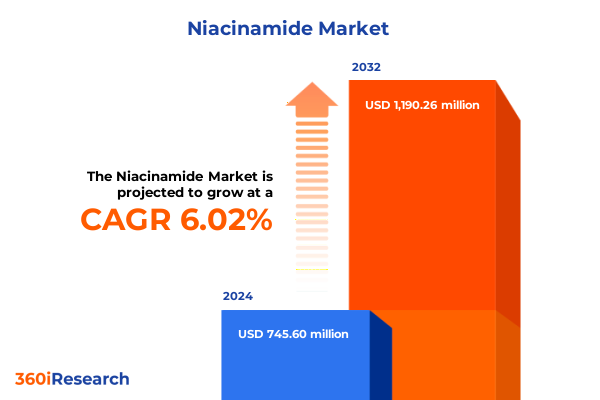

The Niacinamide Market size was estimated at USD 782.66 million in 2025 and expected to reach USD 826.02 million in 2026, at a CAGR of 6.17% to reach USD 1,190.26 million by 2032.

Introduction to Niacinamide as a Versatile Ingredient Driving Innovations Across Cosmetics, Nutraceuticals, Food, Feed, and Pharmaceutical Industries

Niacinamide, also known as vitamin B3, has emerged as an indispensable multifunctional ingredient across a diverse array of industries ranging from cosmetics and dietary supplements to food and beverage, animal feed, and pharmaceuticals. Its unique ability to enhance skin barrier function, improve metabolic health, and act as an essential nutrient in animal nutrition has stoked significant interest among product developers and formulators. In the cosmetics sphere, its anti-aging, brightening, and moisturizing benefits have encouraged brands to incorporate Niacinamide into color cosmetics, hair care serums, and specialized skin care formulations. Simultaneously, the dietary supplement sector has witnessed a surge in demand for Niacinamide delivered in capsules, powders, liquids, and tablets, driven by heightened consumer awareness of immune support and metabolic wellness.

Beyond human health applications, the feed industry is exploring Niacinamide’s potential to bolster growth performance and stress resilience in aquaculture, cattle, poultry, and swine feed formulations. In food and beverage, its fortification in bakery, confectionery, and dairy products underscores a broader trend toward functional foods. The pharmaceutical segment continues to value Niacinamide in both over-the-counter and prescription drug formulations for dermatological and metabolic therapies. As global consumer preferences pivot toward multifunctional, scientifically substantiated ingredients, Niacinamide has solidified its role as an innovation catalyst across sectors, offering ingredient manufacturers, formulating companies, and end users a compelling value proposition for next-generation product pipelines.

Exploring Transformative Shifts Impacting Niacinamide Adoption Driven by Consumer Awareness, Regulatory Evolution, and Technological Breakthroughs in Formulations

The landscape for Niacinamide has transformed dramatically in recent years, propelled by a confluence of regulatory, technological, and consumer-driven shifts. Heightened consumer sophistication around skin health and functional nutrition has prompted brands to prioritize clinically backed ingredients, elevating Niacinamide’s stature in product claims. Concurrently, regulatory agencies in major markets have refined permissible usage levels and purity standards, driving manufacturers to adopt advanced analytical methods and supply chain traceability solutions. This evolution has fostered collaboration between industry stakeholders and testing laboratories to ensure compliance and product safety across color cosmetics, hair care, and dietary supplement applications.

Technological innovations have further reshaped the market dynamics, with encapsulation techniques and nanoemulsion technologies enabling enhanced stability and bioavailability of Niacinamide in liquid, powder, and tablet formats. Developments in green chemistry have introduced vegetable-derived and yeast-derived Niacinamide options that resonate with sustainability mandates, while advances in bio-synthetic production have improved cost-efficiency and supply security. Taken together, these transformative shifts have compelled players across animal feed, food and beverage, and pharmaceutical segments to reassess formulation strategies, supply chain architectures, and product positioning to harness Niacinamide’s full potential in an increasingly competitive environment.

Analyzing the Cumulative Impact of 2025 United States Tariffs on Niacinamide Supply Chains Pricing Dynamics and Strategic Sourcing Decisions Across Sectors

The introduction of additional tariff measures by the United States in 2025 has had a profound impact on Niacinamide supply chains and pricing dynamics. Following the imposition of a 25 percent duty on imports primarily sourced from China, manufacturers and distributors have scrambled to mitigate cost pressures through strategic sourcing diversification. Many have accelerated partnerships with European and Indian producers to stabilize supply, while some capacity expansions in domestic production facilities have been fast-tracked to lessen dependency on high-tariff markets. A noticeable uptick in long-term contracts and volume buy agreements has emerged as companies seek to lock in favorable terms and shield themselves from sudden tariff escalations.

These tariff-driven developments have also influenced end-user strategies. Cosmetic and personal care firms have recalibrated product portfolios to emphasize higher-margin premium lines that can absorb increased raw material costs, whereas dietary supplement and pharmaceutical manufacturers have explored reformulation efforts to maintain competitive price positioning. The animal feed and food and beverage sectors, traditionally more price-sensitive, have engaged in collaborative dialogues with ingredient suppliers to negotiate blended sourcing models combining natural vegetable-derived or yeast-derived Niacinamide with bio-synthetic grades. As a result, the tariff landscape has become a critical consideration in supplier evaluations, cost-benefit analyses, and long-term strategic planning across the Niacinamide ecosystem.

Dissecting Niacinamide Market Segmentation Insights Across Application, Form, Distribution Channel, End User, and Nature to Reveal Growth Opportunities

In dissecting the Niacinamide market through the lens of diverse segmentation criteria, distinct growth pockets and strategic imperatives come into focus. Application-wise, major traction is evident in animal feed, where aquaculture feed providers are leveraging Niacinamide to enhance fish biomass yield and disease resilience, while poultry and swine feed producers emphasize immune modulation benefits. Cosmetics segments have seen the fastest uptake in skin care, particularly within anti-aging and brightening formulations, as well as in hair care products seeking scalp health claims. Dietary supplement manufacturers favor capsule and powder forms for their ease of formulation and consumer familiarity, whereas functional bakery, confectionery, and dairy innovators within food and beverage exploit Niacinamide’s stability in thermal processing. The pharmaceutical domain, spanning over-the-counter and prescription products, relies on high-purity grades to address metabolic and dermatological applications.

Form segmentation reveals a consistent preference for powder formats, driven by cost advantages, extended shelf life, and versatile inclusion in dry blends. Liquid and tablet offerings, however, are gaining ground in personalized nutrition and direct-to-consumer channels seeking convenience. Distribution channel analysis highlights burgeoning e-commerce penetration, particularly through company websites that support brand storytelling and educational content, alongside third-party platforms where subscription models foster customer retention. Offline retail remains essential, with pharmacies and drug stores leading the charge for health-oriented purchases, supplemented by specialty stores and supermarkets offering impulse and mass-market visibility. End user insights underscore the pivotal role of personal care manufacturers as major volume consumers, closely followed by pharmaceutical and functional food producers, while feed manufacturers drive niche applications in livestock and aquaculture sectors.

Finally, nature-based segmentation showcases the growing appeal of natural-derived Niacinamide, especially vegetable-derived and yeast-derived grades, among clean-label advocates. Synthetic sources, including bio-synthetic and petrochemical-sourced variants, continue to dominate overall volume due to cost efficiencies and supply consistency. Market participants increasingly position vegetable-derived and yeast-derived alternatives as premium offerings, aligning with sustainable and traceable sourcing narratives to meet evolving regulatory standards and consumer preferences.

This comprehensive research report categorizes the Niacinamide market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Form

- Nature

- Application

- Distribution Channel

Unveiling Critical Regional Insights into Niacinamide Demand Patterns and Strategic Drivers Shaping Growth Trajectories in the Americas, EMEA, and Asia-Pacific

Regional performance disparities in the Niacinamide market underscore strategic nuances that industry leaders must navigate. In the Americas, robust demand in North America for premium skin care products and dietary supplements has been buoyed by proactive regulatory frameworks and well-established distribution channels, while feed manufacturers in South America exploit Niacinamide’s cost-effectiveness to bolster livestock productivity. The Europe, Middle East & Africa region presents a heterogeneous environment: Western European markets emphasize stringent quality and sustainability certifications for natural-derived grades, whereas the Middle East prioritizes high-purity cosmetic ingredients for affluent consumer segments, and emerging African markets are beginning to integrate Niacinamide fortification in staple foods and feed.

Asia-Pacific emerges as the fastest-growing territory, driven by rising disposable incomes, increasing health consciousness, and robust skin-brightening and functional food trends in China, India, and Southeast Asia. Government initiatives supporting local production in China and India have stimulated capacity expansions and innovation in bio-synthetic manufacturing. Moreover, feed producers across the region capitalize on intensive aquaculture and poultry farming operations, creating substantial volume demand. As cost differentials narrow due to tariff realignments, importers in the Americas and EMEA are increasingly sourcing Niacinamide from Asia-Pacific suppliers, further reshaping global trade flows and compelling multinational players to recalibrate supply networks and localize value-added services.

This comprehensive research report examines key regions that drive the evolution of the Niacinamide market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Identifying Leading Companies Driving Innovation Production Efficiency and Strategic Partnerships to Capitalize on Niacinamide Market Opportunities

A select group of leading chemical and specialty ingredient companies has positioned itself at the forefront of Niacinamide innovation, balancing production scale with product differentiation. Major global producers have invested in multi-site manufacturing models, enabling them to optimize production efficiency, manage tariff exposure, and serve regional markets with reduced lead times. Strategic partnerships between manufacturers and contract development organizations have facilitated co-creation of patented Niacinamide derivatives tailored for specific anti-aging or metabolic health claims, enhancing competitive moats.

Beyond scale, these companies are prioritizing sustainability and traceability, with several launching vegetable-derived and yeast-derived Niacinamide lines certified under various eco-label frameworks. Research and development collaborations with academic institutions and industry consortia are yielding streamlined bio-synthetic processes that lower carbon footprints and production costs. In response to evolving feed and food regulations, top-tier players have expanded their analytical capabilities to deliver extended certification packages, ensuring compliance with regional standards. As the market matures, leading companies continue to pursue capacity expansions, joint ventures, and bolt-on acquisitions to secure feedstock availability and broaden their application portfolios, reinforcing their competitive leadership.

This comprehensive research report delivers an in-depth overview of the principal market players in the Niacinamide market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Bactolac Pharmaceutical, Inc.

- BASF SE

- Brother Enterprises Holding Co., Ltd.

- Evonik Industries AG

- Hefei TNJ Chemical Co., Ltd.

- Jubilant Life Sciences Ltd.

- Koninklijke DSM N.V.

- Lasons India Pvt. Ltd.

- Lonza Group AG

- Merck KGaA

- Nantong Acetic Acid Chemical Co., Ltd.

- Resonance Specialties Ltd.

- Roquette Frères

- Shandong Pharmaceutical Group Co., Ltd.

- Shanghai Lixin Biochemical Technology Co., Ltd.

- Vertellus Holdings LLC

- Wuhan Grand Harvest Biotech Co., Ltd.

- Zhejiang Medicine Co., Ltd.

Actionable Recommendations for Industry Leaders to Navigate Supply Chain Challenges Optimize Formulation Strategies and Drive Growth in the Dynamic Niacinamide Market

Industry leaders must adopt a multi-pronged approach to thrive amid evolving market dynamics. Proactively diversifying supply chains by integrating alternative sources from Europe, India, and domestic capacities can mitigate tariff-induced cost fluctuations and reinforce resilience. Concurrently, investing in green synthesis and certification for vegetable-derived and yeast-derived Niacinamide positions organizations to meet escalating clean-label and sustainability mandates in cosmetics, food, and feed sectors.

To capture consumer demand for personalized nutrition and advanced skin care solutions, companies should collaborate closely with end-user manufacturers to co-develop tailored formulations and delivery formats. Strengthening digital channels, including direct-to-consumer platforms and subscription models, will enhance customer engagement and facilitate data-driven demand forecasting. Engaging with regulatory bodies and industry consortia can shape favorable standards and ensure timely compliance, especially in complex markets in Europe and the Middle East. Finally, leveraging advanced analytics to monitor real-time market signals, aligning production schedules with evolving consumption patterns, and fostering strategic alliances with downstream stakeholders will unlock sustainable growth and competitive advantage in the Niacinamide landscape.

Comprehensive Research Methodology Detailing Data Collection Approaches and Analytical Frameworks Ensuring Robust Insights into the Niacinamide Market

The research underpinning this report integrates a rigorous methodology combining primary and secondary data sources to ensure comprehensive market intelligence. Primary research included structured interviews with senior decision-makers across ingredient manufacturers, feed providers, food and beverage companies, personal care brands, and pharmaceutical firms, capturing firsthand perspectives on supply chain dynamics, formulation preferences, and strategic priorities. Secondary research encompassed review of regulatory frameworks, patents, corporate disclosures, and trade association publications, enabling validation of production capacities, global trade flows, and product launches.

Quantitative analyses leveraged data triangulation techniques, aligning consumption volumes, import-export statistics, and end-user production data to model demand by application, form, distribution channel, end user, and nature-derived category. Regional insights were refined through cross-referencing official trade databases and proprietary consumption surveys. Qualitative validation was conducted via an expert panel consisting of industry consultants, academic researchers, and regulatory specialists, ensuring that analytical frameworks reflect practical realities and emerging industry trends. This blended approach delivers robust, actionable insights to inform strategic decision-making across the Niacinamide value chain.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Niacinamide market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Niacinamide Market, by Form

- Niacinamide Market, by Nature

- Niacinamide Market, by Application

- Niacinamide Market, by Distribution Channel

- Niacinamide Market, by Region

- Niacinamide Market, by Group

- Niacinamide Market, by Country

- United States Niacinamide Market

- China Niacinamide Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 2385 ]

Concluding Insights Highlighting Strategic Imperatives and Future Outlook to Empower Stakeholders with Actionable Perspectives on the Evolving Niacinamide Market Landscape

The Niacinamide market stands at a pivotal juncture where innovation, regulatory developments, and shifting consumer preferences intersect to create new avenues for growth and differentiation. Stakeholders must embrace agility in supply chain strategies, leveraging diversified sourcing and green synthesis to navigate tariff pressures and sustainability expectations. Product developers are advised to harness technological breakthroughs in formulation and encapsulation to unlock enhanced efficacy and deliver tailored consumer benefits in skin care, nutrition, and animal performance applications.

Looking ahead, the confluence of rising health consciousness, demand for natural-derived ingredients, and supportive government policies across key regions will fuel continued expansion in the Niacinamide market. Companies that invest in collaborative R&D, data-driven market intelligence, and strategic partnerships will be best positioned to capture high-value segments and outmaneuver competitors. By aligning business models with evolving market imperatives-namely personalization, traceability, and environmental stewardship-industry leaders can secure sustainable growth and establish enduring competitive advantage in the dynamic Niacinamide landscape.

Contact Ketan Rohom to Secure the Comprehensive Niacinamide Market Research Report and Gain Exclusive Strategic Insights Driving Innovation

Contact Ketan Rohom today to learn how the comprehensive Niacinamide market research report can equip your organization with cutting-edge strategies product innovation insights and strategic supply chain intelligence to outpace competitors and capture emerging market segments

- How big is the Niacinamide Market?

- What is the Niacinamide Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?