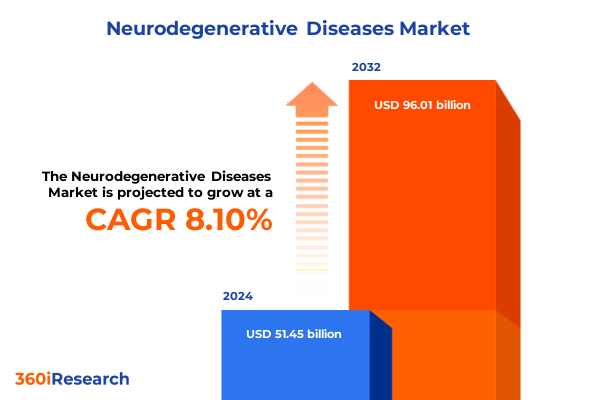

The Neurodegenerative Diseases Market size was estimated at USD 51.45 billion in 2024 and expected to reach USD 55.33 billion in 2025, at a CAGR of 8.10% to reach USD 96.01 billion by 2032.

An authoritative opening framing the convergence of clinical breakthroughs, demographic pressure, and system-level constraints that define modern neurodegenerative care

The neurodegenerative disease landscape sits at an inflection point defined by scientific momentum and operational complexity. Advances in biomarker science, coupled with the emergence of disease-modifying therapeutics and precision medicine approaches, are rewriting clinical pathways while amplifying demands on diagnostics, infusion infrastructure, and specialized care. At the same time, demographic shifts and longer life expectancy are expanding the population that will require longitudinal management, increasing pressure on payers and service providers to balance access with affordability.

These dynamics have produced a dual reality: clinicians and researchers now have tools that enable earlier and more biologically specific interventions, yet health systems and manufacturers face new bottlenecks in delivering these therapies at scale. The growing importance of blood- and imaging-based biomarkers as gatekeepers to targeted treatments has intensified competition for diagnostic capacity and raised the bar for integrated care models. As a result, stakeholders must design strategies that align scientific opportunity with operational feasibility, regulatory pathways, and patient-centered care delivery. This report synthesizes those tensions to help leaders translate clinical advances into pragmatic commercial and policy responses.

A strategic synthesis of how biomarker adoption, regulatory adaptation, diversified therapeutics, and digital innovations are reshaping diagnosis and treatment pathways

The last several years have produced transformative shifts that are remapping research, care delivery, and commercial priorities across neurodegenerative conditions. First, biomarker-driven diagnosis has moved from research settings into routine clinical decision-making; blood- and imaging-based indicators are increasingly used to stratify patients, monitor disease activity, and select candidates for targeted therapies. Second, the regulatory landscape has adapted to this science-led era: accelerated approval pathways and biomarker-based endpoints have shortened development timelines for certain high-need therapies, but these approvals often come with confirmatory requirements that create parallel clinical commitments.

Third, therapeutic modalities have diversified beyond small molecules to include monoclonal antibodies, antisense oligonucleotides, gene therapies, and cell-based approaches, each carrying distinct development, manufacturing, and delivery implications. Fourth, digital health tools and AI-enabled diagnostics are decentralizing assessment and enabling remote monitoring, which is improving access while introducing new standards for data validation and reimbursement. Finally, payer and provider stakeholders have pushed for real-world evidence generation and outcomes-based contracting as conditions for access to high-cost treatments. Taken together, these shifts require cross-functional strategies that bridge clinical validation, manufacturing scale, reimbursement design, and patient support infrastructure. The interplay of science and systems will determine which innovations achieve durable impact in care and commercial success across disease areas.

How 2025 tariff probes and potential duties on medical equipment and inputs are forcing rapid supply-chain redesign and procurement strategy shifts across the ecosystem

Recent trade-policy actions and investigations have introduced a new variable into the equation by raising the potential for tariff-driven cost and supply disruptions in medical devices, diagnostics, and related components. National security reviews and tariff probes initiated in 2025 have focused attention on imported medical equipment, personal protective equipment, and sophisticated device components that are integral to infusion delivery, in-clinic diagnostics, and certain manufacturing inputs. The unfolding nature of these investigations, and the possibility of targeted duties, has already prompted companies to reassess supplier concentration and to accelerate nearshoring or dual-sourcing strategies.

Operationally, tariffs and related trade measures create both direct and indirect effects: direct increases in landed cost for affected goods, and indirect downstream effects on procurement decisions, inventory planning, and capital investments for infusion centers and diagnostic capacity. In response, manufacturers and health systems are evaluating pathways to mitigate exposure by redesigning product portfolios for modularity, qualifying alternate manufacturing partners, and engaging with policymakers on carve-outs for essential medical supplies. Leaders must therefore integrate trade-scenario planning into supply-chain risk management and commercial access models, because the ability to reliably deliver diagnostics, therapeutics, and supportive devices is a precondition for realizing the clinical benefits of recent therapeutic advances. Reuters coverage and contemporaneous industry reporting underscore the urgency with which stakeholders are responding to these evolving trade risks.

Segmentation-driven insight across disease type, treatment modalities, stages, administration routes, and care settings to align product and care delivery strategies

Segmentation reveals practical differences in clinical needs, development complexity, and care-delivery models across disease type, treatment modality, stage of illness, route of administration, and end-user settings. When the market is parsed by disease type-Alzheimer’s disease, amyotrophic lateral sclerosis, frontotemporal dementia, multiple sclerosis, and Parkinson’s disease-each category presents distinct scientific trajectories: Alzheimer’s has seen recent amyloid-targeting approvals that concentrate demand on diagnostic and infusion services; ALS has produced genetically targeted therapies that require diagnostic genotyping and specialized follow-up; frontotemporal dementia and other rarer syndromes place a premium on differential diagnostics and specialist networks; multiple sclerosis continues to evolve with immunomodulatory innovation and long-term disease management expectations; and Parkinson’s disease strategy increasingly emphasizes motor symptom management alongside neuroprotective research.

Across treatment type, the divide between non-pharmacological interventions and pharmacological treatments highlights different value chains. Non-pharmacological care, including cognitive behavioral therapy, occupational therapy, physical therapy, and speech therapy, depends on workforce availability, reimbursement for longitudinal services, and digital augmentation to scale access. Pharmacological approaches-spanning cholinesterase inhibitors, dopamine agonists, immunomodulatory drugs, and NMDA receptor antagonists-require robust clinical pipelines, manufacturing capacity, and route-of-administration planning. Treatment stage stratification into early, moderate, and late phases dictates priorities: early-stage strategies push toward diagnostics and disease modification, moderate-stage care blends symptomatic control with supportive services, and late-stage management emphasizes palliative approaches and long-term care coordination. Route of administration pressures-injectables, intrathecal or intraventricular delivery, and oral therapies-drive different clinical-site requirements and influence adoption timelines. Finally, end-user segmentation across home care, hospitals and clinics, and long-term care facilities underscores the need for flexible care pathways and value propositions that match setting-specific constraints and reimbursement models. This segmentation-based view enables leaders to align product design, commercialization, and care-integration efforts with the operational realities of each patient journey.

This comprehensive research report categorizes the Neurodegenerative Diseases market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Disease Type

- Treatment Type

- Treatment Stage

- Route of Administration

- End User

Regional strategy essentials that reconcile regulatory heterogeneity, infrastructure readiness, and trade-policy exposures across global geographies

Geographic dynamics remain central to strategy because regulatory regimes, care infrastructure maturity, and trade exposures vary significantly across regions. In the Americas, advances in regulatory acceptance of biomarker-driven approvals and the concentration of large integrated health systems accelerate uptake of certain disease-modifying therapies, but the same region also faces pronounced payer scrutiny and distributional complexity between public and private payers. Europe, the Middle East, and Africa present a heterogeneous landscape where centralized regulatory processes in parts of Europe coexist with capacity constraints and access inequalities elsewhere; reimbursement negotiations and health-technology assessment mechanisms play decisive roles in shaping access timelines, and cross-border manufacturing relationships in EMEA often intersect with supply-chain vulnerability considerations.

Asia-Pacific combines rapid adoption potential in urban centers with wide variation in diagnostic and infusion infrastructure across countries. Several markets in the region are investing in domestic biomanufacturing and diagnostics to reduce import dependence, which alters partnership and licensing dynamics for global developers. Across regions, the ability to deploy scalable diagnostics, maintain cold-chain and infusion infrastructure, and navigate local reimbursement frameworks will determine where and how quickly new therapies translate into improved patient outcomes. Regional strategies must therefore be calibrated to infrastructure readiness, regulatory expectations, and trade-policy exposures to optimize patient reach and commercial viability.

This comprehensive research report examines key regions that drive the evolution of the Neurodegenerative Diseases market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Competitive and partnership dynamics showing why integrated capabilities in therapeutics, diagnostics, manufacturing, and digital health determine durable advantage

The competitive and partnership landscape is defined by a mix of established pharmaceutical and medtech enterprises, biotechs specializing in novel modalities, diagnostics companies advancing scalable biomarker platforms, contract manufacturers, and a growing set of digital health vendors. Leading therapeutics have signalled a shift from symptom management toward disease modification, which has stepped up demand for companion diagnostics, infusion and monitoring infrastructure, and long-term follow-up frameworks. Biotechs continue to drive early innovation, but partnerships and licensing arrangements with larger firms remain the primary pathway to scale complex manufacturing and global commercial distribution.

Diagnostics and digital-health firms are creating adjacent value by enabling remote monitoring, accelerating patient identification for trials and therapy, and improving adherence through telehealth-enabled care pathways. Contract development and manufacturing organizations have become strategic nodes in the ecosystem by offering platform capabilities that reduce time-to-scale for nucleic-acid therapeutics and monoclonal antibodies. Across these relationships, intellectual property, data access for algorithm development, and regulatory coordination determine the shape and speed of collaboration. Organizations that couple clinical credibility with operational breadth-spanning manufacturing, diagnostics, and value-based contracting-will be positioned to capture enduring advantage as the field moves from isolated approvals to integrated care solutions. Recent approvals of disease-targeted therapies and biomarker-based diagnostic advances underscore how company capabilities must span the full continuum from discovery to delivery.

This comprehensive research report delivers an in-depth overview of the principal market players in the Neurodegenerative Diseases market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AbbVie Inc.

- Amgen Inc.

- Bayer AG

- Biogen Inc.

- Bristol-Myers Squibb Company

- Eli Lilly and Company

- GlaxoSmithKline plc

- GW Pharmaceuticals plc

- Ionis Pharmaceuticals, Inc.

- Johnson & Johnson Services, Inc.

- Lundbeck A/S

- Merck & Co., Inc.

- Mitsubishi Tanabe Pharma Corporation

- Neurocrine Biosciences, Inc.

- Otsuka Holdings Co., Ltd.

- Roche Holding AG

- Sanofi SA

- Sumitomo Dainippon Pharma Co., Ltd.

- Takeda Pharmaceutical Company Limited

- Teva Pharmaceutical Industries Ltd.

- UCB S.A.

Actionable recommendations for industry leaders that combine diagnostic enablement, supply-chain resilience, payer engagement, care model adaptation, and digital integration

Industry leaders must translate scientific promise into resilient, patient-centered strategies that manage regulatory, operational, and commercial risk. First, align portfolio development with diagnostic capacity by investing in validated biomarker platforms and collaborations that accelerate patient identification and enable meaningful post-approval evidence generation. Second, build supply-chain resilience by qualifying alternate suppliers, creating dual-sourcing plans for critical components, and evaluating nearshoring or regional manufacturing to mitigate tariff and trade-policy exposure. Third, design care-delivery models that are adaptable across settings: create protocols and service bundles that allow therapies to be delivered safely in hospital, clinic, and home-care environments while ensuring specialty staffing and infusion access where required.

Fourth, engage payers early with transparent evidence-generation plans and pragmatic real-world outcomes metrics to facilitate coverage pathways and to explore outcomes-based contracting where misalignment of short-term cost and long-term benefit exists. Fifth, integrate digital tools that expand diagnostic reach, monitor safety and adherence, and reduce clinic burden, while ensuring regulatory-grade validation and robust data governance. Finally, pursue targeted partnerships with contract manufacturers and diagnostic developers to shorten scaling timelines and to distribute operational risk. These actions should be sequenced into a three-to-five stage plan that prioritizes diagnostic enablement, supply-chain fortification, payer engagement, care model adaptation, and digital integration to shepherd innovations from approval to sustainable patient impact.

Transparent research methodology describing source prioritization, triangulation approach, and analytical framing used to derive strategic insights

This analysis synthesizes peer-reviewed literature, regulatory announcements, high-quality clinical reporting, and contemporary trade-policy coverage to produce an evidence-driven executive perspective. Clinical and scientific assertions are grounded in recent regulatory milestones and biomarker research reported in primary sources and specialty publications. Policy and supply-chain conclusions incorporate contemporaneous reporting from reputable news outlets and industry analyses that track national trade inquiries and their implications for medical equipment and input sourcing. Where primary trial data and regulatory documentation were available, those sources were prioritized to ensure accurate representation of approval pathways and post-approval commitments.

Qualitative judgment was applied when reconciling heterogeneous sources, and conflicting interpretations were annotated and resolved by triangulating between regulatory statements, major journals, and industry disclosures. Segmentation and regional insights were developed by mapping clinical characteristics, delivery requirements, and infrastructure constraints to pragmatic adoption pathways. The methodology deliberately avoids market sizing and forecasting in favor of causal analysis that identifies operational levers, risk exposures, and strategic inflection points for stakeholders. Readers seeking granular datasets, proprietary forecasts, or scenario-specific financial modelling should commission the tailored report package and analyst consultation described in the call-to-action.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Neurodegenerative Diseases market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Neurodegenerative Diseases Market, by Disease Type

- Neurodegenerative Diseases Market, by Treatment Type

- Neurodegenerative Diseases Market, by Treatment Stage

- Neurodegenerative Diseases Market, by Route of Administration

- Neurodegenerative Diseases Market, by End User

- Neurodegenerative Diseases Market, by Region

- Neurodegenerative Diseases Market, by Group

- Neurodegenerative Diseases Market, by Country

- Competitive Landscape

- List of Figures [Total: 30]

- List of Tables [Total: 603 ]

A forward-looking conclusion urging alignment of clinical innovation with operational design to convert breakthroughs into accessible, sustainable care

The neurodegenerative disease field is transitioning from an era of symptomatic management to one in which biologically targeted interventions, enhanced diagnostics, and integrated care models are now feasible at scale. This shift creates a window of commercial and clinical opportunity, but realizing durable impact requires deliberate orchestration across diagnostics, manufacturing, payer engagement, and care delivery. Trade-policy developments and tariff uncertainties have injected an additional, near-term operational risk that must be managed through diversified sourcing and regional manufacturing strategies.

In conclusion, organizations that align clinical innovation with pragmatic operational design-investing in validated biomarkers, flexible manufacturing partnerships, payer-forward evidence plans, and digital-enabled care pathways-will be best positioned to deliver meaningful patient outcomes while containing systemic risk. The choices leaders make today about partnerships, infrastructure, and evidence-generation priorities will determine whether recent therapeutic advances translate into broader, equitable access and sustainable care models for people living with neurodegenerative disease. For teams seeking an immediate operational roadmap, a tailored report and analyst briefing will provide the granular guidance needed to act decisively.

Contact Ketan Rohom, Associate Director Sales & Marketing, to secure the full report and tailored briefings that translate insights into strategic execution

For decision-makers ready to convert insight into action, engage directly with Ketan Rohom, Associate Director, Sales & Marketing, to obtain the full market research report and tailored briefing that aligns with your strategic priorities. A direct briefing will include deeper dives into clinical development pathways, payer access scenarios, supply-chain impact assessments, and segmentation-level implications across disease, treatment type, stage, route of administration, and end user, enabling teams to prioritize investments and de-risk operational plans.

To maximize the value of the purchase, request a tailored add-on that focuses on the regions and therapeutic areas most relevant to your organization, and ask for scenario modelling that maps tariff sensitivity to procurement and manufacturing options. If you plan to present findings to investors or board members, request the executive slide deck and an analyst-led walkthrough that highlights actionable milestones, regulatory inflection points, and partnership opportunities. Ketan will coordinate delivery of the report package and can arrange follow-up consulting hours for implementation support.

Taking the next step ensures your organization moves from broad market awareness to specific, executable strategies informed by recent clinical approvals, evolving diagnostic standards, and trade-policy risks that are reshaping supply chains and care pathways.

- How big is the Neurodegenerative Diseases Market?

- What is the Neurodegenerative Diseases Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?