerings that align with industry-specific requirements, organizational scale, and deployment preferences.

Regional dynamics reveal distinct adoption patterns, with mature markets prioritizing advanced automation and risk mitigation frameworks, and emerging regions embracing wireless and software-defined solutions. Competitive landscapes reflect a blend of established vendors and niche specialists, each contributing to a vibrant ecosystem of innovation. By synthesizing these findings and adhering to a disciplined research methodology, decision-makers can chart informed strategies that harness the full potential of network engineering services, driving operational excellence and sustained growth.

Engage with Ketan Rohom to Unlock Customized Insights Secure Your Market Research Report and Propel Your Network Engineering Strategy Forward Today

To explore unparalleled depth, clarity, and actionable intelligence on network engineering services, connect directly with Ketan Rohom, Associate Director, Sales & Marketing. His expertise in translating complex technical findings into strategic recommendations will ensure you receive a tailored research experience. By engaging with this report, you gain exclusive access to advanced insights, real-world use cases, and comprehensive segmentation analyses that empower decision-makers to make data-driven investments. Take the decisive step to secure your organization’s competitive edge; Ketan will guide you through report options, customization possibilities, and enterprise licensing models. Reach out to initiate your journey toward optimized network performance and innovation leadership-elevate your strategic roadmap today.

- How big is the Network Engineering Services Market?

- What is the Network Engineering Services Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?