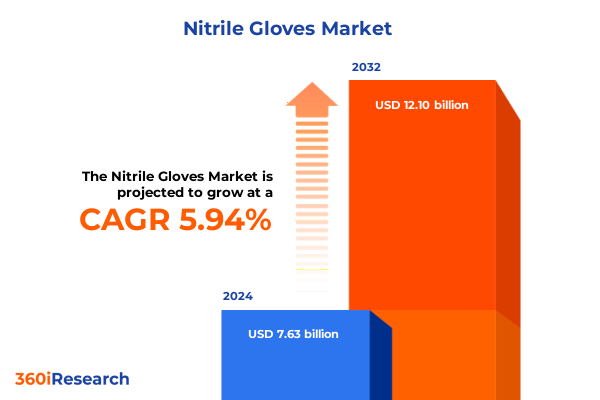

The Nitrile Gloves Market size was estimated at USD 8.08 billion in 2025 and expected to reach USD 8.56 billion in 2026, at a CAGR of 5.94% to reach USD 12.10 billion by 2032.

Understanding the Critical Role of Nitrile Gloves Across Healthcare, Industrial, and Consumer Safety Environments in a Post-Pandemic World

Nitrile gloves have solidified their position as an indispensable barrier for healthcare practitioners worldwide, ensuring protection against contamination and bloodborne pathogens. Clinical safety guidelines emphasize the importance of glove use in patient care settings, advocating for disposable medical examination gloves whenever there is potential contact with bodily fluids. These protocols underscore that gloves are a critical complement-not a substitute-for rigorous hand hygiene, which remains the foundation of infection control in hospitals and clinics.

Beyond healthcare, nitrile gloves have become a cornerstone of occupational safety in environments where chemical exposure, abrasion, and cross-contamination risks are prevalent. Regulatory frameworks outline that glove selection must be tailored to specific hazards, taking into account factors such as chemical compatibility, material thickness, and expected duration of use. This emphasis on performance characteristics has driven industrial facilities to adopt nitrile variants for their superior resistance to solvents, hydrocarbons, and cleaning agents, aligning protective measures with standardized hazard assessments.

Major Shifts Driving Innovation, Sustainability, and Supply Chain Resilience in the Nitrile Gloves Industry Globally

The nitrile gloves industry has entered a phase defined by rapid product innovation and enhanced functional specialization. In response to heightened hygiene requirements, powder-free nitrile gloves have become the preferred standard in both clinical and laboratory contexts, significantly reducing the risk of dermatitis and allergenic reactions associated with residual powder. Simultaneously, textured surfaces have gained traction across sectors that demand secure grip and tactile sensitivity, from surgical procedures to precision assembly tasks, driving manufacturers to refine micro-texturing techniques for improved dexterity and safety.

Sustainability has emerged as a strategic imperative, prompting the development of biodegradable and eco-friendly nitrile formulations. Leading producers are integrating novel additives that accelerate material breakdown under controlled conditions, meeting stringent environmental mandates without compromising ASTM compliance. This green pivot has resonated strongly in markets with robust ecological regulations, where procurement tenders increasingly reward biodegradable performance credentials in personal protective equipment portfolios.

On the manufacturing front, automation and digitalization are reshaping production processes. Major facilities have adopted robotic glove molding and inspection systems to enhance throughput, ensure consistency, and minimize human error. Concurrently, the emergence of smart gloves-embedded with sensors to monitor contamination levels and usage duration-signals a future convergence of personal protection and real-time data analytics, elevating safety standards in critical environments.

Assessing the Impact of Escalating U.S. Section 301 Tariffs on Nitrile Glove Imports and Supply Chain Realignment Through 2025

In January 2025, the United States implemented a significant uptick in Section 301 tariffs on rubber medical and surgical gloves, raising duties from a prior rate of 7.5% to 50% on imports originating from China. This escalation reflects a strategic effort to encourage nearshoring and bolster domestic manufacturing capacity, while simultaneously diversifying sourcing strategies among major industrial and healthcare purchasers.

Simultaneously, reforms to the “de minimis” threshold have narrowed the scope for low-value, duty-free imports under $800, now subjecting previously exempt shipments to applicable tariffs. Industry stakeholders anticipate that this policy realignment will curb tariff evasion tactics employed by certain e-commerce channels, but may also introduce logistical complexities as customs processes adapt to enhanced classification requirements and parcel-level duty assessments.

The combined impact of elevated duties and stricter exemption rules has intensified interest in alternative production hubs. Executives report that suppliers in Malaysia, Thailand, and Malaysia’s neighbors are scaling capacity to capture redirected volumes, while U.S. buyers are proactively securing long-term contracts with non-Chinese manufacturers to mitigate margin pressure and safeguard supply continuity moving forward.

Unveiling Segmentation Dynamics That Reveal Consumer and Industrial Preferences Across Type, End User, Thickness, Texture, Color, Size, and Packaging

Consumer preferences and operational requirements vary widely across product categories, driving a nuanced segmentation landscape. Among glove types, powder-free variants dominate clinical and laboratory applications owing to their hypoallergenic profiles, whereas powdered gloves retain a foothold in select industrial contexts where ease of donning remains a priority. End-user segmentation reveals that the healthcare sector continues to anchor global demand, with food and beverage handlers valuing nitrile’s chemical resistance and tactile feedback, and automotive and heavy-industry operators relying on thicker gloves for robust protection against oils and mechanical abrasion.

Beyond functional attributes, thickness thresholds have emerged as a critical decision criterion. Thinner grades, typically below 5 mils, cater to tasks demanding superior dexterity, while mid-range options of 5–8 mils achieve a balance between tactile sensitivity and barrier integrity. Above-8 mil formulations serve high-risk settings where extended wear time and puncture resistance are paramount. Texture preferences further differentiate user segments: smooth surfaces facilitate rapid donning and doffing in emergency care, whereas textured palms enhance grip security during precision assembly.

Color customization has evolved from a mere aesthetic choice into a visual workflow signal, with white gloves prevailing in sterile environments, blue in mid-tier clinical use for contamination detection, and black becoming a hallmark of automotive and industrial settings. Size gradations-from small through extra-large-ensure ergonomic fit and compliance, particularly in regulated healthcare workflows. Packaging strategies mirror buyer needs: healthcare facilities often opt for boxed counts of 50 or 100 for inventory control, while bulk shipments of 1,000 or 5,000 units accommodate high-volume industrial operations without frequent replenishment.

This comprehensive research report categorizes the Nitrile Gloves market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- End User

- Thickness

- Texture

- Color

- Size

- Packaging

Regional Demand Patterns Highlight the Americas, EMEA, and Asia-Pacific as Distinct Hubs Shaping the Global Nitrile Gloves Market

In the Americas, the United States and Canada continue to drive demand through robust healthcare expenditures and stringent regulatory frameworks that prioritize infection control. The buy-American movement and related procurement incentives have spurred domestic and near-shore production partnerships, encouraging multinational providers to establish regional facilities and minimize exposure to global tariff fluctuations.

Europe, the Middle East, and Africa present a diverse tapestry of market drivers. Western European nations emphasize sustainability and circular economy principles, mandating biodegradable materials and life-cycle reporting in public tenders. Emerging markets in Eastern Europe, the Gulf Cooperation Council, and North Africa are ramping up healthcare infrastructure investments, creating new growth corridors for nitrile gloves that meet EU-aligned quality and environmental standards.

Asia-Pacific remains the fulcrum of global production, with Malaysia, Thailand, and Vietnam leading capacity expansions. Established giants such as Top Glove and Hartalega leverage cost-efficient raw material access and advanced manufacturing clusters to serve both domestic and export channels. As regional trade agreements and industrial policy frameworks evolve, local producers are positioned to reinforce resiliency across global supply chains while catering to surging intra-regional demand.

This comprehensive research report examines key regions that drive the evolution of the Nitrile Gloves market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Strategic Moves by Leading Manufacturers That Are Driving Growth, Innovation, and Competitive Advantage in the Nitrile Gloves Sector

Market leadership in the nitrile gloves sector coalesces around a group of specialized manufacturers that have pursued distinct strategic pathways. Top Glove Corporation, the world’s largest producer, has invested heavily in automation and vertical integration of nitrile butadiene rubber supply, aiming to stabilize input costs and scale production throughput efficiently.

Hartalega Holdings differentiates through targeted research and development focused on ultra-thin, antimicrobial coatings, catering to high-precision laboratory and pharmaceutical applications. Ansell has arranged strategic alliances to penetrate emerging safety segments, aligning its portfolio with petrochemical and aerospace requirements. Meanwhile, Kossan Rubber Industries and Sempermed have emphasized capacity growth in Southeast Asia and robust quality assurance measures to secure long-term contracts with government and institutional buyers.

This comprehensive research report delivers an in-depth overview of the principal market players in the Nitrile Gloves market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 3M Company

- AmerCareRoyal

- Ansell Limited

- Cardinal Health, Inc.

- Dyad Medical Sourcing

- Harmony Lab & Safety Supplies

- Hartalega Holdings Berhad

- HOSPECO

- INTCO Medical Products Co., Ltd.

- Kimberly-Clark Corporation

- Kossan Rubber Industries Bhd

- Rubberex Corporation

- Semperit AG Holding

- Shield Scientific

- Supermax Corporation Berhad

- The Safety Zone

- Top Glove Corporation Bhd

- UG Healthcare Group

- United Glove, LLC

- Ventyv

Actionable Strategies for Industry Leaders to Navigate Tariff Challenges, Leverage Innovation, and Strengthen Market Positioning

To navigate the evolving trade and regulatory landscape, industry leaders should consider proactive supply chain diversification, engaging multiple regional partners to hedge against tariff volatility. Securing long-term agreements with trusted suppliers in Malaysia and Thailand can reduce exposure to unilateral policy shifts while maintaining competitive cost structures and delivery performance.

Investing in sustainable production technologies and embracing eco-certifications will unlock access to premium segments in Europe and North America, where environmental credentials increasingly influence procurement decisions. Manufacturers should explore biodegradable formulations and closed-loop recycling collaborations to differentiate offerings and meet emerging compliance thresholds.

Furthermore, integrating traceability tools-such as digital authentication and batch-level sensing-can enhance transparency across distribution networks, supporting both quality assurance and brand trust. Complementing product innovation with tailored customer engagement and flexible packaging options will strengthen market positioning and foster resilience in an era of rapid change.

Methodological Approach Integrating Primary Insights, Secondary Research, and Rigorous Qualitative and Quantitative Analysis for Reliable Findings

This analysis synthesizes qualitative insights drawn from confidential discussions with senior executives at major glove manufacturers, supply chain managers, and end-user procurement teams. It is underpinned by systematic review of public trade records, tariff schedules, and regulatory notices published by the United States Trade Representative and customs authorities.

Secondary research encompassed examination of industry association outputs, technical guidelines from health and safety agencies, and peer-reviewed literature on glove performance characteristics. Segmentation frameworks for type, end user, and physical attributes were validated through scenario-based modeling and comparative analysis of adoption trends across key markets.

Quantitative validation involved cross-referencing import-export data and supplier capacity metrics to assess supply chain shifts, while qualitative benchmarking provided context on innovation trajectories and strategic imperatives. This comprehensive methodology ensures that the findings reflect the most current dynamics shaping the nitrile gloves industry.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Nitrile Gloves market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Nitrile Gloves Market, by Type

- Nitrile Gloves Market, by End User

- Nitrile Gloves Market, by Thickness

- Nitrile Gloves Market, by Texture

- Nitrile Gloves Market, by Color

- Nitrile Gloves Market, by Size

- Nitrile Gloves Market, by Packaging

- Nitrile Gloves Market, by Region

- Nitrile Gloves Market, by Group

- Nitrile Gloves Market, by Country

- United States Nitrile Gloves Market

- China Nitrile Gloves Market

- Competitive Landscape

- List of Figures [Total: 19]

- List of Tables [Total: 1590 ]

Concluding Perspectives on the Evolving Nitrile Gloves Landscape and the Imperative Actions for Sustained Success

The nitrile gloves sector stands at a pivotal juncture, where escalating global health concerns, evolving industrial standards, and shifting trade policies intersect. Stakeholders who remain attuned to segmentation nuances-from powder-free formulations to specialized thickness and texture profiles-will be best positioned to capture emerging opportunities. Concurrently, supply chain diversification and tariff risk management have become strategic imperatives, compelling buyers and producers alike to reevaluate sourcing networks and production footprints.

Innovation in sustainability, automation, and smart protection solutions promises to redefine value propositions across stakeholder groups, while regional demand patterns highlight the importance of targeted market strategies. By aligning product development with regulatory requirements and end-user priorities, organizations can drive resilience and competitive differentiation. Ultimately, the capacity to translate actionable market intelligence into strategic execution will determine leadership in this rapidly transforming landscape.

Engage with Our Associate Director to Access Comprehensive Market Intelligence and Customized Insights on the Nitrile Gloves Industry

Ready to unlock the full spectrum of insights into the nitrile gloves industry and its future trajectory? Contact Ketan Rohom, Associate Director of Sales & Marketing, to explore tailored market research solutions and secure your competitive advantage today.

- How big is the Nitrile Gloves Market?

- What is the Nitrile Gloves Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?