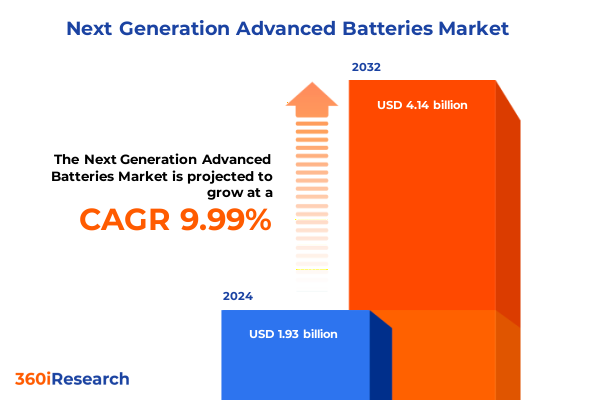

The Next Generation Advanced Batteries Market size was estimated at USD 2.10 billion in 2025 and expected to reach USD 2.28 billion in 2026, at a CAGR of 10.21% to reach USD 4.14 billion by 2032.

Introduction to the Dynamic Evolution of Next Generation Advanced Batteries Shaping the Future of Energy Storage and Transportation

The transition toward a cleaner energy future has propelled advanced batteries from a niche research topic to a pivotal enabler of decarbonization and electrification across multiple sectors. Driven by ambitious global climate targets and mounting pressure to reduce greenhouse gas emissions, the demand for high-performance energy storage solutions is soaring. Electric vehicles, renewable power systems, and portable electronics alike are reshaping traditional energy consumption models, underscoring the critical importance of next generation battery technologies. As a result, industry stakeholders are intensifying their focus on breakthroughs that extend range, enhance safety, and lower lifecycle costs.

In parallel, researchers and manufacturers are exploring an increasingly diverse array of chemistries and form factors that promise to overcome longstanding limitations of conventional lithium-ion platforms. Innovations in flow batteries offer scalable solutions for utility-scale storage, while solid state batteries hold the potential for dramatic improvements in energy density and safety. Nickel metal hydride and emerging hybrid systems provide complementary advantages in specific applications, further broadening the technological spectrum. This proliferation of options underscores the intricate nature of the market landscape and the necessity of strategic alignment to achieve competitive differentiation.

This executive summary synthesizes the key trends, regulatory influences, and competitive dynamics that are shaping the advanced battery sector. By examining transformative shifts, tariff impacts, segmentation insights, regional nuances, and corporate strategies, this analysis equips decision-makers with the contextual understanding required to prioritize investment, accelerate innovation, and navigate evolving policy frameworks. Ultimately, the insights presented herein lay the groundwork for informed action and sustained leadership in a rapidly advancing global market.

Emerging Technological and Market Transformations Driving a Fundamental Shift in Advanced Battery Development and Deployment Worldwide

The advanced battery landscape is undergoing foundational transformations that extend well beyond incremental improvements. Rising from the convergence of materials science breakthroughs and digital manufacturing advances, next generation technologies are redefining performance benchmarks. Flow batteries, once relegated to early demonstration projects, are now demonstrating grid-scale viability through cost-effective chemistries that facilitate long-duration storage. Meanwhile, solid state developments have accelerated into pilot production and raised expectations for enhanced safety and energy density, leveraging ceramic and polymer electrolytes to mitigate the risks associated with liquid electrolytes. These dynamic shifts in chemistry are transforming project economics and unlocking novel applications across stationary and mobile platforms.

Moreover, the rise of electric mobility is reshaping form factor preferences. Traditional cylindrical cells continue to maintain relevance in power tools and legacy applications, yet pouch and prismatic designs are increasingly favored for automotive and energy storage system integration. Pouch cells offer flexibility in packaging and thermal management, while prismatic formats strike a balance between structural robustness and volumetric efficiency. As manufacturers refine production processes, they are also optimizing form factor selection to align with specific performance and cost objectives. This nuanced approach is enabling more precise fit-for-purpose solutions that match the evolving demands of vehicle OEMs and utility-scale operators.

Furthermore, the industry is witnessing an expansion of downstream services and lifecycle considerations. Cell manufacturing remains the foundational node of value creation, but strategic attention is turning toward pack integration and raw material sourcing to secure supply resilience. At the same time, recycling initiatives are gaining momentum, driven by sustainability commitments and regulatory mandates to reclaim critical minerals. In parallel, the aftermarket channel is carving out new revenue streams by supporting second-life applications for grid integration and consumer electronics, complementing traditional OEM partnerships. Collectively, these transformative shifts are forging an ecosystem that places innovation, circularity, and supply chain agility at the forefront of strategic planning.

Assessing the Comprehensive Impact of 2025 United States Tariffs on the Advanced Battery Supply Chain and Cost Structures Across Key Nodes

In 2025, the United States reinforced its Section 301 tariffs, raising duties on lithium-ion electric vehicle batteries from 7.5% to 25% to protect domestic manufacturers and address intellectual property concerns with China’s supply chain practices. These measures, which came into effect on September 27, 2024, reshaped cost structures and compelled multinational battery producers to reassess sourcing strategies in North America. As a result, many automakers and energy storage developers accelerated local investment in cell production facilities to mitigate tariff exposure and secure stable supply commitments.

Additionally, the administration invoked the International Emergency Economic Powers Act in early 2025 to impose a 25% tariff on imports from Canada and Mexico, alongside a supplementary 10%–20% levy on Chinese battery-related components. Effective March 4, 2025, this dual mechanism layered new charges onto existing Section 301 duties, creating a complex tariff landscape that has increased landed costs for conventional cylindrical, pouch, and prismatic cells alike. Consequently, stakeholders are evaluating tariff-inclusive cost models to optimize cross-border manufacturing footprints.

Furthermore, preliminary antidumping and countervailing duty rates on active anode materials imported from China have introduced combined duties ranging from approximately 105% to 114.4%, though modest compared to the rates originally petitioned by domestic producers. These duties were determined following an affirmative injury finding by the U.S. International Trade Commission and are projected to elevate the cost of lithium-ion cell components by up to 12%, prompting strategic sourcing adjustments and price negotiations with global suppliers.

Meanwhile, emerging data illustrate the broader financial implications. Industry analysts estimate that the cumulative effect of reciprocal tariffs and elevated duties could add nearly $8 billion to the annual cost of imported cells alone, amplifying price pressures on U.S. carmakers and stationary storage integrators. As a direct response, original equipment manufacturers and policymakers are intensifying support for domestic capacity expansions, including grant funding and tax incentives under recent clean energy legislation.

Integrated Segmentation Insights Revealing Strategic Opportunities Across Chemistry Form Factors Lifecycle Stages and Sales Channels

A detailed segmentation analysis reveals distinct strategic imperatives across chemistry categories that warrant careful evaluation. Flow batteries, valued for their decoupled energy and power scaling, are gaining traction in long-duration grid deployments, while conventional lithium-ion systems continue to dominate electric mobility due to their proven performance and mature supply chains. Nickel metal hydride retains relevance in certain industrial and aerospace applications, offering robust cycling stability, and emerging solid state technologies promise breakthroughs in energy density and safety. Together, these chemistry options underscore the importance of differentiated product roadmaps aligned with specific application requirements.

Equally significant are the distinctions among form factors that influence system integration and thermal management priorities. Cylindrical cells remain the workhorse of many legacy platforms, prized for automated manufacturing efficiencies, whereas pouch cells offer adaptable packaging formats conducive to rapid prototyping. Prismatic designs, with their rigid casings and optimized space utilization, are increasingly favored for automotive pack integration and stationary energy storage systems. Recognizing these form factor nuances is critical for designers and procurement teams seeking to balance volumetric efficiency with manufacturability and cost targets.

Lifecycle stage segmentation further illuminates value creation opportunities across the battery value chain. Cell manufacturing commands substantial capital investment but sets the baseline for future cost trajectories. Pack integration translates cell-level performance into system-level reliability and safety metrics, while raw material processing ensures secure access to critical minerals. Recycling initiatives, driven by circular economy and regulatory objectives, are emerging as a strategic growth area, enabling the recovery of lithium, nickel, and cobalt and reducing dependence on primary sources. Each stage demands specialized capabilities and presents unique risk and reward profiles.

Finally, the sales channel dynamic differentiates aftermarket services from direct OEM partnerships. Aftermarket players are carving out niche opportunities by supporting repurposed batteries in grid stabilization and consumer applications, whereas OEM channels prioritize long-term supply agreements and integrated system warranties. Aligning channel strategies with product portfolios and end-customer expectations is thus essential for maximizing market penetration and establishing enduring competitive advantage.

This comprehensive research report categorizes the Next Generation Advanced Batteries market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Battery Chemistry

- Form Factor

- Lifecycle Stage

- Application

- Sales Channel

Critical Regional Dynamics Unveiling Unique Drivers Challenges and Growth Pathways in the Advanced Battery Markets of the Americas EMEA and Asia-Pacific

The Americas region is driven by ambitious climate legislation and substantial public and private investment in domestic battery production. The passage of the Inflation Reduction Act has enabled significant tax credits and grant programs that bolster cell manufacturing and material processing facilities across North America. In parallel, the urgency to secure critical mineral supply chains has spurred partnerships with mining operations in Latin America, reinforcing a regional focus on end-to-end value chain resilience. This collective policy and investment momentum is fostering a rapidly expanding ecosystem for both electric mobility and grid-scale storage deployments.

Meanwhile, Europe, the Middle East, and Africa are navigating a multifaceted regulatory environment that emphasizes emissions reduction targets and circular economy principles. The European Union’s Fit for 55 package and the forthcoming Critical Raw Materials Act are shaping incentives for localized battery gigafactories and imposing stringent reuse and recycling requirements. In addition, emerging markets in the Middle East are allocating sovereign wealth funds toward large-scale energy storage projects that support the integration of solar and wind energy resources. Across Africa, nascent mining initiatives for lithium and cobalt hold the potential to diversify global supply, although geopolitical complexities and infrastructure gaps pose ongoing challenges.

In the Asia-Pacific region, established battery powerhouses continue to drive capacity expansions and technology innovations. China remains the predominant manufacturing hub, benefitting from vertically integrated supply chains and strong government support for advanced chemistry research. Japan and South Korea complement this landscape with focused investments in solid state and semiconductor-enabled manufacturing processes. Southeast Asian nations are also emerging as important production nodes, offering lower labor costs and strategic access to global trade routes. Together, these regional dynamics contribute to a complex interplay of competition and collaboration that defines the global advanced battery market.

This comprehensive research report examines key regions that drive the evolution of the Next Generation Advanced Batteries market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Key Corporate Strategies and Innovations from Leading Advanced Battery Players Shaping Competitive Advantage and Industry Collaboration Trends

Leading battery manufacturers are deploying diverse strategic initiatives to maintain technological leadership and market share. LG Energy Solution has responded to shifting tariff landscapes by diversifying its product portfolio, expanding both lithium iron phosphate (LFP) and nickel-based cell lines in its Michigan facility. By simultaneously accelerating production of energy storage system batteries, the company aims to offset potential slowdowns in automotive demand and capitalize on robust grid storage opportunities.

Similarly, Panasonic is strengthening its automotive partnerships by leveraging joint ventures to localize production in key markets. Collaboration with Tesla at the Gigafactory in Nevada exemplifies this approach, enabling vertical integration of cell manufacturing and pack assembly. This strategy enhances supply predictability and aligns product development cycles with evolving vehicle platforms. Concurrently, Panasonic is investing in advanced anode research to support next generation lithium-metal and solid state chemistries.

Battery giant CATL is forging alliances across the value chain to secure upstream materials and downstream applications. The company has announced strategic joint ventures with mining firms to ensure stable access to lithium and cobalt, while simultaneously partnering with leading electric vehicle OEMs in Europe and North America to co-develop tailored cell formats. CATL’s integrated approach to raw material processing, cell manufacturing, and system integration underscores its ambition to maintain scale advantages and technological differentiation.

Emerging disruptors such as QuantumScape, Ion Storage Systems, and Solid Power are advancing pilot production of solid state batteries, attracting significant venture and strategic investments. These startups are differentiating through novel separator materials, anode-less architectures, and roll-to-roll manufacturing innovations. Although commercialization timelines vary, their progress is reshaping industry expectations and prompting incumbent players to accelerate R&D roadmaps.

This comprehensive research report delivers an in-depth overview of the principal market players in the Next Generation Advanced Batteries market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- A123 Systems, LLC

- AESC Group Ltd.

- Amara Raja Batteries Limited

- BYD Company Limited

- China Aviation Lithium Battery Co., Ltd.

- Contemporary Amperex Technology Co., Limited

- EnerSys

- EVE Energy Co., Ltd.

- Exide Technologies, LLC

- Factorial Inc.

- Farasis Energy Inc.

- Ganfeng Lithium Group Co., Ltd.

- GS Yuasa Corporation

- Guoxuan Hi-Tech Co., Ltd.

- Johnson Matthey plc

- LG Chem Ltd.

- LG Energy Solution Ltd.

- Panasonic Holdings Corporation

- ProLogium Technology Co., Ltd.

- QuantumScape Corporation

- Saft Groupe SAS

- Samsung SDI Co., Ltd.

- SES AI Corporation

- SK On Co., Ltd.

- Solid Power, Inc.

- Sunwoda Electronic Co., Ltd.

- SVOLT Energy Technology Co., Ltd.

- Tesla, Inc.

- Toshiba Corporation

Actionable Recommendations to Strengthen Supply Chain Resilience Technology Roadmaps and Regulatory Engagement for Advanced Battery Industry Leaders

To navigate the rapidly evolving advanced battery landscape, industry leaders should prioritize a diversified portfolio of chemistries that align with specific application goals. By investing in both mature lithium-ion formats and emerging solid state or flow technologies, organizations can mitigate the risks associated with technology obsolescence and capture growth across multiple segments. In particular, forming collaborative research partnerships with academic institutions and startups can accelerate development timelines and facilitate knowledge transfer.

Supply chain resilience must be reinforced through strategic partnerships and localized production nodes. Companies should evaluate opportunities to secure critical mineral supplies via direct investments in mining operations or long-term offtake agreements. Concurrently, accelerating plant expansions in regions with favorable policy incentives will reduce exposure to complex tariff regimes and logistical bottlenecks. Engaging proactively with government programs can unlock grants, tax credits, and concessional financing to support capital-intensive manufacturing projects.

In addition, developing robust recycling and repurposing frameworks will enhance sustainability credentials and alleviate raw material constraints. Stakeholders can collaborate with specialized recycling firms to refine collection networks and optimize material recovery processes. Establishing clear circular economy targets, coupled with traceability standards, will bolster brand reputation and preempt emerging regulatory requirements focused on end-of-life management.

Finally, executives should maintain active policy engagement to shape regulatory outcomes and align industry standards. By contributing to public-private working groups and standardization bodies, organizations can influence product safety regulations, performance metrics, and sustainability guidelines. Transparent communication of technological roadmaps and investment plans will strengthen stakeholder confidence and position companies to capitalize on evolving market opportunities.

Robust Multi-Method Research Methodology Underpinning the Analysis of Next Generation Advanced Batteries Ensuring Data Accuracy and Strategic Relevance

This analysis draws upon a rigorous multi-method research approach combining primary and secondary data sources. Expert interviews with executives, R&D leads, and policy specialists provided nuanced perspectives on emerging trends and competitive priorities. These qualitative insights were augmented by quantitative datasets sourced from industry associations, government agencies, and proprietary databases to ensure comprehensive coverage of market activities and investment flows.

Secondary research encompassed a systematic review of trade publications, peer-reviewed journals, and patent filings to track technological advancements and intellectual property trends. Regulatory filings and tariff schedules were examined in detail to quantify policy impacts and cost implications across key jurisdictions. Supply chain analyses were informed by trade statistics and logistics performance indices to identify critical nodes and potential vulnerabilities.

To ensure analytical rigor, all data points underwent cross-validation through multiple independent sources. Triangulation techniques reconciled discrepancies between public disclosures, expert testimonies, and market intelligence. Scenario modeling was employed to assess the sensitivity of strategic variables-such as tariff rates, raw material prices, and technology adoption timelines-under various regulatory and economic assumptions.

Finally, this methodology was guided by a robust quality assurance framework, which included editorial peer reviews and consistency checks. The result is a cohesive body of analysis that integrates diverse perspectives and evidence streams, delivering actionable insights with precision and credibility.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Next Generation Advanced Batteries market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Next Generation Advanced Batteries Market, by Battery Chemistry

- Next Generation Advanced Batteries Market, by Form Factor

- Next Generation Advanced Batteries Market, by Lifecycle Stage

- Next Generation Advanced Batteries Market, by Application

- Next Generation Advanced Batteries Market, by Sales Channel

- Next Generation Advanced Batteries Market, by Region

- Next Generation Advanced Batteries Market, by Group

- Next Generation Advanced Batteries Market, by Country

- United States Next Generation Advanced Batteries Market

- China Next Generation Advanced Batteries Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 3180 ]

Conclusive Insights Highlighting Pivotal Trends and Strategic Imperatives to Navigate the Next Generation Advanced Battery Landscape Confidently

As advanced battery technologies continue to evolve, stakeholders face a complex interplay of innovation, policy, and market dynamics. The convergence of next generation chemistries, form factor diversification, and a growing emphasis on lifecycle sustainability is reshaping value chains and competitive landscapes. At the same time, regulatory measures-such as the 2025 tariff increases in the United States and strategic incentives in key regions-are accelerating the localization of capacity and the reconfiguration of global supply networks.

Taken together, these forces are creating both challenges and opportunities. Organizations that adopt a proactive stance-by investing in emerging technologies, securing supply chain resilience, and engaging with policymakers-will be best positioned to capitalize on growth trajectories. Similarly, those who emphasize circular economy principles and develop holistic lifecycle management strategies will gain differentiation in increasingly sustainability-driven markets.

Ultimately, the insights presented in this executive summary underscore the importance of integrated decision-making across R&D, manufacturing, and policy engagement functions. By harnessing detailed segmentation analysis, regional perspectives, and corporate strategy reviews, leaders can forge data-driven roadmaps that navigate uncertainty and capture strategic advantage. As the advanced battery ecosystem matures, those who align innovation and commercial execution will drive the next wave of energy transformation.

Engaging with Ketan Rohom to Secure Your Comprehensive Advanced Battery Market Research Report and Gain Unparalleled Strategic Intelligence

If you are ready to deepen your understanding of the next generation advanced batteries landscape and unlock strategic insights that will empower your organization, please reach out to Ketan Rohom, Associate Director, Sales & Marketing at 360iResearch. Ketan can guide you through the comprehensive scope and unique value propositions of our market research report, ensuring that you receive tailored intelligence aligned with your business objectives. We look forward to partnering with you to transform critical data into actionable strategies and to support your success in the rapidly evolving advanced battery industry.

- How big is the Next Generation Advanced Batteries Market?

- What is the Next Generation Advanced Batteries Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?