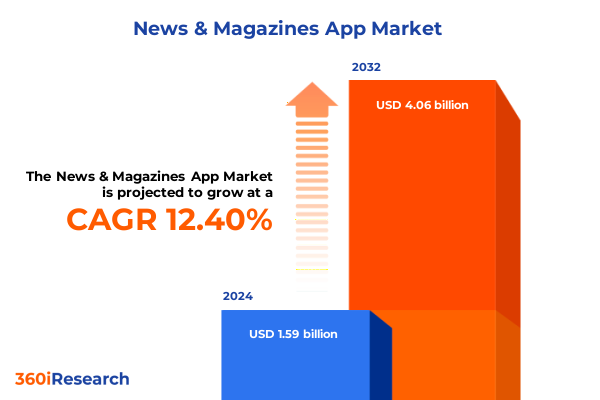

The News & Magazines App Market size was estimated at USD 1.79 billion in 2025 and expected to reach USD 2.02 billion in 2026, at a CAGR of 12.36% to reach USD 4.06 billion by 2032.

Exploring how digital transformation and evolving audience behaviors are redefining the competitive environment of news and magazine applications worldwide

Digital transformation has irrevocably shifted the way audiences discover, consume, and engage with news and magazine content. Smartphones and tablets now serve as primary gateways, with 86% of U.S. adults accessing news at least sometimes through digital devices, and 58% preferring these platforms over traditional media outlets. Moreover, social media and search engines have emerged as critical distribution channels, with 54% of Americans obtaining news via social platforms and two-thirds using news websites or apps frequently. This widespread digital adoption has sparked a wave of innovation among publishers, prompting a surge in investment in mobile-first interfaces, personalized recommendation engines, and interactive storytelling features.

As a result, publishers and app developers are competing on the basis of speed, personalization, and seamless cross-device experiences. In response to growing concerns around data privacy and the phasing out of third-party cookies, leading platforms are also refining consent management and exploring first-party data strategies. Consequently, content providers must navigate a balance between delivering tailored user experiences and adhering to evolving privacy regulations. Through this lens, it becomes clear that success in the current environment depends on understanding the confluence of technology advances, audience behaviors, and regulatory developments.

Looking ahead, market participants that leverage these insights to optimize their digital offerings and refine their engagement models will be best positioned to capture and retain the ever-mobile audience. The convergence of technological innovation and consumer expectation underscores a dynamic competitive landscape where agility and user-centric design reign supreme.

Examining the convergence of AI personalization immersive multimedia experiences and advanced monetization tactics that are driving a paradigm shift in digital publishing

The media industry is experiencing a paradigm shift driven by emerging technologies and novel content delivery methods. Fueled by breakthroughs in artificial intelligence, publishers are harnessing generative tools to automate routine editorial workflows and enhance creative production. At the 2025 NAB Show, experts highlighted the rapid elevation of AI from experimental use to strategic asset, as platforms integrate agentic systems for tasks ranging from post-production indexing to culturally sensitive content localization. Simultaneously, personalization engines powered by rich metadata and machine learning are enabling real-time customization of in-app recommendations and ad placements, significantly boosting engagement and retention.

In parallel, immersive multimedia formats are rising to the forefront, redefining how audiences interact with stories. Augmented reality and virtual reality experiences-once niche experiments-are gaining traction among major publishers eager to differentiate their offerings. By embedding AR-enhanced news segments and 3D interactive features, brands can invite readers into participatory narratives that transcend passive consumption. Moreover, short-form video and live streaming integrations within magazine apps have unlocked vibrant new revenue pathways, particularly through addressable advertising on connected television and mobile platforms.

As these transformative forces continue to converge, content creators and distributors face unprecedented opportunities to reshape narrative experiences. The imperative for industry leaders is clear: embrace these innovations holistically and steward them responsibly to foster deeper audience connections and unlock novel monetization avenues.

Analyzing how recent U.S. trade policies and rising electronic goods and infrastructure tariffs are reshaping cost structures and consumer device adoption trends in the digital publishing ecosystem

The advent of sweeping U.S. tariff policies in 2025 has introduced new complexities for digital publishers and app developers. While digital news and magazine platforms are often viewed as immune to traditional trade measures, the ripple effects are tangible and significant. Rising duties on consumer electronics-such as tablets and laptops-are expected to drive device price increases of up to 46%, potentially suppressing new hardware adoption and limiting the expansion of app-based readerships. This surge in device costs can, in turn, constrain user growth for digital subscription services and erode advertising impressions tied to active users.

Moreover, tariffs applied to ancillary inputs like servers and network infrastructure components contribute to elevated operational expenditures for content delivery networks and cloud-based service providers. As the White House contemplates tariff floors ranging between 15% and 50%, economists caution that a significant portion of these cost increments-estimated at 65%-could be absorbed by platform operators before they fully pass through to end users. Consequently, publishers may face margin compression and be forced to reevaluate pricing structures or optimize infrastructure efficiency.

Despite these headwinds, industry participants can leverage strategic supply-chain diversification and localized content delivery solutions to mitigate tariff-driven disruptions. By forging partnerships with hardware manufacturers outside of heavily tariffed regions and adopting edge-computing architectures, digital publishers can sustain growth trajectories even as global trade dynamics evolve.

Unpacking critical audience access and revenue segments content verticals platform differences and device preferences shaping the future of digital publishing

Critical insights emerge when assessing the market through varied segmentation frameworks. Within the access model, the landscape is defined by free offerings that drive discovery, freemium tiers that encourage trial and upsell opportunities, and paid access that secures higher-value, committed readers. Each of these approaches demands distinct content curation strategies and aligns with specific user journeys centered on acquisition, monetization, and loyalty.

Examining the revenue model reveals multiple avenues for value creation. Advertising continues to play a foundational role, encompassing banner ads for broad visibility, native advertising that blends seamlessly with editorial, and video ads that command premium rates and user attention. In-app purchases further diversify income streams, spanning consumables designed for one-off unlocks, non-consumables such as permanent content packs, and premium feature upgrades that enhance the user experience. Subscription revenue then offers a predictable base, segmented into monthly plans for flexibility, annual options for cost savings, and lifetime access for deep-value propositions.

Content type segmentation underscores the importance of editorial focus and audience alignment. Aggregators collate blogs and news items for broad appeal, while digital magazines specialize along verticals such as fashion, lifestyle, and technology to cultivate dedicated followings. Digital newspapers also maintain vital niches, differentiating between international coverage, local reporting, and national affairs. Further, platform segmentation across Android, iOS, and web interfaces highlights the necessity of tailored development roadmaps and user interface considerations. Lastly, device type-whether smartphone or tablet-shapes design priorities, engagement patterns, and feature implementations, underscoring the need for responsive and adaptive user experiences.

This comprehensive research report categorizes the News & Magazines App market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Access Model

- Revenue Model

- Content Type

- Platform

- Device Type

Highlighting regional dynamics across the Americas Europe Middle East Africa and Asia Pacific revealing distinctive opportunities and hurdles in digital publishing

Regional market dynamics underscore unique opportunities and challenges for digital publishers across three global clusters. The Americas remain a powerhouse of digital news engagement, led by high smartphone penetration and mature app ecosystems. Consumer behavior in North America-where 86% of adults use digital devices for news-tends toward premium subscriptions and integrated multimedia experiences that leverage robust broadband infrastructure. Latin American markets exhibit rapid mobile growth, though monetization strategies must account for varying purchasing power and emerging ad networks.

Europe, the Middle East, and Africa present a multifaceted environment shaped by rigorous data privacy regulations and diverse cultural contexts. The EU’s Digital Services Act and GDPR have compelled publishers to adopt privacy-first advertising strategies and transparent consent mechanisms, fostering user trust but also introducing compliance complexities. In parts of the Middle East and Africa, digital news consumption is gaining momentum through social media and mobile-first platforms, though localized content and language support remain critical for engagement.

In Asia-Pacific, dynamic innovation hubs like China, India, and Southeast Asia are reshaping global standards for app functionality and distribution. Superapps that integrate news, commerce, and social features drive high frequency usage, while platforms in Japan and South Korea emphasize immersive multimedia and subscription bundles tied to lifestyle content. Across the region, device diversity-from entry-level smartphones to premium tablets-demands flexible development and targeted monetization strategies.

This comprehensive research report examines key regions that drive the evolution of the News & Magazines App market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling leading players innovative partnership models and platform optimizations shaping competition and growth in the digital news and magazine landscape

Leading companies are charting diverse strategies to strengthen their positions in the digital news and magazine sector. Meta has signaled a strategic pivot to safeguard user trust by suspending political advertising within the EU under forthcoming transparency regulations, reflecting a broader shift toward privacy-aligned monetization models and content authenticity. Meanwhile, traditional media conglomerates such as CNN are doubling down on digital transformation with new subscription offerings aimed at audience diversification and revenue resilience; the forthcoming non-news service slated for 2025 underscores a push to expand beyond conventional news streams.

Digital-first publishers are also forging innovative alliances to broaden their footprints. The New York Times, for example, is exploring subscription bundling partnerships with emerging news startups to tap into niche audiences, underscoring the importance of collaborative growth in an increasingly competitive paid journalism market. At the same time, platform specialists like Apple News and Google News continue to refine their curation algorithms and revenue-share models, incentivizing high-quality content creation while balancing ad and subscription revenues. Emerging contenders-such as Flipboard and Inoreader-are focusing on personalization and community features to differentiate their propositions and foster deeper reader loyalty.

Collectively, these company initiatives illustrate a mosaic of strategic responses-from compliance-driven ad reforms to cross-industry subscription alliances-highlighting the multiplicity of pathways to sustainable growth in the digital publishing realm.

This comprehensive research report delivers an in-depth overview of the principal market players in the News & Magazines App market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Agence France-Presse

- Apple Inc

- Bloomberg LP

- British Broadcasting Corporation

- Comcast Corporation

- Dow Jones & Company Inc

- Eterno Infotech

- Flipboard

- Gannett Co Inc

- Google LLC

- Jagran Prakashan Limited

- Magzter Inc

- Medium Corporation

- News Corporation

- Paramount Global

- The Associated Press

- The Economist Newspaper

- The Financial Times Limited

- The Guardian

- The New York Times Company

- The Walt Disney Company

- The Washington Post

- THG Publishing Private Limited

- Thomson Reuters

- Warner Bros Discovery

Strategic imperatives and pragmatic approaches to optimize personalization monetization geographic expansion and privacy compliance for digital publishers

Industry leaders should prioritize a cohesive strategy that aligns content innovation with evolving audience expectations and regulatory demands. First, optimizing personalized experiences through AI-driven recommendation engines and dynamic content modules will drive deeper engagement. By leveraging advanced metadata frameworks and continuous machine learning feedback loops, publishers can surface content that resonates on an individual level and maximizes session duration.

Second, diversifying monetization models is critical. Combining targeted advertising formats-including addressable CTV spots and interactive native units-with flexible subscription options will mitigate revenue risks. Introducing tiered memberships that offer exclusive multimedia content, early access features, and community forums can enhance the perceived value proposition and reduce churn.

Third, geographic expansion should be transactional-rooted in localized content strategies and mobile network partnerships. Establishing regional content centers and forging alliances with telcos or social platforms can accelerate user acquisition and improve delivery performance in high-potential markets.

Finally, adopting a privacy-first mindset in adtech and data practices will engender user trust and regulatory compliance. Implementing robust consent management platforms, exploring contextual targeting, and participating in emerging clean-room initiatives will ensure sustainable ad revenues without compromising consumer privacy.

Detailing the rigorous multi source research framework integrating executive interviews consumer surveys regulatory reviews and data triangulation underpinning this report

This report’s findings are grounded in a rigorous research methodology that combines both primary and secondary data sources. In the primary phase, structured interviews were conducted with senior executives from leading publishing houses, technology providers, and advertising platforms to glean firsthand perspectives on emerging trends and strategic priorities. These qualitative insights were further supplemented by a comprehensive survey of digital news consumers across key regions, capturing usage patterns, willingness to pay, and content preferences.

On the secondary research front, publicly available filings, regulatory documentation, and reputable industry analyses were systematically reviewed to validate corporate strategies, regulatory developments, and technological advancements. Proprietary databases and analytical dashboards provided detailed data on app usage metrics, advertising rates, and device adoption trends, which were cross-referenced with third-party research from neutral think tanks.

Data triangulation was employed to reconcile divergent data points, ensuring consistency and reliability. Where necessary, methodologies were adjusted to align definitions and timeframes. Finally, findings were peer reviewed by an internal editorial board to safeguard analytical objectivity and accuracy. This rigorous, multi-layered approach underpins the strategic recommendations and market insights presented herein.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our News & Magazines App market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- News & Magazines App Market, by Access Model

- News & Magazines App Market, by Revenue Model

- News & Magazines App Market, by Content Type

- News & Magazines App Market, by Platform

- News & Magazines App Market, by Device Type

- News & Magazines App Market, by Region

- News & Magazines App Market, by Group

- News & Magazines App Market, by Country

- United States News & Magazines App Market

- China News & Magazines App Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1908 ]

Summarizing how converging innovations audience expectations and regulatory shifts define the strategic roadmap for digital news and magazine applications in a dynamic environment

The convergence of technological innovation, evolving consumer behaviors, and shifting regulatory environments is reshaping the competitive contours of the digital news and magazine sector. As AI and immersive media redefine content creation and distribution, publishers must remain agile to capture the attention of increasingly discerning audiences. Meanwhile, tariff-induced cost pressures on devices and infrastructure underscore the need for strategic supply-chain diversification and infrastructure optimization.

Segmentation analysis highlights the importance of tailored access models and revenue streams-ranging from free tiers and banner advertising to premium subscriptions and in-app purchases-each addressing unique user segments and content verticals. Regional insights further illustrate that success hinges on localizing offerings, adhering to privacy regulations, and partnering with telcos to drive adoption in growth markets.

By examining the initiatives of leading players-from privacy-driven ad reforms at Meta to subscription expansion strategies at CNN and The New York Times-industry stakeholders can glean best practices for sustainable growth. Ultimately, this report provides a strategic blueprint for navigating the dynamic digital publishing landscape, empowering decision-makers to align innovation, compliance, and user engagement to secure long-term value creation.

Engage with our Associate Director to unlock strategic insights and drive growth with the complete digital publishing market intelligence report

To explore how this comprehensive market intelligence can inform your strategic initiatives in digital publishing, reach out to Ketan Rohom, Associate Director of Sales & Marketing. Engage directly with an expert to discuss how our insights on audience segmentation, monetization strategies, regional dynamics, and competitive positioning can help you optimize your product roadmap and maximize revenue potential. Secure your access to the full report today to stay ahead in an increasingly dynamic and competitive digital news and magazine landscape

- How big is the News & Magazines App Market?

- What is the News & Magazines App Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?