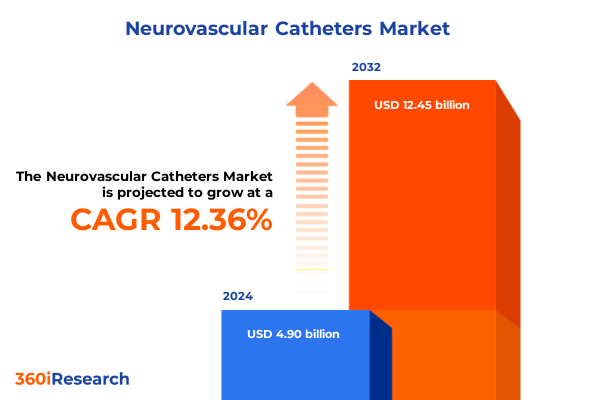

The Neurovascular Catheters Market size was estimated at USD 5.40 billion in 2025 and expected to reach USD 5.97 billion in 2026, at a CAGR of 12.64% to reach USD 12.45 billion by 2032.

Pioneering the Future of Neurovascular Catheters Through Innovative Technologies and Clinical Applications Shaping Patient Outcomes

Neurovascular catheters have emerged as a cornerstone in the diagnosis and treatment of cerebrovascular disorders, reflecting the convergence of engineering prowess, clinical demand, and regulatory evolution. Over the past decade, the field has witnessed significant advances in catheter design, material science, and image-guided navigation, culminating in devices that allow clinicians to reach intricate cerebral vasculature with unprecedented precision. The aging global population and rising incidence of stroke and aneurysms have amplified the clinical urgency for minimally invasive interventions, driving hospitals, specialty clinics, and ambulatory centers to deploy next-generation catheters that balance performance, safety, and cost-effectiveness.

This executive summary offers a panoramic view of the neurovascular catheter industry, illuminating the forces reshaping product portfolios, supply chains, and regional adoption patterns. It delves into technological milestones-from polymer innovations to microcatheter miniaturization-and examines how emerging clinical protocols and reimbursement frameworks are influencing procurement decisions. By articulating the pivotal shifts and granular trends that define this dynamic market, the following analysis empowers stakeholders to identify opportunities for innovation, optimize strategic priorities, and stay ahead in an increasingly competitive landscape.

Navigating Key Technological Disruptions and Clinical Breakthroughs Reshaping the Neurovascular Catheter Landscape in 2025

The neurovascular catheter landscape is undergoing transformative shifts driven by the integration of advanced imaging modalities and next-generation materials. Innovations in polymer science, including high-torque polyether block amide and ultra-thin polyimide composites, are enabling unprecedented flexibility and navigability within tortuous cerebral vessels. Simultaneously, the adoption of photon-counting and biplane fluoroscopy systems has revolutionized real-time visualization, reducing contrast volumes and procedural times while enhancing safety profiles for patients and clinicians alike.

Beyond hardware enhancements, the integration of robotics and artificial intelligence is reshaping procedural workflows. Robotic catheter navigation platforms offer haptic feedback and micro-adjustment capabilities that transcend human limitations, allowing for sub-millimeter positioning accuracy. AI-driven image segmentation and path-planning algorithms further streamline procedural planning, identifying optimal access routes and risk zones before the first guidewire is advanced. Together, these breakthroughs are not only improving clinical outcomes but also catalyzing new training paradigms for interventionalists, fostering proficiency in increasingly complex neurovascular therapies.

Assessing the Aggregate Effects of 2025 United States Trade Tariffs on Neurovascular Catheter Costs Supply Chains and Strategic Sourcing

In 2025, the United States implemented a series of import tariffs that have materially affected the economics and supply chains of neurovascular catheters. Following executive orders in early February, a baseline 10% tariff was applied to all imports from China, while tariff relief on Canadian and Mexican medical products was temporarily delayed, maintaining a 25% duty on a broad range of healthcare goods including critical device components. This policy shift has introduced upstream cost pressures, particularly for manufacturers reliant on specialized polymers and precision-engineered hub assemblies sourced from Asian partners.

Section 301 expansions announced in late 2024 further intensified the burden on imported medical supplies. Starting January 1, 2025, tariffs on rubber medical gloves doubled to 50%, while duties on textile-based face masks and non-surgical respirators rose to 25%. Importantly for catheter producers, increased rates on advanced polymer materials-commonly utilized in braiding layers and reinforced shafts-have elevated input costs by an estimated 15% to 20%, prompting manufacturers to reevaluate supplier contracts and consider near-shoring options to offset escalating duties.

The cumulative impact of these tariff measures is evident in extended lead times, shifted production footprints, and margin compression across the supply chain. Some catheter providers have responded by diversifying procurement to include European and Latin American material sources, while others are forging joint ventures with domestic polymer innovators. Nevertheless, the unpredictability of trade policy continues to underscore the need for dynamic sourcing strategies and collaborative engagement with regulatory authorities to mitigate disruptions and preserve patient access to life-saving neurovascular therapies.

Unveiling Critical Segmentation Dynamics Across Product Types Materials Dimensions Clinical Applications and End-User Profiles

A granular analysis of neurovascular catheter market segmentation reveals differentiated growth drivers and competitive dynamics across product families, materials, dimensions, clinical applications, and end-user settings. Within product type differentiation, diagnostic catheters-subdivided into angiographic diagnostic and pressure monitoring variants-continue to underpin early vessel visualization, whereas guiding catheters, differentiated into reinforced and soft tip configurations, serve as the workhorse platforms for device delivery. Microcatheters, available in over-the-wire and rapid exchange formats, are driving penetration in delicate interventions where microcatheter trackability and pushability can determine procedural success.

Material composition plays a pivotal role in performance differentiation, with polyether block amide offering a balance of flexibility and kink resistance, polyimide delivering ultra-thin profile consistency, and polytetrafluoroethylene ensuring low-friction lumens for device compatibility. Size gradations from 1.2F to 1.5F, 1.6F to 2.0F, and 2.1F to 2.5F influence selection based on vessel caliber and target anatomy. In application-centric segmentation, aneurysm treatment platforms, encompassing endovascular coiling systems and flow diversion devices, are expanding alongside embolization procedures-featuring both liquid and particle embolization approaches-as well as thrombectomy solutions for acute ischemic stroke.

End-user segmentation underscores the nuanced requirements across ambulatory surgery centers, hospitals, and specialty clinics. Within hospital systems, community hospitals focus on general diagnostic and treatment protocols, while tertiary care centers demand advanced catheter configurations for complex neurointerventional procedures. Specialty clinics and outpatient surgical sites are increasingly adopting streamlined catheter portfolios optimized for high throughput and cost control, reflecting the broader shift toward ambulatory care models in neurovascular therapy.

This comprehensive research report categorizes the Neurovascular Catheters market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Material

- Size

- Application

- End User

Illuminating Regional Variations and Growth Drivers Influencing Neurovascular Catheter Adoption Across Key Global Markets

Regional insights into the neurovascular catheter market highlight divergent growth trajectories and adoption barriers across key geographic clusters. In the Americas, robust healthcare infrastructure and favorable reimbursement pathways have accelerated adoption of microcatheters and flow diversion technologies. The United States, supported by Centers for Medicare & Medicaid Services registries and stroke center accreditation pathways, remains at the forefront of clinical innovation, while Latin American markets are gradually expanding through public-private partnerships and targeted training programs that bolster clinician proficiency.

In Europe, Middle East & Africa, regulatory harmonization via CE marking has facilitated cross-border distribution, yet price sensitivity in public health systems and tender-driven procurement models exert downward pressure on ASPs. Germany, France, and the United Kingdom continue to drive premium catheter adoption, whereas emerging markets in the Middle East and Africa focus on scalable platforms suited for high procedural volumes and constrained budgets. Collaborative consortia and capacity-building initiatives are actively shaping market access and driving incremental demand.

Asia-Pacific presents a bifurcated landscape, with advanced economies such as Japan and South Korea rapidly integrating AI-enabled navigation and next-generation imaging, while markets in China, India, and Southeast Asia prioritize volume accessibility and cost containment. Local manufacturing clusters are expanding through strategic alliances, aiming to capture both domestic demand and export opportunities. As regional regulatory bodies streamline approval frameworks, the Asia-Pacific region is poised to become a pivotal innovation and production hub for neurovascular catheters.

This comprehensive research report examines key regions that drive the evolution of the Neurovascular Catheters market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Strategic Competitor Positions and Cutting-Edge Innovation Portfolios of Leading Global Neurovascular Catheter Companies Driving Industry Progress

The competitive arena in neurovascular catheters is defined by established multinational medtech corporations and agile specialty innovators. Boston Scientific has fortified its portfolio through the acquisition of advanced microcatheter technologies, while Medtronic continues to leverage its global R&D network to introduce polymer enhancements and integrated sensor-enabled catheters. Siemens Healthineers has broadened its presence by coupling catheter systems with high-resolution imaging platforms, effectively creating bundled solutions that streamline clinical workflows.

Simultaneously, nimble challengers like Penumbra and Stryker are gaining traction by focusing on niche applications such as aspiration thrombectomy and flow diverter design. Terumo and MicroVention remain strategic partners of choice for clinicians seeking novel coil delivery systems and braided catheter shafts that optimize radial strength. Meanwhile, local players in Asia-Pacific and Latin America are carving out defensible positions through cost-effective manufacturing and regional distribution alliances, intensifying competitive pressure on global incumbents.

Looking ahead, strategic collaboration between device manufacturers and imaging technology providers is expected to accelerate. Partnerships aimed at combining catheter navigation software with real-time analytics promise to redefine procedural efficiency and outcome predictability. Companies that effectively marry core competencies in materials, manufacturing, and digital integration will be best positioned to lead the next wave of growth in this high-stakes, patient-centric market.

This comprehensive research report delivers an in-depth overview of the principal market players in the Neurovascular Catheters market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Abbott Laboratories

- Acandis GmbH

- Asahi Intecc Co., Ltd.

- B. Braun Melsungen AG

- Balt Extrusion

- Becton, Dickinson and Company

- Boston Scientific Corporation

- Cook Medical LLC

- ICU Medical, Inc.

- Imperative Care Inc.

- Inari Medical, Inc.

- Integer Holdings Corporation

- Integra LifeSciences Holdings Corporation

- Johnson & Johnson Services, Inc.

- Medtronic plc

- Merit Medical Systems, Inc.

- MicroPort Scientific Corporation

- Penumbra, Inc.

- Phenox GmbH

- Rapid Medical Ltd.

- Stryker Corporation

- Teleflex Incorporated

- Terumo Company

- Terumo Corporation

- Zeus Industrial Products, Inc.

Strategic Imperatives and Actionable Guidance for Industry Leaders to Navigate Market Challenges and Capitalize on Emerging Opportunities

To navigate the evolving neurovascular catheter landscape, industry leaders must prioritize agility in product development and supply chain design. Investing in polymer research partnerships and additive manufacturing capabilities can unlock cost-effective production while enhancing device performance. Leveraging predictive analytics to forecast material shortages and demand fluctuations will be critical for maintaining inventory resilience in the face of variable tariff regimes and geopolitical uncertainty.

Clinical adoption can be accelerated through comprehensive education programs that demonstrate procedural efficiencies and patient outcome benefits. Collaborative pilot studies and registry data sharing help build real-world evidence, reinforcing payer coverage and bolstering physician confidence. Engaging health economics experts early in the development cycle ensures that value propositions are aligned with evolving reimbursement frameworks, facilitating smoother market entry.

Finally, forging cross-sector alliances-spanning imaging system manufacturers, digital health platforms, and clinical research organizations-can create integrated care solutions that differentiate portfolios and drive scalable growth. By cultivating a culture of continuous innovation and stakeholder collaboration, companies will be better equipped to deliver transformative neurovascular therapies and sustain competitive advantage.

Elucidating a Robust Multi-Source Research Approach Combining Primary Interviews Secondary Data and Rigorous Analytical Frameworks

This report synthesizes insights derived from a robust multi-source research methodology. Primary data collection involved in-depth interviews with leading neurointerventionalists, hospital procurement directors, and device engineers, ensuring firsthand perspectives on procedural preferences and technology requirements. Complementing these discussions, structured surveys of supply chain managers provided quantitative validation of material cost pressures and sourcing strategies across geographic regions.

Secondary research encompassed a comprehensive review of peer-reviewed journals, clinical trial registries, and regulatory filings, alongside analysis of public policy documents from agencies such as the USTR and CMS. Market data from global health organizations, combined with corporate annual reports and financial disclosures, underpinned the evaluation of competitive landscapes and tariff impacts. Rigorous analytical frameworks-including SWOT, PESTEL, and Porter’s Five Forces-were applied to assess strategic positioning and external drivers.

To enhance accuracy, preliminary findings were subjected to validation workshops with an expert advisory panel of neurovascular specialists and industry consultants. Feedback loops were integrated to refine data interpretations and ensure that actionable recommendations reflect both clinical realities and commercial viability. This multi-tiered approach yields a nuanced understanding of the neurovascular catheter market, equipping stakeholders with defensible insights and strategic roadmaps.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Neurovascular Catheters market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Neurovascular Catheters Market, by Product Type

- Neurovascular Catheters Market, by Material

- Neurovascular Catheters Market, by Size

- Neurovascular Catheters Market, by Application

- Neurovascular Catheters Market, by End User

- Neurovascular Catheters Market, by Region

- Neurovascular Catheters Market, by Group

- Neurovascular Catheters Market, by Country

- United States Neurovascular Catheters Market

- China Neurovascular Catheters Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1908 ]

Synthesis of Core Findings Underlining Market Evolution and Strategic Imperatives for Sustainable Growth in Neurovascular Catheters

The neurovascular catheter market is at an inflection point, characterized by rapid technological innovation, evolving clinical protocols, and dynamic trade landscapes. High-performance polymers, miniaturized microcatheter architectures, and AI-assisted navigation systems are setting new benchmarks for procedural efficacy and patient safety. Concurrently, fluctuating tariff policies underscore the imperative for resilient supply chains and adaptive sourcing strategies.

Segmentation analysis reveals that nuanced differentiation across product types, materials, sizes, applications, and end-user profiles is driving targeted growth. Regional dynamics highlight the maturity of the Americas, the cost containment pressures in Europe, Middle East & Africa, and the dual focus on affordability and innovation in Asia-Pacific. Competitive insights underscore the importance of strategic partnerships and bundled technology offerings as margins tighten and end-user expectations rise.

Looking forward, successful market participants will be those that marry clinical excellence with operational agility. By embracing collaborative innovation, investing in digital integration, and maintaining proactive policy engagement, organizations can navigate uncertainties and capture opportunities across this critical domain of neurovascular care. This collective synthesis provides a strategic blueprint for sustainable growth and clinical impact.

Connect Directly with Associate Director Ketan Rohom to Secure Your Comprehensive Neurovascular Catheter Market Research Report Today

For bespoke insights and tailored strategic guidance on the neurovascular catheter landscape, connect directly with Associate Director Ketan Rohom to secure the comprehensive market research report today. As an industry expert deeply versed in clinical, technological, and regulatory developments, he can assist you in understanding the nuanced drivers that influence market dynamics and help you translate findings into actionable growth initiatives. Reach out to discuss report customization options, volume licensing packages, and strategic consulting add-ons that align with your organization’s priorities. By engaging with Ketan, you will gain direct access to leading-edge data, expert analysis, and personalized support designed to empower your decision-making process and accelerate your competitive advantage.

- How big is the Neurovascular Catheters Market?

- What is the Neurovascular Catheters Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?