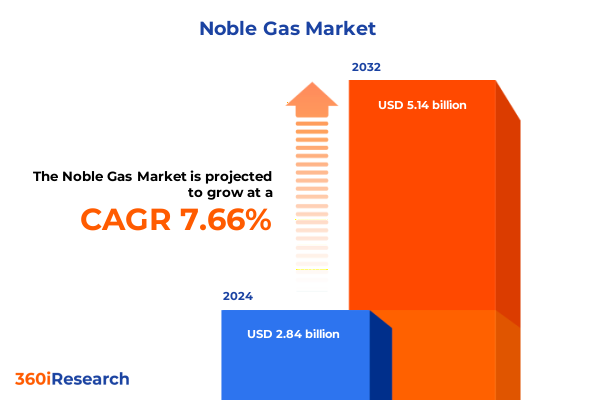

The Noble Gas Market size was estimated at USD 3.16 billion in 2025 and expected to reach USD 3.55 billion in 2026, at a CAGR of 12.82% to reach USD 7.36 billion by 2032.

Unveiling the Strategic Foundations and Core Dynamics Driving Innovation, Investment, and Sustainable Growth Across the Global Noble Gas Industry

The noble gas sector stands at a critical inflection point, characterized by its indispensable contributions to high-value industries and scientific research. Distinguished by properties such as chemical inertness, low boiling points, and exceptional thermal conductivity, noble gases have become foundational in applications ranging from semiconductor fabrication and medical imaging to aerospace propulsion and advanced lighting solutions. This industry’s strategic importance has only grown as technology-driven markets continue to demand gases with ultra-high purity and consistent supply reliability.

Historically, helium has garnered significant attention due to its scarcity and non-renewable origin, yet argon remains the workhorse for welding and metal fabrication, while neon, krypton, and xenon serve niche yet high-margin applications in lighting and research instrumentation. Meanwhile, radon, although less prominent commercially, underscores the specialized nature of certain research use cases. As emerging economies accelerate investments in electronics manufacturing and advanced healthcare infrastructure, the landscape for noble gases becomes increasingly dynamic and complex.

Against this backdrop, stakeholders must appreciate both macroeconomic forces and micro-level innovations that define the market. This executive summary navigates through transformative shifts, trade policy impacts, segmentation nuances, and regional drivers to establish a solid foundation for understanding the present state and future trajectory of the global noble gas industry.

Mapping the Transformative Shifts Reshaping Supply Chains, Technology Integration, and Competitive Dynamics in the Evolving Noble Gas Market Ecosystem

The noble gas market has undergone profound transformations in recent years, spurred by supply chain disruptions and technological breakthroughs. Notably, geopolitical tensions and logistical bottlenecks exposed vulnerabilities in helium sourcing when major suppliers in Russia and the Middle East faced export constraints. In response, end users and distributors accelerated investments in domestic extraction capabilities and diversified procurement strategies to mitigate risk.

Concurrently, advancements in cryogenic storage and recovery technologies have reshaped operational efficiencies, enabling providers to capture and recycle rarer gases that were once prohibitively expensive to reclaim. These innovations, combined with digital monitoring and predictive analytics, are optimizing downstream delivery networks and reducing waste. Furthermore, the trend toward sustainable production practices has prompted the introduction of green extraction projects, which leverage renewable energy sources for helium purification, thereby aligning with broader decarbonization goals.

At the same time, consolidation among leading industrial gas companies has intensified competitive dynamics, driven by the desire to secure long-term offtake agreements with semiconductor fabs, research institutions, and healthcare equipment manufacturers. This convergence of supply diversification, technological sophistication, and strategic partnerships is fundamentally reshaping cost structures, capacity planning, and value propositions across the noble gas ecosystem.

Analyzing the Cumulative Impact of 2025 U.S. Tariff Policies on Import Costs, Supply Chain Volatility, and Market Access in the Noble Gas Industry

In 2025, the United States introduced sweeping tariff measures designed to address trade imbalances and incentivize domestic production. Under the so-called “Liberation Day” orders, a baseline 10 percent duty was applied to all imports effective April 5, with additional reciprocal rates for designated partners commencing April 9. These policies extended to noble gas imports from key suppliers in the Middle East and Europe, immediately raising landed costs for end users reliant on external sources. Concurrently, goods originating in Canada and Mexico were exempted under existing trade pacts, preserving favorable terms for those bilateral flows while isolating non-North American shipments.

The imposition of reciprocal tariffs on imports from countries determined to enforce higher barriers against U.S. exports further complicated supply chain planning. Suppliers in China faced duties that elevated their effective rates well above the baseline, prompting downstream purchasers to reevaluate sourcing matrices. At the same time, a parallel proposal to levy pollution-intensity fees on certain industrial imports gained traction in legislative committees, signaling potential future eco-tariffs based on carbon emissions associated with gas production.

Although multiple legal challenges culminated in injunctions disputing the executive’s authority, these remain on hold pending appeals and thus did not immediately rescind the tariffs. As a result, procurement specialists have grappled with increased price volatility and operational uncertainties, prompting accelerated contract renegotiations and a renewed focus on captive gas generation projects. The cumulative effect underscores the necessity for comprehensive scenario planning and agile supply chain strategies to navigate this shifting trade policy landscape.

Revealing Key Segmentation Insights Across Gas Type, Applications, Purity Levels, Form Factors, and Distribution Strategies in the Noble Gas Market

A nuanced understanding of market segmentation illuminates how demand patterns and value pools differ within the noble gas industry. When viewed through the lens of gas type, argon continues to dominate in welding and metal fabrication, while helium claims primacy in semiconductor manufacturing and healthcare imaging, and krypton and xenon secure high-margin roles in specialty lighting and aerospace research. Neon finds its niche in laser applications and signage, and radon maintains a select set of research-oriented uses. Equally, application-based insights reveal that aerospace and research consistently drive demand for ultra-pure grades, whereas healthcare facilities prioritize reliable helium supplies for MRI systems. In lighting, xenon and krypton fulfill diverse requirements spanning general illumination to high-intensity strobe equipment. Semiconductor manufacturing exerts substantial influence over front-end wafer processing and back-end packaging, and industrial markets rely on argon for inert shielding.

Purity levels further delineate market segments, with industrial grade prevailing in welding and general utility applications, high purity serving specialized electronics fabrication, and ultra high purity demanded by precision research environments. This stratification heightens the importance of robust quality assurance protocols and tailored production streams. The form of delivery, whether gas cylinders or bulk liquid storage, dictates infrastructure investments and logistical considerations, with liquid offering economies of scale for large-volume purchasers and gaseous deliveries ensuring rapid site replenishment. Distribution channels span longstanding direct relationships with large end users to a network of regional distributors, each enabling customized service models and varying degrees of technical support.

This comprehensive research report categorizes the Noble Gas market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Gas Type

- Purity

- Form

- Application

- Distribution Channel

Illuminating Regional Dynamics and Growth Drivers in the Noble Gas Market Across the Americas, Europe, Middle East, Africa, and Asia-Pacific

Regional dynamics continue to play a pivotal role in how the noble gas market evolves and where growth opportunities emerge. In the Americas, the United States benefits from both domestic helium extraction initiatives and reliable argon production tied to nearby air separation facilities, with Canada and Mexico supplying substantial volumes that remain tariff-exempt under existing trade agreements. This region’s mature infrastructure and advanced manufacturing base sustain consistent demand across welding, healthcare, and semiconductor segments.

Moving eastward, Europe, the Middle East & Africa present a complex mosaic of regulatory environments and resource endowments. Western European markets emphasize stringent purity standards and supply security for research institutions, while the Middle East has begun exploring helium extraction in tandem with its broader gas production portfolio. African nations, though nascent in their industrial gas capabilities, hold significant potential as upstream resource partners and strategic transit zones for pipelines and shipping routes.

In the Asia-Pacific arena, robust expansion of semiconductor fabrication plants in China, South Korea, Taiwan, and Japan underpins the region’s position as the fastest-growing market for ultra high-purity gases. Concurrently, rising investments in advanced welding systems and specialty lighting applications across Southeast Asia fuel additional volume growth. These intertwined regional characteristics necessitate flexible commercial strategies that align distribution footprints with localized demand profiles and regulatory frameworks.

This comprehensive research report examines key regions that drive the evolution of the Noble Gas market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Examining Strategies, Innovations, and Competitive Positioning of Leading Industry Players Shaping the Global Noble Gas Market Landscape

Leading industrial gas providers are leveraging capacity expansions, strategic alliances, and technological innovation to consolidate their market positions. Global giants have announced new air separation plant projects adjacent to major semiconductor clusters to guarantee supply reliability and exploit economies of scale. Partnerships between gas producers and semiconductor equipment manufacturers are increasingly common, fostering co-investment in mixed gas solutions optimized for back-end packaging and front-end processing.

Regional and niche players are differentiating through advanced purification technologies and service models that offer on-site generation systems, minimizing transportation risks and enabling just-in-time supply. Several companies have introduced digital platforms that integrate real-time monitoring, predictive maintenance, and automated replenishment to enhance uptime and reduce administrative burdens for end users. Additionally, investments in research and development are driving progress in quantum gas applications, where isotopically refined xenon and krypton play critical roles in emerging photonics and sensor technologies.

This competitive landscape underscores the importance of agility and innovation; leading firms are actively pursuing mergers and acquisitions to extend their geographical reach, diversify product portfolios, and access new customer segments. Thus, stakeholders must continually assess strategic moves and technological shifts to remain ahead in this fast-evolving sector.

This comprehensive research report delivers an in-depth overview of the principal market players in the Noble Gas market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Air Liquide SA

- Air Products and Chemicals Inc

- Air Water Inc

- Airgas Inc

- American Gas

- BASF SE

- BP plc

- Buzwair Industrial Gases Factories

- Chevron Corporation

- CNOOC Limited

- ConocoPhillips

- Coregas Pty Ltd

- Cryoin Engineering

- Eni S.p.A

- Equinor ASA

- Evonik Industries

- Exxon Mobil Corporation

- Gazprom

- Gulf Cryo

- IWATANI CORPORATION

- Linde plc

- Matheson Tri-Gas Inc

- Messer Group GmbH

- Nippon Sanso Holdings Corporation

- PetroChina Company Limited

- Praxair Technology Inc

- Saudi Aramco

- Shell plc

- SHOWA DENKO K.K.

- SOL Group

- TAIYO NIPPON SANSO CORPORATION

- TotalEnergies SE

- Yingde Gases Group Company

Implementing Actionable Strategies for Industry Leaders to Navigate Regulatory Shifts, Supply Challenges, Emerging Opportunities in the Noble Gas

To thrive amid regulatory uncertainties and supply fluctuations, industry leaders should adopt a series of proactive measures. First, diversifying sourcing strategies by combining imports with in-country extraction and on-site generation can alleviate exposure to tariff fluctuations and logistical disruptions. Concurrently, investing in recycling initiatives to recapture process emissions-particularly helium-can offset reliance on external supplies and support sustainability objectives.

Second, forging long-term supply agreements with transparent pricing mechanisms will enhance cost predictability and strengthen relationships across the value chain. Engagement in policy advocacy, through both trade associations and direct government channels, can ensure that the industry’s unique characteristics are considered in future tariff deliberations and environmental regulations. Furthermore, deploying digital twins and advanced analytics within production and distribution operations can yield deeper visibility into demand patterns, enabling more responsive inventory management and operational agility.

Finally, exploring alternative gas blends for lower-purity applications and evaluating adjacent niche markets-such as specialty electronics or emerging quantum computing segments-can uncover new revenue streams. By integrating these recommendations into their strategic roadmaps, industry leaders can navigate the evolving landscape with confidence and secure a sustainable competitive advantage in the noble gas market.

Detailing the Comprehensive Research Methodology, Data Sources, and Analytical Framework Employed to Study the Global Noble Gas Market

This study employs a multifaceted research methodology designed to ensure the accuracy, reliability, and relevance of findings. Primary research activities included in-depth interviews with senior executives from leading gas producers, strategic discussions with procurement managers at major end-user facilities, and consultations with technology providers specializing in gas purification and delivery systems. Complementing these insights, secondary research incorporated data from government trade publications, international customs records, and academic journals focusing on cryogenics and gas applications.

Quantitative analysis involved mapping global supply chains, tracking import-export flows, and assessing the impact of tariff changes on cost structures. A scenario-based framework was applied to model potential outcomes under varying levels of trade policy stringency and supply chain resilience. Rigorous validation occurred via expert workshops and cross-verification of key assumptions with multiple independent data sources. While every effort was made to account for rapidly evolving market conditions, readers should consider inherent uncertainties related to geopolitical developments and technological breakthroughs.

Overall, this comprehensive approach provides a holistic view of the noble gas market’s current state and future trajectories, enabling stakeholders to make informed strategic decisions.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Noble Gas market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Noble Gas Market, by Gas Type

- Noble Gas Market, by Purity

- Noble Gas Market, by Form

- Noble Gas Market, by Application

- Noble Gas Market, by Distribution Channel

- Noble Gas Market, by Region

- Noble Gas Market, by Group

- Noble Gas Market, by Country

- United States Noble Gas Market

- China Noble Gas Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1113 ]

Synthesizing Core Insights and Strategic Imperatives Highlighting Future Trajectories in the Global Noble Gas Industry Amid Market and Regulatory Developments

In synthesizing the core insights, several strategic imperatives emerge for participants in the noble gas industry. Persistent supply constraints, amplified by geopolitical tensions and infrastructural bottlenecks, coexist with robust end-user demand driven by semiconductors, advanced healthcare, and research applications. The confluence of trade policy shifts-I including tariffs and potential eco-tariffs based on production carbon intensity-has introduced a layer of complexity that necessitates agile procurement and diversified sourcing.

Simultaneously, segmentation analysis underscores that different gas types and applications carry distinct risk-return profiles. Providers and consumers must align their commercial models with these nuances, optimizing for purity requirements, delivery formats, and service expectations. Regional examinations reveal both mature and high-growth markets, each subject to unique regulatory and logistical considerations that influence market entry and expansion strategies.

Looking ahead, successful navigation of this evolving landscape will depend on strategic partnerships, technological innovation in recycling and purification, and proactive engagement in policy channels. By harnessing the granular insights presented in this report, stakeholders can chart a course toward sustainable growth and resilience in the global noble gas industry.

Engage with Ketan Rohom to Secure Detailed Market Intelligence and Propel Strategic Decision-Making in the Global Noble Gas Industry via Market Research Report

We invite industry professionals and decision-makers seeking in-depth analysis and tailored insights to engage directly with Ketan Rohom, Associate Director of Sales & Marketing. By securing detailed market intelligence through this market research report, you can fortify your strategic planning, optimize supply chain resilience, and identify emerging opportunities before your competitors. Ketan Rohom is ready to discuss bespoke research packages, data deliverables, and consultation services designed to address your unique challenges in the noble gas sector. Reach out today to propel your strategic decision-making and gain a significant competitive advantage in the global noble gas industry.

- How big is the Noble Gas Market?

- What is the Noble Gas Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?