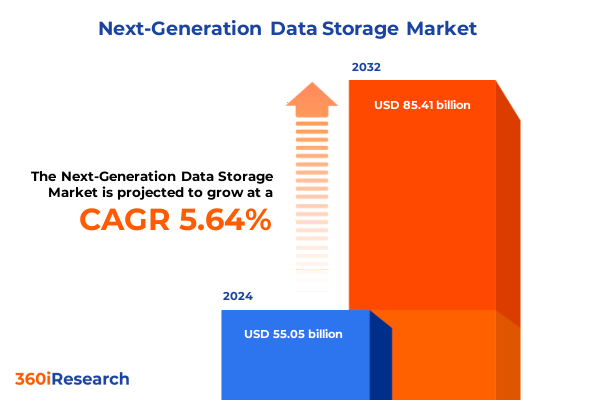

The Next-Generation Data Storage Market size was estimated at USD 58.14 billion in 2025 and expected to reach USD 61.40 billion in 2026, at a CAGR of 5.64% to reach USD 85.41 billion by 2032.

Introduction to the Evolving Next-Generation Data Storage Landscape Highlighting Emerging Requirements Performance Expectations and Strategic Imperatives for the Digital Era Transformation

The unprecedented expansion of digital information is reshaping how organizations think about storing managing and leveraging data. As enterprises contend with petabyte-scale repositories and the relentless surge of unstructured content they are seeking storage solutions that deliver higher throughput lower latency and greater reliability than legacy systems can provide. Furthermore emerging use cases driven by artificial intelligence machine learning analytics and edge computing are placing new demands on infrastructure architects compelling them to adopt storage technologies designed for real-time responsiveness and seamless scalability.

Against this backdrop next-generation data storage is evolving from a back-office utility into a strategic enabler of innovation and competitive differentiation. Organizations are shifting their focus beyond pure capacity considerations toward holistic solutions that integrate hardware architecture software orchestration and services into cohesive ecosystems. Moreover sustainability concerns and total cost of ownership pressures are driving demand for energy-efficient platforms that balance performance with environmental responsibility. This introduction establishes the foundational context for understanding why data storage is now at the forefront of enterprise transformation initiatives.

Key Transformational Technology Shifts Redefining Data Storage Architectures Enabling Enhanced Capacity Efficiency and Resilience in Modern Infrastructures

The modern data storage paradigm is being redefined by a series of transformative technological shifts that are unlocking unprecedented levels of performance efficiency and resiliency. One of the most significant drivers is the widespread adoption of Non-Volatile Memory Express (NVMe) interfaces which radically reduce latency by enabling direct communication between storage media and host CPUs. Concurrently software-defined storage platforms are decoupling control and data planes allowing seamless integration across heterogeneous hardware environments and delivering greater agility through programmable storage policies.

In addition cloud-native architectures and container-aware storage solutions are facilitating the deployment of persistent data volumes that dynamically scale in tandem with application workloads. Edge computing nodes are increasingly incorporating flash-based storage arrays to handle local processing and reduce the data egress required for centralized analysis. Furthermore developments in erasure coding advanced compression and deduplication techniques are optimizing capacity utilization while sophisticated analytics engines are proactively predicting failure patterns and automating remediations to enhance overall system availability.

Assessing the Cumulative Impact of United States Tariffs on Next-Generation Data Storage Ecosystems and Supply Chains in 2025 Amid Global Trade Dynamics

During 2025 United States tariffs on imported storage media components and subsystem elements have had a cumulative impact on global supply chains for next-generation data storage solutions. These levies have increased the landed cost of flash controllers specialized processors and raw materials used in advanced solid-state drives. Many manufacturers have responded by reallocating production to domestic facilities or partnering with local assemblers to mitigate escalated import duties and maintain competitive pricing structures. This shift has introduced additional complexities in logistics planning and inventory management as companies strive to balance tariff avoidance with rapid delivery commitments.

The tariff environment has also prompted greater investment in strategic sourcing initiatives aimed at diversifying the supplier base and reducing geographic concentration risk. More broadly procurement teams are reassessing contractual frameworks to include tariff pass-through clauses and longer-term price guarantees. As a result originally planned capital budgets have been realigned to accommodate incremental cost exposures. Despite these headwinds industry leaders are leveraging these disruptions as catalysts for strengthening regional manufacturing footprints and forging closer collaboration with government agencies to support sustainable supply chain resilience and ensure consistent availability of mission-critical storage technologies.

Actionable Segmentation-Derived Insights Clarifying Storage Media Deployment Models Architectures Applications and Service Types Driving Market Nuances

Diving into segmentation insights reveals that different storage media classes are following distinct trajectories shaped by performance requirements and cost dynamics. Hard disk drives continue to serve as the backbone for capacity-heavy workloads with the enterprise segment prioritizing multi-actuator architectures to accelerate data access. In parallel consumer hard drives remain essential for personal backup systems while optical storage retains relevance for long-term archival. The solid-state drive category is witnessing rapid growth led by Non-Volatile Memory Express devices that cater to latency-sensitive applications, even as Serial Advanced Technology Attachment drives maintain a price-per-gigabyte advantage in cost-constrained environments.

Deployment model analysis indicates that pure cloud adoption is escalating among digital-native enterprises while hybrid architectures are emerging as the prevailing approach for organizations balancing legacy on-premises investments with agility requirements. Private cloud implementations are favored by highly regulated industries seeking control over data sovereignty while public cloud services enable elastic scale. Storage architectures also demonstrate varied usage patterns: Direct Attached Storage remains integral for high-performance compute clusters, Network Attached Storage is preferred for file-based collaboration, and Storage Area Networks continue to power mission-critical transactional databases.

When examining application verticals consumer electronics manufacturers are integrating embedded flash modules to support ultra-portable devices. Data centers are pivoting toward hyper-converged storage fabrics to simplify operations. Enterprise applications from customer relationship management to enterprise resource planning rely on tiered storage hierarchies, while industrial use cases such as IoT data aggregation demand ruggedized media. End-user industries display differentiated adoption curves: banking and financial services prioritize data integrity and disaster recovery, governments emphasize compliance, healthcare focuses on secure patient records, information technology and telecom providers require high throughput backbones, and retail chains leverage real-time analytics for customer personalization. Finally service providers are expanding consulting offerings and managed service portfolios, while installation maintenance and support segments are evolving to deliver predictive and subscription-based models.

This comprehensive research report categorizes the Next-Generation Data Storage market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Storage Media

- Storage Architecture

- Service Type

- Deployment Model

- Application

- End User Industry

Comprehensive Regional Examination of Next-Generation Data Storage Trends and Growth Drivers across Americas EMEA and Asia-Pacific Market Environments

Across the Americas region organizations are setting the pace for large-scale deployments of next-generation storage driven by significant cloud investment and proactive regulatory frameworks that encourage data localization. North American enterprises are leading in adopting solid-state platforms for performance-intensive applications, while Latin American markets show growing interest in hybrid configurations aimed at cost optimization and business continuity. Canada’s public sector continues to procure multi-petabyte tape libraries for sustainable long-term archival solutions.

In Europe Middle East & Africa regional dynamics are influenced by stringent data privacy regulations and national digital sovereignty mandates. Western European countries exhibit strong uptake of private cloud storage and software-defined storage platforms, whereas emerging markets in the Middle East and Africa prioritize turnkey appliances to support initial digitalization efforts. Cross-border data transfer restrictions have underscored the importance of localized manufacturing partnerships to maintain compliance and minimize latency for end users.

The Asia-Pacific region is witnessing the fastest expansion as governments and enterprises accelerate digital transformation agendas. China and India have ramped up investments in domestic flash and HDD fabrication facilities to reduce import dependency. Southeast Asian economies are driving greenfield data center growth that leverages containerized storage modules for rapid scalability. Meanwhile Australia and Japan continue refining edge storage deployments to support distributed intelligence in smart cities and 5G-enabled applications.

This comprehensive research report examines key regions that drive the evolution of the Next-Generation Data Storage market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Market-Leading Enterprises Shaping the Competitive Landscape through Innovation Strategic Partnerships and Comprehensive Product Portfolios

An examination of leading industry players highlights a competitive landscape defined by continuous innovation and strategic alliances. Major flash manufacturers are integrating proprietary controller algorithms and low-power memory cells to deliver differentiated solid-state platforms. Meanwhile traditional disk drive giants are diversifying into hybrid arrays that combine rotational media with embedded SSD caches to enhance performance for mixed-workload environments. Strategic partnerships between semiconductor firms and storage appliance vendors are accelerating the time to market for specialized data center solutions.

In addition to hardware players a range of software and services companies is expanding their influence through acquisitions and ecosystem collaborations. Software-defined storage providers are forging alliances with cloud hyperscalers to offer unified management interfaces, while managed services firms are creating turnkey offerings that bundle consulting integration and ongoing support. This convergence of disciplines is driving the emergence of full-stack storage vendors capable of delivering end-to-end solutions that span hardware firmware orchestration software and lifecycle services.

This comprehensive research report delivers an in-depth overview of the principal market players in the Next-Generation Data Storage market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- DataDirect Networks, Inc.

- Dell Technologies Inc.

- Fujitsu Limited

- Hewlett Packard Enterprise Company

- Hitachi Vantara, LLC

- Huawei Technologies Co., Ltd.

- IBM Corporation

- Infinidat Ltd.

- Micron Technology, Inc.

- NetApp, Inc.

- Nutanix, Inc.

- Pure Storage, Inc.

- SK Hynix Inc.

Actionable Strategic Recommendations Empowering Industry Leaders to Leverage Next-Generation Data Storage Technologies for Competitive Advantage and Operational Excellence

Industry leaders should prioritize investment in emerging NVMe and persistent memory technologies to meet the escalating demand for real-time data processing. Aligning procurement strategies with diversified supply chain partners will mitigate the impact of continued trade uncertainties and ensure a steady flow of critical components. Moreover organizations are advised to adopt hybrid IT infrastructure models that seamlessly integrate on-premises and cloud-native storage to achieve optimum agility and cost efficiency.

It is also crucial to foster collaborative ecosystems by engaging with software-defined storage innovators and managed service specialists. By leveraging their expertise companies can reduce operational complexity and accelerate deployment timelines. Investing in advanced analytics tools that monitor storage health and predict performance bottlenecks will further drive operational excellence, enabling teams to proactively address issues before they impact end-user experience.

Rigorous Multi-Phased Research Methodology Combining Primary Data Collection Secondary Analysis and Statistical Validation to Ensure Robust Market Intelligence

This research employs a multi-phased methodology beginning with extensive secondary data analysis. Industry whitepapers trade publications vendor briefings and regulatory filings were systematically reviewed to establish a baseline understanding of market trends and technology advancements. Insights derived from this phase informed the design of primary research instruments used to capture frontline perspectives.

Primary data collection consisted of structured interviews and surveys conducted with C-level executives architects and operations managers across end-user organizations and service providers. The qualitative findings were triangulated with quantitative survey responses to validate emerging themes. A robust statistical validation process was applied to ensure the reliability of trend projections and to calibrate the interpretation of complex supply chain impacts. Throughout the study rigorous data governance protocols and expert reviews were implemented to guarantee the accuracy and impartiality of the final analysis.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Next-Generation Data Storage market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Next-Generation Data Storage Market, by Storage Media

- Next-Generation Data Storage Market, by Storage Architecture

- Next-Generation Data Storage Market, by Service Type

- Next-Generation Data Storage Market, by Deployment Model

- Next-Generation Data Storage Market, by Application

- Next-Generation Data Storage Market, by End User Industry

- Next-Generation Data Storage Market, by Region

- Next-Generation Data Storage Market, by Group

- Next-Generation Data Storage Market, by Country

- United States Next-Generation Data Storage Market

- China Next-Generation Data Storage Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1590 ]

Concluding Reflections on the Future Trajectory of Next-Generation Data Storage Emphasizing Strategic Adaptation and Sustainable Innovation Imperatives

The next-generation data storage market is on a trajectory of rapid evolution guided by advancements in interface standards media chemistries and intelligent orchestration software. As enterprises seek to transform vast data volumes into actionable insights the convergence of high-performance flash technologies with scalable cloud architectures will become increasingly prominent. Sustainable practices and energy-efficient design will differentiate providers as environmental and cost pressures intensify.

Ultimately organizations that embrace strategic adaptation will position themselves to capitalize on emerging opportunities in edge computing Internet of Things and AI-driven analytics. By aligning investments with a clear understanding of segmentation and regional diversities executives can build resilient infrastructure that supports innovation while maintaining operational discipline. This conclusion underscores the imperative for continuous optimization and long-term planning in a landscape defined by unrelenting change and technological breakthroughs.

Exclusive Invitation to Engage with Ketan Rohom Associate Director Sales and Marketing to Access the Comprehensive Next-Generation Data Storage Market Research Report and Consultation

Thank you for exploring this comprehensive analysis of the next-generation data storage market. To obtain the full report complete with in-depth market intelligence detailed case studies and proprietary insights please reach out to Ketan Rohom Associate Director Sales and Marketing at 360iResearch. Engaging directly with Ketan Rohom will ensure you receive tailored guidance on how the report’s findings can be applied to your organization’s strategic planning and technology roadmaps.

Seize this exclusive opportunity to gain clarity on the most critical trends and to position your company ahead of the competition with data-driven decision making. Contact Ketan Rohom today to secure immediate access to the comprehensive next-generation data storage market research report and to schedule a personalized consultation.

- How big is the Next-Generation Data Storage Market?

- What is the Next-Generation Data Storage Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?