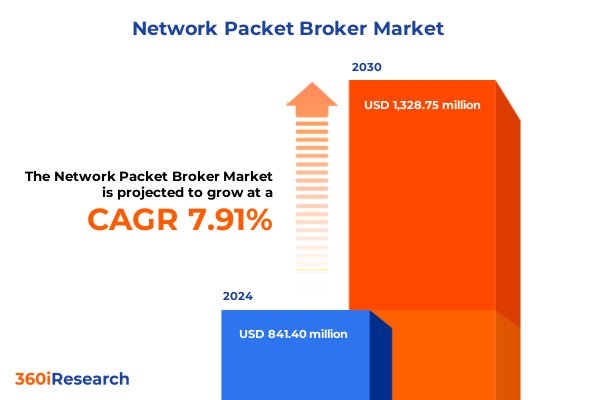

The Network Packet Broker Market size was estimated at USD 904.50 million in 2025 and expected to reach USD 973.42 million in 2026, at a CAGR of 8.09% to reach USD 1,559.77 million by 2032.

Understanding the Critical Role of Network Packet Brokers in Modern Infrastructure for Efficient Data Visibility and Operational Excellence

The rise of data-intensive applications and the proliferation of complex network environments have elevated the strategic importance of network packet brokers. These devices serve as intermediaries that capture, aggregate, and distribute network traffic to performance monitoring, security, and analytics tools, ensuring that organizations maintain deep visibility across physical, virtual, and cloud infrastructures. As enterprises continue to adopt digital transformation initiatives, the demand for real-time insights into network behavior has never been more critical. This executive summary examines the foundational role that network packet brokers play in modern data centers, service provider networks, and distributed edge environments.

In recent years, enterprises and carriers have shifted their emphasis from traditional, siloed monitoring solutions to unified visibility platforms that rely on packet brokers to normalize and filter traffic. Consequently, network operations teams can optimize tool usage by reducing unnecessary load and enhancing the accuracy of threat detection, compliance monitoring, and performance analysis. Moreover, the evolution of encryption technologies and the surge in high-speed links have intensified the need for specialized packet processing, further underscoring the significance of broker appliances. As a result, stakeholders are increasingly prioritizing scalable, high-capacity packet brokers that can seamlessly integrate with multi-vendor monitoring ecosystems, thereby future-proofing their visibility architectures.

How Cloud Native Deployments, AI-Driven Traffic Classification, and Hardware Acceleration Are Redefining Visibility Architectures

The evolution of network architectures and the advent of cloud-native environments have triggered transformative shifts in how organizations deploy and leverage packet brokers. Driven by virtualization and the migration of workloads to public and private clouds, visibility solutions are no longer confined to on-premises hardware. Instead, network packet broker functionality has expanded to include software-defined and cloud-native variants that can be spun up alongside virtual machines and containerized services. As a result, businesses can achieve consistent monitoring across hybrid ecosystems without introducing packet loss or risking blind spots in virtualized traffic flows.

In parallel, the pace of innovation in artificial intelligence and machine learning has permeated visibility frameworks, enabling packet brokers to perform real-time traffic classification, anomaly detection, and dynamic load balancing. Consequently, these intelligent brokers reduce the manual effort typically associated with rule-based filtering and streamline the orchestration of monitoring policies. Furthermore, the transition to multi-gigabit and terabit networks has compelled vendors to integrate advanced hardware offloads such as FPGA and ASIC acceleration, ensuring line-rate performance even under heavy encrypted traffic volumes. Overall, these shifts highlight a broader trend toward convergence between security, performance, and analytics, positioning network packet brokers as indispensable enablers of digital transformation.

Analyzing the Financial and Operational Ramifications of Recent United States Tariff Measures on Packet Broker Deployments

In 2025, United States tariffs on networking equipment originating from certain regions have cumulatively affected the total cost of ownership for packet broker solutions. Import duties imposed earlier this year have primarily targeted components and finished goods imported under network infrastructure categories, leading to price increases for both fixed and modular broker platforms. Consequently, procurement teams have been compelled to reassess vendor sourcing strategies and explore alternative supply chains to mitigate escalating import costs.

Moreover, the ripple effects of these tariffs have extended beyond direct component pricing to influence the availability of spare parts and service support agreements. Extended lead times for chassis modules and line cards have prompted some organizations to maintain higher levels of on-site inventory, thereby tying up working capital. Additionally, the added expense associated with tariff-inclusive pricing models has fueled interest in virtual packet broker offerings, which circumvent hardware import duties by running as software instances within existing compute resources. As a result, many enterprises are balancing the trade-offs between upfront capital expenditures for onsite hardware and the operational flexibility of cloud-resident deployments.

Unveiling Diverse Deployment Archetypes and User Demands Through Product Type Connectivity Port Speed Application Orientation Industry Focus and Organizational Scale

Market segmentation offers a lens through which the diverse requirements of organizations can be understood, revealing distinct demand patterns across product offerings and deployment scenarios. For instance, when evaluating product type, enterprises must decide between fixed network packet brokers that deliver turnkey performance out of the box or modular systems that allow for chassis-based scaling and rack-mounted flexibility as traffic volumes evolve. These modular configurations often appeal to service providers and large enterprises seeking incremental port expansion without forklift upgrades.

Connectivity preferences further shape deployment strategies, with some organizations opting for physical packet broker appliances to handle on-premises traffic aggregation, while others leverage virtual variants for monitoring within private or public clouds. This choice is frequently influenced by architectural objectives, such as maintaining tool convergence across hybrid infrastructures or minimizing physical footprint in edge data centers. The emphasis on port speed also guides procurement decisions, as line rates of 1/10 Gbps remain prevalent in legacy sections of the network while newer segments demand 25/40 Gbps performance, and hyperscale environments push beyond 100 Gbps for high-throughput analytics.

Application-driven segmentation highlights how monitoring requirements vary across use cases. Teams responsible for application performance management depend on broker-level filtering to isolate transaction flows, whereas network forensics and compliance groups require fine-grained packet captures and long-term archives. In addition, security monitoring and threat detection initiatives increasingly rely on broker-enabled decryption and metadata extraction to feed intrusion detection systems, while performance monitoring tools prioritize aggregated metadata streams for capacity planning. The distribution of demand across industry verticals underscores these differences as well: banking, financial services and insurance firms have stringent compliance mandates, healthcare and life sciences organizations focus on patient data protection, telecom and IT sectors emphasize uptime and latency, and retail enterprises seek visibility into e-commerce transaction lifecycles. Finally, organization size informs scaling strategies, as large enterprises typically adopt distributed, multi-tiered broker fabrics, whereas small and medium-sized businesses favor compact, all-in-one appliances to streamline management and cost overheads.

This comprehensive research report categorizes the Network Packet Broker market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Connectivity

- Port Speed

- Application

- Industry Vertical

- Organizations Size

Examining How Regional Regulatory Regimes Infrastructure Maturity and Industry Priorities Shape Packet Broker Adoption Across the Americas EMEA and Asia Pacific

Regional dynamics influence how network packet broker technologies are adopted and customized to address local regulatory frameworks, traffic profiles, and digital transformation maturity. In the Americas, the emphasis remains on consolidating expansive legacy infrastructures with emerging cloud initiatives, resulting in hybrid solutions that blend on-premises brokers supporting colocation facilities and virtual appliances managing multicloud workloads. The regulatory environment in this region, particularly data privacy legislation in North America and evolving cybersecurity directives in Latin America, drives investments in packet-level encryption visibility and compliance reporting capabilities.

Meanwhile, Europe, the Middle East and Africa present a heterogeneous landscape in which advanced economies invest heavily in AI-driven traffic analytics and telco-grade packet processing, whereas emerging markets prioritize cost-effective appliances with simplified management consoles. GDPR and other data sovereignty requirements in European Union jurisdictions compel vendors to provide regionally deployed broker clusters to ensure data residency, while operators in the Middle East and Africa focus on expanding fiber backbones and 5G testbeds, necessitating high-throughput packet brokerage at distributed aggregation points.

In the Asia-Pacific region, rapid digitalization across industries-from smart manufacturing in East Asia to telehealth initiatives in Southeast Asia-has spurred demand for both on-premises and edge-based packet brokers capable of handling variable workloads. Supply chain considerations, such as proximity to hardware manufacturing hubs, have also enabled faster deployment cycles, whereas regulatory regimes across nations impose diverse encryption and interception rules, influencing feature roadmaps and certification requirements for packet broker platforms.

This comprehensive research report examines key regions that drive the evolution of the Network Packet Broker market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Mapping the Competitive Ecosystem of Packet Broker Vendors Demonstrating Hardware Acceleration Integration and Software Native Innovations

A competitive ecosystem of vendors has emerged to address the multifaceted requirements of modern visibility solutions, each bringing unique strengths to the network packet broker arena. Established networking giants have leveraged their broad portfolios to offer packet brokers as part of integrated observability suites, simplifying procurement for organizations seeking unified vendor relationships. Meanwhile, specialized providers continue to innovate at the hardware level, introducing purpose-built ASIC and FPGA accelerators to optimize performance under high encryption workloads.

Additionally, software-centric firms have advanced the capabilities of virtual and container-native brokers, enabling seamless integration with DevOps toolchains and orchestration platforms. This diversity of approaches ensures that buyers can select solutions aligned with their strategic priorities-whether that be the lowest latency packet forwarding, the deepest protocol-level inspection, or the most seamless CI/CD integration path. Partnerships between pure-play broker vendors and monitoring tool developers have further enriched the ecosystem, offering pre-validated tool integrations and reducing deployment timelines for complex, multi-vendor environments.

This comprehensive research report delivers an in-depth overview of the principal market players in the Network Packet Broker market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 5FeetNetworks Oy

- APCON, Inc.

- Arista Networks, Inc.

- BE Networks

- CGS Tower Networks Ltd.

- Cisco Systems, Inc.

- cPacket Networks, Inc.

- Cubro Acronet GesmbH

- Datacom Systems Inc.

- EXTREME NETWORKS, INC.

- Fastech Telecommunications (I) Pvt Ltd.

- Garland Technology LLC

- Gigamon Inc.

- International Business Machines Corporation

- Keysight Technologies, Inc.

- Microsoft Corporation

- Microtel Innovation S.r.l

- NEOX NETWORKS GmbH

- Netka System Co., Ltd

- NetScout Systems, Inc.

- Network Critical Solutions Ltd.

- Niagara Networks

- Palo Alto Networks, Inc.

- Parsons Corporation

- Profitap HQ B.V

- Sewar Technologies Ltd.

- Sun Ivy International Inc

- Telnet Networks Inc by Vivacom

- VIAVI Solutions Inc.

Implementing a Unified Visibility Blueprint That Aligns Packet Broker Filtering Policy Hybrid Deployments and Interoperability for Future Agility

Industry leaders must adopt a proactive visibility strategy that harmonizes packet broker deployments with broader digital transformation objectives. First, organizations should establish a unified monitoring policy framework that leverages broker-level filtering rules to enforce consistent security and performance standards across both on-premises and cloud environments. By centralizing policy management, teams can reduce configuration drift and accelerate time-to-value for new monitoring use cases.

Next, investing in hybrid packet broker architectures-blending physical appliances with virtual instances-will allow enterprises to dynamically allocate visibility resources in response to traffic surges and workload migrations. Such an approach not only optimizes capital allocation but also supports rapid scaling of monitoring capacity during periods of heightened threat activity or peak business cycles. Furthermore, collaboration with network security teams to integrate packet broker telemetry into SIEM and SOAR platforms can enhance threat hunting capabilities and streamline incident response workflows.

Finally, leaders should prioritize interoperability by validating broker-to-tool integrations through proof-of-concept trials. Engaging early with vendors on roadmap discussions ensures that upcoming features-such as enhanced metadata extraction or AI-driven classification enhancements-align with organizational roadmaps. This forward-looking stance will empower businesses to remain agile as traffic volumes grow and compliance standards evolve.

Leveraging Mixed Methods Research Combining Expert Interviews Secondary Source Analysis and Empirical Deployment Data for Holistic Market Insights

This market analysis is grounded in a rigorous mixed-methods research methodology that synergizes primary interviews, secondary research, and data triangulation. Expert perspectives were gathered through structured interviews with network architects, security operations leaders, and solution providers, ensuring that qualitative insights reflect real-world deployment challenges and strategic priorities. Concurrently, publicly available technical documentation, regulatory filings, and whitepapers were reviewed to validate feature sets, performance benchmarks, and compliance certifications across leading packet broker offerings.

Quantitative data was sourced from anonymized deployment records and port installation statistics supplied by select service providers under non-disclosure agreements, allowing for an empirical assessment of usage patterns by port speed and connectivity type. These datasets were cross-referenced with third-party network traffic surveys and cloud infrastructure reports to contextualize growth trends within broader industry dynamics. Throughout this process, data integrity protocols were maintained through peer review and consistency checks, ensuring that the analysis presents a balanced representation of current capabilities and future trajectories.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Network Packet Broker market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Network Packet Broker Market, by Product Type

- Network Packet Broker Market, by Connectivity

- Network Packet Broker Market, by Port Speed

- Network Packet Broker Market, by Application

- Network Packet Broker Market, by Industry Vertical

- Network Packet Broker Market, by Organizations Size

- Network Packet Broker Market, by Region

- Network Packet Broker Market, by Group

- Network Packet Broker Market, by Country

- United States Network Packet Broker Market

- China Network Packet Broker Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1272 ]

Synthesizing Visibility Demands and External Pressures to Build Resilient and Future Ready Packet Broker Architectures

As digital transformation accelerates across industries, the centrality of network packet brokers in enabling comprehensive visibility will only intensify. The convergence of security, performance, and compliance requirements underscores the need for brokers that can adapt to evolving traffic profiles, regulatory landscapes, and infrastructure architectures. By embracing cloud-native deployments alongside hardware-accelerated appliances, organizations can forge resilient visibility fabrics that accommodate both legacy environments and future-proof scalable infrastructures.

Furthermore, the cumulative impact of external factors such as tariff fluctuations and regional regulatory mandates necessitates a flexible procurement strategy that balances on-premises hardware investments with software-defined alternatives. Ultimately, businesses that integrate packet brokers into a unified observability framework-encompassing policy management, tool orchestration, and telemetry analytics-will gain a decisive edge in monitoring efficiency, threat detection accuracy, and operational agility. These imperatives will guide CIOs, network operations teams, and security leaders as they navigate the next wave of network complexity.

Engage with Our Associate Director of Sales & Marketing to Secure Tailored Network Packet Broker Insights and Empower Strategic Decision Making

For organizations navigating the complexities of packet broker deployments and seeking tailored market intelligence, engaging directly with Ketan Rohom, Associate Director of Sales & Marketing, ensures access to comprehensive insights and bespoke guidance. By partnering with him, stakeholders gain early visibility into emerging technologies, opportunities for pilot program collaborations, and in-depth briefings on competitive dynamics. Reach out to Ketan Rohom to secure your copy of the definitive network packet broker market research report today and empower your strategic decisions with empirically backed analysis.

- How big is the Network Packet Broker Market?

- What is the Network Packet Broker Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?