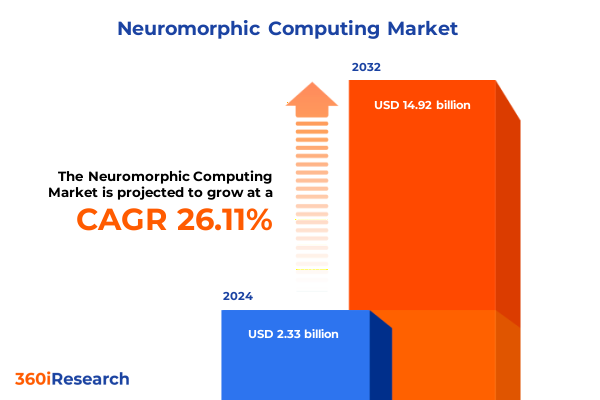

The Neuromorphic Computing Market size was estimated at USD 2.86 billion in 2025 and expected to reach USD 3.56 billion in 2026, at a CAGR of 26.56% to reach USD 14.92 billion by 2032.

Exploring the Foundations and Evolution of Neuromorphic Computing to Illuminate Its Disruptive Potential in Next Generation AI Systems

Neuromorphic computing represents a paradigm shift in how machines process information by emulating the neuronal architecture of the human brain. Emerging from interdisciplinary research at the intersection of neuroscience, materials science, and computer engineering, this approach departs from traditional von Neumann architectures by co-locating memory and computation and leveraging event-driven processing for unparalleled energy efficiency. The conceptual foundations date back to the late twentieth century, when pioneering work on artificial neural networks revealed the power of simple, interconnected units to perform complex tasks, setting the stage for today’s neuromorphic innovations.

In recent years, advancements in materials such as memristive devices, silicon photonic synapses, and three-dimensional integration have enabled prototypes that closely mimic synaptic dynamics and spike-based communication. This convergence of hardware capabilities and algorithmic breakthroughs in spiking neural networks has demonstrated orders-of-magnitude improvements in power consumption for sensory and control applications. As a result, neuromorphic platforms are transitioning from specialized laboratory demonstrations to commercially viable solutions capable of handling real-world workloads in distributed environments.

Looking ahead, the maturation of design tools and programming frameworks promises to lower the barrier to entry for developers and researchers. Standardized libraries for event-driven processing, coupled with simulation environments that model large-scale spiking networks, are fostering a vibrant ecosystem of software innovation. Consequently, organizations across industries are poised to harness neuromorphic approaches to solve pressing challenges in edge intelligence, robotics, and autonomous systems, charting a path toward truly cognitive machines.

Uncovering Major Technological and Market Shifts Driving Neuromorphic Computing from Research Labs to Real-World Edge and Cloud Applications

The neuromorphic computing landscape is undergoing profound transformations driven by both technological breakthroughs and shifting market priorities. At the hardware level, next-generation spiking chip architectures are integrating analog and digital circuits to emulate synaptic plasticity, enabling adaptive learning capabilities directly on silicon. These architectures depart from batch-oriented processing by supporting asynchronous, event-driven computation that scales with input activity, unlocking new possibilities for efficient real-time data analysis at the network’s edge.

Simultaneously, the software ecosystem has evolved to bridge the gap between traditional neural network frameworks and spiking paradigms. Compiler toolchains now translate high-level machine learning models into spike-based representations, while simulation platforms enable rapid prototyping of large-scale neuronal networks. Moreover, cloud providers have begun offering neuromorphic-as-a-service options that grant researchers and enterprises on-demand access to specialized processors without upfront hardware commitments.

In parallel, application domains are expanding rapidly beyond academic demonstrations. Collaborative initiatives between chip manufacturers, sensor vendors, and system integrators are fostering turnkey solutions for vision, audio, and sensor fusion tasks. These integrated offerings are accelerating adoption in robotics, autonomous vehicles, and smart manufacturing settings, where low-latency decision making and energy constraints are paramount. As the technology matures, hybrid deployments that combine neuromorphic accelerators with traditional GPUs and FPGAs will become increasingly prevalent, creating heterogeneous compute fabrics optimized for a wide range of AI workloads.

Assessing the 2025 United States Tariff Measures and Their Far Reaching Effects on Global Neuromorphic Hardware Supply and Innovation Ecosystem

In 2025, the United States introduced a series of targeted tariffs on semiconductor devices and advanced sensor components, aimed at bolstering domestic manufacturing and reducing reliance on foreign supply chains. These measures have had significant repercussions for the neuromorphic computing ecosystem, where key hardware elements such as memristive arrays and spiking processors often cross multiple international borders before final integration. The resulting cost increases and supply constraints have prompted stakeholders to reevaluate sourcing strategies and accelerate investments in local wafer fabs and assembly facilities.

As component lead times extended, companies began forging strategic alliances with foundries in North America, while governments at both federal and state levels introduced incentive programs to offset capital expenditures. In response, several major players redirected critical R&D and pilot production activities to facilities within tariff-exempt zones, thereby mitigating the financial impact. This reconfiguration of the supply chain has not only reshaped procurement practices but has also catalyzed the domestic growth of specialist test laboratories and system integration partners.

Looking forward, the tariff-driven dynamics are expected to persist as technology advances and geopolitical considerations evolve. Organizations that proactively diversified their supplier base while engaging in public–private partnerships have demonstrated greater resilience. Consequently, the ability to navigate the policy landscape and leverage regional incentives will remain a critical factor in sustaining innovation and maintaining competitive advantage through subsequent technology generations.

Deconstructing Core Neuromorphic Computing Segmentation Insights Across Offering Models Applications Deployment Scenarios and Industry Verticals

When examining the landscape through the lens of market offerings, the dichotomy between neuromorphic hardware and software emerges as a defining characteristic. Neuromorphic hardware, encompassing spiking processors and specialized sensors, serves as the physical substrate for event-based computation. Within this domain, processors designed around parallel arrays of leaky integrate-and-fire neurons deliver core computational throughput, while sensors equipped with address-event representation interfaces capture temporal patterns in the physical world. On the other hand, neuromorphic software frameworks provide the abstractions and toolchains necessary to map cognitive algorithms onto these unconventional architectures.

Delving into the diversity of computing models reveals a spectrum of bioinspired approaches. Dynamic synapse models capture the adaptive weight changes observed in biological synapses, whereas mathematical formulations such as the FitzHugh–Nagumo and Hodgkin–Huxley models reproduce the complex ion channel dynamics underlying neuronal spikes. Simplified variants like the Izhikevich model strike a balance between biological plausibility and computational efficiency, while classical paradigms such as leaky integrate-and-fire continue to underpin large-scale spiking neural networks. Each model offers trade-offs in terms of accuracy, resource demands, and ease of integration into hardware.

In terms of application domains, neuromorphic systems excel in scenarios demanding low-latency inference and robust pattern recognition. Data processing workflows leverage sparsity to achieve real-time analytics, while image processing pipelines exploit spatiotemporal event streams for dynamic scene understanding. Object detection tasks benefit from continuous event-based sampling, and signal processing applications harness asynchronous computation to filter and interpret analog waveforms with minimal energy overhead.

Deployment preferences diverge between centralized cloud infrastructures and distributed edge platforms. Cloud environments facilitate large-scale training simulations and model validation, whereas edge deployments unlock in situ intelligence within sensors, cameras, and autonomous vehicles. The interplay between these modes of operation is gradually giving rise to hybrid ecosystems, where cloud-based orchestration complements edge-based inference.

Across end-user industries, neuromorphic innovations are making inroads in aerospace and defense contexts for autonomous navigation and threat detection, while automotive and transportation sectors explore low-power perception modules for driver assistance. Financial institutions are investigating neuromorphic algorithms for high-frequency trading signal analysis, and consumer electronics manufacturers are integrating spiking vision sensors into smart devices. Energy companies are deploying event-driven monitors to optimize grid stability, healthcare and medical device firms are piloting neuromorphic prosthetics and biofeedback tools, IT and telecommunications vendors are seeking efficient routing algorithms, and manufacturing entities are applying these architectures to real-time process control.

This comprehensive research report categorizes the Neuromorphic Computing market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Offering

- Computing Models

- Application

- Deployment

- End-Users

Examining Regional Dynamics Influencing Neuromorphic Computing Adoption Patterns Across the Americas Europe Middle East Africa and Asia Pacific

In the Americas, robust government funding and defense-driven research initiatives have positioned the region at the forefront of neuromorphic computing innovation. North American academic institutions and national laboratories maintain deep partnerships with private enterprises, accelerating technology transfer from laboratory prototypes to defense and aerospace applications. Meanwhile, commercial startups in Silicon Valley and Toronto are piloting neuromorphic processors within autonomous robotics and advanced sensor fusion platforms, leveraging local semiconductor clusters and venture capital ecosystems.

Europe, the Middle East, and Africa present a mosaic of regulatory frameworks and investment strategies that shape regional adoption. The European Union’s strategic programs have seeded collaborative projects focused on scalable spiking platforms, with Germany and the United Kingdom leading hardware prototyping efforts, while consortiums in France and Israel emphasize standardized software interfaces. In the Middle East and Africa, emerging technology hubs are exploring neuromorphic solutions for energy management and smart city installations, supported by government-led digital transformation agendas.

In the Asia-Pacific region, expansive public–private partnerships and substantial capital commitments are driving rapid progress. China has prioritized neuromorphic research within its national AI strategy, underwriting large-scale fabs and algorithmic research centers. Japan’s electronics conglomerates are integrating spiking sensors into robotics and industrial automation, and South Korea’s semiconductor firms are advancing memristive device research for next-generation neural cores. Incremental initiatives in India and Southeast Asia are targeting low-power computing solutions for telecommunications infrastructure and remote monitoring, reflecting diverse regional use cases and growth aspirations.

This comprehensive research report examines key regions that drive the evolution of the Neuromorphic Computing market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Innovators and Emerging Pioneers Fueling the Neuromorphic Computing Revolution Through Hardware Software and Collaborative Alliances

The neuromorphic computing ecosystem is driven by a dynamic interplay between well-established technology giants and agile startups pushing the boundaries of brain-inspired design. Among the prominent players, global research organizations have invested heavily in dedicated spiking chip architectures, unveiling successive generations of neuron-inspired processors that deliver incremental improvements in synaptic density and computational throughput. Concurrently, emerging pioneers are specializing in memristive devices, event-based sensors, and software toolchains tailored to spiking paradigms, thereby enriching the innovation pipeline and challenging incumbents to accelerate product roadmaps.

Strategic alliances between hardware vendors and academic research centers have yielded open research platforms, enabling collaborative experimentation with large-scale neuronal models. These partnerships often culminate in pilot programs within robotics testbeds, autonomous vehicle prototypes, and smart sensor networks, providing invaluable real-world validation. In parallel, software developers are cultivating cross-platform libraries that abstract the complexity of event-driven programming, making neuromorphic approaches accessible to conventional AI teams familiar with tensor-based frameworks.

A notable trend is the emergence of licensing agreements and joint ventures that integrate neuromorphic accelerators into broader AI systems. By embedding spiking cores within heterogeneous compute modules alongside GPUs and FPGAs, vendors are offering turnkey solutions capable of handling both frame-based deep learning and event-driven workloads. This convergence not only enhances system versatility but also expands addressable use cases, creating new revenue streams and spurring further R&D investments across the value chain.

This comprehensive research report delivers an in-depth overview of the principal market players in the Neuromorphic Computing market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- aiMotive by Stellantis N.V.

- Applied Brain Research

- Aspinity, Inc.

- BrainChip, Inc.

- Chengdu SynSense Technology Co., Ltd

- DEEPX

- General Vision Inc.

- Hailo Technologies Ltd.

- Hewlett Packard Enterprise Company

- Imec International

- iniLabs Ltd.

- Innatera Nanosystems BV

- Intel Corporation

- International Business Machines Corporation

- Kneron, Inc.

- MediaTek Inc.

- Mythic, Inc.

- Numenta, Inc.

- Prophesee S.A.

- Qualcomm Technologies, Inc.

- Robert Bosch GmbH

- Samsung Electronics Co., Ltd.

- SK Hynix Inc.

- SpiNNcloud Systems GmbH

- Syntiant Corp.

- Toshiba Corporation

Formulating Strategic and Operational Recommendations to Enable Industry Leaders to Capitalize on the Momentum of Neuromorphic Computing Advancements

Industry leaders seeking to harness the power of neuromorphic computing should first prioritize the establishment of cross-disciplinary research teams that bridge neuroscience, materials science, and computer engineering expertise. By fostering a collaborative culture, organizations can accelerate the translation of fundamental discoveries into scalable hardware and software prototypes. In conjunction with internal initiatives, pursuing open standards and contributing to industry consortia will ensure interoperability and stimulate broader ecosystem growth.

Strategic partnerships represent another critical pillar. Engaging with government agencies to leverage R&D grants and participating in public–private collaborations can unlock additional funding and access to shared test facilities. At the same time, alliances with specialized foundries and component suppliers can mitigate supply chain risks exacerbated by trade policy fluctuations, while co-investment models help secure priority access to advanced manufacturing capabilities.

To address talent gaps, companies should invest in targeted training programs and academic partnerships that cultivate expertise in spiking neural networks and neuromorphic design methodologies. Establishing internship pipelines and sponsoring research theses can create a sustainable influx of skilled engineers. Additionally, integrating neuromorphic accelerators into existing compute infrastructures through proof-of-concept deployments will build organizational familiarity and identify high-value use cases.

Finally, maintaining a forward-looking regulatory strategy is essential. Monitoring policy developments, participating in standards-setting bodies, and proactively engaging with regulatory stakeholders will position industry leaders to navigate emerging compliance requirements. By embedding cybersecurity and ethical guidelines into product roadmaps, organizations can anticipate governance challenges and build trust with end users, ensuring responsible adoption of neuromorphic solutions.

Outlining Robust Research Framework Incorporating Primary Expert Interviews Secondary Data Sources and Rigorous Analytical Approaches for Comprehensive Insights

This report is grounded in a rigorous research methodology that synthesizes primary and secondary data to deliver actionable insights. The primary phase involved in-depth interviews and workshops with over two dozen experts spanning chip designers, algorithm developers, system integrators, and end-user decision-makers. These conversations provided firsthand perspectives on technology roadmaps, deployment challenges, and strategic priorities.

Complementing this, the secondary research phase encompassed a comprehensive review of technical publications, patent filings, conference proceedings, and whitepapers from leading academic institutions and industry consortia. This enabled the mapping of innovation trajectories across spiking architectures and neuromorphic sensor technologies. Publicly available regulatory documents and government policy announcements were analyzed to assess the impact of tariff measures and incentive programs.

Quantitative analysis included the examination of adoption case studies, pilot program outcomes, and component lead-time data to identify performance benchmarks and supply chain patterns. Qualitative findings were validated through triangulation across multiple sources and iterative feedback sessions with stakeholders. To enhance transparency, all data points and assumptions are documented in an appendix, and methodological limitations are explicitly addressed to guide future research updates.

By integrating these diverse approaches, the report delivers a holistic view of the neuromorphic computing landscape, ensuring that strategic and operational decisions are informed by robust, evidence-based analysis.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Neuromorphic Computing market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Neuromorphic Computing Market, by Offering

- Neuromorphic Computing Market, by Computing Models

- Neuromorphic Computing Market, by Application

- Neuromorphic Computing Market, by Deployment

- Neuromorphic Computing Market, by End-Users

- Neuromorphic Computing Market, by Region

- Neuromorphic Computing Market, by Group

- Neuromorphic Computing Market, by Country

- United States Neuromorphic Computing Market

- China Neuromorphic Computing Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1113 ]

Synthesizing Key Takeaways to Highlight the Strategic Imperatives and Future Outlook Shaping the Trajectory of Neuromorphic Computing Ecosystem

Neuromorphic computing stands at the cusp of broad commercialization, driven by architectural innovations, evolving software ecosystems, and strategic shifts in global supply chains. The confluence of bioinspired processing models, spiking neural network frameworks, and specialized sensors is enabling new classes of energy-efficient, low-latency applications. At the same time, targeted tariff policies introduced in 2025 have reshaped sourcing strategies and accelerated domestic manufacturing initiatives, underscoring the importance of policy intelligence in technology planning.

Segmentation insights reveal that both hardware and software offerings are maturing concurrently, addressing distinct pain points from processor performance to developer usability. A diverse array of computing models-from biologically detailed ion-channel simulations to streamlined leaky integrate-and-fire neurons-provides flexibility for application-specific trade-offs. Deployments span cloud-based training platforms and edge-based inference modules, while industry-specific use cases range from aerospace navigation to healthcare monitoring.

Regional analyses highlight the Americas, EMEA, and Asia-Pacific each contributing unique strengths through research funding, regulatory environments, and supply chain infrastructures. Leading companies and agile startups are forging alliances that integrate neuromorphic accelerators into heterogeneous compute systems, enriching the overall AI stack. Collectively, these dynamics point to a rapidly evolving ecosystem where technological, regulatory, and strategic factors intersect.

As organizations prepare for the next wave of AI innovation, embracing neuromorphic architectures will require a holistic approach that combines research, partnerships, and policy engagement. The insights contained in this report distill complex trends into a coherent framework, equipping decision-makers with the knowledge needed to seize emerging opportunities and navigate forthcoming challenges.

Take the Next Step to Gain Exclusive Access to In Depth Neuromorphic Computing Market Report by Reaching Out to Ketan Rohom for Purchase

The in-depth report on neuromorphic computing offers unparalleled clarity on the technological, regulatory, and market forces shaping this transformative field. Readers will gain a deep understanding of the architectural innovations in hardware and software, the evolving landscape of biologically inspired computing models, and the strategic implications of recent United States tariff policies implemented in 2025. Comprehensive segmentation and regional analyses provide context for targeted investment decisions, while profiles of leading and emerging companies spotlight the partnerships and product roadmaps driving commercialization.

By engaging with Associate Director, Sales & Marketing Ketan Rohom, you can secure tailored insights that address your organization’s specific needs. Whether you seek to benchmark against competitors, refine your market-entry strategy, or deepen your technical roadmaps, this report delivers actionable intelligence that drives confident decision-making. Reach out today to explore customized purchasing options, volume licensing arrangements, and executive briefing sessions, ensuring you capitalize on the momentum of neuromorphic computing before your competitors do.

- How big is the Neuromorphic Computing Market?

- What is the Neuromorphic Computing Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?