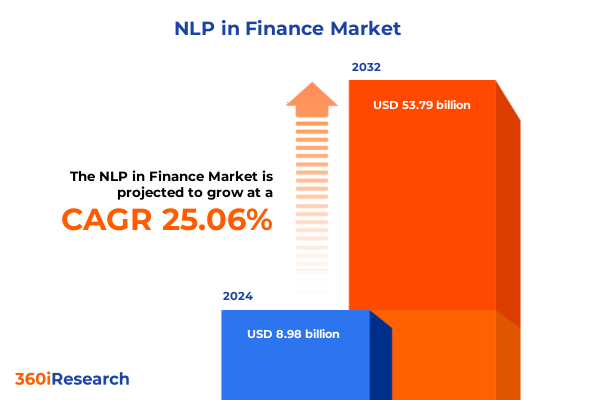

The NLP in Finance Market size was estimated at USD 11.19 billion in 2025 and expected to reach USD 13.77 billion in 2026, at a CAGR of 25.12% to reach USD 53.79 billion by 2032.

Exploring the Evolution of Natural Language Processing Applications in Financial Services from Algorithmic Trading to Risk Management Solutions

Financial institutions are increasingly recognizing the transformative potential of natural language processing, heralding a new era of data-driven decision making and automated operational efficiencies. What began as rudimentary text classification and keyword-based sentiment analysis has evolved into sophisticated transformer architectures capable of generating investment insights, automating compliance workflows, and enhancing client engagement across multiple touchpoints. With data volumes expanding exponentially, the ability to parse unstructured text from earnings calls, regulatory filings, newsfeeds, and social media has become indispensable for competitive advantage.

In this executive summary, we outline how natural language processing is fundamentally reshaping the way financial services firms source, interpret, and act on textual information. We frame the key shifts in technology, regulatory pressures, and market dynamics that are driving adoption, then delve into the specific impact of recent United States tariff policies on AI hardware and software costs. Building on a detailed segmentation by component, model type, deployment mode, organization size, and end user, we distill the most salient regional and competitive insights. Finally, we offer actionable recommendations and an overview of our rigorous research methodology, equipping leaders with the context and clarity needed to make informed strategic decisions.

Identifying the Technological Breakthroughs and Regulatory Transformations Reshaping Financial Natural Language Processing for Data-Driven Decision Making

Over the past five years, financial natural language processing has undergone a remarkable transformation fueled by both technological breakthroughs and shifting regulatory landscapes. The introduction of transformer-based models in late 2018 turbocharged capabilities for context-aware language understanding, enabling more accurate sentiment analysis, document summarization, and question-answering applications. At the same time, machine learning pipelines matured to incorporate real-time streaming data, empowering firms to detect market signals and to adapt trading algorithms on the fly. This confluence of advanced models and ever-faster data processing is redefining the speed and precision with which firms respond to market developments.

Concurrently, global regulators have tightened disclosure requirements and anti-money-laundering protocols, prompting institutions to automate compliance reviews and surveillance at scale. Regulations around data privacy and protection have spurred investments in secure on-premise deployments, while open banking initiatives in key jurisdictions have unlocked access to customer communications and transactional records. These regulatory shifts are not merely obstacles but catalysts, redirecting R&D efforts toward privacy-preserving NLP frameworks and compliance-centric tooling. Together, these developments signal a fundamentally reoriented industry landscape, where technological prowess and regulatory adaptability are inextricably linked to competitive success.

Assessing the Cumulative Effects of 2025 United States Tariff Policies on Global Natural Language Processing Investments and Financial Sector Innovation

In January 2025, the United States implemented a new suite of tariffs targeting AI hardware components and software licenses imported from major tech manufacturing hubs. These levies, averaging 15% on semiconductors and up to 10% on cloud-based NLP subscriptions, immediately increased capital expenditure for financial firms seeking to expand or upgrade their language processing infrastructures. As global supply chain constraints persisted, many organizations re-evaluated their dependency on offshore providers, accelerating in-house chip design partnerships and negotiating long-term contracts with domestic vendors to hedge against future tariff volatility.

The cumulative effect of these tariffs has been multifaceted. On one hand, procurement costs for GPUs, tensor processing units, and enterprise NLP software licenses rose sharply, leading institutions to postpone non-critical initiatives and to optimize existing models rather than invest in new deployments. On the other hand, the tariff environment spurred a wave of collaborative innovation among U.S. research labs, financial engineering teams, and domestic technology vendors. Many firms redirected budget toward developing open-source transformer frameworks and explored hybrid cloud architectures that prioritize locally hosted inference engines. While short-term project delays were unavoidable, the tariffs ultimately fostered a more resilient, home-grown ecosystem for financial NLP research and deployment.

Uncovering Strategic Opportunities Through Analysis of Component, Model Type, Deployment Mode, Organization Size, and End User Segments in Financial NLP

A nuanced understanding of the financial NLP market emerges when viewed through multiple segmentation lenses. At its core, component segmentation distinguishes between services and solutions. Within services, managed offerings span monitoring as well as support and maintenance, while professional services encompass both consulting and implementation engagements. Solutions themselves range from algorithmic trading engines to chatbot interfaces, compliance automation, and advanced modules for fraud detection, risk management, document automation, and sentiment analysis. Each of these components carries distinct value propositions and resource requirements, shaping vendor positioning and buyer decision-making.

Model type segmentation reveals a clear shift toward transformer architectures, which now represent the majority of new NLP model rollouts, although traditional deep learning, classical machine learning, and rule-based approaches still retain niche relevance-particularly for legacy compliance and reporting systems. Deployment mode continues to polarize between cloud environments, valued for scalability and rapid updates, and on-premise solutions, prized for data security and regulatory compliance. Meanwhile, organization size segmentation underscores divergent adoption trajectories: large enterprises are leading investments in end-to-end NLP platforms, whereas small and medium enterprises are selectively piloting pre-built chatbots and document processing tools to reduce operational overhead.

End-user segmentation further refines strategic priority areas across asset management firms, banks, brokerages, FinTech companies, hedge funds, insurance companies, investment firms, and regulatory bodies. While asset managers and hedge funds emphasize advanced sentiment analysis and algorithmic trading signals, banks and insurers prioritize compliance, fraud detection, and customer service chatbots. FinTech innovators often bridge multiple use cases, leveraging agile development to commercialize new offerings rapidly. Regulatory bodies themselves are adopting NLP for supervisory analytics and risk surveillance, reflecting a broader ecosystem where buyers, providers, and overseers all harness language intelligence for specialized outcomes.

This comprehensive research report categorizes the NLP in Finance market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- Model Type

- Deployment Mode

- Organization Size

- End User

Revealing Core Regional Trends and Growth Drivers in the Americas, Europe, Middle East & Africa, and Asia-Pacific Financial Natural Language Processing Markets

Geographically, the financial NLP landscape exhibits distinct regional dynamics shaped by local market maturity, regulatory regimes, and investment priorities. In the Americas, the United States dominates the market with a well-established ecosystem of cloud service providers, AI research institutes, and major financial institutions that are early adopters of cutting-edge solutions. Demand is driven by robust venture capital backing for NLP startups, a favorable regulatory climate for AI experimentation, and a keen emphasis on leveraging textual analytics for algorithmic trading.

In Europe, Middle East & Africa, regulatory stewardship under frameworks such as GDPR and the Digital Operational Resilience Act has engendered strong demand for privacy-preserving NLP architectures, driving growth in on-premise deployments and specialized compliance modules. Financial centers in London, Frankfurt, and the UAE are simultaneously fostering public-private partnerships to pioneer use cases in sustainable finance and regulatory reporting. Across Africa, emerging markets are selectively adopting cloud-based sentiment analysis platforms to enhance micro-lending and fintech outreach.

Asia-Pacific is characterized by a dual focus on digital banking innovation and large-scale consumer finance applications. China and India are investing heavily in domestic transformer research, while regional financial hubs in Singapore, Hong Kong, and Australia prioritize cross-border compliance automation and multilingual chatbot solutions to support diverse customer bases. This regional mosaic reveals how local drivers-from venture funding to regulatory mandates-shape distinct NLP adoption pathways and growth trajectories.

This comprehensive research report examines key regions that drive the evolution of the NLP in Finance market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Analyzing Leading Industry Players and Their Strategic Initiatives Driving Innovation in Financial Natural Language Processing Technologies

Leading technology providers and financial institutions are actively vying for market share through strategic partnerships, targeted acquisitions, and product innovation. Major cloud vendors have embedded specialized NLP toolkits into their platforms, enabling seamless integration of sentiment analysis, entity recognition, and contextual search within trading and risk management workflows. Financial data publishers have extended their offerings to include API-driven NLP models trained on proprietary datasets, while pure-play AI specialists are forging alliances with banks to co-develop compliance and fraud detection solutions.

Meanwhile, a cohort of nimble startups is carving out niches in high-value use cases. Some are developing explainable transformer models to address regulatory transparency requirements, while others focus on high-frequency news analytics that feed directly into algorithmic trading engines. Several vendors are also differentiating on user experience, delivering low-code or no-code interfaces that democratize NLP capabilities for non-technical business users. Across the competitive landscape, firms are leveraging open-source contributions, community forums, and academic collaborations to accelerate model improvements and to broaden the ecosystem of plugins, connectors, and domain-specific language packs.

This comprehensive research report delivers an in-depth overview of the principal market players in the NLP in Finance market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ABBYY Europe GmbH

- Accern LLC

- Amazon Web Services, Inc.

- Automated Insights, Inc.

- Baidu, Inc.

- Basis Technology Corporation

- Bitext S.L.

- Cognigy GmbH

- Conversica, Inc.

- Expert.ai S.p.A

- Google LLC

- International Business Machines Corporation

- Kasisto, Inc.

- Kensho Technologies, Inc.

- Lilt, Inc.

- LivePerson, Inc.

- Microsoft Corporation

- MosaicML, Inc.

- Nuance Communications, Inc.

- Observe.AI, Inc.

- Oracle Corporation

- Qualtrics International Inc.

- SAS Institute Inc.

- Veritone, Inc.

Implementing Data-Driven Strategies and Best Practices for Industry Leaders to Harness Financial NLP Capabilities and Achieve Competitive Advantage

Industry leaders should prioritize strategic investments in transformer-based architectures coupled with robust data governance frameworks to maintain competitive edge. By establishing cross-functional teams that unite data scientists, compliance experts, and business strategists, firms can ensure that NLP initiatives align with both regulatory obligations and revenue-generation targets. Leaders must also evaluate hybrid deployment models that balance the scalability of cloud services with the security advantages of on-premise inference servers, tailoring each project to the organization’s risk profile and data sensitivity requirements.

Collaboration is equally critical: forging partnerships with academic research labs, startup incubators, and open-source communities can fast-track access to novel algorithms and domain-specific language resources. Meanwhile, investing in talent development programs will be essential to cultivate the specialized skillsets needed for fine-tuning sophisticated models and for implementing explainability frameworks. Finally, leaders are advised to pilot targeted use cases-such as compliance automation and sentiment-driven investment signals-before scaling broadly, ensuring that each deployment yields measurable ROI and operational learnings to inform subsequent expansions.

Detailing Rigorous Research Methodology and Analytical Framework Employed to Evaluate Financial NLP Market Dynamics and Stakeholder Perspectives

Our research methodology combined exhaustive primary and secondary data collection with rigorous analytical validation. In the primary phase, we conducted in-depth interviews with senior executives from global banks, asset managers, FinTech firms, and regulatory agencies, gathering qualitative insights on adoption drivers, implementation challenges, and future roadmaps. Simultaneously, survey data was collected from technology vendors and consulting firms to quantify project timelines, budgetary allocations, and technology preferences.

Secondary research encompassed a comprehensive review of industry white papers, academic journals, regulatory filings, and patent databases to map the evolution of transformative NLP models and to track policy developments influencing market dynamics. We performed multiple rounds of data triangulation, cross-referencing findings from different sources to enhance accuracy and to identify divergent viewpoints. Our analytical framework segmented the market by component, model type, deployment mode, organization size, and end user, then applied a hybrid top-down and bottom-up approach to ensure consistency across qualitative narratives and quantitative indicators. Finally, we held expert validation workshops to refine our conclusions and to stress-test strategic recommendations under various macroeconomic and regulatory scenarios.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our NLP in Finance market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- NLP in Finance Market, by Component

- NLP in Finance Market, by Model Type

- NLP in Finance Market, by Deployment Mode

- NLP in Finance Market, by Organization Size

- NLP in Finance Market, by End User

- NLP in Finance Market, by Region

- NLP in Finance Market, by Group

- NLP in Finance Market, by Country

- United States NLP in Finance Market

- China NLP in Finance Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1590 ]

Synthesizing Key Takeaways and Strategic Imperatives Highlighted in the Examination of Financial Natural Language Processing Market Trends and Insights

In conclusion, natural language processing stands at the forefront of innovation in the financial services sector, enabling unprecedented efficiencies, deeper insights, and enhanced compliance capabilities. The advent of transformer models and the growing demand for privacy-preserving architectures have redefined best practices, while the imposition of United States tariffs in 2025 has galvanized domestic innovation even as it temporarily heightened deployment costs. By analyzing segmentation across components, model types, deployment modes, organization sizes, and end users, we have distilled the core value drivers and competitive dynamics shaping this rapidly evolving market.

Regionally, the Americas continue to lead in innovation, EMEA is cementing its role as a compliance and resilience hub, and Asia-Pacific is leveraging digital finance proliferation to scale novel use cases. Leading companies are differentiating through strategic alliances, product diversification, and open-source ecosystem contributions. For industry leaders, the imperative now is to adopt a balanced technology portfolio, foster collaborative innovation, and build talent pipelines. With these strategic imperatives in place, organizations can confidently navigate the complexities of language intelligence, capture new revenue streams, and drive sustained competitive advantage.

Engage with Associate Director Ketan Rohom to Obtain Your Comprehensive Financial NLP Market Research Report and Drive Strategic Decision Making

To drive your strategic planning with unmatched insight into the financial natural language processing market, reach out to Ketan Rohom, Associate Director of Sales & Marketing. Ketan’s expertise in tailoring market research deliverables to executive needs ensures you receive a comprehensive, actionable report that aligns precisely with your organization’s objectives. By partnering with Ketan, you can leverage deep industry know-how, gain early access to proprietary data, and benefit from bespoke advisory sessions that translate complex analytical findings into clear strategic pathways.

Secure your advantage by engaging directly with Ketan to explore pricing options, delivery timelines, and customization possibilities. Whether you aim to benchmark your existing NLP initiatives, identify new growth vectors, or validate your investment thesis, Ketan will guide you through the process of acquiring and maximizing the impact of this definitive research resource. Contact him today to transform insights into competitive edge and position your enterprise at the forefront of financial language intelligence innovation.

- How big is the NLP in Finance Market?

- What is the NLP in Finance Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?