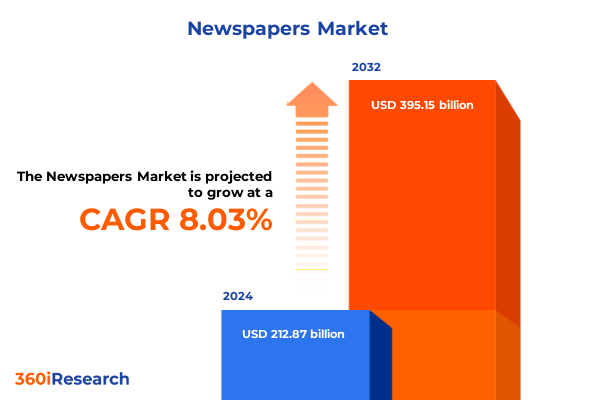

The Newspapers Market size was estimated at USD 230.19 billion in 2025 and expected to reach USD 245.10 billion in 2026, at a CAGR of 8.02% to reach USD 395.15 billion by 2032.

Unveiling the Critical Forces Reshaping the Newspaper Industry Through a Deep Contextual Introduction and Market Overview

Over the past decade, the American news ecosystem has undergone profound change as readers migrate from traditional print editions to digital platforms. According to Pew Research Center, 86% of U.S. adults say they at least sometimes get news from digital devices, with 57% using smartphones, computers, or tablets often for news. Digital devices are now the preferred platform for 58% of Americans, far outstripping television and print, which registers a mere 4% preference. This shift reflects not only the convenience of on-demand access but also the growing sophistication of audience targeting and content personalization, which have rendered daily newspapers less central to everyday routines.

Print circulation continues its descent, challenging publishers to reinvent business models amid declining ad revenues and intensifying competition from digital natives. The share of U.S. adults who say they get local news from daily newspapers fell from 43% in 2018 to 33% in 2024, signaling a widening gap in information access for communities that lack sufficient digital infrastructure. At the same time, rising production costs and evolving regulatory frameworks, including recent international trade measures, have compounded financial pressures. Against this backdrop, industry leaders must navigate a fragmented attention economy while preserving the core values of journalistic integrity and public trust.

Mapping the Technological Evolutions and Consumer Behavior Shifts That Are Fundamentally Transforming the News Landscape

As digital disruption accelerates, smartphones have cemented their position as the primary gateway for news consumption, fundamentally altering routines that once revolved around morning papers or evening newscasts. The Reuters Institute Digital News Report 2025 highlights that 39% of American adults encounter news first on mobile devices each day, surpassing traditional appointment-based channels. This pervasive mobile engagement has rendered news a continuous, interrupt-driven experience, compelling publishers to optimize for concise, visually engaging formats tailored to on-the-go lifestyles.

Concurrently, video content has emerged as a dominant force, with social media platforms driving the majority of consumption. Research shows that the proportion of people who consume social video for news has surged from 52% in 2020 to 65% in 2025, and short-form video networks such as TikTok and YouTube are now key sources for younger demographics. The blending of entertainment and journalism in these channels is reshaping editorial priorities and blurring the lines between content and platform.

Alternative media ecosystems led by so-called ‘newsfluencers’ and AI-driven aggregators are further fragmenting the audience landscape. In many markets, generative AI powers personalized news selections and real-time notifications, although concerns about accuracy have led over three-quarters of users to disable alerts at least temporarily. This dynamic underscores the tension between innovation and credibility, as publishers weigh the benefits of automation against the imperative of maintaining editorial trust.

Despite these advances, the quest for sustainable revenue models remains elusive. Subscription growth has plateaued in mature markets, with only 18% of consumers globally paying for online news, and similar resistance seen among potential digital subscribers in the United States. As advertising revenues fragment across platforms, news organizations face the challenge of balancing paywall strategies with the need to maintain broad audience reach in an increasingly crowded information ecosystem.

Examining How the 2025 U.S. Tariff Measures Have Accumulated to Reshape Costs Supply Chains and Consumer Access in the Print Sector

Broadly speaking, the series of tariff measures enacted by the United States throughout 2025 has imposed a significant tax on imported goods, quietly reshaping supply chains and consumer markets. While headline economic indicators such as GDP and inflation have managed to remain relatively stable, the deeper effects of these policies are eroding consumer choice and undermining product quality as businesses pivot to less efficient domestic suppliers. Analysis indicates that the combined effective U.S. tariff rate has climbed to 22.5%, the highest level since 1909, translating to an immediate 2.3% increase in consumer price levels, equivalent to an average annual loss of $3,800 per household.

The newspaper printing sector has been especially vulnerable due to its heavy reliance on foreign-sourced newsprint. Canada supplies approximately 80% of North America’s newsprint-producing around 2.1 million metric tons compared to just 409,000 metric tons from U.S. mills-leaving domestic capacity insufficient to meet demand. Industry coalition studies show that a 25% tariff could drive newsprint prices up by more than 30%, pushing costs above $190 per metric ton, and inflict nearly half a billion dollars in added expense on newspapers and printers. This shift not only threatens the bottom line of publishers but also risks creating news deserts as smaller outlets struggle to absorb elevated production costs.

Furthermore, these tariffs function as a regressive tax burden, disproportionately affecting lower-income households. Short-run distributional analysis reveals that the tariffs enacted through April have imposed a 4% loss in disposable income for households in the second income decile, compared with a 1.6% loss for those in the top decile. In dollar terms, lower-income households face annual losses of $1,700, while the highest-income tier encounters an average expense of $8,100, underscoring the uneven impact of trade policy across the economic spectrum.

Uncovering Segmentation Dynamics Across Formats Content Types Pricing Structures and Publication Frequencies for Informed Strategic Positioning

Analyzing the market through the lens of format reveals a stark dichotomy between print and digital channels. Within digital offerings, desktop platforms cater to comprehensive reading experiences while mobile environments demand succinct, scroll-friendly design, and tablets occupy an intermediary space that blends depth with portability. Print editions, by contrast, maintain a tactile prestige and perceived authority but face increasing challenges in distribution efficiency and audience reach as readers increasingly pivot to screen-based consumption.

Segmenting by content type underscores the importance of thematic specialization. Business coverage attracts a highly engaged, subscription-ready audience, whereas entertainment and sports segments thrive on high-velocity, shareable headlines and multimedia storytelling. General news assemblies serve as broad gateways to diverse advertiser segments, and political reportage fuels loyalty-driven readership fluctuations that correspond closely to election cycles and policy debates, making each vertical uniquely dependent on content cadence and audience targeting strategies.

Examining pricing models illuminates the delicate balance between free access and revenue generation. Ad-supported offerings can drive scale and awareness but often face compression in digital ad rates and user resistance to intrusive formats. Freemium approaches unlock trial experiences that can be upsold to full access, while paid subscription models rely on value-added content and loyalty incentives. At the same time, publishers must weigh the trade-offs between single-copy revenue opportunities and longer-term subscription commitments in structuring their revenue architectures.

Frequency segmentation further refines market understanding by showing how consumer habits align with publication schedules. Daily newspapers serve as habitual touchpoints that reinforce brand consistency, whereas Sunday editions, rich with in-depth investigative features and lifestyle supplements, command premium advertising rates. Weekly publications, with their curated summaries and niche focuses, engage audiences who seek reflective analysis and thematic depth, providing an essential counterbalance to the immediacy of daily headlines.

This comprehensive research report categorizes the Newspapers market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Format

- Content Type

- Frequency

- Pricing Model

Highlighting Regional Variations in Newspaper Markets Emphasizing Distinct Opportunities and Challenges Across the Americas EMEA and Asia-Pacific Regions

Within the Americas, the United States remains a bellwether for digital adoption and revenue diversification, with major publishers experimenting aggressively with membership programs and integrated audio-visual content. Canada’s proximity to U.S. tariff measures has intensified discussions around domestic paper production, while Latin American markets exhibit mixed digital penetration rates, often constrained by internet infrastructure and economic volatility. Regional consolidation among legacy publishers has yielded scale benefits, but local news deserts continue to emerge, underscoring the need for sustainable community-focused initiatives.

Europe, the Middle East, and Africa present a mosaic of regulatory environments and consumer preferences. In Western Europe, stringent privacy laws and platform regulation have reshaped data-driven advertising, prompting many outlets to emphasize paid memberships and quality journalism as differentiators. Middle Eastern markets demonstrate rapid mobile-first news consumption propelled by youth demographics, whereas African nations show nascent opportunities in distributing hyperlocal digital content amid improving connectivity. Across EMEA, multilingual reporting and cultural nuance remain paramount for audience relevance.

Asia-Pacific markets are characterized by their mobile-centric engagement and vibrant social video ecosystems. In countries such as India, Southeast Asian markets, and Australia, news organizations leverage AI-driven personalization to cater to diverse linguistic communities, while digital subscription uptake varies widely based on local purchasing power. Regional giants are investing in super-app integrations and audio news formats, while smaller outlets focus on hyperlocal reporting to build trust-based relationships in crowded digital marketplaces.

This comprehensive research report examines key regions that drive the evolution of the Newspapers market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Newspaper and Digital News Organizations to Reveal Strategic Moves Partnerships Innovations and Market Position Strengths

Legacy mastheads continue to exercise significant influence through diversified portfolios and established brand equity. The New York Times, buoyed by a 32% rise in digital-only subscriptions during 2022, has surpassed 10 million paid subscribers by investing heavily in investigative reporting, podcasts, and live events that reinforce its value proposition. Similarly, The Washington Post and The Wall Street Journal leverage premium membership tiers and targeted newsletters to deepen reader relationships and monetize specialized verticals such as financial analysis and opinion journalism. Gannett has pursued a multi-brand strategy, unifying regional titles under centralized digital platforms to optimize ad operations, while News Corp’s global footprint spans print, digital, and broadcast assets, enabling cross-selling opportunities and scale efficiencies.

Digital-native challengers have carved out distinctive niches by emphasizing nimble content delivery and audience engagement. BuzzFeed’s video-first approach and native advertising integrations have driven strong social reach, while Axios’s brevity-focused newsletters and partnership model with platforms like Facebook Instant Articles accelerated its growth trajectory. The Athletic disrupted sports journalism through granular subscription tiers and community forums, prompting legacy publishers to reevaluate engagement tactics. Emerging Substack publishers benefit from low-friction monetization, though their dependence on individual personalities highlights risks in brand sustainability. Overall, the industry’s average global online news subscription rate remains at 18%, suggesting that both traditional and digital-first players must innovate continuously to expand the willing-payer market.

This comprehensive research report delivers an in-depth overview of the principal market players in the Newspapers market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Asahi Shimbun Company

- Axel Springer SE

- Bennett Coleman & Co Ltd

- China Daily

- Gannett Co Inc

- HT Media Ltd

- Lee Enterprises

- Mediahuis NV

- News Corp

- Nikkei Inc

- Nine Entertainment Co Holdings

- People's Daily Group

- Postmedia Network Canada Corp

- Reach PLC

- Schibsted ASA

- Singapore Press Holdings

- South China Morning Post Publishers Ltd

- The Globe and Mail Inc

- The Guardian Media Group

- The McClatchy Company

- The New York Times Company

- Torstar Corporation

- Tribune Publishing Company

- Yomiuri Shimbun Holdings

Delivering Actionable Strategic Recommendations to Empower Newspaper Industry Leaders to Navigate Disruption Drive Growth and Sustain Competitive Advantage

Industry leaders must embrace a holistic digital engagement strategy that integrates advanced analytics and AI to deliver personalized content pathways. By leveraging machine learning to tailor article recommendations and optimize notification cadences, publishers can enhance reader retention and drive incremental subscription conversions. Investing in multimedia capabilities–from immersive video storytelling to interactive audio series–will cater to diverse consumption preferences and generate new sponsorship opportunities. Strategic partnerships with social platforms should prioritize direct subscriptions and data-sharing agreements that balance audience reach with revenue control. Additionally, exploring flexible pricing frameworks such as micropayments and multi-brand bundles can attract reluctant payers without alienating core subscribers.

In parallel, operational resilience demands proactive supply chain management, particularly in response to evolving trade policies. Engaging in collaborative advocacy with industry associations can help shape tariff reviews and mitigate cost spikes in critical inputs like newsprint. Diversifying paper sourcing and exploring recycled and alternative materials will bolster agility, while hedging strategies can shield budgets against price volatility. To address regional disparities and local news deserts, publishers should empower community bureaus and adopt lean, digitally enabled reporting models that lower overhead. Finally, fostering a culture of experimentation, underpinned by continuous audience research, will reveal emergent consumption patterns and guide iterative refinement of editorial and commercial initiatives.

Detailing the Robust Research Methodology Employed to Ensure Rigorous Data Collection Credible Analysis and Actionable Market Intelligence

This research employs a multi-pronged approach combining comprehensive secondary analysis with targeted primary investigation to ensure depth and reliability. Secondary sources include publicly available data from national media audits, trade association publications, government trade and tariff documentation, and respected academic and policy think tanks. Data points covering digital engagement metrics, subscription trends, and tariff schedules were collated and cross-verified against official releases and expert commentary. Historical circulation and revenue patterns were mapped using longitudinal datasets to identify underlying shifts, while comparative analyses of global media markets provided contextual benchmarks for regional insights.

Primary research comprised in-depth interviews with senior executives across newsroom, commercial, and supply chain functions, as well as an online survey capturing the perspectives of over five hundred media professionals, including publishers, editors, and distribution specialists. Key informant interviews with trade association representatives and logistics experts yielded actionable intelligence on tariff impacts and operational resilience. Quantitative survey findings were integrated with qualitative insights through a transactional narrative analysis framework, enabling the distillation of high-priority themes. Rigorous data validation and peer review protocols underpinned each stage of analysis to maintain objectivity and ensure actionable market intelligence.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Newspapers market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Newspapers Market, by Format

- Newspapers Market, by Content Type

- Newspapers Market, by Frequency

- Newspapers Market, by Pricing Model

- Newspapers Market, by Region

- Newspapers Market, by Group

- Newspapers Market, by Country

- United States Newspapers Market

- China Newspapers Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 954 ]

Drawing Conclusions That Synthesize Key Insights From the Research Emphasize Strategic Implications and Outline Future Industry Outlooks

In conclusion, the newspaper industry stands at a critical juncture defined by accelerating digital transformation, evolving consumer behaviors, and the ripple effects of shifting trade policies. While digital channels offer unprecedented opportunities for personalized engagement and diversified revenue streams, the economic headwinds from tariff measures underscore the need for agile operational strategies, especially in print production. Strategic segmentation across format, content type, pricing, and publication frequency provides a roadmap for targeted audience outreach and optimized monetization. By synthesizing global regional dynamics and profiling both legacy and digital-first players, this research illuminates pathways to sustain journalistic integrity, drive growth, and fortify industry resilience amid ongoing disruption. Industry leaders equipped with these insights can navigate complexity and seize emergent opportunities to redefine the future of news.

Encouraging Immediate Engagement With Ketan Rohom to Secure Comprehensive Newspaper Market Research Insights and Unlock Strategic Competitive Benefits

To gain comprehensive access to the full suite of data, detailed analyses, and strategic foresight outlined herein, we invite you to engage directly with Ketan Rohom, Associate Director, Sales & Marketing. His team is ready to tailor a consultation, answer any questions, and facilitate your acquisition of the market research report. Secure these critical insights today to inform decision-making and strengthen your competitive positioning in the dynamic newspaper landscape.

- How big is the Newspapers Market?

- What is the Newspapers Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?