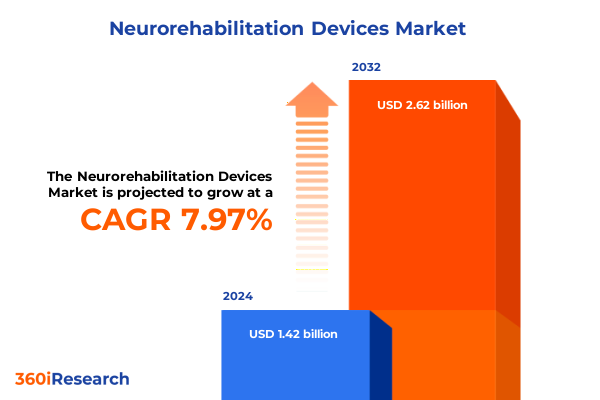

The Neurorehabilitation Devices Market size was estimated at USD 1.53 billion in 2025 and expected to reach USD 1.66 billion in 2026, at a CAGR of 7.98% to reach USD 2.62 billion by 2032.

Understanding the Evolving Landscape of Neurorehabilitation Devices and Emerging Opportunities for Stakeholders Globally Across Markets Worldwide

The landscape of neurorehabilitation devices has witnessed remarkable transformation over recent years, driven by rapid technological advancements and escalating demand from patients and healthcare providers alike. Innovations in robotics, virtual reality, brain–computer interfaces, and neuromodulation have enhanced the precision and efficacy of therapeutic interventions, offering new hope for individuals recovering from conditions such as stroke, spinal cord injury, and movement disorders. As medical institutions and research centers increasingly collaborate with technology firms, the convergence of multidisciplinary expertise is accelerating the pace of product development and pushing the boundaries of what was once considered achievable in neural recovery and motor function restoration.

With heightened focus on personalized care, patient-centric design principles are reshaping device development to deliver more engaging, effective, and user-friendly solutions. At the same time, regulatory frameworks and reimbursement policies are evolving to accommodate these novel technologies, although variability across regions continues to influence market uptake. This report provides an in-depth exploration of emerging trends, regulatory impacts, and technological breakthroughs that are redefining the field of neurorehabilitation. Through systematic analysis, stakeholders will gain clarity on strategic imperatives and be better equipped to navigate the complexities of this dynamic and rapidly expanding market.

Charting Transformative Shifts Redefining Neurorehabilitation Practices Driven by Technological Integration and Patient-Centric Innovations in Rehabilitation Care

Technological integration has become a defining force in neurorehabilitation, ushering in a new era where digital therapeutics and intelligent assistance converge to amplify patient outcomes. Robotics platforms equipped with adaptive algorithms now support tailored gait training, while immersive virtual reality environments engage neural circuits in rehabilitative exercises that enhance motor learning and cognitive function. At the same time, wearable sensors and portable neuromodulation devices enable continuous monitoring of patient progress, facilitating data-driven adjustments to therapy protocols. As AI-driven analytics mature, predictive models of recovery trajectories are emerging, empowering clinicians to optimize intervention timing and intensity.

Parallel to these innovations, patient-centered approaches are gaining traction, as providers recognize the importance of motivation, engagement, and feedback in driving sustained participation. Gamified interfaces and biofeedback systems cater to diverse patient populations, from pediatric rehabilitation to geriatric mobility restoration. The rise of tele-rehabilitation platforms is further expanding access, allowing therapists to remotely supervise sessions and deliver personalized guidance. Together, these shifts underscore a broader movement toward integrative, technology-enabled rehabilitation ecosystems that promise to reshape care delivery models and unlock new avenues for clinical effectiveness.

Examining the Cumulative Effects of Newly Imposed United States Tariffs in 2025 on Neurorehabilitation Device Supply Chains and Market Dynamics

The introduction of new United States tariffs in 2025 has introduced added complexity to the neurorehabilitation device supply chain, particularly for components sourced from international markets. Sensors, advanced semiconductor chips, and specialized polymers essential to exoskeleton and neuromodulation platforms have seen cost increases, prompting manufacturers to reevaluate sourcing strategies. In response, some developers have accelerated efforts to diversify supplier bases, shifting production to regions with more favorable trade terms, while others are investing in domestic manufacturing capabilities to insulate themselves from tariff volatility.

Beyond component procurement, these tariffs have influenced pricing strategies and negotiation dynamics between suppliers, manufacturers, and end users. As cost pressures mount, device makers are exploring modular designs that allow for easier upgrades and localized assembly. Concurrently, clinical partners are prioritizing value-based purchasing agreements and exploring alternative funding models to mitigate budgetary constraints. Although the immediate impact has manifested as squeezed margins and extended lead times, the industry’s adaptive measures may ultimately foster greater supply chain resilience and encourage innovation in cost-effective manufacturing techniques.

Unveiling Critical Insights into Device Type Application End User Technology and Age Group Segmentation Shaping Neurorehabilitation Market Trends

Analysis organized around device types reveals distinct growth drivers across biofeedback systems, exoskeletons, functional electrical stimulation devices, neuromodulation devices, and virtual reality systems. Within biofeedback, electromyography-driven feedback solutions and pressure-based approaches are gaining traction for their ability to deliver precise, real-time metrics that enhance motor awareness. Exoskeleton development is bifurcated into lower limb and upper limb applications, each responding to specific therapeutic needs ranging from gait restoration to arm mobility. Functional electrical stimulation devices are advancing on both implantable and surface platforms, offering clinicians versatile tools for muscle reactivation. Neuromodulation strategies span invasive and noninvasive interventions, with emerging evidence supporting the synergistic use of both to promote neuroplasticity. In virtual reality, immersive and nonimmersive systems are being tailored to patient engagement levels, setting new standards for interactive rehabilitation.

When viewed through the lens of clinical applications, the spectrum from cerebral palsy to stroke underscores the importance of condition-specific design. Ataxic, dyskinetic, and spastic profiles in cerebral palsy each demand customized therapy regimens, while the progressive and relapsing remitting forms of multiple sclerosis benefit from adaptive stimulation protocols. Parkinson’s disease devices tailored for early stage intervention differ markedly from those targeting advanced stage symptom management. In spinal cord injury care, complete and incomplete classifications guide the selection of exoskeletal support versus neuromodulation techniques, and hemorrhagic as well as ischemic stroke survivors are increasingly turning to immersive virtual reality to reignite motor function.

End user segmentation illuminates how clinics and hospitals, home care settings, rehabilitation centers, and research institutes are shaping demand. General and specialty clinics are leveraging biofeedback and surface stimulation, while private and public hospitals integrate exoskeletons and invasive neuromodulation into acute care pathways. In home care environments, assisted living residents and self-managed patients are increasingly adopting portable stimulation and nonimmersive virtual reality tools to continue therapy beyond clinical walls. Inpatient and outpatient rehabilitation centers harness advanced robotics and integrated sensor suites, and academic as well as private research institutes drive early-stage innovation.

From a technological standpoint, brain–computer interfaces operating in both invasive and noninvasive modes are opening novel pathways for direct neural engagement. Robotics approaches range from end-effector devices that support joint-specific exercises to full exoskeleton suits that road-map complete limb rehabilitation journeys. Transcranial direct current stimulation is being calibrated across anodal and cathodal waveforms to target cortical excitability, while transcranial magnetic stimulation modalities leverage deep and repetitive pulse patterns to promote connectivity. Virtual reality solutions continue to evolve, offering patients either fully immersive or screen-based experiences that cater to therapy objectives and tolerance levels.

Age group considerations further refine product positioning. Adults aged 18 to 40, 41 to 64, and those 65 and older face different mobility and neuroplasticity challenges, prompting tailored intervention intensities and device ergonomics. Within the geriatric cohort of 65 to 74, 75 to 84, and 85-plus segments, user interface simplicity and fall prevention become critical design priorities. Pediatric applications across adolescent, childhood, and neonatal categories demand safety-first approaches, adjustable form factors, and engaging content to support developmental milestones. These segmentation layers deliver a granular roadmap for developers and providers aiming to meet precise therapeutic needs.

This comprehensive research report categorizes the Neurorehabilitation Devices market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Device Type

- Technology

- Age Group

- Application

- End User

Evaluating Regional Variations in Adoption Utilization and Potential of Neurorehabilitation Solutions across Americas Europe Middle East Africa and Asia Pacific

In the Americas, significant investments in medical technology infrastructure and a supportive reimbursement environment have accelerated adoption of sophisticated neurorehabilitation solutions. The United States leads with integrated hospital systems piloting robotic exoskeletons and immersive virtual reality programs, while private rehabilitation centers across Canada are forging partnerships with software innovators to expand tele-rehabilitation services. Despite regulatory complexity in regions with varying provincial or state-level policies, the trajectory remains positive as public and private payers increasingly recognize the long-term value of functional recovery and reduced hospitalization rates.

Across Europe, the Middle East, and Africa, harmonization efforts within the European Union have streamlined approvals for device types, enabling faster market entry for manufacturers. Germany, with its established medical device industry, and the United Kingdom, with robust NHS-sponsored pilot programs, are key hubs for clinical validation of next-generation neuromodulation platforms. In the Middle East, government-led initiatives to modernize healthcare infrastructure are driving demand in the United Arab Emirates and Saudi Arabia. Conversely, many African markets are still developing reimbursement frameworks, creating a dual landscape where high-end private clinics coexist with under-resourced public facilities, suggesting opportunities for modular, low-cost solutions that can bridge treatment gaps.

The Asia-Pacific region presents a mosaic of opportunity shaped by economic growth and varying healthcare investment. Japan’s advanced aging population fuels demand for geriatric-focused exoskeletons and noninvasive stimulation therapies, while China’s manufacturing capacity and growing clinical trial base support rapid iteration of brain–computer interface prototypes. South Korea and India are ramping up regulatory frameworks to encourage digital health solutions, and Australia’s remote communities benefit from tele-rehabilitation deployments that leverage broadband infrastructure. Across these markets, balancing affordability with clinical efficacy is essential to achieving scalable implementation and driving widespread technology adoption.

This comprehensive research report examines key regions that drive the evolution of the Neurorehabilitation Devices market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Neurorehabilitation Device Innovators and Evaluating Strategic Initiatives Shaping Competitive Dynamics throughout the Industry

Leading industry innovators are differentiating themselves by combining robust research and development with strategic collaborations. One prominent exoskeleton specialist has partnered with academic medical centers to validate device efficacy through longitudinal studies, reinforcing its position as a clinical-grade solution provider. A pioneer in functional electrical stimulation is expanding its global footprint by licensing technology to local manufacturers, ensuring that surface and implantable systems are adapted to region-specific clinical protocols. Meanwhile, a virtual reality developer has forged alliances with software companies to integrate gamified rehabilitation platforms, increasing patient engagement and compliance in home-based programs.

In the neuromodulation arena, established medical device corporations are leveraging their regulatory expertise to accelerate approvals for both invasive implants and noninvasive stimulation devices. Concurrently, emerging brain–computer interface startups backed by venture capital are focusing on ergonomic consumer-grade headsets to democratize neural engagement. Robotics firms are exploring modular designs that bridge end-effector and full exoskeleton architectures, giving clinicians the flexibility to customize therapy plans. Across the ecosystem, mergers and acquisitions have intensified, with larger entities acquiring niche technology providers to broaden their offerings and meet integrated care demands.

This comprehensive research report delivers an in-depth overview of the principal market players in the Neurorehabilitation Devices market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Abbott Laboratories

- ANT Neuro B.V.

- Bioness, Inc.

- Bionik Laboratories Corp.

- BioXtreme Robotics Rehabilitation

- Boston Scientific Corporation

- BTS Bioengineering S.p.A.

- Cyberdyne Inc.

- Ekso Bionics Holdings, Inc.

- Hasomed GmbH

- Hocoma AG

- Kinetic Muscles, Inc.

- Kinova Inc.

- Medtronic plc

- MindMaze SA

- Myomo, Inc.

- NeuroStyle Pte Ltd

- ReWalk Robotics Ltd.

- Synertial Europe Ltd.

- Tyromotion GmbH

- Vibrant Ltd.

Actionable Strategies for Industry Leaders to Capitalize on Advancements and Overcome Barriers in Neurorehabilitation Device Development and Market Penetration

To navigate evolving regulatory landscapes and maximize market penetration, industry leaders should pursue proactive engagement with health authorities to secure early feedback on device classification and clinical trial requirements. Prioritizing collaboration with rehabilitation specialists and patient advocacy groups can unlock deeper insights into user needs, enabling the development of more intuitive interfaces and compelling therapy content. Investing in pilot programs that demonstrate cost-effectiveness-such as reduced rehospitalizations and accelerated functional gains-will bolster reimbursement dialogues and strengthen payer value propositions.

Supply chain resilience is another critical focus area; organizations should diversify component sourcing by identifying alternative suppliers and exploring domestic manufacturing partnerships to minimize exposure to tariff fluctuations and logistical bottlenecks. Embracing modular product architectures will allow for incremental upgrades, reducing capital expenditure burdens for healthcare providers and extending product lifecycles. Additionally, integrating data analytics and remote monitoring capabilities into device ecosystems can generate real-world evidence that informs iterative design improvements and supports differentiated service models.

Finally, leveraging strategic alliances through co-development agreements or joint ventures can accelerate market entry in regions with complex regulatory and cultural landscapes. Tailoring go-to-market strategies to align with local healthcare infrastructure, reimbursement schemes, and patient behavior will be essential for achieving sustainable growth and fostering long-term partnerships across the neurorehabilitation continuum.

Ensuring Rigor and Reliability through Comprehensive Research Methodologies and Data Collection Practices in Neurorehabilitation Market Analysis

This analysis combines primary research-comprising in-depth interviews with clinicians, device developers, payers, and patients-with comprehensive secondary research drawing on peer-reviewed journals, regulatory filings, and real-world case studies. A rigorous data triangulation process was employed to validate findings, ensuring that insights reflect both quantitative trends and qualitative perspectives. Segmentation criteria were established through synthesis of clinical usage patterns and technology adoption rates, enabling the delineation of demand across device types, therapeutic applications, end users, technological modalities, and age cohorts.

Quantitative assessments were supplemented by scenario analyses to examine the potential impacts of external factors such as changing tariff structures, reimbursement policy shifts, and emerging competitive entries. Quality control protocols included cross-verification of data points and iterative feedback loops with subject matter experts to refine assumptions and contextualize market dynamics. Ethical considerations and confidentiality agreements were upheld throughout, particularly in areas involving patient data and proprietary clinical trial outcomes. While every effort was made to ensure accuracy and relevance, stakeholders are encouraged to contextualize these insights according to evolving regulatory guidelines and local market nuances.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Neurorehabilitation Devices market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Neurorehabilitation Devices Market, by Device Type

- Neurorehabilitation Devices Market, by Technology

- Neurorehabilitation Devices Market, by Age Group

- Neurorehabilitation Devices Market, by Application

- Neurorehabilitation Devices Market, by End User

- Neurorehabilitation Devices Market, by Region

- Neurorehabilitation Devices Market, by Group

- Neurorehabilitation Devices Market, by Country

- United States Neurorehabilitation Devices Market

- China Neurorehabilitation Devices Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 4611 ]

Drawing Cohesive Conclusions to Inspire Continued Innovation in Neurorehabilitation Technologies and Illuminate Emerging Treatment Paradigms

The convergence of robotics, neuromodulation, virtual reality, and brain–computer interfaces is fundamentally reshaping neurorehabilitation, offering clinicians and patients an expanded toolkit for restoring function and enhancing quality of life. Technological innovations, coupled with patient-centric design and strategic repositioning in response to tariff headwinds, underscore the adaptability and resilience of this industry. Regional disparities in adoption and infrastructure reveal both challenges and opportunities, emphasizing the need for tailored approaches that consider local regulatory environments and healthcare models.

As key players refine their portfolios through partnerships, acquisitions, and interdisciplinary research collaborations, the competitive landscape will continue to evolve. Stakeholders must stay vigilant to emerging trends, from data-driven therapy optimization to modular device architectures, to maintain a leadership position. Looking ahead, sustained investment in clinical validation, supply chain diversification, and patient engagement will be vital to unlocking new growth horizons and driving the next wave of innovation in neurorehabilitation technology.

Engage with Our Associate Director of Sales and Marketing for Personalized Insights Access and to Secure the Neurorehabilitation Devices Market Research Report

To access deep-dive analyses, expert commentary, and the most comprehensive breakdown of device types, applications, regions, and technologies shaping the neurorehabilitation landscape, reach out to Ketan Rohom who leads sales and marketing efforts. As Associate Director specializing in market strategies, he can provide you with tailored insights and sample chapters that align with your organizational objectives. Engage directly to learn how this report can support your decision-making, uncover hidden opportunities, and accelerate growth by equipping your teams with data-driven intelligence.

Connect with Ketan today to secure your copy of the neurorehabilitation devices market research report and gain the strategic edge you need to innovate, compete, and succeed in this dynamic sector.

- How big is the Neurorehabilitation Devices Market?

- What is the Neurorehabilitation Devices Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?