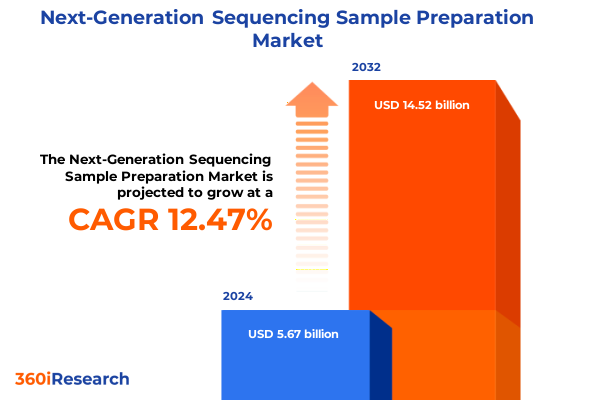

The Next-Generation Sequencing Sample Preparation Market size was estimated at USD 6.34 billion in 2025 and expected to reach USD 7.10 billion in 2026, at a CAGR of 12.55% to reach USD 14.52 billion by 2032.

Understanding the fundamental significance of optimized sample preparation workflows as enablers of accuracy efficiency and reproducibility in next-generation sequencing outcomes

Next-generation sequencing has fundamentally transformed biological research and clinical diagnostics by enabling comprehensive analysis of genomic and transcriptomic landscapes. At the heart of this revolution, sample preparation serves as the critical preanalytical step that influences the accuracy, sensitivity, and reproducibility of downstream sequencing results. By converting raw biological material into high-quality libraries amenable to sequencing platforms, modern preparation workflows address challenges such as low input quantities, sample heterogeneity, and the removal of inhibitors that compromise read depth and fidelity. Consequently, advances in extraction, library construction, and target enrichment have become cornerstones of reliable sequencing outcomes across diverse applications.

This executive summary presents an in-depth examination of current trends, market forces, and tactical considerations shaping sample preparation in next-generation sequencing. It synthesizes insights across technological shifts, regulatory impacts, segmentation dynamics, and regional variations to equip decision makers with a clear understanding of the evolving landscape. By highlighting strategic imperatives and actionable recommendations, this document aims to guide stakeholders in research institutes, clinical laboratories, and commercial organizations toward optimized processes, robust supply chains, and sustained innovation in sample preparation workflows.

Moreover, as the demand for precision medicine and large-scale population genomic studies continues to accelerate, the scalability and cost-effectiveness of sample preparation workflows stand out as key differentiators for laboratory operations and service providers. This summary will navigate through transformative innovations and market dynamics that are redefining sample preparation, setting the stage for strategic investments and partnerships that drive future growth.

Examining the convergence of advanced automation regulatory evolution and data analytics reshaping the future of next-generation sequencing sample preparation

Recent years have witnessed a relentless pace of innovation reshaping sample preparation from end to end. High-throughput automated liquid handling systems have moved beyond basic pipetting to integrate microfluidic cartridges, enabling the processing of hundreds of samples in parallel with minimal hands-on time. Simultaneously, single-cell sequencing protocols have matured, requiring precise isolation and barcoding chemistries that challenge traditional extraction methods and spurring the development of specialized reagents designed for minute input quantities. In parallel, library preparation kits have evolved to incorporate enzymatic improvements that reduce bias and deliver more uniform coverage, while novel target enrichment panels streamline workflows for clinical and research applications.

Moreover, digital transformation has become a defining force across the sample preparation landscape. Laboratory information management systems are being augmented with cloud-based analytics that track samples, reagents, and instrument performance in real time, facilitating proactive troubleshooting and compliance with rigorous quality standards. Artificial intelligence–driven algorithms are increasingly applied to optimize protocol parameters and predict reagent consumption, improving cost efficiency and reproducibility. As a result, the confluence of automation, advanced chemistries, and data-driven analytics is propelling sample preparation toward unprecedented levels of throughput and reliability, setting a new benchmark for next-generation sequencing operations.

In addition, regulatory frameworks are evolving to accommodate complex sample preparation procedures, particularly in clinical diagnostics and companion testing. The emergence of harmonized quality standards and regulatory guidances for extraction and library workflows encourages vendors and end users to adopt validated platforms that ensure traceability and minimize variability. This regulatory momentum underscores the importance of standardized protocols and collaborative initiatives among stakeholders, ultimately enhancing the credibility and utility of next-generation sequencing outputs across diverse sectors.

Analyzing the economic supply chain and strategic impact of newly enacted United States tariffs on sample preparation components in next-generation sequencing

In early 2025, the United States government implemented revised tariff measures targeting a range of imported goods, notably including key reagents, instruments, and consumables used in next-generation sequencing sample preparation. These measures, introduced under Section 301 provisions, impose additional duties of up to 25 percent on selected commodities sourced from certain regions, significantly raising the landed cost of high-precision enzymes, magnetic bead kits, and automated platforms. Consequently, laboratories and commercial service providers have encountered margin pressures, prompting some to adjust procurement strategies and reevaluate vendor partnerships to mitigate the cost burden associated with these tariffs.

Despite these challenges, industry participants are deploying adaptive strategies to sustain operational continuity and cost-effectiveness. Diversification of supplier portfolios has become a central tactic, with organizations seeking alternative sources in tariff-exempt jurisdictions or investing in domestic reagent manufacturing to reduce exposure. Furthermore, some stakeholders are exploring collaborative purchasing consortia to leverage collective bargaining power and buffer against price volatility. Collectively, these responses illustrate a pragmatic approach to navigating the cumulative impact of United States tariffs in 2025, underscoring the importance of flexible sourcing, transparent supply chains, and strategic vendor engagement to ensure the resilience of next-generation sequencing sample preparation workflows.

Looking ahead, continuous monitoring of trade policy developments will be essential as additional tariff adjustments or exclusions may emerge, requiring rapid decision-making and scenario planning by industry leaders.

Revealing differentiation strategies across product workflow technology sample type application end user segments unlocking value in next-generation sequencing

Within the product dimension, the instruments category commands notable attention as laboratories seek high-throughput automated platforms that enhance precision and reduce manual variability. Concurrently, reagents and consumables remain indispensable, with demand driven by specialized chemistries for library construction, target enrichment, and quality control measures. Service offerings, encompassing external sample processing and assay development, have also expanded significantly, catering to organizations that prefer to outsource complex workflows and focus internal resources on data interpretation and downstream analysis. These segments operate in tandem, forming an interconnected ecosystem where instrument performance, reagent quality, and service reliability collectively dictate the overall efficiency and robustness of sample preparation processes.

Examining the workflow segmentation reveals distinct growth patterns across library preparation and amplification, library quantification and quality control, nucleic acid extraction, and target enrichment. Library preparation and amplification protocols continue to evolve toward simplified, one-step chemistries, while quantification and quality control solutions are increasingly automated to ensure consistent input metrics. Nucleic acid extraction workflows benefit from magnetic bead–based kits that streamline processing, and targeted enrichment has seen a surge in customizable panels that accelerate the identification of clinically relevant regions. When overlaid with technology choices, from chromatin immunoprecipitation sequencing to exome, methylation, RNA, targeted, and whole genome sequencing, organizations are calibrating their workflow selections to match specific research objectives and throughput requirements.

Considerations around sample type, application, and end user further refine the market landscape. DNA and RNA inputs present unique challenges, motivating tailored extraction and library strategies for each biomolecule. Applications ranging from agricultural genomics and animal science to clinical diagnostics, drug development, consumer genomics, and forensic analysis underscore the versatility required in preparation protocols. Academic and research institutions, hospitals and clinics, as well as pharmaceutical and biotechnology companies, each bring distinct operational imperatives, regulatory constraints, and scale requirements, driving segmentation-specific opportunities for vendors to deliver customized solutions that resonate with end-user priorities.

This comprehensive research report categorizes the Next-Generation Sequencing Sample Preparation market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product

- Workflow

- NGS Technology

- Sample Type

- Application

- End User

Exploring regulatory infrastructure dynamics across the Americas EMEA and Asia-Pacific driving innovation in next-generation sequencing sample preparation

In the Americas, robust research funding and a dense network of academic, clinical, and commercial laboratories have established the region as a leading hub for next-generation sequencing sample preparation. The United States continues to drive innovation through significant investment in automation platforms, portable extraction instruments, and scalable library prep kits. Regulatory agencies have introduced streamlined pathways for companion diagnostics, encouraging the adoption of standardized workflows and quality metrics. Canada’s genomics initiatives, supported by public–private collaborations, further reinforce North America’s position as a growth engine for advanced sample preparation solutions.

Across Europe, the Middle East and Africa, varied regulatory landscapes and funding models present both challenges and opportunities. Western European markets benefit from cohesive regulatory frameworks and established genomic consortia that facilitate protocol harmonization and vendor qualification. Meanwhile, emergent genomics programs in the Middle East and selected African nations are catalyzing demand for cost-effective extraction reagents and portable library preparation tools. Transitioning to the Asia-Pacific, expanding population genomics projects in China, Japan, India, and Southeast Asia are driving volume, while local manufacturers and collaborative research centers accelerate technology transfer. Consequently, this region demonstrates a versatile blend of high-volume sequencing capacity and evolving infrastructure, underscoring its critical role in global sample preparation innovation.

Collectively, these regional dynamics highlight the importance of tailored strategies that respect distinct regulatory environments, infrastructure maturity, and collaboration models. Stakeholders seeking to navigate this complex terrain can benefit from region-specific partnerships, dynamic compliance plans, and investments that align with local research priorities.

This comprehensive research report examines key regions that drive the evolution of the Next-Generation Sequencing Sample Preparation market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling leading innovators strategic partnerships technology investments and competitive positioning in next-generation sequencing sample preparation

Illumina continues to set industry benchmarks with fully integrated automated platforms that combine extraction, library construction, and target enrichment in seamless workflows, pairing proprietary enzymatic chemistries with sophisticated software to elevate reproducibility. Thermo Fisher Scientific has expanded its reagent portfolio to include advanced enzyme formulations and barcoding kits tailored for both low-input and high-complexity samples. QIAGEN has prioritized service diversification through its contract research and sample preparation–as-a-service offerings, delivering turnkey solutions to pharmaceutical and academic customers. Agilent Technologies has strengthened its position through alliances with software developers, embedding real-time quality control analytics and remote monitoring capabilities in its liquid handling instruments.

BGI Genomics has distinguished itself by offering modular magnetic bead–based extraction kits optimized for automated workflows, ensuring consistent yields and minimal hands-on time. PerkinElmer has focused on single-cell library preparation innovations, simplifying cell lysis, barcoding, and amplification processes to support high-throughput applications. New England Biolabs has introduced a suite of methylation and long-read sequencing preparation kits with unique enzyme mixes that reduce bias. Smaller specialized enterprises are also entering strategic partnerships to integrate predictive maintenance sensors and cloud-based analytics into sample preparation platforms, leveraging machine learning algorithms for protocol optimization. Collectively, these initiatives underscore a competitive environment in which both established leaders and agile challengers pursue differentiated tactics to enhance efficiency, scalability, and data quality in sample preparation workflows.

This comprehensive research report delivers an in-depth overview of the principal market players in the Next-Generation Sequencing Sample Preparation market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Agilent Technologies, Inc.

- Azenta Life Sciences

- BGI Genomics Co., Ltd.

- Biodiscovery, LLC

- Bio‐Rad Laboratories, Inc.

- Charles River Laboratories International, Inc

- Danaher Corporation

- F. Hoffmann-La Roche Ltd

- GenScript Biotech Corporation

- Hamilton Bonaduz AG

- Illumina, Inc.

- LGC Biosearch Technologies

- Merck KGaA

- Meridian Bioscience, Inc

- New England Biolabs, Inc

- NimaGen B.V.

- Omega Bio-tek, Inc.

- Oxford Nanopore Technologies PLC

- Pacific Biosciences of California, Inc.

- Parse Biosciences

- PerkinElmer, Inc.

- Promega Corporation

- QIAGEN N.V.

- Standard BioTools Inc.

- Takara Bio Inc.

- Thermo Fisher Scientific, Inc.

- Twist Bioscience Corporation

- Zymo Research Corporation

Delivering strategic guidance for leaders to optimize efficiency foster innovation and mitigate supply chain risks in next-generation sequencing

To stay ahead in the evolving landscape of next-generation sequencing sample preparation, industry leaders should prioritize the adoption of modular, scalable automation systems that balance throughput with flexibility. Investing in platforms that support interchangeable consumables and customizable workflows can accommodate diverse sample types and application demands. Furthermore, establishing strategic partnerships with reagent suppliers enables co-development of specialized chemistries, reducing lead times for optimized protocols and unlocking opportunities for exclusive distribution agreements.

Moreover, organizations must cultivate resilient supply chains by diversifying sourcing models and engaging in near-shoring initiatives for critical reagents and consumables. Implementing robust quality management systems, including digital tracking from raw material receipt through library construction, will bolster compliance with regulatory requirements and facilitate rapid troubleshooting. Lastly, embedding data-driven analytics and predictive maintenance capabilities within preparation workflows can enhance operational transparency, minimize downtime, and inform continuous process improvements, ensuring sustained excellence and cost-effectiveness in sample preparation operations.

Leaders should also champion workforce development initiatives that emphasize cross-training laboratory personnel in both instrument operation and bioinformatics basics, fostering interdisciplinary expertise that accelerates technology adoption. By integrating training programs with digital simulation tools and hands-on workshops, organizations can cultivate a culture of innovation and reinforce adherence to standardized protocols. These combined measures will empower stakeholders to capitalize on emerging opportunities, enhance competitiveness, and deliver high-quality genomic insights with greater speed and confidence.

Outlining a rigorous mixed-method framework combining primary interviews secondary research and data analysis protocols for sample preparation intelligence

This report’s findings are grounded in a comprehensive mixed-method research framework designed to capture the multifaceted nature of sample preparation in next-generation sequencing. Primary research efforts included in-depth interviews with over thirty senior executives, laboratory directors, and technical experts representing leading academic, diagnostic, and commercial organizations. These conversations provided nuanced perspectives on emerging technologies, supply chain dynamics, and strategic priorities across diverse geographies and application areas.

In parallel, extensive secondary research drew upon peer-reviewed journals, regulatory agency databases, patent filings, and publicly available financial disclosures to map technology trends and vendor activities. Quantitative data analysis, including protocol throughput metrics, reagent consumption patterns, and equipment deployment figures, was conducted to validate qualitative insights. Data triangulation and rigorous validation protocols were employed to ensure accuracy, with findings reviewed by an advisory panel of industry thought leaders. Through this methodological rigor, the report delivers actionable intelligence and strategic clarity for stakeholders seeking to optimize sample preparation workflows.

Additionally, scenario modeling was utilized to assess the potential impact of regulatory changes and trade policy developments on sourcing strategies and cost structures. Sensitivity analyses highlighted critical factors influencing process scalability and resilience, offering stakeholders a robust framework for decision-making under uncertainty.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Next-Generation Sequencing Sample Preparation market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Next-Generation Sequencing Sample Preparation Market, by Product

- Next-Generation Sequencing Sample Preparation Market, by Workflow

- Next-Generation Sequencing Sample Preparation Market, by NGS Technology

- Next-Generation Sequencing Sample Preparation Market, by Sample Type

- Next-Generation Sequencing Sample Preparation Market, by Application

- Next-Generation Sequencing Sample Preparation Market, by End User

- Next-Generation Sequencing Sample Preparation Market, by Region

- Next-Generation Sequencing Sample Preparation Market, by Group

- Next-Generation Sequencing Sample Preparation Market, by Country

- United States Next-Generation Sequencing Sample Preparation Market

- China Next-Generation Sequencing Sample Preparation Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1113 ]

Summarizing key insights strategic imperatives and opportunities to enhance innovation operational excellence and resilience in next-generation sequencing

As the demand for comprehensive genomic analysis accelerates across research and clinical domains, next-generation sequencing sample preparation has emerged as both a critical enabler and a strategic differentiator. This executive summary has highlighted transformative technological advances, evolving regulatory landscapes, and segmentation dynamics that collectively shape the efficiency, quality, and scalability of sample preparation workflows. From the integration of automation and AI-driven analytics to the navigation of United States tariff impacts, stakeholders must engage in continuous innovation and agile decision-making to maintain competitive advantage.

Looking forward, the interplay between regional market characteristics, leading company strategies, and actionable best practices will determine the pace of adoption and the emergence of new opportunities. By aligning investments with workflow-specific requirements and fostering cross-sector collaborations, organizations can unlock enhanced data fidelity and operational resilience. In this context, the insights and recommendations presented herein provide a strategic roadmap for driving sustainable growth and delivering high-impact genomic insights with confidence and precision.

Ultimately, the capacity to adapt sample preparation processes to evolving scientific, economic, and policy environments will be instrumental in realizing the full potential of next-generation sequencing. Strategic alignment of technology roadmaps, supply chain frameworks, and talent development initiatives will empower stakeholders to meet rising demands and translate genomic discoveries into tangible outcomes.

Connect with Associate Director Ketan Rohom to access expert guidance drive your next-generation sequencing sample preparation success

For organizations seeking deeper analysis and comprehensive data on next-generation sequencing sample preparation, engaging with our Associate Director of Sales & Marketing, Ketan Rohom, offers direct access to tailored market intelligence and expert advisory. Mr. Rohom brings extensive experience in guiding industry stakeholders through complex technology landscapes and can provide personalized insights to support your strategic initiatives.

To explore how this in-depth research can inform your operational and investment decisions, we invite you to connect with Ketan Rohom. His expertise will help you uncover new growth opportunities, optimize workflows and achieve a competitive edge in the rapidly evolving sample preparation ecosystem.

- How big is the Next-Generation Sequencing Sample Preparation Market?

- What is the Next-Generation Sequencing Sample Preparation Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?