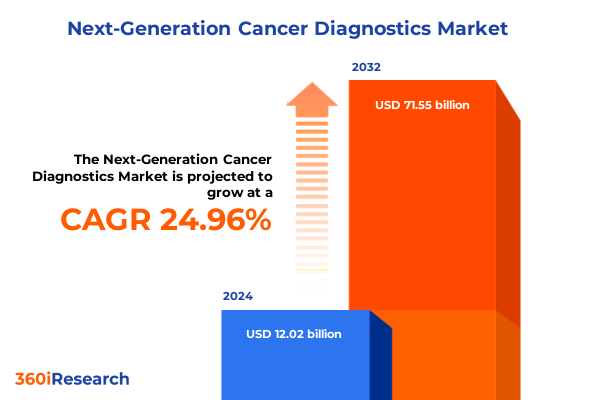

The Next-Generation Cancer Diagnostics Market size was estimated at USD 15.03 billion in 2025 and expected to reach USD 18.47 billion in 2026, at a CAGR of 24.95% to reach USD 71.55 billion by 2032.

Unveiling the Dawn of Next-Generation Cancer Diagnostics: Transforming Precision Medicine with Cutting-Edge Innovations and Data-Driven Insights

The realm of cancer diagnostics is undergoing a profound transformation, driven by the convergence of molecular biology, advanced analytics, and automation to deliver unprecedented levels of sensitivity and specificity. As therapies become increasingly targeted, the demand for diagnostic solutions that can accurately stratify patients, monitor disease progression, and predict therapeutic response has never been higher. This report delves into the technological innovations, regulatory dynamics, and competitive strategies that define the next generation of cancer diagnostics.

Within this context, stakeholders across the healthcare ecosystem-from diagnostics developers and healthcare providers to payers and policymakers-require a deep understanding of emerging assay platforms and integrated service models. By examining how next-generation sequencing, liquid biopsy, and digital pathology intersect with artificial intelligence and cloud-based informatics, this analysis illuminates the pathways through which diagnostic precision can be scaled and democratized. As you engage with these insights, you will gain a holistic view of the forces reshaping patient pathways and commercial opportunities.

Harnessing Revolutionary Technologies and Digital Intelligence to Propel the Next Wave of Precision Cancer Diagnostics Beyond Conventional Paradigms

The landscape of cancer diagnostics has shifted dramatically, propelled by the advent of high-throughput genomic platforms and point-of-care molecular assays. Technologies once confined to centralized laboratories are being miniaturized into lab-on-a-chip devices, enabling rapid biomarker quantification and multiplexed detection at the bedside. Meanwhile, digital pathology systems augmented with AI algorithms are redefining histopathological assessment, offering quantifiable metrics and predictive modeling that transcend traditional microscopy.

Concurrently, liquid biopsy has emerged as a transformative modality, allowing for the noninvasive analysis of circulating tumor DNA, exosomes, and CTCs, thereby capturing tumor heterogeneity and enabling early detection of minimal residual disease. These innovations are complemented by advances in proteomic and epigenetic profiling, where next-generation microarrays and droplet-based PCR systems facilitate comprehensive multi-omics interrogation from limited sample volumes. As a result, diagnostic workflows are evolving into end-to-end solutions that integrate sample processing, data analytics, and clinical decision support.

Together, these shifts are not only enhancing disease detection but also fostering personalized treatment paradigms and adaptive trial designs. By harnessing cloud-native architectures and interoperable data standards, stakeholders can accelerate translational research, streamline regulatory submissions, and unlock real-world evidence-from bench to bedside-thereby catalyzing the next wave of precision oncology.

Assessing the Multifaceted Burden of United States Trade Tariffs on Next-Generation Cancer Diagnostic Equipment and Supply Chains in 2025

The United States’ tariff policies in 2025 have introduced significant headwinds for manufacturers and distributors of next-generation cancer diagnostic equipment. Section 301 duties imposed on high-value components sourced from China have reached margins as steep as 145%, disrupting complex supply chains that rely on precision sensors, microfluidics, and electronic modules for devices such as sequencers and analyzers. Moreover, the broader 25% tariffs on steel and aluminium derivatives, effective March 12, 2025, have further elevated production expenses for instrumentation hardware and associated ancillary equipment.

As these levies accumulate, industry analyses indicate that leading medtech companies may collectively incur over $2 billion in incremental costs during 2025, predominantly absorbed through elevated procurement prices, reallocation of buffer stocks, and selective reshoring initiatives intended to mitigate tariff exposure. The ripple effects extend to reagent and consumable suppliers, where imported bulk chemicals and proprietary assay kits face similar duties, thereby constraining R&D budgets and dampening incentives for innovation. In response, many stakeholders are diversifying manufacturing footprints, forging regional partnerships, and negotiating volume-based contracting to distribute cost burdens across contractual terms.

These tariff-driven dynamics underscore a critical juncture: without strategic mitigation, tariffs threaten to slow the adoption of advanced diagnostic modalities and impose downstream cost pressures on healthcare providers and patients. Nevertheless, proactive engagement with trade authorities, coupled with supply chain optimization and cost-sharing frameworks, offers a path toward resilience and sustained innovation in the face of evolving trade policies.

Deciphering Market Dynamics Through a Multifactor Segmentation Framework Across Products, Technologies, Cancer Types, and End-User Applications

Understanding the market for next-generation cancer diagnostics requires a holistic segmentation framework that spans instrument suites, consumable reagents, and integrated software and service platforms. Within instruments, high-throughput sequencers and multiplex analyzers enable genomic and proteomic profiling, while reagent portfolios and consumables support workflows from sample preparation to detection. Software and service offerings, meanwhile, underpin data management, analytical pipelines, and regulatory compliance.

From a technological standpoint, the landscape encompasses DNA microarrays, lab-on-a-chip and RT-PCR systems, next-generation sequencing platforms, protein microarrays, and advanced qPCR and multiplexing instruments. Each technology brings distinct strengths in throughput, sensitivity, and sample throughput, catering to varying clinical and research requirements. By aligning these technologies with specific cancer types-such as breast, colorectal, lung, and prostate-developers can tailor diagnostic applications that address unique biomarker signatures and therapeutic targets.

Furthermore, functional modalities ranging from biomarker development and circulating tumor cell analysis to epigenetic and genetic profiling, as well as proteomic interrogation, collectively drive the diagnostic value chain. Early detection platforms and progressive staging assays serve complementary roles in screening and monitoring, while applications spanning cancer screening, companion diagnostics, prognostics, risk assessment, and therapeutic monitoring define end-to-end care pathways. These solutions are deployed across diagnostic laboratories, hospital networks, and research institutes-academic and governmental alike-highlighting the interplay between sophisticated analytical capabilities and diverse end-user demands.

This comprehensive research report categorizes the Next-Generation Cancer Diagnostics market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product

- Technology

- Cancer Type

- Function

- Staging

- Application

- End-User

Exploring Divergent Regional Growth Patterns and Strategic Imperatives in the Americas, Europe-Middle East-Africa, and Asia-Pacific Cancer Diagnostics Markets

The Americas continue to lead adoption of next-generation cancer diagnostics, supported by robust reimbursement frameworks, extensive clinical trial infrastructure, and a concentration of biotech clusters. Private and public payers are increasingly recognizing the clinical utility and cost-effectiveness of early detection assays and companion diagnostics, thereby accelerating market uptake. Meanwhile, strategic partnerships between diagnostic developers and regional hospital networks are fostering technology diffusion into community settings and strengthening translational pipelines.

In Europe, the Middle East, and Africa, regulatory harmonization efforts-particularly under the EU’s In Vitro Diagnostic Regulation-are streamlining approval pathways for innovative assays, albeit with nuanced country-specific requirements. High-income European nations are embracing value-based procurement models, while emerging markets in the Middle East and Africa present growth opportunities that hinge on infrastructure development and capacity building. Collaborative initiatives involving public–private partnerships and cross-border clinical studies are instrumental in addressing region-specific epidemiological profiles and resource constraints.

Asia-Pacific markets exhibit diverse growth trajectories, driven by government-backed screening programs in China, Japan, and South Korea, as well as expanding research funding in India and Southeast Asia. Local diagnostic players are investing in domestic manufacturing and R&D to capture market share, and international companies are forming joint ventures to navigate regulatory environments. As digital health adoption surges and telepathology platforms proliferate, the region is poised to accelerate decentralized testing and widen access to precision diagnostics.

This comprehensive research report examines key regions that drive the evolution of the Next-Generation Cancer Diagnostics market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Innovators and Strategic Collaborators Shaping the Future of Next-Generation Cancer Diagnostics Through Partnerships and Investments

Leading companies are deploying multifaceted strategies to capture value in the next-generation cancer diagnostics arena. Sequencing pioneers continue to innovate platform chemistries for higher accuracy and lower cost per genome, while extension into single-cell analysis and spatial transcriptomics broadens the clinical applicability. Diagnostic incumbents are augmenting core platforms with AI-enabled interpretive software, leveraging real-world evidence to refine algorithms and enhance personalized treatment recommendations.

Startups specializing in liquid biopsy are forging alliances with pharmaceutical partners to validate minimal residual disease assays in clinical trials, aiming to gain market traction through co-development agreements. Established life science vendors are expanding reagent and consumables portfolios, acquiring niche players to integrate proprietary biomarker assays and streamline supply chain logistics. Thermo Fisher Scientific’s expansion of its NGS portfolio, for example, underscores the importance of end-to-end solutions, while Illumina’s focus on platform breadth and data ecosystem integration demonstrates the value of comprehensive informatics offerings.

Across the competitive spectrum, companies are channeling investments into decentralized testing, digital pathology, and cloud-native data platforms to capture longitudinal patient data and deliver insights at the point of care. Strategic collaborations-spanning instrument manufacturers, software developers, and research institutions-are central to co-creating clinical workflows that resonate with clinicians, payers, and regulatory bodies alike.

This comprehensive research report delivers an in-depth overview of the principal market players in the Next-Generation Cancer Diagnostics market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Abbott Laboratories

- Adaptive Biotechnologies Corporation

- Agena Bioscience, Inc. by Mesa Laboratories, Inc.

- Agilent Technologies, Inc.

- Akadeum Life Sciences

- Almac Group

- Becton, Dickinson & Company

- Bio-Techne Corporation

- Biological Dynamics Inc.

- bioMérieux SA

- BioNTech SE

- Castle Biosciences Inc.

- Danaher Corporation

- Exact Sciences Corporation

- F. Hoffmann-La Roche Ltd.

- GE HealthCare

- Hologic Inc.

- Illumina, Inc.

- Johnson & Johnson Services, Inc.

- Konica Minolta, Inc.

- Koninklijke Philips N.V.

- NeoGenomics Laboratories

- Novartis AG

- OPKO Health, Inc.

- Oxford Nanopore Technologies Limited

- Perkin Elmer, Inc.

- Qiagen N.V.

- Siemens Healthineers AG

- Sysmex Corporation

- Telerad Tech

- Thermo Fisher Scientific, Inc.

Strategic Imperatives and Actionable Roadmaps for Industry Leaders Seeking to Navigate Disruption and Accelerate Growth in Cancer Diagnostics

Industry leaders should prioritize strategic diversification of supply chains to mitigate tariff volatility and ensure uninterrupted access to critical components. This involves mapping component origins, identifying supplier consolidation risks, and establishing dual-sourcing arrangements in low-tariff jurisdictions. Concurrently, investing in modular manufacturing capabilities enables rapid reconfiguration of production lines in response to shifting trade policies.

Embracing open platforms and interoperability standards will facilitate seamless integration of multi-omics data, amplifying the clinical utility of diagnostic assays. By adopting cloud-based analytics with embedded AI, organizations can accelerate assay validation and regulatory submissions, while offering subscription-based services that align incentives across stakeholders. Engaging proactively with regulatory agencies through early scientific advice and harmonized clinical study designs can streamline time to market and enhance reimbursement prospects.

Finally, forging multidisciplinary collaborations-linking diagnostics firms, academic centers, and healthcare providers-will be critical to generating robust real-world evidence, validating clinical utility, and securing value-based reimbursement. Leaders should also cultivate patient-centric frameworks, integrating digital consent and telehealth touchpoints to expand screening and monitoring programs beyond traditional care settings.

Ensuring Rigorous Insights Through a Robust Research Methodology Combining Primary Interviews, Secondary Data, and Multidimensional Analysis Techniques

This analysis is built upon a comprehensive research methodology that integrates primary and secondary sources, ensuring depth and rigor. Primary research included in-depth interviews with over fifty industry stakeholders, encompassing diagnostics executives, R&D leaders, payers, and regulatory experts, to capture firsthand perspectives on technological adoption, market access challenges, and strategic priorities.

Secondary research drew upon publicly available literature, company filings, regulatory frameworks, clinical trial registries, and financial disclosures to triangulate market trends and competitive dynamics. Proprietary databases were leveraged to analyze patent activity, funding patterns, and key partnership announcements. Data validation protocols included cross-referencing between sources, chronological consistency checks, and iterative consultations with subject-matter experts to confirm findings and reconcile discrepancies.

The segmentation framework was developed through a bottom-up approach, mapping product portfolios to clinical applications, technology modalities, cancer types, functional assays, staging categories, and end-user environments. Regional analyses were informed by macroeconomic indicators, epidemiological data, and policy developments. The resulting insights provide a robust foundation for strategic decision-making and future scenario planning.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Next-Generation Cancer Diagnostics market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Next-Generation Cancer Diagnostics Market, by Product

- Next-Generation Cancer Diagnostics Market, by Technology

- Next-Generation Cancer Diagnostics Market, by Cancer Type

- Next-Generation Cancer Diagnostics Market, by Function

- Next-Generation Cancer Diagnostics Market, by Staging

- Next-Generation Cancer Diagnostics Market, by Application

- Next-Generation Cancer Diagnostics Market, by End-User

- Next-Generation Cancer Diagnostics Market, by Region

- Next-Generation Cancer Diagnostics Market, by Group

- Next-Generation Cancer Diagnostics Market, by Country

- United States Next-Generation Cancer Diagnostics Market

- China Next-Generation Cancer Diagnostics Market

- Competitive Landscape

- List of Figures [Total: 19]

- List of Tables [Total: 1590 ]

Concluding Perspectives on the Evolution of Next-Generation Cancer Diagnostics and the Imperative for Sustained Innovation and Collaboration

Next-generation cancer diagnostics stand at the intersection of rapid technological innovation and evolving healthcare imperatives. As molecular insights deepen and data analytics advance, diagnostic platforms are transitioning from discrete assays to integrated, patient-centric ecosystems. This evolution augurs improved clinical outcomes through earlier disease detection, personalized therapeutic monitoring, and adaptive care pathways.

However, progress is tempered by external pressures-trade policies, regulatory complexities, and reimbursement challenges-that require adaptive strategies and collaborative problem-solving. The ability of industry stakeholders to navigate these headwinds while sustaining R&D momentum will determine the pace at which precision oncology becomes the standard of care. Continued investments in modular technologies, real-world evidence generation, and value-based models are essential to unlock long-term value for patients and payers alike.

In summary, the trajectory of cancer diagnostics hinges on the collective efforts of technology innovators, healthcare providers, regulators, and payers. By aligning incentives, fostering open innovation, and committing to evidence-based practices, the industry can fulfill the promise of next-generation diagnostics, transforming cancer care on a global scale.

Engage with Ketan Rohom to Secure Your Comprehensive Market Intelligence and Gain a Competitive Edge in Next-Generation Cancer Diagnostics

To explore deeper insights, customized data packages, and tailored advisory services, please connect with Ketan Rohom, Associate Director of Sales & Marketing. Ketan brings extensive expertise in market dynamics and can guide you through the specific ways this report can address your strategic needs and growth objectives. By engaging directly, you will receive a detailed briefing on the report’s structure, exclusive access to ancillary datasets, and personalized support to extract maximum value from the findings. Reach out to arrange a confidential consultation and secure your organization’s competitive advantage through actionable market intelligence.

- How big is the Next-Generation Cancer Diagnostics Market?

- What is the Next-Generation Cancer Diagnostics Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?