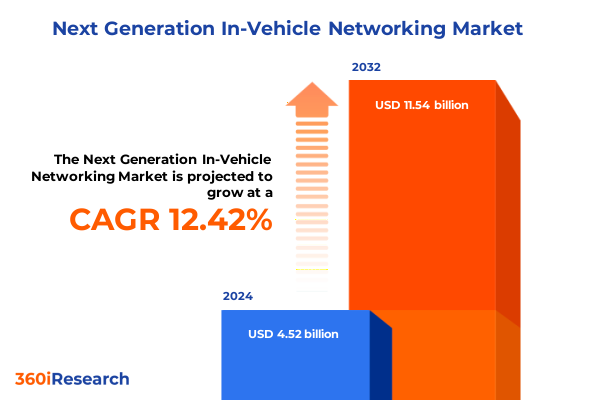

The Next Generation In-Vehicle Networking Market size was estimated at USD 4.98 billion in 2025 and expected to reach USD 5.55 billion in 2026, at a CAGR of 12.50% to reach USD 11.36 billion by 2032.

Unveiling the Future of Automotive Connectivity with Next Generation In-Vehicle Networking Advancements Driving Safer and Smarter Mobility

The accelerating pace of innovation in automotive electronics is reshaping how vehicles communicate, process, and respond to the world around them. As vehicles evolve from isolated mechanical systems into sophisticated digital platforms, the underlying in-vehicle network serves as the nervous system that enables critical functions-ranging from advanced driver assistance systems (ADAS) to immersive infotainment experiences. The advent of next generation in-vehicle networking harnesses the convergence of high-bandwidth Ethernet, deterministic Time-Sensitive Networking (TSN), and seamless wireless communication protocols, setting the stage for safer, smarter, and more connected mobility.

A confluence of regulatory mandates, technological breakthroughs, and shifting consumer expectations is driving widespread adoption of robust networking architectures. With the rise of autonomous driving features, manufacturers must balance the demands of ultra-low latency control loops and high-volume data flows from cameras, radar, and lidar sensors. Meanwhile, consumers expect continuous connectivity, over-the-air updates, and personalized digital experiences on par with smartphones. This dual imperative challenges automotive original equipment manufacturers (OEMs) to architect resilient, scalable networks that can accommodate evolving software architectures and stringent cybersecurity requirements.

Looking ahead, the intersection of electrification and digitalization will further amplify the role of in-vehicle networking. Electric powertrains require sophisticated battery management systems and power-train controls that rely on reliable communication backbones. As such, strategic decisions made today about network topology, redundancy, and integration will reverberate throughout vehicle lifecycles, influencing development costs, time to market, and the ability to differentiate in an increasingly competitive marketplace. This executive summary sets the stage for a deep dive into the transformative shifts, regulatory influences, segmentation dynamics, and regional factors shaping the next generation in-vehicle networking landscape.

How Shifting from Domain-Based Architectures to Integrated Ethernet and TSN Foundations Is Reshaping Vehicle Networking

The automotive networking landscape is undergoing transformative shifts driven by evolving requirements for data throughput, reliability, and system integration. Traditional domain-based architectures, characterized by separate communication networks for powertrain, chassis, body, and infotainment, are giving way to zonal or centralized architectures that consolidate electronic control units (ECUs) and optimize wiring harnesses. This shift reduces complexity and weight, fosters economies of scale, and streamlines vehicle production processes, laying the groundwork for next generation Ethernet-based backbones that can manage bandwidth requirements exceeding multiple gigabits per second.

Concurrently, adoption of Time-Sensitive Networking (TSN) standards is accelerating across safety-critical systems to ensure deterministic, low-latency communication. TSN enables prioritized traffic scheduling, precise time synchronization, and seamless failover mechanisms essential for advanced driver assistance systems such as sensor fusion, collision avoidance, and automated braking. Major OEMs are integrating IEEE 802.1Qbv and related amendments into their vehicle networks, thereby reducing latency and meeting stringent functional safety requirements under ISO 26262.

Wireless connectivity is also making inroads as a complementary channel, facilitating vehicle-to-everything (V2X) communication, over-the-air (OTA) updates, and passenger connectivity services. The confluence of 5G cellular and dedicated short-range communications (DSRC) offers new avenues for low-latency telematics, real-time traffic management, and cooperative automated driving. These wireless layers augment wired backbones, enabling a holistic network capable of supporting dynamic service distribution and continuous software evolution.

At the same time, the proliferation of software-defined vehicle architectures underscores the need for secure, high-speed in-vehicle networks. Cybersecurity, over-the-air maintenance, and digital twin integration are now integral components of the networking strategy, ensuring vehicles remain resilient against emerging threats while enabling feature-rich user experiences. As these trends converge, they collectively drive the next generation of in-vehicle networking, empowering automakers to meet regulatory demands and position themselves at the forefront of connected mobility innovation.

Assessing How Recent Section 232 Tariffs and Offset Programs Are Reshaping Supply Chains and Manufacturing Strategies for In-Vehicle Network Components

In 2025, the United States government imposed sweeping Section 232 tariffs to shore up domestic auto manufacturing and fortify national security, fundamentally altering the economics of in-vehicle networking component sourcing. As of April 2, 2025, a 25% ad valorem tariff applies to all imported passenger vehicles and light trucks, effectively doubling the existing tariff burden to as much as 27.5% for cars and 50% for light trucks when combined with reciprocal duties. To address rising costs, automakers and Tier 1 suppliers are recalibrating their supply chains by reshoring critical electronic control units (ECUs) and consolidating procurement channels within US-based manufacturing hubs.

By May 3, 2025, the tariff regime expanded to include a 25% levy on key automobile parts-engines, transmissions, powertrain modules, and electrical components-exerting additional cost pressure on in-vehicle network switches, connectors, and semiconductor chips imported under Section 232. While parts compliant with the United States-Mexico-Canada Agreement (USMCA) enjoy a temporary exemption, the transitional nature of the policy means non-US content will ultimately face tariffs once certification processes are finalized by US Customs and Border Protection. This phased approach incentivizes higher domestic content in networking hardware and accelerates investment in local assembly of critical components.

Subsequent policy measures have introduced offset programs to soften the immediate impact on US-based OEMs. In June 2025, the Department of Commerce launched an auto tariff offset mechanism, allowing manufacturers to apply for reductions in Section 232 duties proportional to their production volume and investment in domestic assembly facilities. However, the program’s eligibility criteria and administrative lead times present challenges for just-in-time supply chains, necessitating strategic stockpiling and dual-sourcing strategies.

Collectively, these tariffs have accelerated the repatriation of electronic manufacturing, prompted strategic partnerships between OEMs and domestic foundries, and elevated the importance of network topology optimization to minimize component count. In turn, this dynamic environment underscores the urgency for cost-effective design and modular architectures that can absorb regulatory shocks while sustaining innovation in next generation in-vehicle networks.

Unraveling Market Dynamics Through Multi-Dimensional Segmentation Across Network Technology Connectivity Vehicle Type and Application Use Cases

Mapping the next generation in-vehicle networking market through multiple lenses reveals nuanced dynamics that inform product development and go-to-market strategies. Based on network technologies, product roadmaps highlight continued growth for Ethernet as the backbone, complemented by FlexRay legacy solutions and the emergence of Time-Sensitive Networking to meet deterministic control requirements. Controller Area Network remains prevalent for simple, low-bandwidth use cases, while Media Oriented Systems Transport addresses high-definition multimedia distribution. Flexibility in technology choices allows OEMs to align performance with cost targets.

Connectivity stands at the crossroads of wired and wireless paradigms. Wired connectivity offers predictable latency and security for safety-critical subsystems, whereas wireless channels unlock new possibilities for OTA software updates, V2X communications, and passenger services. Striking the right balance ensures that in-vehicle networks deliver robust performance without compromising the ability to deploy new features dynamically.

Different vehicle types impose distinct networking requirements. Commercial vehicles, including heavy-duty trucks and light-medium commercial vehicles, demand ruggedized components, extended lifecycle support, and integration with fleet management telematics. Passenger cars prioritize infotainment richness and seamless connectivity, while electric and hybrid variants introduce battery management networks that interoperate with powertrain controls. Each segment’s unique demands drive tailored network architectures and specialized software stacks.

In-vehicle networks also vary by application focus. Advanced driver assistance systems rely on high-speed channels for sensor fusion and real-time decision making. Body control and comfort systems utilize moderately sized networks to manage functions like lighting and HVAC. Infotainment and V2X communication harness high bandwidth to support streaming and external data exchange. Powertrain networks focus on deterministic, low-latency communication for engine and transmission controls. Meanwhile, aftermarket solutions and OEM installations form the end user segmentation, with original equipment manufacturers focusing on integration at the design stage and aftermarket players emphasizing retrofit compatibility and ease of installation.

This comprehensive research report categorizes the Next Generation In-Vehicle Networking market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Network Technologies

- Connectivity

- Vehicle Type

- Application

- End User

How Regional Regulatory Frameworks Industry Ecosystems and Automotive Innovation Hubs Are Steering In-Vehicle Networking Growth Across Americas EMEA and APAC

Regional insights into next generation in-vehicle networking underscore how market maturity, regulatory frameworks, and supply chain ecosystems vary across the globe. In the Americas, strong domestic OEM presence and strategic investments in software-defined vehicle platforms drive rapid uptake of Ethernet and TSN backbones. North American regulations around collision avoidance and cybersecurity certification further accelerate adoption, supported by a dense network of semiconductor fabs and automotive software hubs.

Europe, the Middle East, and Africa benefit from rigorous safety and emissions standards that compel OEMs to adopt advanced networking for ADAS and electrification. The European Union’s regulations on cybersecurity for connected vehicles mandate stringent network security protocols, fostering growth in secure onboard network solutions. Localized R&D centers and collaborations with leading automotive suppliers create a vibrant ecosystem for innovation in zonal architectures and V2X standards.

Asia-Pacific represents a diverse landscape, with mature markets like Japan and South Korea pioneering semiconductor innovation and 5G-enabled vehicle connectivity, while emerging markets in Southeast Asia and India emphasize affordability and modular solutions. China’s aggressive push for EV deployment and government incentives for intelligent connected vehicles position the region as a leading hub for scale manufacturing of network components. Regional initiatives for standardization and extensive testing facilities for autonomous driving further reinforce Asia-Pacific’s pivotal role in shaping next generation in-vehicle networking.

This comprehensive research report examines key regions that drive the evolution of the Next Generation In-Vehicle Networking market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Overview of Leading Providers of Automotive Networking Solutions Combining Semiconductor Expertise Software Integration and Strategic Alliances

Leading companies at the forefront of next generation in-vehicle networking are combining semiconductor expertise, software development, and strategic partnerships to deliver end-to-end solutions. NXP Semiconductors leverages its broad portfolio of microcontrollers and Ethernet transceivers to enable zonal architectures, working closely with automakers to integrate TSN features into production vehicles. Infineon Technologies focuses on high-reliability chips designed for stringent automotive standards, emphasizing secure boot and functional safety in network controllers.

STMicroelectronics offers Ethernet PHYs and MAC controllers tailored for harsh automotive environments, complemented by embedded software stacks for rapid integration. Bosch contributes through its cross-domain computing platforms that unify ADAS, infotainment, and powertrain control, facilitating streamlined networking across multiple vehicle domains. Continental’s offerings span network switches to end-to-cloud connectivity modules, backed by cybersecurity services and OTA software management.

Texas Instruments and Microchip Technology support the ecosystem with cost-optimized CAN and FlexRay controllers, bridging legacy systems to modern Ethernet backbones. Marvell and Broadcom are shaping the TSN ecosystem with high-performance switches and PHYs capable of multi-gigabit synchronization, catering to next generation over-the-air update requirements. Qualcomm’s automotive division advances cellular-V2X modules, enabling seamless handoffs between wired in-vehicle networks and external communication channels.

These companies are also forging alliances with Tier 1 integrators and standard-setting bodies, participating in consortia like Avnu Alliance and IEEE working groups. Such collaborations accelerate interoperability testing and certification processes, ensuring that diverse components coalesce into reliable, future-proof in-vehicle networks.

This comprehensive research report delivers an in-depth overview of the principal market players in the Next Generation In-Vehicle Networking market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ACOME

- Advanced Micro Devices, Inc.

- Analog Devices, Inc.

- Astera Labs, Inc.

- Broadcom Inc.

- Capgemini SE

- Continental AG

- Elmos Semiconductor SE

- Hitachi, Ltd.

- Hyundai Motor Company

- Infineon Technologies AG

- Intel Corporation

- Keysight Technologies

- LG Electronics Inc.

- Melexis NV

- Microchip Technology Inc.

- NVIDIA Corporation

- NXP Semiconductors N.V.

- Qualcomm Incorporated

- Renault Group

- Renesas Electronics Corporation

- Robert Bosch GmbH

- Samsung Electronics Co., Ltd

- STMicroelectronics N.V.

- Tektronix, Inc. by Fortive Corporation

- Texas Instruments Incorporated

- Toyota Motor Corporation

- Visteon Corporation

- Würth Elektronik GmbH & Co. KG

- Yazaki Corporation

Strategic Roadmap for Automotive OEMs and Suppliers to Enhance Agility Resilience and Security Through Collaborative Architectures

To capitalize on the momentum in next generation in-vehicle networking, industry leaders should prioritize collaborative ecosystem development and flexible architecture design. OEMs and tier suppliers can co-invest in modular zoning frameworks that support both current requirements and future software-defined vehicle enhancements. By standardizing on Ethernet and TSN protocols, stakeholders reduce integration complexity and unlock economies of scale across multiple vehicle programs.

Manufacturers must also strengthen supply chain resilience by diversifying sourcing strategies and establishing regional centers of excellence. The introduction of US Section 232 tariffs highlights the necessity of dual-sourcing critical components and leveraging local manufacturing capabilities. Strategic partnerships with domestic foundries and regional system integrators can mitigate geopolitical risks and ensure continuity of supply.

Investing in robust cybersecurity and OTA infrastructure is equally essential. As firmware updates and feature rollouts become integral to vehicle lifecycles, companies need secure, over-the-air channels that maintain data integrity and functional safety. Building comprehensive vulnerability management programs and adopting international standards such as ISO 21434 will safeguard networks against evolving threats.

Finally, maintaining a forward-looking R&D roadmap inclusive of emerging wireless technologies such as 5G C-V2X and IEEE 802.11bd will position organizations to exploit new business models. Piloting V2X-enabled services in smart city environments and leveraging digital twin simulations can validate network performance under real-world conditions, de-risking large-scale deployments and maximizing return on investment.

Explaining the Comprehensive Blend of Primary Research Interviews Secondary Data Triangulation and Multi-Stage Validation Techniques

Our research methodology blends primary expert interviews, secondary data triangulation, and rigorous validation processes to deliver a comprehensive analysis of the in-vehicle networking market. Primary inputs were collected through in-depth discussions with cross-functional stakeholders, including OEM network architects, Tier 1 and Tier 2 suppliers, semiconductor manufacturers, and regulatory authorities. These interviews provided qualitative insights into technology adoption drivers, supply chain dynamics, and investment priorities.

Secondary research encompassed a thorough review of industry publications, white papers, and corporate filings, as well as standards body documentation from IEEE, ISO, and industry consortia. We analyzed patent filings, trade press, and public policy announcements, such as Section 232 tariff proclamations, to quantify the impact of regulatory shifts on network component sourcing and manufacturing strategies.

Quantitative data was triangulated using published production volumes, component shipment forecasts, and macroeconomic indicators. We applied scenario analysis to model the effects of geopolitical developments, including tariffs and automotive trade agreements, on regional market trajectories. A proprietary scoring framework assessed vendors across criteria such as technology maturity, scalability, and cybersecurity readiness.

Finally, all findings underwent multi-stage validation, including peer review by subject matter experts and alignment with current market trends observed at major automotive forums and trade shows. This layered approach ensures that our insights and recommendations reflect the most accurate and up-to-date perspectives on next generation in-vehicle networking.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Next Generation In-Vehicle Networking market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Next Generation In-Vehicle Networking Market, by Network Technologies

- Next Generation In-Vehicle Networking Market, by Connectivity

- Next Generation In-Vehicle Networking Market, by Vehicle Type

- Next Generation In-Vehicle Networking Market, by Application

- Next Generation In-Vehicle Networking Market, by End User

- Next Generation In-Vehicle Networking Market, by Region

- Next Generation In-Vehicle Networking Market, by Group

- Next Generation In-Vehicle Networking Market, by Country

- United States Next Generation In-Vehicle Networking Market

- China Next Generation In-Vehicle Networking Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1113 ]

Synthesizing the Critical Role of Network Architecture Evolution and Regulatory Dynamics in Steering the Future of Connected Mobility

The evolution of in-vehicle networking is central to the future of automotive innovation, catalyzing advancements in safety, connectivity, and software-defined vehicle architectures. As the industry transitions towards zonal Ethernet backbones augmented by Time-Sensitive Networking and wireless V2X channels, stakeholders gain the platform to deliver high-performance ADAS, seamless infotainment, and adaptive software ecosystems.

Regulatory developments, notably the 2025 Section 232 tariffs and offset mechanisms, have underscored the strategic importance of supply chain resilience and regional manufacturing. Companies that embrace modular, standardized network frameworks and foster collaborative partnerships will be best positioned to navigate cost pressures and regulatory complexity while accelerating time to market.

Looking ahead, the confluence of electrification, autonomous driving, and digital services will further amplify demands on in-vehicle networks. Those who proactively align their architectural choices, cybersecurity strategies, and R&D investments with emerging trends will secure a competitive advantage. The insights and recommendations provided in this summary equip decision makers with the context needed to steer their organizations through this dynamic landscape and capitalize on the next wave of in-vehicle networking innovation.

Empower Your Strategic Vision and Secure Comprehensive Market Intelligence by Engaging with Our Senior Sales Director for Next Generation In-Vehicle Networking Insights

If you’re ready to gain a competitive edge and harness the transformative power of next generation in-vehicle networking, don’t navigate this journey alone. Reach out to Ketan Rohom, Associate Director of Sales & Marketing at 360iResearch, to explore tailored solutions and secure your copy of the comprehensive market research report. His expertise will guide you through the data-driven insights, actionable strategies, and in-depth analysis essential for leading your organization into the future of connected mobility. Contact Ketan today to unlock unparalleled market intelligence and drive innovation in your in-vehicle networking initiatives.

- How big is the Next Generation In-Vehicle Networking Market?

- What is the Next Generation In-Vehicle Networking Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?