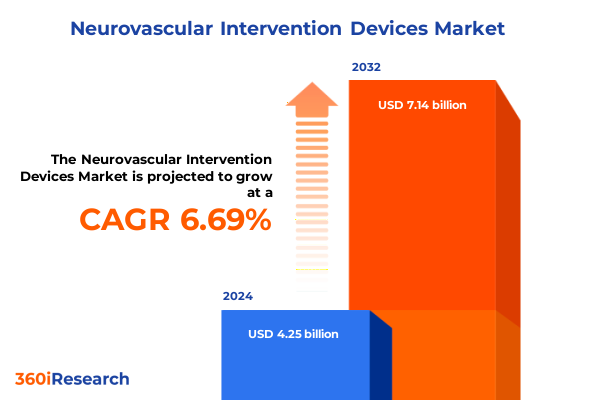

The Neurovascular Intervention Devices Market size was estimated at USD 4.53 billion in 2025 and expected to reach USD 4.84 billion in 2026, at a CAGR of 6.69% to reach USD 7.14 billion by 2032.

Navigating the Evolution of Neurovascular Intervention Devices Amidst Rapid Technological Innovations Clinical Adoption and Market Dynamics

The neurovascular intervention devices arena has experienced a remarkable transformation driven by converging technological, clinical, and regulatory forces. Over recent years, advances in imaging modalities have enabled more precise catheter navigation, while the integration of artificial intelligence algorithms into treatment planning has enhanced procedural outcomes and patient safety. At the same time, evolving reimbursement frameworks and stringent post-market surveillance requirements have reshaped the development lifecycle, compelling manufacturers to adopt agile design and validation processes. Consequently, this dynamic environment demands that stakeholders continually reassess strategic priorities and investments.

In response to these shifts, healthcare providers are forging multidisciplinary teams that leverage endovascular expertise alongside neurosurgical acumen, thereby elevating the standard of care. Concurrently, collaborative partnerships between medtech firms, academic institutions, and contract research organizations are accelerating the translation of bench-side innovations into clinical practice. As the interventional neuroradiology community embraces these developments, the stage is set for sustained innovation that addresses unmet clinical needs and improves patient outcomes. By understanding the interplay of these factors, organizations can navigate uncertainty and capitalize on emerging opportunities within this high-growth segment.

Tracing the Pivotal Shifts Redefining the Neurovascular Intervention Space Driven by Digital Integration Regulatory Evolution and Clinical Practice Patterns

In recent years, several disruptive trends have converged to redefine the neurovascular device landscape. Advances in biomaterials have enabled the development of next-generation flow diverters with enhanced conformability and endothelialization properties, improving long-term vessel healing. Simultaneously, liquid embolic formulations characterized by controlled polymerization kinetics have provided interventionalists with greater precision and reduced distal migration risks. In parallel, the accelerated adoption of 3D printing technologies has facilitated patient-specific device prototyping, expediting procedural planning and device customization.

Regulatory modernization initiatives have also played a pivotal role in shaping the ecosystem. Streamlined pathways for breakthrough devices, coupled with real-world evidence requirements, have prompted manufacturers to integrate robust post-market surveillance mechanisms early in development. Moreover, the growing emphasis on value-based care has driven stakeholders to demonstrate the clinical and economic benefits of minimally invasive interventions, fostering broader payer acceptance. As these transformative shifts coalesce, the neurovascular sector is poised for a new era of precision therapy that aligns technological prowess with patient-centric outcomes.

Unpacking the Aggregate Consequences of Enhanced United States Tariff Measures on Neurovascular Device Supply Chains Clinical Costs and Industry Stability

The reinstatement and expansion of Section 301 tariffs targeting medical devices and components sourced from China and other regions have generated far-reaching implications for the neurovascular supply chain. Initially introduced in late 2024, these duties imposed tariff rates ranging from 25% to as high as 100% on select consumables and key materials, while consumable device categories faced the brunt of first-wave increases due January 1, 2025. Simultaneously, a general 10% tariff on all Chinese imports, combined with selective reciprocal tariffs on European and Southeast Asian inputs, has compounded cost pressures across the ecosystem.

Industry leaders have reported that elevated duties on catheter materials, embolic polymers, and guidewire coatings have disrupted established supply relationships, forcing a shift toward higher-cost domestic manufacturing or alternative sourcing hubs in Southeast Asia and Latin America. These adjustments have not only heightened inventory holding costs but also introduced regulatory complexity, as device manufacturers navigate varied quality standards across geographies. In response, several top‐tier companies are ramping up capital investments in U.S. and EMEA production facilities to mitigate tariff exposure, although lead times for facility expansions and regulatory filings may delay tangible benefits until late 2025.

Illuminating Strategic Insights Through Product Use Case Indication Based End User and Procedure Type Segmentation in Neurovascular Intervention

A nuanced examination of market segmentation reveals critical drivers underpinning device adoption and development priorities. By product type, embolic agents encompass both liquid embolics designed for in situ polymerization and particulate embolics employed for vessel occlusion, while flow diverter offerings span established pipeline embolization devices alongside next-generation Surpass flow diverters. Microcatheters bifurcate into hydrophilic coated models prized for superior trackability and polymer coated variants offering enhanced biocompatibility. In parallel, neurovascular coils range from detachable configurations facilitating controlled deployment to pushable coils that optimize procedural efficiency. Complementary stent options include balloon mounted platforms engineered for precise expansion and self expanding constructs that adapt dynamically to vascular anatomy. Thrombectomy devices further segment into aspiration devices optimized for direct clot removal and stent retrievers that mechanically engage thrombi.

Turning to clinical indication, the market addresses aneurysm repair, arteriovenous malformation management, and acute ischemic stroke, each requiring tailored device attributes and procedural workflows. End-user adoption patterns highlight the critical roles of ambulatory surgery centers, specialized clinics, and tertiary hospitals, with procedural complexity and reimbursement scenarios influencing device selection. Lastly, procedure type segmentation underscores the distinct dynamics of embolization, flow diversion, and thrombectomy interventions, each presenting unique R&D imperatives and clinical outcome benchmarks. Through this multifaceted lens, stakeholders can align product portfolios with evolving clinical demands and operational environments.

This comprehensive research report categorizes the Neurovascular Intervention Devices market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Indication

- Procedure Type

- End User

Decoding Regional Dynamics Shaping the Neurovascular Intervention Market Across Americas Europe Middle East Africa and Asia Pacific Geographies

Regional dynamics exert a profound influence on the evolution of neurovascular intervention devices, reflecting divergent healthcare infrastructures, reimbursement models, and clinical practice norms. In the Americas, established interventional networks and robust private and public payer systems have accelerated the uptake of advanced flow diversion and polymer-based embolic technologies. Concurrently, localized manufacturing capabilities and supply chain resilience have mitigated recent tariff disruptions, fostering a competitive environment that incentivizes incremental innovation.

Within Europe, Middle East & Africa, heterogeneous regulatory frameworks and varied healthcare funding mechanisms have shaped adoption curves. In key European markets, early access schemes and reimbursement reforms for breakthrough neurovascular devices have catalyzed clinical trials and post-market studies, generating real-world evidence that informs broader EMEA rollout strategies. Conversely, emerging markets in the Middle East and Africa are characterized by nascent interventional programs and targeted infrastructure investments, presenting growth opportunities alongside training and resource-allocation challenges.

The Asia-Pacific region exhibits a dual narrative of rapid market expansion in advanced economies and infrastructure development in emerging nations. Japan and South Korea lead in regulatory harmonization and clinical specialization, while China and India are expanding domestic production networks and clinical education initiatives to address rising stroke and aneurysm prevalence. As these divergent trajectories converge, global manufacturers must adopt region-specific go-to-market strategies that balance centralized R&D with decentralized deployment models.

This comprehensive research report examines key regions that drive the evolution of the Neurovascular Intervention Devices market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Revealing Competitive Advantages Growth Strategies and Impactful Collaborations Driving Market Leadership Among Global Neurovascular Device Manufacturers

Leading global players have demonstrated varied strategic approaches to secure leadership within the neurovascular device space. Medtronic has prioritized organic product innovation, recently unveiling a next-generation flow diverter featuring a hybrid polymer-metal scaffold designed to enhance porosity and promote endothelial healing. Boston Scientific has pursued tactical acquisitions to bolster its embolic and microcatheter portfolio, while simultaneously expanding its U.S. manufacturing footprint to address tariff-induced cost volatility. Stryker has focused on iterative enhancements to its coil platforms, emphasizing detachment mechanisms that reduce procedural times and minimize re-treatment rates.

Other notable innovators include Penumbra, which continues to refine its aspiration thrombectomy systems through user-driven design modifications that enhance pushability and clot engagement. Terumo’s MicroVention subsidiary has deepened collaborations with academic centers to accelerate the clinical validation of novel liquid embolics. Johnson & Johnson’s Codman Neurovascular unit has invested in digital health integration, incorporating procedural analytics and AI-driven device performance monitoring into its next wave of microcatheters. Across the board, these industry titans are reinforcing their competitive moats through targeted R&D investment, strategic partnerships, and operational agility.

This comprehensive research report delivers an in-depth overview of the principal market players in the Neurovascular Intervention Devices market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Abbott Laboratories

- Acandis GmbH

- Balt Group

- Becton, Dickinson and Company

- Boston Scientific Corporation

- Carl Zeiss AG

- Evasc Medical Systems Corp.

- GE Healthcare

- Imperative Care Inc.

- Japan Lifeline Co.

- Johnson & Johnson Services, Inc.

- Kaneka Corporation

- Koninklijke Philips N.V.

- LivaNova PLC

- Medikit Co., Ltd.

- Medtronic plc

- MicroPort Scientific Corporation

- MicroVention, Inc.

- Nanoflex Robotics AG

- Penumbra, Inc.

- Phenox GmbH by Wallaby Medical, LLC

- Rapid Medical Ltd.

- Stryker Corporation

- Terumo Corporation

Empowering Industry Leaders with Actionable Strategies to Navigate Regulatory Shifts Technological Advances and Competitive Pressures in Neurovascular Intervention

To thrive amidst accelerating technological progress and shifting policy landscapes, industry leaders must adopt a multifaceted playbook. Investing in modular manufacturing platforms can yield rapid responsiveness to tariff fluctuations and localized supply demands. Moreover, fostering deeper alliances with interventional radiology societies and neurosurgical centers will ensure early clinical feedback loops, expediting iterative design enhancements. In parallel, embedding data analytics infrastructure into device ecosystems will provide actionable insights into real-world performance and health-economic outcomes, underpinning value-based reimbursement discussions.

Furthermore, crafting regionally tailored market access strategies-grounded in local regulatory nuances and healthcare financing structures-will optimize launch trajectories across diverse geographies. Companies should also consider orchestrating joint ventures with strategic suppliers in emerging markets to secure preferential access to critical raw materials and polymer substrates. Finally, advancing digital education platforms for interventionalists will accelerate adoption curves and cement brand preference, positioning organizations to capture long-term procedural volume growth.

Detailing Robust Research Methodology Integrating Secondary Data Analysis Expert Validation and Comprehensive Industry Review for Market Accuracy

This research effort integrates a robust blend of secondary data synthesis, expert validation, and rigorous qualitative analysis. We systematically collated publicly available regulatory filings, peer-reviewed clinical trial outcomes, and industry white papers to establish a foundational data corpus. Independent interviews with leading neurointerventionalists, R&D executives, and supply chain specialists provided nuanced context and validated emergent themes. Our analytical framework incorporated comparative assessments of device innovation pipelines, manufacturing geographies, and reimbursement landscapes.

To ensure methodological rigor, key findings underwent triangulation across multiple data sources, while highlighted strategic imperatives were stress-tested through scenario analysis. Quality control measures included cross-referencing corporate disclosures with regulatory databases and leveraging proprietary deal-tracking datasets to capture recent collaborations and facility expansions. This comprehensive approach guarantees a high-degree of confidence in the insights presented, empowering stakeholders with a clear, actionable view of the neurovascular intervention market's trajectory.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Neurovascular Intervention Devices market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Neurovascular Intervention Devices Market, by Product Type

- Neurovascular Intervention Devices Market, by Indication

- Neurovascular Intervention Devices Market, by Procedure Type

- Neurovascular Intervention Devices Market, by End User

- Neurovascular Intervention Devices Market, by Region

- Neurovascular Intervention Devices Market, by Group

- Neurovascular Intervention Devices Market, by Country

- United States Neurovascular Intervention Devices Market

- China Neurovascular Intervention Devices Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1749 ]

Concluding Perspectives on the Transformative Trajectory Opportunities and Challenges Defining the Future of Neurovascular Intervention Devices

The cumulative insights presented herein underscore a market at the nexus of unprecedented innovation and evolving operational challenges. Technological breakthroughs in device materials, digital planning tools, and personalized manufacturing are unlocking new dimensions of therapeutic precision. At the same time, expanded tariff regimes and regional policy divergences necessitate resilient supply chains and adaptive market strategies. Against this backdrop, segmentation analysis and regional perspectives reveal distinct pockets of opportunity-whether in advanced embryonic clinical programs within EMEA or capacity expansions across the Americas.

Ultimately, success in the neurovascular intervention space will hinge on an organization’s ability to integrate cross-functional expertise, harness real-world data for value demonstration, and proactively navigate the shifting trade and regulatory environment. As stakeholders engage with these dynamics, the overarching imperative remains clear: to translate technological promise into tangible patient benefit while safeguarding commercial viability in a complex global ecosystem.

Partner with Ketan Rohom to Secure In-Depth Market Intelligence and Propel Growth through Our Comprehensive Neurovascular Intervention Devices Report

I invite you to delve deeper into this comprehensive analysis and harness the actionable intelligence contained within our full market research report. Connect with Ketan Rohom, Associate Director of Sales & Marketing, to explore how these insights can empower your organization’s strategic roadmap and drive sustainable growth in the evolving neurovascular intervention devices landscape. Reach out today to secure your copy and position your team at the forefront of innovation and competitive advantage.

- How big is the Neurovascular Intervention Devices Market?

- What is the Neurovascular Intervention Devices Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?