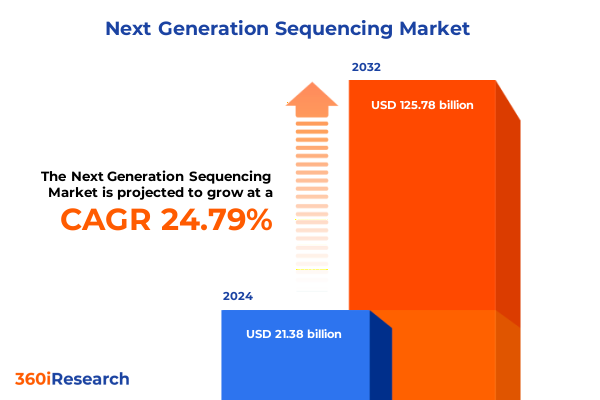

The Next Generation Sequencing Market size was estimated at USD 26.69 billion in 2025 and expected to reach USD 31.77 billion in 2026, at a CAGR of 24.78% to reach USD 125.78 billion by 2032.

Discover How Next Generation Sequencing Is Redefining Biomedical Research Through Unprecedented Data Depth And Accelerated Discovery Processes

In recent years, next generation sequencing has emerged as a cornerstone technology in biomedical research and clinical diagnostics. With the ability to rapidly decode millions of DNA fragments in parallel, laboratories across the United States and around the world can explore genetic variation at unprecedented depth and scale. This shift has enabled breakthroughs in oncology, rare disease diagnosis, and infectious disease surveillance, driving a paradigm shift from hypothesis-driven approaches to data-driven discovery. Moreover, advancements in sequencing chemistry and instrumentation have propelled overall throughput while reducing hands-on time, allowing research teams to allocate resources more efficiently.

As the technology matures, integration with advanced bioinformatics platforms has become essential to interpret vast datasets. The convergence of sequencing hardware with cloud-based analytics and artificial intelligence has streamlined variant calling, annotation, and visualization workflows. This integration has not only accelerated time to insight but also opened the door to real-time genomic surveillance and personalized medicine applications. Transitioning from traditional Sanger sequencing to next generation platforms has also democratized access to high-resolution genetic data, enabling smaller laboratories and emerging markets to participate in cutting-edge research.

Overall, the rapid evolution of next generation sequencing over the past decade has redefined experimental design, clinical trial stratification, and diagnostic pipelines. This introduction lays the groundwork for understanding how transformative shifts, regulatory pressures, and market segmentation converge to shape the future trajectory of genomic analysis.

Uncover The Revolutionary Technological And Analytical Shifts Shaping The Future Of Genomic Sequencing And Biomedical Breakthroughs

Recent innovations have redefined the sequencing landscape, catalyzing transformative shifts across technology, workflow, and analytical capabilities. High-throughput short-read platforms now coexist with third-generation long-read systems, offering complementary strengths for applications ranging from single-cell transcriptomics to de novo genome assembly. At the same time, targeted sequencing approaches such as amplicon and gene panel analysis have expanded the toolkit for precision oncology and infectious disease genotyping, providing cost-effective alternatives for focused investigations.

Beyond hardware, software-driven breakthroughs in alignment algorithms, annotation pipelines, and variant calling methods have significantly enhanced data accuracy and interpretability. Machine learning models integrated into data analysis software can now predict functional impacts of novel variants and flag potential artifacts, reducing false positives and accelerating validation workflows. In parallel, sample preparation innovations, including automation of library and template preparation steps, have minimized hands-on time and improved reproducibility across multicenter studies.

Taken together, these interrelated advancements have reshaped research paradigms by enabling end-to-end workflows that integrate sequencing, data processing, and actionable insights. As the field moves forward, convergence between sequencing technologies and informatics solutions will continue to drive unparalleled levels of throughput, precision, and discovery potential.

Examine How The 2025 United States Tariffs Have Reshaped Supply Chains Costs And Strategic Investment Decisions In Genomic Sequencing

In 2025, the United States implemented tariffs on key components and reagents used in next generation sequencing, prompting stakeholders to reevaluate supply chain strategies and cost structures. Sequencer manufacturers faced increased import duties on critical parts, driving a shift toward regionalized production and diversification of suppliers. At the reagent level, enzymes, kits, and ancillary consumables became subject to higher levies, exerting upward pressure on operational expenses for research laboratories and diagnostic facilities.

Consequently, many organizations accelerated efforts to qualify domestic vendors and invest in vertically integrated manufacturing solutions to mitigate tariff-related risks. Some leading instrument providers announced partnerships with local assembly plants to circumvent import barriers, while reagent companies optimized formulations to reduce reliance on tariffed inputs. This realignment has fostered greater resilience but has also introduced transitional challenges, including lead time variability and initial capital outlay for facility upgrades.

Despite these hurdles, the long-term impact of the tariffs has been a maturation of the NGS ecosystem within the United States. Enhanced domestic capabilities have begun to offset external shocks, positioning the industry to maintain momentum amid evolving geopolitical landscapes. As stakeholders adapt to this new environment, strategic supply chain optimization and regulatory agility will remain critical for sustaining innovation and competitive advantage.

Discover Key Technology Workflow Product And Application Segmentation Drivers Unlocking Market Opportunities In Next Generation Sequencing

Deep understanding of market segmentation is essential to uncover growth drivers and prioritize investment in next generation sequencing technologies. Based on technology, the field encompasses a broad spectrum of approaches including amplicon sequencing for high-throughput targeted analysis, gene panel sequencing for oncology profiling, RNA sequencing to capture transcriptomic landscapes, targeted sequencing for focused variant detection, whole exome sequencing (WES) to interrogate coding regions, and whole genome sequencing (WGS) for comprehensive genomic interrogation. Each technology segment offers distinct advantages depending on research objectives, sample throughput requirements, and cost considerations.

When considering product type segmentation, the market spans consumables reagents, instruments, and software services. Consumables reagents include critical enzymes and kits essential for library preparation and sequencing reactions, while instruments cover both ancillary instruments and high-throughput sequencers that drive data acquisition. Complementing these tangible assets, software services encompass advanced data analysis platforms and expert services that translate raw sequence reads into actionable insights. Recognizing how these categories interact is fundamental to tailoring offerings that address end user requirements and streamline workflow integration.

Workflow segmentation further delineates opportunities across data analysis, data storage, sample preparation, and sequencing stages. Within data analysis, alignment, annotation, and variant calling subsegments enable precise interpretation of genomic data, while data storage options such as cloud storage and on-premise solutions support scalability and regulatory compliance. Sample preparation encompasses library preparation and template preparation steps, underpinning consistent sequencing performance. Finally, end user segmentation highlights the diverse ecosystem of academic research institutes, healthcare diagnostic laboratories, and pharmaceutical biotechnology companies, each driving unique drivers for technology adoption based on their specific applications in agrigenomics, carrier screening, epigenomics, forensic genomics, genetic and rare diseases, infectious diseases, neurogenomics, oncology, and pharmacogenomics.

This comprehensive research report categorizes the Next Generation Sequencing market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Technology

- Product Type

- Workflow

- End User

- Application

Explore How Regional Dynamics Across The Americas EMEA And AsiaPacific Drive Differential Adoption And Innovation In Genomic Sequencing

In the Americas, strong funding for academic research and robust public–private partnerships have propelled widespread adoption of next generation sequencing. North American research institutions and clinical laboratories benefit from established infrastructure and active collaborations with biotechnology firms, driving advances in oncology panels and infectious disease surveillance. Meanwhile, efforts in Latin America to expand genomic capabilities have gained momentum, with regional initiatives focusing on genetic epidemiology and biodiversity studies that leverage NGS.

Across Europe, the Middle East, and Africa, diverse regulatory frameworks and healthcare systems have shaped sequencing adoption in distinct ways. European Union directives on data privacy and cross-border health regulations have reinforced the importance of secure data storage and standardized workflows, while national research programs in the Middle East are investing in precision medicine strategies to address regional disease prevalence. In Africa, initiatives to enhance genomic surveillance of pathogens have underscored the role of portable sequencing platforms in field-deployable applications, addressing endemic and emerging infectious threats.

The Asia-Pacific region has emerged as a dynamic growth hub, with significant investments in sequencing infrastructure and localized manufacturing. Countries such as China, Japan, and Australia are pioneering large-scale genomics programs, integrating NGS into national health policies and agricultural research. Southeast Asian markets are also accelerating their capabilities, focusing on rare disease screening and pharmacogenomics. The convergence of governmental support, academic expertise, and industry partnerships across these regions is shaping a globally interconnected NGS landscape.

This comprehensive research report examines key regions that drive the evolution of the Next Generation Sequencing market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Gain Strategic Insights Into Major Innovators Shaping Sequencing Technology Landscape With Partnerships Product And Market Positioning Highlights

Leading life sciences companies have continuously innovated to expand the capabilities and accessibility of next generation sequencing. One prominent provider specializes in high-throughput short-read platforms, consistently refining flowcell chemistries and automation to boost output and reduce per-sample processing times. Another major player focuses on long-read sequencing systems, offering unique applications in structural variant detection and de novo genome assembly with portable devices that cater to remote clinical and field environments. Meanwhile, a third innovator has strengthened its position through strategic acquisitions of bioinformatics software companies, integrating cloud-native analytics and AI-driven interpretation tools that enhance variant annotation and visualization.

In parallel, emerging firms are differentiating themselves by developing specialized reagent kits and ancillary instruments that optimize sample preparation workflows for specific applications such as single-cell sequencing and epigenomic profiling. These companies often collaborate with academic and clinical partners to co-develop targeted gene panels and diagnostic assays, accelerating time to market and ensuring high sensitivity and specificity. At the same time, service-oriented organizations have expanded their offerings to include turnkey sequencing solutions, combining on-demand data generation with expert consulting services that guide study design, regulatory compliance, and data interpretation.

By leveraging partnerships, investing in R&D, and broadening their product portfolios, these key companies are collectively shaping an ecosystem where sequencing hardware, consumables, and software converge. Their differentiated strategies highlight the importance of end-to-end solution providers that can address evolving user needs and regulatory environments, thereby driving sustained innovation and market leadership in the NGS landscape.

This comprehensive research report delivers an in-depth overview of the principal market players in the Next Generation Sequencing market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 10x Genomics, Inc.

- Agilent Technologies, Inc.

- Azenta US, Inc.

- Becton, Dickinson and Company

- BGI Genomics Co., Ltd.

- Bio-Rad Laboratories, Inc.

- Danaher Corporation

- Eurofins Scientific SE

- F. Hoffmann-La Roche Ltd.

- Fulgent Genetics

- GenScript

- Hamilton Company

- Illumina, Inc.

- Invitae Corporation

- LGC Limited

- Macrogen Inc.

- Merck KGaA

- MGI Tech Co., Ltd.

- NeoGenomics Laboratories

- Novogene Co., Ltd.

- Oxford Nanopore Technologies Plc.

- Pacific Biosciences of California, Inc.

- QIAGEN N.V.

- Revvity

- Thermo Fisher Scientific Inc.

Strategic Actionable Roadmap For Industry Leaders To Navigate Regulatory Challenges Optimize Supply Chains And Drive NextGeneration Sequencing Innovation

Industry leaders must adopt a proactive approach to navigate the evolving next generation sequencing landscape and capitalize on emerging opportunities. To begin, diversifying supply chains through regional manufacturing partnerships and multi-sourcing strategies will mitigate risks associated with geopolitical tensions and tariff fluctuations. Securing reliable access to critical reagents, instruments, and components is essential to maintain seamless operations and prevent costly disruptions.

Investing strategically in advanced data analytics and cloud-based infrastructure can further enhance competitive advantage. By integrating artificial intelligence and machine learning into annotation and variant calling workflows, organizations can deliver faster, more accurate insights that inform clinical decisions and research hypotheses. It is also imperative to establish robust data governance frameworks that address privacy, compliance, and scalability requirements across jurisdictions.

Collaborative partnerships with academic centers, diagnostic laboratories, and pharmaceutical companies can unlock novel applications and expand market reach. Co-development agreements enable shared expertise, rapid assay validation, and accelerated regulatory approval pathways, particularly in areas such as genetic rare disease screening and infectious disease outbreak response. Moreover, dedicating resources to continuous professional education and cross-disciplinary training ensures that technical teams remain proficient in emerging protocols and analytical methodologies.

Finally, maintaining a forward-looking regulatory strategy that anticipates changes in tariff policies, data privacy regulations, and reimbursement frameworks will position organizations to adapt swiftly to external pressures. By aligning operational, technical, and strategic initiatives, industry leaders can drive sustainable growth and maintain a leadership edge in the highly competitive next generation sequencing sector.

Discover The Comprehensive Research Methodology Integrating Primary Secondary And Expert Validation To Ensure Robust Next Generation Sequencing Insights

To generate comprehensive insights into the next generation sequencing landscape, a rigorous research methodology was employed, integrating primary data collection and secondary source validation. Primary research efforts included in-depth interviews with industry executives, laboratory directors, and key opinion leaders to capture qualitative perspectives on technology adoption, supply chain dynamics, and regulatory impacts. These interviews provided firsthand accounts of challenges and strategic priorities across academic, clinical, and commercial settings.

Secondary research comprised a thorough review of peer-reviewed publications, government reports, and reputable industry white papers, ensuring that findings were grounded in the latest scientific and policy developments. Data from public financial disclosures and company filings supplemented these sources, offering context on strategic initiatives, partnerships, and product launches. Wherever possible, peer benchmarking and cross-validation techniques were applied to corroborate qualitative insights and identify convergent trends.

An expert advisory panel reviewed preliminary findings to validate interpretations and refine analytical frameworks. Their feedback informed iterative revisions to the segmentation analysis, regional insights, and strategic recommendations, enhancing the robustness and relevance of the report. Throughout the process, methodological rigor was maintained by adhering to best practices in qualitative research, including systematic documentation, transparent source attribution, and continuous stakeholder engagement. This comprehensive approach underpins the credibility and actionable value of the insights presented within the report.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Next Generation Sequencing market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Next Generation Sequencing Market, by Technology

- Next Generation Sequencing Market, by Product Type

- Next Generation Sequencing Market, by Workflow

- Next Generation Sequencing Market, by End User

- Next Generation Sequencing Market, by Application

- Next Generation Sequencing Market, by Region

- Next Generation Sequencing Market, by Group

- Next Generation Sequencing Market, by Country

- United States Next Generation Sequencing Market

- China Next Generation Sequencing Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1908 ]

Summarize Key Takeaways From Transformations Regulatory Impacts And Strategic Opportunities Driving The Future Trajectory Of Genomic Sequencing

As next generation sequencing continues to evolve, the convergence of technological innovation, strategic supply chain realignment, and regional dynamics is reshaping the genomics landscape. Transformative advances in both short-read and long-read platforms, coupled with breakthroughs in sample preparation and bioinformatics, are enabling researchers and clinicians to derive actionable insights at unprecedented speed and scale. At the same time, regulatory changes and tariff measures in 2025 have driven the industry toward greater domestic resilience and supplier diversification.

Segmentation analysis highlights the nuanced requirements across technology modalities, product types, workflows, and end users, underscoring the importance of tailored solutions that address specific application needs from agrigenomics to pharmacogenomics. Regional insights reveal that the Americas, EMEA, and Asia-Pacific regions each present distinct growth drivers, reflecting variations in funding models, regulatory environments, and disease burden priorities. Key companies are differentiating themselves through strategic partnerships, acquisition of analytical capabilities, and expansion of service offerings, collectively driving an integrated ecosystem of hardware, consumables, and software services.

Looking ahead, organizations that proactively optimize their supply chains, invest in advanced analytics, and foster collaborative alliances will be best positioned to navigate the changing geopolitical and regulatory landscape. By leveraging robust research methodologies and maintaining agility in strategy execution, industry leaders can harness the full potential of next generation sequencing to advance scientific discovery and improve patient outcomes.

Connect With Associate Director Of Sales And Marketing To Unlock InDepth Customized Sequencing Market Intelligence Tailored To Accelerate Your Initiatives

Unlock deeper strategic insights and customized market intelligence by connecting directly with Ketan Rohom, Associate Director of Sales and Marketing. By partnering with our team, you gain access to an in-depth market research report tailored to your organization’s unique objectives in the next generation sequencing space. Whether you seek detailed segmentation analysis, comprehensive regulatory impact assessments, or actionable regional intelligence, this report delivers a holistic view of the evolving genomics landscape.

Engage with Ketan to discuss your specific research priorities, explore available customization options, and secure a solution that aligns with your strategic initiatives. Your organization can benefit from expert guidance on supply chain optimization, technological advancements, and competitive positioning. Reach out today to accelerate your decision-making and maintain a leadership edge in the dynamic world of next generation sequencing.

- How big is the Next Generation Sequencing Market?

- What is the Next Generation Sequencing Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?