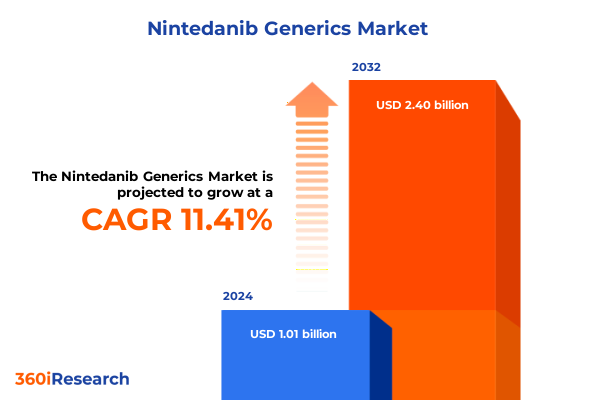

The Nintedanib Generics Market size was estimated at USD 1.10 billion in 2025 and expected to reach USD 1.23 billion in 2026, at a CAGR of 11.71% to reach USD 2.40 billion by 2032.

Discover the Crucial Role of Nintedanib Generics in Shaping Future Treatment Pathways and Unveiling Market Potential Across Diverse Clinical Indications

Nintedanib, a small-molecule tyrosine kinase inhibitor marketed under names such as Ofev and Vargatef, has become a cornerstone therapy for conditions like idiopathic pulmonary fibrosis and non-small-cell lung cancer, due to its dual antifibrotic and antitumor properties. Since its initial U.S. approval in October 2014 for IPF, nintedanib’s clinical utility has expanded into systemic sclerosis-associated interstitial lung disease, and it remains a critical component of combination regimens in various oncology settings, underscoring its strategic importance in treatment portfolios.

As Boehringer Ingelheim’s primary patent protection approaches its NCE-1 date in March 2026, generic manufacturers have intensified efforts to enter this high-value segment. In January 2023, Lotus Pharmaceutical obtained tentative approval for its nintedanib capsule ANDA, marking a pivotal step toward broader generic availability. Such developments are poised to reshape pricing dynamics, patient access, and competitive positioning once patent exclusivity sunsets on core indications.

Given this evolving backdrop, a thorough understanding of regulatory timelines, competitive strategies, supply chain complexities, and clinical adoption trends is essential. This analysis synthesizes these dimensions to provide a clear perspective on how nintedanib generics are poised to transform the therapeutic landscape, offering stakeholders actionable insight into market entry strategies, operational readiness, and emerging opportunities.

Exploring the Major Paradigm Shifts Driving the Evolution of Nintedanib Generics and the Escalation of Competitive and Clinical Dynamics

The impending patent expiration for originator nintedanib has catalyzed a fundamental shift in market dynamics, driving generic entrants to refine their strategies on multiple fronts. Traditionally, exclusivity afforded Boehringer Ingelheim a monopoly in fibrotic lung diseases, but as patents approach their cliff, generics developers are capitalizing on lean manufacturing processes and strategic ANDA filings to secure regulatory footholds.

Concurrently, clinical paradigms for nintedanib are evolving. In oncology, there is growing interest in leveraging its antiangiogenic profile alongside immune checkpoint inhibitors to enhance therapeutic efficacy in cancers such as non-small-cell lung cancer, colorectal cancer, and ovarian malignancies. These combination approaches not only heighten clinical demand but also spur novel dosage forms and administration protocols, challenging manufacturers to innovate beyond traditional capsule presentations.

Moreover, the generic sector is witnessing an accelerated emphasis on supply chain resilience and cost management. With regulatory bodies enforcing stricter quality standards post pandemic, generics producers are investing in advanced manufacturing technologies, digital process controls, and rigorous quality assurance to differentiate on reliability and compliance. Finally, strategic patent litigation, exemplified by the Unified Patent Court’s recent denial of provisional measures against Zentiva, underlines the importance of robust IP analysis and risk mitigation for market entrants.

Evaluating the Comprehensive Effects of 2025 United States Pharmaceutical Tariffs on Nintedanib Generic Production and Supply Chain Resilience

In April 2025, the U.S. implemented a 10% global tariff on all imported goods, encompassing active pharmaceutical ingredients (APIs) and finished drug products, to bolster domestic manufacturing capacity. This blanket duty directly impacts generic nintedanib manufacturers, which often rely on foreign-sourced raw materials for cost-effective production. Consequently, input costs for generic capsules have risen, compelling companies to reassess sourcing strategies and operational budgets.

The trade tensions between the U.S. and China have further escalated tariff rates on Chinese imports to as high as 245% for APIs deemed critical, including key intermediates used in nintedanib synthesis. Given that up to 40% of U.S. generic drug APIs originate from China, this exceptional duty has triggered significant cost pressures and supply chain disruptions. Companies are now actively exploring “China+1” strategies to diversify sourcing, though shifts to alternative suppliers involve regulatory revalidation and logistical complexity.

Generic drugmakers are particularly vulnerable due to narrow profit margins and high dependency on API availability. The United States Pharmacopeia has warned that these tariff hikes could “blow back” across the entire generics ecosystem, potentially resulting in manufacturing discontinuations and drug shortages if alternative supply routes are not secured expeditiously. In tandem, Section 232 investigations into pharmaceuticals could introduce new levies based on national security considerations, creating an uncertain policy environment. As a result, nintedanib generics suppliers must implement agile supply chain diversification, engage with government tariff exemption programs, and optimize cost models to sustain market viability.

Unveiling Comprehensive Segmentation Insights to Decode Market Dynamics Across Indications Formulations Dosage Strengths Distribution Channels and End Users

The nintedanib generics landscape can be decoded by examining its rich segmentation across therapeutic, formulation, strength, channel, end-user, and administration variables. In terms of indication, the market spans idiopathic pulmonary fibrosis, oncology, and systemic sclerosis-associated interstitial lung disease, with oncology further subdividing into colorectal, non-small-cell lung, and ovarian cancer portfolios. Each indication exhibits unique physician prescribing patterns, patient demographics, and reimbursement nuances that shape demand trajectories.

Formulation diversity is equally pronounced, as manufacturers offer the API in capsule, tablet, and oral solution formats to cater to patient preferences and ease of administration. This drives competition not only on pricing but also on bioequivalence studies and stability profiles. Furthermore, dosage strength segmentation between 100 mg and 150 mg variants influences inventory management, prescribing fidelity, and generic substitution dynamics in pharmacies.

When considering distribution channels, hospital pharmacies, retail outlets, and online pharmacies each present distinct logistics, margin structures, and regulatory compliance requirements. The hospital segment often demands bulk purchasing agreements and long-term contracts, whereas retail and online channels prioritize rapid turnaround and patient convenience. End-user insights reveal that clinics, home care providers, and hospitals differ in their treatment protocols and stock management practices, necessitating tailored engagement strategies. Finally, route of administration considerations-oral versus intravenous-affect formulation focus and clinical adoption, given nintedanib’s primary oral delivery but emerging interest in parenteral formulations for niche oncology indications.

This comprehensive research report categorizes the Nintedanib Generics market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Indication

- Formulation

- Route Of Administration

- Distribution Channel

- End User

Highlighting Key Regional Accelerators and Challenges Shaping the Nintedanib Generic Market Across the Americas Europe Middle East Africa and Asia Pacific

Regional dynamics play a pivotal role in shaping the trajectory of nintedanib generics. In the Americas, robust regulatory frameworks and well-established reimbursement systems facilitate rapid generic uptake, yet pricing pressures and payer negotiations demand competitive cost structures. Manufacturers invest heavily in local API production and strategic alliances to mitigate tariff exposures and align with national healthcare priorities.

Within Europe, the Middle East, and Africa, regulatory heterogeneity and varied intellectual property regimes present both challenges and opportunities. Western European markets often follow the European Medicines Agency’s centralized pathways, expediting approvals for high-quality generics. Conversely, emerging markets in the Middle East and Africa may face longer review cycles and require additional local clinical data, prompting manufacturers to pursue tiered pricing and partnership models to ensure market access.

The Asia-Pacific region exhibits a growing appetite for generics driven by healthcare system expansion and government initiatives to reduce pharmaceutical import dependency. Countries like India and China not only serve as manufacturing hubs but are also rapidly adopting domestic ANDA guidelines that encourage timely generic launches. Nevertheless, complex import tariffs, regulatory reform, and quality standard alignment with global benchmarks remain critical focal areas for manufacturers seeking sustainable growth in these high-potential markets.

This comprehensive research report examines key regions that drive the evolution of the Nintedanib Generics market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Illuminating the Strategic Moves and Competitive Positioning of Leading Originator and Generic Drugmakers in the Nintedanib Market Landscape

The competitive landscape for nintedanib generics is led by originator Boehringer Ingelheim, whose deep clinical data portfolio and global distribution network continue to influence market expectations. Among generics players, Lotus Pharmaceutical’s tentative ANDA approval exemplifies early mover advantage, reflecting the company’s strategic investment in pulmonary and oncology segments. Meanwhile, established global generics leaders such as Teva, Sandoz, and Viatris are leveraging their expansive manufacturing footprints and regulatory expertise to file multiple ANDAs, often pursuing collaborative licensing arrangements with API specialists to ensure uninterrupted supply.

Indian companies like Biocon and Aurobindo are capitalizing on cost-efficient API production and local R&D capabilities, positioning themselves as competitive suppliers for both branded and off-patent formulations. These firms are also engaging in strategic partnerships with contract development and manufacturing organizations (CDMOs) to expand capacity and navigate complex regulatory landscapes. At the same time, legal developments, such as the Unified Patent Court’s denial of provisional measures against Zentiva, underscore the importance of IP litigation strategies and timing to sustain competitive advantage.

In parallel, specialty CDMOs and technology providers are emerging as critical enablers of differentiation, offering services ranging from advanced formulation technologies to serialization solutions for traceability. Their role in accelerating time-to-market and ensuring compliance with evolving quality standards cannot be overstated, making them indispensable partners for generic drugmakers targeting the nintedanib segment.

This comprehensive research report delivers an in-depth overview of the principal market players in the Nintedanib Generics market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Apotex Inc.

- Aurobindo Pharma Limited

- Cipla Limited

- Dr. Reddy's Laboratories Limited

- Formosa Laboratories

- Glenmark Pharmaceuticals Limited

- Hetero Labs Limited

- Lupin Limited

- MSN Laboratories Private Limited

- Mylan Pharmaceuticals Inc.

- Natco Pharma Limited

- Sandoz International GmbH

- Shilpa Medicare Limited

- Sun Pharmaceutical Industries Ltd.

- Teva Pharmaceuticals USA, Inc.

- Viatris Inc.

- Zentiva Group, a.s.

Delivering Actionable Strategic Recommendations for Industry Stakeholders to Navigate the Evolving Nintedanib Generics Ecosystem with Confidence

Industry leaders must adopt a multi-pronged strategy to thrive amid the evolving nintedanib generics environment. First, diversifying API sourcing through a balanced “China+1” approach can mitigate tariff volatility and supply disruptions, leveraging alternative hubs such as India and Eastern Europe. Concurrently, investment in local manufacturing capacity and quality compliance will safeguard against future trade policy shifts and reinforce supply chain resilience.

Second, forging strategic alliances with specialty CDMOs and technology firms can accelerate bioequivalence testing, enhance formulation performance, and streamline serialization requirements. Collaborative models that combine clinical expertise, advanced analytics, and digital supply chain visibility will enable faster market entry and sustained competitive differentiation. Third, proactive engagement with regulatory authorities to secure timely approvals and obtain potential tariff exemptions under Section 301 or 232 will enhance operational agility.

Finally, industry stakeholders should align commercial efforts with real-world evidence generation and patient support programs. By integrating dosage variation strategies, patient adherence initiatives, and tailored channel management across hospital, retail, and online pharmacy networks, companies can maximize product uptake and establish brand-agnostic trust among prescribers and payers. These recommendations, when orchestrated effectively, will position organizations to lead in the next phase of nintedanib generics.

Outlining Rigorous Research Methodologies Leveraging Primary and Secondary Sources to Uncover Actionable Insights in the Nintedanib Generics Analysis

This analysis is built upon a rigorous research framework combining primary and secondary data sources. Extensive literature reviews of regulatory filings, patent documents, and clinical trial registries provided foundational insights into nintedanib’s therapeutic landscape and generic entry timelines. In parallel, expert interviews with industry executives, regulatory consultants, and IP attorneys were conducted to capture nuanced perspectives on patent litigation, tariff impacts, and supply chain strategies.

Secondary data integration drew from authoritative sources including government tariff schedules, FDA ANDA databases, and industry publications detailing recent policy shifts and market dynamics. Quantitative data on API flow, manufacturing cost structures, and pricing benchmarks were triangulated from publicly available trade data, fostering a comprehensive view of cost pressures and sourcing trends.

Finally, qualitative cross-validation occurred through structured workshops with key opinion leaders in pulmonology and oncology, ensuring alignment between market projections and clinical realities. By blending these methodologies, the report delivers robust, actionable insights that reflect both macroeconomic forces and on-the-ground operational considerations in the nintedanib generics sector.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Nintedanib Generics market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Nintedanib Generics Market, by Indication

- Nintedanib Generics Market, by Formulation

- Nintedanib Generics Market, by Route Of Administration

- Nintedanib Generics Market, by Distribution Channel

- Nintedanib Generics Market, by End User

- Nintedanib Generics Market, by Region

- Nintedanib Generics Market, by Group

- Nintedanib Generics Market, by Country

- United States Nintedanib Generics Market

- China Nintedanib Generics Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1113 ]

Synthesizing Critical Insights to Illuminate the Future Trajectory and Strategic Imperatives of the Emerging Nintedanib Generics Sphere

The maturation of the nintedanib generics landscape is defined by converging trends in patent expiration, evolving clinical applications, and shifting trade policy. As originator exclusivity wanes, a new cohort of generics developers will enter the market, driving cost competition and expanding patient access to critical therapies for fibrotic and oncological indications. However, the trajectory of this segment will hinge on the ability of stakeholders to navigate complex tariff regimes, safeguard supply chain integrity, and align with emerging regulatory expectations.

Key strategic imperatives include diversification of API sourcing, targeted investments in compliance and quality systems, and dynamic engagement with regulatory authorities to secure timely market entry. Concurrently, clinical innovation-whether through novel combination therapies or differentiated formulations-will shape prescriber preferences and payer reimbursement policies. Ultimately, those organizations that marry operational excellence with forward-looking partnership models and robust risk management will lead the next phase of growth in the nintedanib generics era.

By synthesizing the multifaceted dimensions of segmentation, regional dynamics, and competitive positioning, this report illuminates the strategic pathways for sustained success and underscores the critical actions required to capitalize on the opportunities ahead.

Engage with Ketan Rohom to Secure Your Comprehensive Nintedanib Generics Market Research Report and Drive Informed Strategic Decisions Today

To explore the full depth of the Nintedanib Generics market landscape and gain tailored insights that drive confident decision-making, connect today with Ketan Rohom, Associate Director, Sales & Marketing, and secure your comprehensive market research report

- How big is the Nintedanib Generics Market?

- What is the Nintedanib Generics Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?