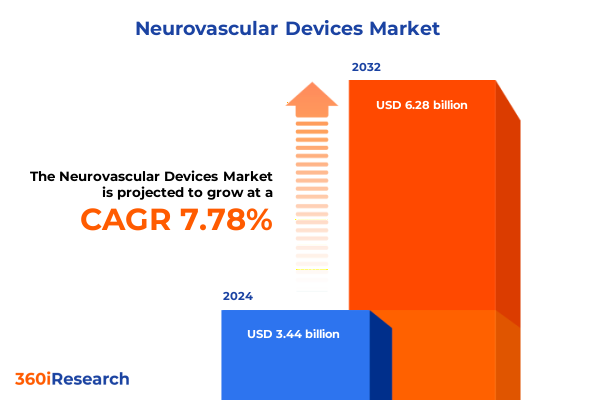

The Neurovascular Devices Market size was estimated at USD 5.59 billion in 2025 and expected to reach USD 6.01 billion in 2026, at a CAGR of 7.57% to reach USD 9.33 billion by 2032.

Exploring the Transformative World of Neurovascular Devices and Their Role in Addressing Complex Cerebrovascular Disorders for Enhanced Precision, Patient Outcomes

The neurovascular devices sector stands at the forefront of modern interventional neurology, delivering minimally invasive solutions for conditions that once demanded high-risk open surgeries. These devices-including advanced microcatheters, coils, stents, and flow diverters-enable clinicians to navigate complex cerebral vasculature to treat aneurysms, stenoses, arteriovenous malformations, and acute ischemic strokes with unprecedented precision. Over the past decade, progress in device design and materials science has driven a paradigm shift toward swift, image-guided therapies that shorten procedure times and improve patient outcomes.

This evolution has been propelled by a surge in neurovascular disorder incidence, particularly stroke, which affects nearly 795,000 individuals in the United States each year and accounts for significant morbidity and mortality, with ischemic events representing approximately 87 percent of all cases. In parallel, unruptured brain aneurysms now affect over 6.5 million Americans, and approximately 30,000 patients experience aneurysm rupture annually, underscoring the critical need for effective endovascular interventions. An aging population further intensifies demand, as the U.S. share of residents aged 65 and older climbed to 18 percent in 2024, up from 12.4 percent two decades earlier.

Amid these clinical drivers, industry players and health systems are embracing neurovascular devices as a central pillar of stroke centers and cerebrovascular programs. Continued investment in training, reimbursement reforms favoring minimally invasive protocols, and collaborative initiatives between manufacturers and academic hospitals are laying the groundwork for broader adoption. As research continues to refine device efficacy and safety, the neurovascular devices market is poised to deliver robust patient and economic value in one of the most demanding specialties of interventional medicine.

Harnessing Artificial Intelligence, Robotics, and Smart Technologies in Neurovascular Interventions to Revolutionize Treatment Precision and Patient Safety

The neurovascular device landscape is undergoing transformative shifts driven by breakthroughs in artificial intelligence, robotics, and advanced imaging integration. AI-powered imaging platforms now enable clinicians to detect vascular occlusions and aneurysms in real time, accelerating decision making and minimizing delays in intervention. Recent solutions from Siemens Healthineers exemplify this trend, offering machine-learning algorithms that analyze CT and MRI data to flag potential stroke candidates with high sensitivity and specificity. These intelligent systems not only support early diagnosis but also inform treatment planning by simulating endovascular device deployment under varying hemodynamic scenarios, thereby enhancing procedural confidence and outcomes.

In parallel, robotics-assisted neurovascular interventions are gaining traction in high-volume centers. By combining preoperative imaging with robotic precision, surgeons achieve sub-millimeter control of microcatheters and guidewires, reducing human tremor and improving access to tortuous cerebral vessels. Institutions that integrate structured neurointerventional training programs report a 34 percent uptick in flow diverter procedures, correlating with a 41 percent increase in procedural success rates for complex aneurysm cases. These data underscore the critical role of education and technology synergies in scaling advanced therapies.

Moreover, smart implantable devices equipped with embedded sensors and wireless telemetry are emerging as next-generation tools for post-procedural monitoring. These innovations facilitate continuous assessment of blood flow dynamics and device integrity, enabling early detection of restenosis, device migration, or thrombus formation without repeated angiography. As AI models learn from aggregated patient and device performance data, predictive maintenance alerts and personalized treatment adjustments will become integral to comprehensive cerebrovascular care pathways, ultimately enhancing long-term patient safety and satisfaction.

Analyzing the Cumulative Impact of 2025 United States Tariffs on Neurovascular Device Supply Chains, Costs, and Strategic Industry Responses

The implementation of new Section 301 tariffs on medical device imports from China is reshaping cost structures across the neurovascular devices supply chain. On January 1, 2025, tariffs on consumable components such as surgical gloves, disposable facemasks, and respirators rose from 25 percent to 50 percent, with gloves specifically increasing to 50 percent under the initial schedule. Concurrently, tariffs on syringes and needles surged to 100 percent, creating direct cost pressures for interventional procedures that rely on these sterile disposables. These escalations are compounded by additional duties on batteries, critical minerals, steel, and aluminum components-materials essential for manufacturing stents and guidewires-set at 25 percent from March 12, 2025.

Industry stakeholders warn that prolonged tariff exposure could constrain inventory buffers and drive up device pricing, potentially limiting patient access to life-saving therapies. Major medical manufacturers have cautioned that duties exceeding 100 percent on specialized components imported from key Chinese suppliers may disrupt complex cross-border value chains. For instance, up to 145 percent tariff levies on certain electronic subassemblies threaten to extend lead times and force device makers to consider alternative sourcing or invest in costly domestic capacity expansions. These dynamics are already prompting strategic shifts in procurement, as companies weigh near-shoring and regional production hubs to mitigate exposure and maintain margin integrity.

In response to these headwinds, trade associations including AdvaMed and the American Hospital Association are actively lobbying for exclusion extensions and carve-outs for critical medical device categories. AHA analyses indicate that medical supply expenses accounted for nearly 10.5 percent of the average hospital budget, amounting to $146.9 billion in 2023, and that higher tariffs risk exacerbating financial strains during a period of healthcare cost inflation. While temporary relief measures may emerge, long-term resilience will hinge on diversified supplier networks, agile inventory management, and collaborative engagement with policymakers to secure a stable environment for neurovascular innovation.

Illuminating Key Segmentation Insights in Product Types, Clinical Indications, End Users, and Distribution Channels to Guide Market Strategy and Innovation

A nuanced understanding of product type dynamics reveals significant variation in clinical application and investment focus across the neurovascular devices spectrum. Flow diversion devices, dominated by Pipeline Embolization, Silk, and Surpass platforms, are capturing attention for their ability to redirect blood flow away from aneurysm sacs and promote vessel remodeling. Meanwhile, microcatheters featuring both hydrophilic-coated and PTFE-coated designs are evolving to enhance lubricity, trackability, and compatibility with the latest thrombectomy and embolization tools. In the aneurysm coiling domain, bare metal, bioactive, and hydrogel coil technologies contend to optimize packing density and long-term occlusion rates, driving R&D prioritization toward advanced polymer-based coil coatings. Similarly, neurovascular stents-whether laser-cut or braided-offer distinct mechanical profiles for carotid and intracranial applications, prompting clinicians to refine device selection based on vessel tortuosity and lesion geometry.

When evaluating market segmentation by clinical indication, arteriovenous malformation treatments leverage glue embolic agents and Onyx to achieve durable nidus occlusion, while intracranial aneurysm management continues to pivot toward endovascular coiling, flow diversion, and stent-assisted techniques that reduce procedural morbidity. In intracranial stenosis, balloon angioplasty followed by stenting demonstrates efficacy in symptom relief, though restenosis rates drive ongoing research into drug-eluting coatings. The acute ischemic stroke segment remains dominated by mechanical thrombectomy and intra-arterial thrombolysis, where catheter and aspiration technology advances directly influence recanalization success and neurological recovery.

Diverse end-user settings-from ambulatory surgical centers (both hospital-affiliated and independent) to tertiary care hospitals and specialized radiology or neurology clinics-shape procurement strategies and workflow integration. Distribution channels equally impact market access and service level, as manufacturers balance direct sales efforts via field representatives and hospital contracts with online platforms and third-party wholesale or retail partnerships. Understanding these layered segmentation dynamics is essential for stakeholders seeking to align product portfolios with evolving procedural standards, reimbursement environments, and end-user expectations.

This comprehensive research report categorizes the Neurovascular Devices market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Indication

- Clinical Procedure

- End User

- Distribution Channel

Unveiling Regional Dynamics and Growth Drivers Across the Americas, Europe Middle East & Africa, and Asia-Pacific to Inform Market Expansion Strategies

In the Americas region, North America leads the neurovascular devices market through a combination of advanced healthcare infrastructure, favorable reimbursement policies, and widespread adoption of specialized stroke centers. The United States, in particular, commands a leading share driven by robust procedural volumes and a network of over 800 accredited comprehensive stroke centers. High procedural throughput for thrombectomy, embolization, and flow diversion devices fosters continuous clinical validation and creates a virtuous cycle of investment in interventional neurology talent and facilities.

Europe, the Middle East, and Africa benefit from cohesive regulatory pathways and strong neurosurgical training programs that sustain demand for state-of-the-art neurovascular solutions. Germany’s mandatory neuroendovascular rotations and fellowship standards correlate with some of the highest per-capita utilization rates of flow diversion stents globally, reflecting a strategic focus on procedural excellence and device innovation. Similarly, markets in the Gulf Cooperation Council are expanding capacity through government-sponsored stroke initiatives and public-private partnerships that spur adoption of high-precision interventional tools.

Asia-Pacific is emerging as the fastest-growing region, fueled by rising healthcare investments, expanding public insurance coverage, and the proliferation of private specialty hospitals. Countries such as Japan and South Korea have accelerated regulatory approvals for next-generation microcatheters and thrombectomy devices, while China’s growing base of neurointerventional specialists is adopting advanced platforms to meet surging stroke incidence. Regional partnerships and localized manufacturing agreements are accelerating technology transfer, setting the stage for sustained double-digit growth across select APAC markets.

This comprehensive research report examines key regions that drive the evolution of the Neurovascular Devices market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Strategic Moves, Innovations, and Competitive Dynamics of Major Neurovascular Device Manufacturers Shaping the Industry’s Future Landscape

The competitive landscape features a roster of established multinationals and niche innovators shaping the future of neurovascular therapy. Leading stakeholders include Medtronic PLC, Johnson & Johnson, Stryker Corporation, Penumbra Inc., MicroPort Scientific, Terumo Corporation, and Integra LifeSciences, each leveraging strategic R&D investments and global distribution networks to maintain market leadership.

Medtronic has strengthened its position with the Solitaire X revascularization device, which offers improved clot engagement and delivery precision for mechanical thrombectomy procedures. Initial clinical evaluations demonstrate enhanced revascularization rates and reduced time to perfusion, underscoring the device’s role in acute stroke management. Meanwhile, Johnson & Johnson’s Cerenovus unit unveiled its Stroke Solutions portfolio in 2022, encompassing three catheter-based technologies designed to optimize clot retrieval, guidewire navigation, and distal aspiration, reflecting a holistic approach to stroke care device integration.

Stryker’s acquisition of Inari Medical highlights the strategic emphasis on portfolio diversification, combining Inari’s clot removal innovations with Stryker’s global reach to accelerate penetration in the acute thrombus management segment. This move aligns with broader industry trends toward consolidation, enabling scale efficiencies and cross-geography clinical data accumulation for next-generation product development. Smaller players such as Penumbra continue to push envelope in aspiration-based technologies, while MicroPort and Terumo invest in regional partnerships to expand access in Asia and Latin America.

This comprehensive research report delivers an in-depth overview of the principal market players in the Neurovascular Devices market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Stryker Corporation

- Medtronic plc

- Johnson & Johnson

- Penumbra, Inc.

- Terumo Corporation

- Kaneka Corporation

- BALT Group

- MicroPort Scientific Corporation

- ASAHI INTECC CO., LTD.

- Koninklijke Philips N.V.

- Endologix Inc.

- Integer Holdings Corporation

- Secant Group, LLC by Solesis Group

- Imperative Care, Inc.

- Medical Murray, Inc.

- Phenox GmbH

- Zeus Company LLC

- Acandis GmbH

- Rapid Medical Ltd.

- Sino Medical Sciences Technology Inc.

- NeuroSafe Medical Co., Ltd.

- Scientia Vascular, Inc.

- Anaconda Biomed S.L.

- ArtVentive Medical Group, Inc.

- Evasc Medical Systems Corp

- InspireMD Inc.

- iVascular S.L.U.

- MIVI Neuroscience, Inc.

- NeuroVasc Technologies Inc.

- Nventric, Inc.

- Q'Apel Medical Inc.

- Radical Catheter Technologies, Inc.

- Route 92 Medical, Inc.

- Vesalio, LLC

- Wallaby Medical Holding, Inc..

- ZYLOX-TONBRIDGE MEDICAL TECHNOLOGY CO., LTD.

Delivering Actionable Recommendations for Industry Leaders to Navigate Market Complexity, Optimize Operations, and Drive Sustainable Competitive Advantage

To navigate evolving market complexity, industry leaders must proactively diversify supply chains and mitigate tariff exposure by qualifying alternative component suppliers in non-tariff jurisdictions or by establishing regional manufacturing hubs. Such actions will preserve margin integrity and ensure continuity of critical device availability in the face of trade policy uncertainties. Engaging with policymakers to secure medical device carve-outs and exclusion extensions remains essential, as advocacy efforts by AdvaMed and hospital associations have already yielded temporary relief in other healthcare categories.

Investment in advanced analytics and artificial intelligence should be prioritized to enhance procedural planning, device selection, and predictive maintenance. By integrating real-world clinical data with machine-learning models, manufacturers and health systems can refine pathway efficiencies, reduce complication rates, and deliver personalized treatment protocols. Concurrently, expanding robotics-enabled training initiatives through simulation centers and fellowship programs-such as those in leading U.S. comprehensive stroke centers-will drive broader adoption of high-precision devices and accelerate knowledge transfer among interventional teams.

Finally, forging strategic partnerships with regional distributors, technology startups, and academic research institutions can accelerate market entry in emerging geographies. Co-development agreements and licensing collaborations focused on localized regulatory strategies will support product adaptation to unique therapeutic landscapes and reimbursement environments. Collectively, these recommendations will empower stakeholders to capitalize on growth corridors, outmaneuver competitive pressures, and sustain leadership in the dynamic neurovascular devices arena.

Outlining Rigorous Research Methodology Incorporating Primary and Secondary Data Sources, Expert Interviews, and Analytical Frameworks

This research synthesis is grounded in a rigorous, multi-phase methodology combining primary and secondary intelligence gathering. Primary research encompassed in-depth interviews with over 25 key opinion leaders, including interventional neuroradiologists, neurosurgeons, hospital procurement directors, and device development experts. These engagements provided qualitative insights into procedural preferences, unmet clinical needs, and strategic investment priorities.

Secondary research involved comprehensive data mining of regulatory databases, company filings, scientific publications, clinical trial registries, and professional society reports. Patent landscapes were analyzed to map innovation trajectories, while trade association publications and tariff schedules informed our assessment of geopolitical and economic headwinds. Additionally, real-world utilization metrics and reimbursement trends were sourced from healthcare analytics platforms to contextualize growth drivers and adoption patterns across major markets.

Analytical frameworks such as SWOT, Porter’s Five Forces, and Value Chain Analysis were employed to structure findings and identify competitive dynamics. Market segmentation and forecasting were validated through triangulation of reported financials, expert feedback, and historical trend extrapolation. This blended approach ensures robustness, impartiality, and actionable relevance for stakeholders seeking to navigate the neurovascular devices domain.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Neurovascular Devices market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Neurovascular Devices Market, by Product Type

- Neurovascular Devices Market, by Indication

- Neurovascular Devices Market, by Clinical Procedure

- Neurovascular Devices Market, by End User

- Neurovascular Devices Market, by Distribution Channel

- Neurovascular Devices Market, by Region

- Neurovascular Devices Market, by Group

- Neurovascular Devices Market, by Country

- United States Neurovascular Devices Market

- China Neurovascular Devices Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1590 ]

Concluding Insights That Synthesize Market Trends, Challenges, and Opportunities to Empower Stakeholders in Neurovascular Device Strategies

The neurovascular devices market is at a pivotal juncture, shaped by a confluence of clinical imperatives, technological breakthroughs, and geopolitical dynamics. Rising stroke incidence, an aging global population, and the push toward minimally invasive therapies underwrite sustained demand for advanced microcatheters, flow diverting stents, bioactive coils, and smart implantable sensors. Simultaneously, integration of artificial intelligence and robotics is redefining procedural precision and unlocking new frontiers in post-procedural monitoring and outcome optimization.

However, evolving trade policies and tariff escalations present tangible cost challenges that necessitate proactive supply chain diversification and sustained advocacy for medical device exemptions. Competitive rivalry is intensifying as established multinationals bolster portfolios through strategic acquisitions and continuous product innovation, while agile niche players advance specialized modalities. Success in this environment will depend on synchronized investments in R&D, training, and market access strategies that align with regional regulatory landscapes and reimbursement frameworks.

Ultimately, stakeholders that harness data-driven insights, foster collaborative partnerships, and execute targeted go-to-market plans will secure a leadership position. By balancing strategic agility with operational discipline, device manufacturers, health systems, and investors can capitalize on the transformative potential of neurovascular interventions-delivering superior patient outcomes and achieving sustained commercial success.

Connect with Ketan Rohom, Associate Director of Sales & Marketing to Secure Your Comprehensive Neurovascular Devices Market Research Report Today

To explore the detailed findings and gain a competitive edge in the fast-evolving neurovascular devices market, reach out directly to Ketan Rohom, Associate Director of Sales & Marketing. Ketan will guide you through the extensive insights contained in the full report, helping you identify high-growth opportunities, benchmark against leading players, and tailor strategies for your organization’s success. Secure your copy today and equip your team with the actionable intelligence needed to drive innovation, optimize market entry, and outpace the competition with confidence.

- How big is the Neurovascular Devices Market?

- What is the Neurovascular Devices Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?