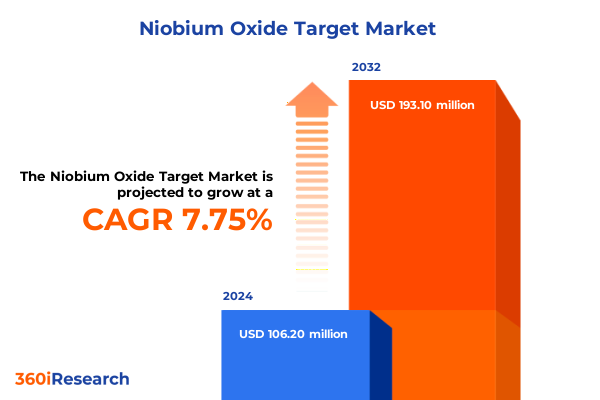

The Niobium Oxide Target Market size was estimated at USD 113.10 million in 2025 and expected to reach USD 122.17 million in 2026, at a CAGR of 7.94% to reach USD 193.10 million by 2032.

Framing the Rise of Niobium Oxide Targets Amid Accelerating Material Science Innovations and Evolving Industrial Requirements

The capabilities of niobium oxide targets to deliver superior dielectric properties, optical clarity, and chemical stability have established them as indispensable components in advanced thin-film deposition processes. As end-use industries intensify their pursuit of miniaturization, energy efficiency, and high-precision coatings, the role of niobium oxide has evolved beyond a niche specialty material into a core enabler for next-generation semiconductors, display technologies, and optical devices. This opening section frames the context for why understanding the nuances of the niobium oxide target landscape is critical for stakeholders looking to harness emerging material science breakthroughs.

Against a backdrop of rapid innovation in physical and chemical vapor deposition techniques, the demand for high-purity, high-performance oxide targets is rising. Manufacturers face a dual imperative: to refine target fabrication methods that enhance uniformity and to scale production in line with electrification and digital transformation trends. Consequently, this report initiates its examination by laying out the foundational technological drivers and industry dynamics that are shaping a more complex and competitive environment for niobium oxide target suppliers and end users alike.

Ultimately, this introduction orients the reader to the strategic importance of niobium oxide targets in contemporary materials engineering. It underscores how shifts in application requirements, coupled with evolving regulatory frameworks and trade considerations, are collectively redefining supply chains. This foundational perspective sets the stage for deeper dives into transformative shifts, tariff impacts, segmentation logic, and regional outlooks that follow.

Exploring Technological Breakthroughs and Demand Drivers Reshaping Niobium Oxide Target Production Processes and Value Chains

Over the past several years, the niobium oxide target market has witnessed a wave of transformative shifts as materials science intersects with ever-more demanding end-use criteria. Innovations in deposition technologies, from enhanced magnetron sputtering systems delivering finer thickness control to electron beam evaporation setups capable of achieving unprecedented film purity, have collectively raised the bar for target performance. These advances have not only expanded the application spectrum for niobium oxide films but also heightened expectations for suppliers to deliver consistent, defect-free targets at scale.

In parallel, end-users in semiconductor fabs, research institutes, and electronics manufacturers are driving demand for next-generation oxide compositions. Collaborations between equipment vendors and material scientists have accelerated development of composite multilayer films, integrating niobium oxide with other high-k materials to meet stringent requirements for dielectric constants, optical transparency, and thermal stability. As a result, the ecosystem is adapting: target fabrication processes now incorporate advanced sintering protocols, optimized pressing pressures, and proprietary post-fabrication treatments designed to minimize internal stress and maximize bonding with deposition cathodes.

Furthermore, supply chain patterns are shifting toward hybrid sourcing models, blending direct procurement from specialized target producers with distribution through value-added resellers and catalog distributors. This approach ensures both flexibility and localized support as customers navigate dynamic demand cycles and regional trade barriers. Such a confluence of technological and commercial transformations underscores the need for stakeholders to continuously monitor evolving process innovations, collaborative R&D initiatives, and strategic partnerships across the value chain.

Analyzing the Multi-layered Effects of Recent United States Trade Tariffs on Niobium Oxide Target Supply Chains and Industry Costs

The imposition of additional duties on imports of critical oxide materials has markedly influenced the economics and logistics of niobium oxide target supply chains in the United States. Beginning in late 2024, expanded tariff schedules under Section 232 were applied to a broader list of specialty ceramic precursors, with niobium compounds falling within the scope of heightened import levies. These trade measures have elevated landed costs, prompted recalibration of supplier contracts, and spurred discussions around domestic target fabrication capacity expansion.

In response to these tariffs, several large electronics and semiconductor manufacturing firms have accelerated efforts to qualify alternative suppliers in regions not subject to the same duties. This has led to a measurable uptick in procurement from Japan and South Korea, where long-established precision target fabricators possess the requisite technical expertise and quality certifications. Simultaneously, some U.S.-based material producers have initiated pilot projects aimed at onshoring key stages of powder synthesis and target pressing, leveraging federal incentives for critical minerals processing.

Although the full ripple effects of the 2025 tariff adjustments are still emerging, stakeholders have reported longer lead times, elevated inventory holding requirements, and renegotiated logistics agreements. This evolving environment has also driven renewed interest in high-purity recovery and recycling programs for spent targets, as companies seek to offset increased raw material costs. These cumulative dynamics illustrate how trade policy continues to shape strategic sourcing decisions and underscore the importance of supply chain resilience in maintaining uninterrupted production schedules.

Unpacking Critical Segmentation Dimensions to Reveal Usage Patterns and End-User Preferences Across Diverse Niobium Oxide Target Applications

The segmentation analysis reveals a nuanced landscape of how niobium oxide targets are specified and procured across diverse applications and user groups. In thin-film deposition processes, Physical Vapor Deposition has emerged as the dominant choice for many semiconductor and electronics manufacturers due to its ability to deliver uniform coatings over large substrate areas. Within this category, Electron Beam Evaporation often serves research institutes and pilot fabs seeking high-purity films and rapid material turnover, while Thermal Evaporation variants cater to lower-volume or cost-sensitive operations. Meanwhile, Sputtering remains indispensable for applications demanding precise stoichiometry; Ion Beam Sputtering is preferred when directional control and ultra-thin layers are critical, and Magnetron Sputtering is leveraged in high-throughput environments where deposition rates and equipment uptime are prioritized. Complementing these deposition pathways, Chemical Vapor Deposition retains relevance for specialty coating applications where conformal coverage and film adhesion must be tightly controlled.

Equally significant are the distinctions drawn by end-user industry. Electronics producers typically require targets with stringent impurity limits to meet performance benchmarks in capacitive components and optical filters. Semiconductor foundries, on the other hand, focus on throughput-optimized formats that align with automated wafer processing lines, whereas academic and national research laboratories prioritize flexibility in target form and composition to support experimental prototyping and process development. These divergent requirements are further modulated by target purity grades, spanning grades below 99.5 percent that accommodate general-purpose research, mid-range grades between 99.5 and 99.9 percent that underpin standard device fabrication, and ultra-high-purity grades above 99.9 percent that are essential for cutting-edge low-defect applications.

Form factor considerations also play a pivotal role in procurement decision-making. While disc geometries are widely adopted across high-vacuum deposition chambers for their balanced surface-to-volume ratios, rectangular and square formats have gained traction in equipment designs that require modular target arrays or non-standard mounting configurations. Finally, the sales channel landscape influences supply chain agility. Direct sales arrangements often involve long-term contracts that secure preferential pricing and technical support, whereas distribution through catalog companies or value-added resellers ensures swift order fulfillment and localized inventory stocking. Online platforms have also emerged as a convenient channel for rapid small-lot purchases, particularly among research entities and emerging technology ventures that demand speed and flexibility.

This comprehensive research report categorizes the Niobium Oxide Target market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Form

- Application

- End-User Industry

- Sales Channel

Mapping Regional Dynamics That Influence Demand Variations and Strategic Opportunities for Niobium Oxide Targets Across Global Markets

Regional dynamics exert a profound influence on the procurement, pricing, and regulatory conditions surrounding niobium oxide targets. In the Americas, established semiconductor hubs in the United States and emerging advanced materials clusters in Canada have propelled efforts to diversify supply sources and strengthen domestic capacity. Government-backed initiatives aimed at critical minerals resilience have catalyzed localized fabrication projects, shifting a greater share of target synthesis and pressing closer to end-use facilities to mitigate the impact of cross-border duties and evolving trade policies.

Across Europe, the Middle East, and Africa, the combination of stringent environmental standards and robust aerospace research programs has driven demand for high-performance optical coatings and dielectric films. Key fabrication centers in Germany and France have become focal points for collaborative ventures between material producers and premium equipment manufacturers. Meanwhile, distributors in the region have streamlined their logistics networks to accommodate frequent small-batch shipments to research institutions, ensuring consistent access to both standard purity grades and specialty formulations.

In the Asia-Pacific region, rapidly expanding capacity in China, Japan, South Korea, and Taiwan anchors the bulk of global consumption. Advanced semiconductor foundries and consumer electronics OEMs have forged long-standing partnerships with target suppliers in these markets, benefiting from large-scale production volumes and integrated supply ecosystems. Regulatory shifts toward export controls on dual-use technologies have introduced new complexities, prompting regional distributors to maintain buffer stocks and coordinate closely with customs authorities to expedite clearances. Collectively, these regional insights illustrate how geographic factors shape strategic sourcing, risk management, and collaborative innovation in niobium oxide target applications.

This comprehensive research report examines key regions that drive the evolution of the Niobium Oxide Target market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Identifying Leading Industry Players Driving Innovation, Supply Chain Excellence, and Competitive Differentiation in the Niobium Oxide Target Sector

Several leading organizations have established themselves as front-runners in the niobium oxide target market by combining deep materials expertise with robust manufacturing infrastructures. Specialty refractory metal producers have leveraged decades of experience in powder metallurgy to optimize sintering profiles and minimize internal stresses in targets, thereby enhancing deposition consistency. In parallel, global chemical firms have capitalized on advanced purification technologies to push impurity levels below critical thresholds, supporting the most demanding semiconductor and photonics applications.

Equipment providers that offer integrated target and cathode systems have further differentiated their value propositions through joint development programs with key end users. These partnerships have produced proprietary target geometries and bonding methods that reduce downtime and extend service life. Additionally, forward-thinking distributors and value-added resellers have cultivated technical support capabilities, providing comprehensive installation, maintenance, and recycling services that reinforce long-term customer loyalty.

Innovation-driven startup ventures have also entered the competitive landscape, focusing on breakthrough composites and novel deposition chemistries to unlock new application avenues for niobium oxide films. By fostering collaborations with university labs and government research centers, these emerging players are advancing pilot-scale process demonstration projects that could redefine performance benchmarks. Together, these diverse company profiles underscore a marketplace in which manufacturing excellence, supply chain integration, and collaborative R&D determine leadership positions.

This comprehensive research report delivers an in-depth overview of the principal market players in the Niobium Oxide Target market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- American Elements Corporation

- H.C. Starck GmbH

- Materion Corporation

- Nanografi Advanced Materials

- PI-KEM Limited

- Plansee SE

- PVD Products, Inc.

- Shanxi Xianglu Group Co., Ltd.

- Source-Material Ltd.

- The Kurt J. Lesker Company

- Umicore SA

Strategic Roadmap for Industry Leaders to Harness Emerging Technological Trends and Navigate Market Challenges in Niobium Oxide Target Production

Given the rapid pace of technological evolution and shifting trade policies, leaders in the niobium oxide target sector must adopt strategies that balance innovation with risk mitigation. To start, investing in modular deposition platforms capable of accommodating multiple target formats and processes will enable organizations to pivot quickly as application requirements evolve. Integrating advanced process monitoring systems can provide real-time insights into film quality and equipment health, reducing scrap rates and unplanned downtime.

In parallel, diversifying supply chains by qualifying multiple domestic and international target fabricators will enhance resilience against tariff fluctuations and geopolitical disruptions. Engaging in long-term off-take agreements with strategically located producers, complemented by inventory buffering programs, will help stabilize lead times and pricing. At the same time, establishing technical partnerships with research institutes and end users can drive co-innovation in high-purity materials, ensuring that next-generation device architectures have access to tailored target chemistries.

Finally, bolstering sales and distribution networks through selective collaborations with catalog distributors and value-added resellers will streamline market access, particularly for emerging markets and specialized research segments. Leveraging digital ordering portals and predictive logistics solutions can further elevate customer experience, securing competitive advantage. By executing this multifaceted roadmap, industry leaders can navigate market complexities while capturing new growth opportunities in advanced materials applications.

Outlining a Rigorous Research Framework Integrating Qualitative and Quantitative Techniques to Ensure Comprehensive Analysis of the Market Dynamics

The research underpinning this analysis integrates both qualitative and quantitative approaches to deliver a comprehensive understanding of market dynamics. Primary data collection included in-depth interviews with material scientists, procurement managers at leading electronics and semiconductor firms, and executives from target fabrication companies. These conversations provided insights into current challenges, technology adoption timelines, and strategic priorities across the value chain.

Secondary research encompassed extensive reviews of peer-reviewed journals, technical white papers, and regulatory filings related to advanced deposition processes, material purity standards, and trade policy developments. Publicly available import-export statistics and industry association publications were analyzed to identify shifts in supply chain flows and tariff impacts. Data triangulation ensured consistency across sources, while thematic coding of qualitative responses revealed prevailing trends and emergent themes.

Analytical rigor was maintained through a structured framework that mapped key drivers, constraints, and opportunities across segmentation categories, regional contexts, and competitive landscapes. Validation workshops with subject-matter experts and follow-up surveys helped refine findings and test scenario resilience. This rigorous methodology ensures that the strategic insights and recommendations presented are grounded in reliable evidence and reflect the complexities of the niobium oxide target ecosystem.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Niobium Oxide Target market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Niobium Oxide Target Market, by Form

- Niobium Oxide Target Market, by Application

- Niobium Oxide Target Market, by End-User Industry

- Niobium Oxide Target Market, by Sales Channel

- Niobium Oxide Target Market, by Region

- Niobium Oxide Target Market, by Group

- Niobium Oxide Target Market, by Country

- United States Niobium Oxide Target Market

- China Niobium Oxide Target Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1272 ]

Synthesizing Critical Findings to Illuminate Future Development Pathways and Cement Strategic Imperatives for Stakeholders in the Sector

Drawing together the critical findings, it becomes clear that the niobium oxide target market is at a pivotal juncture where material innovation, trade policy, and supply chain strategy intersect. Technological breakthroughs in deposition processes have expanded application potential, yet they also raise the bar for purity and uniformity. Trade measures have introduced cost and logistical challenges, underscoring the need for diversified sourcing and greater domestic capabilities.

At the same time, segmentation analysis highlights how application requirements, end-user industries, form factors, and sales channels dictate distinct procurement strategies. Regional insights further reveal that geographic factors influence demand drivers and regulatory hurdles, requiring tailored approaches for the Americas, EMEA, and Asia-Pacific markets. Competitive dynamics continue to be shaped by leading companies that excel in manufacturing precision, collaborative R&D, and comprehensive support services.

Taken together, these insights crystallize strategic imperatives: invest in flexible production platforms, fortify supply chain resilience, deepen partnerships for co-innovation, and leverage data-driven customer engagement channels. Stakeholders who align their organizational priorities with these imperatives will be best positioned to capture the transformative potential of niobium oxide targets and drive sustainable growth in high-technology applications.

Engage with Our Associate Director of Sales & Marketing to Secure Your Comprehensive Niobium Oxide Target Market Intelligence Today

To explore the full depth of insights, contact Ketan Rohom, Associate Director, Sales & Marketing, to secure your comprehensive niobium oxide target market intelligence today. By partnering with Ketan, you can rapidly address specific technical and commercial questions, leverage tailored briefings on regional demand patterns, and gain early visibility into emerging supply chain developments. Engagement with this research will position your organization to capitalize on technological breakthroughs, optimize procurement strategies in the face of evolving trade policies, and drive sustainable growth in advanced materials applications. Reach out now to initiate a customized dialogue and acquire the detailed analysis that will empower your strategic decision making.

- How big is the Niobium Oxide Target Market?

- What is the Niobium Oxide Target Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?