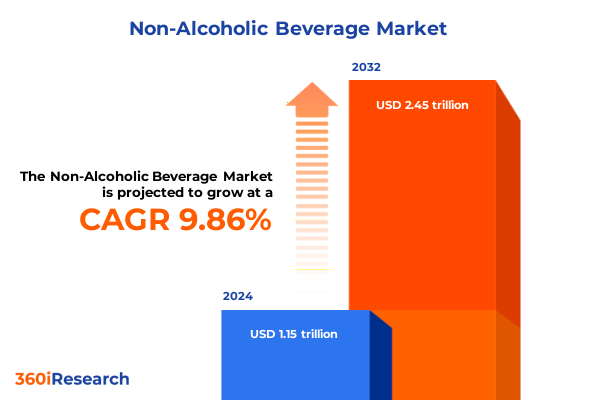

The Non-Alcoholic Beverage Market size was estimated at USD 1.24 trillion in 2025 and expected to reach USD 1.34 trillion in 2026, at a CAGR of 10.15% to reach USD 2.45 trillion by 2032.

Unveiling the Dynamic Evolution of the Non-Alcoholic Beverage Sector Driven by Consumer Trends and Innovation-Led Market Shifts

The non-alcoholic beverage industry is experiencing an unprecedented convergence of consumer demands, regulatory nuances, and technological breakthroughs that together are reshaping the competitive landscape. Fueled by a growing preference for functional ingredients, health-conscious formulations, and sustainable packaging, producers are under pressure to innovate at a pace previously unseen. Meanwhile, evolving distribution models-from digital marketplaces to experiential retail-are redefining how products reach discerning consumers across demographic segments. As these intersecting forces gain momentum, stakeholders must navigate an intricate ecosystem of supply chain complexities, consumer expectations, and market entry barriers.

This analysis opens the door to understanding how industry leaders, emerging disruptors, and supply chain partners are realigning their strategies to capture growth opportunities. By examining key drivers such as shifting consumption patterns, advanced manufacturing processes, and regulatory developments, this exploration provides a foundational perspective for decision-makers. The subsequent sections delve into tectonic shifts in the broader environment, the cumulative impact of recent tariff policies, critical segmentation insights that reveal pockets of opportunity, and regional performance highlights that underscore growth differentials across key geographies. Together, these insights form a cohesive narrative, equipping executives with the clarity needed to formulate and execute strategies that anticipate market evolution and deliver sustainable value creation.

Exploring Foundational Disruptors Reshaping the Non-Alcoholic Beverage Industry Through Health Sustainability and Technological Advancements

The non-alcoholic beverage market is witnessing foundational disruptors that are redefining value creation across the entire value chain. Health and wellness have ascended to the forefront, with functional beverages enriched with probiotics, adaptogens, vitamins, and plant-based proteins becoming mainstream offerings rather than niche products. Concurrently, sustainability imperatives have prompted brands to explore refillable solutions, plant-based packaging alternatives, and closed-loop recycling initiatives, thereby realigning production and logistics strategies toward circular economy principles.

Technological advancements are further accelerating transformation. Automated filling systems, AI-driven flavor formulation platforms, and blockchain-enabled traceability solutions are revolutionizing R&D, quality assurance, and supply chain transparency. Direct-to-consumer models, powered by sophisticated e-commerce ecosystems and personalized subscription services, are augmenting traditional retail channels, allowing brands to foster deeper relationships and streamline inventory management. These dynamics collectively herald a new era of agility, where speed to market, product differentiation, and operational resilience have become critical competencies for sustained growth and competitive fortitude.

Assessing the Wide-Ranging Effects of 2025 United States Import Tariffs on the Non-Alcoholic Beverage Industry’s Supply Chain and Cost Structures

The introduction and escalation of import tariffs by the United States in 2025 have exerted pronounced pressure on cost structures and supply chain configurations within the non-alcoholic beverage sector. Tariffs on aluminum and steel have elevated packaging expenditures, prompting manufacturers to consider alternative materials, regional sourcing strategies, and long-term supplier agreements to mitigate volatility. Simultaneously, levies on imported sugar and beverage concentrates have influenced formulation decisions and supplier portfolios, compelling some brands to pursue local ingredient partnerships or invest in onshore processing capabilities to maintain margin integrity.

These cumulative tariffs have not only impacted procurement costs but also reshaped logistical footprints. Ocean freight tariffs and border processing fees have extended lead times and introduced inventory management challenges, catalyzing a shift toward multi-regional distribution hubs and nearshore manufacturing. While certain players have absorbed incremental expenses in the short term to preserve retail price positions, others have initiated targeted price adjustments, prioritized premium segments, or introduced value-added services to justify cost pass-throughs. As this tariff landscape continues to evolve, companies that proactively diversify sourcing, optimize packaging specifications, and maintain agile distribution networks will be best positioned to preserve competitiveness and safeguard profitability.

Unraveling Market Complexity Through In-Depth Analysis of Product Variations Consumer Demographics Packaging Formats Distribution Channels and End-Use Pathways

Understanding the intricate segmentation of the non-alcoholic beverage market reveals significant nuances in consumer preference and operational focus. Based on product type, industry participants strategize across a broad spectrum, from bottled water offerings-encompassing flavored, mineral, spring, plain, and sparkling variants-to dairy-based beverages, functional formulations, natural and blended juices, ready-to-drink teas and coffees, and both carbonated and non-carbonated soft drinks. This diversified product landscape drives specialized production capabilities and targeted marketing approaches for individual consumer cohorts.

Consumer type segmentation highlights distinct usage patterns among adults seeking wellness-enhancing ingredients, teenagers drawn to low-sugar and flavor-forward options, children favoring novel packaging and sweet profiles, and seniors gravitating toward functional benefits such as digestive health or joint support. Packaging preferences further refine strategic imperatives, as cans, cartons, glass bottles, plastic bottles, and flexible pouches each address unique considerations of portability, recyclability, premium perception, and cost efficiencies.

Distribution channel analysis illuminates the growing significance of convenience stores and gas stations for impulse purchases, the sustained role of supermarkets and hypermarkets as core volume drivers, the rising influence of online and e-commerce platforms for subscription-based and direct-to-consumer models, the value-add of specialty stores for niche and artisanal brands, and the experiential opportunity of food service and drinking venues. Lastly, differentiating between B2B partnerships-spanning cafes, restaurants, and corporate clients-and B2C retail consumer engagements underscores the strategic imperative of channel-specific formulations, co-branding initiatives, and collaborative promotions to maximize market penetration and consumer loyalty.

This comprehensive research report categorizes the Non-Alcoholic Beverage market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Consumer Type

- Packaging

- Distribution Channel

- End-Use

Highlighting Regional Dynamics and Performance Drivers Across the Americas Europe Middle East Africa and Asia-Pacific Non-Alcoholic Beverage Markets

Regional dynamics within the non-alcoholic beverage landscape exhibit pronounced heterogeneity in growth drivers, competitive intensity, and consumer sensibilities. In the Americas, strong demand for low- and zero-calorie formulations, coupled with established distribution networks and mature retail infrastructures, supports the proliferation of premium and functional offerings. North American and Latin American markets share a preference for sparkling water innovations, fruit-infused variants, and functional energy drinks, while localized flavor profiles and culturally resonant packaging have proven effective in driving brand differentiation.

The Europe, Middle East, and Africa region presents a complex tapestry of regulatory frameworks, climatic influences, and consumer lifestyles. Western Europe’s advanced beverage regulations and health-oriented consumer base foster high expectations for natural ingredients and transparent labeling. Meanwhile, emerging markets across the Middle East and Africa display robust demand for affordable hydration solutions amid rising disposable incomes and urbanization, incentivizing brands to balance cost optimization with product quality.

In Asia-Pacific, growth trajectories are propelled by rapid urbanization, expanding middle-income cohorts, and evolving dietary preferences. Consumers in key markets such as China, India, and Southeast Asia are increasingly embracing functional beverages that address immunity, gut health, and stress management. E-commerce penetration and mobile payment ecosystems have unlocked unprecedented access for direct-to-consumer propositions, encouraging brands to tailor offerings to localized consumption rituals and digital-first shopping behaviors.

This comprehensive research report examines key regions that drive the evolution of the Non-Alcoholic Beverage market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Industry Players Innovations Strategic Alliances and Competitive Differentiators Shaping the Non-Alcoholic Beverage Landscape

Leading companies in the non-alcoholic beverage sector are redefining competitive parameters through strategic investments, R&D collaborations, and digital transformations. Global beverage giants are leveraging expansive distribution networks and brand equity to introduce premium extensions, fortified waters, and zero-sugar variants, while concurrently forging partnerships with ingredient innovators and sustainability specialists to bolster product differentiation.

At the same time, nimble challengers and niche players are capitalizing on agility to bring novel formats-such as adaptogenic sodas, cold-pressed botanical infusions, and microalgae-enriched waters-to market with rapid speed. Strategic alliances between start-ups and established bottlers have facilitated co-production agreements and joint go-to-market initiatives, enabling smaller players to scale efficiently while larger firms tap into emerging consumer communities.

Digital enablement has also emerged as a critical differentiator. Companies investing in AI-driven demand forecasting, IoT-enabled production monitoring, and blockchain for supply chain transparency have achieved notable improvements in operational efficiency and consumer trust. As a result, those with the ability to integrate digital across product development, manufacturing, and customer engagement are establishing formidable barriers to entry and setting new performance benchmarks.

This comprehensive research report delivers an in-depth overview of the principal market players in the Non-Alcoholic Beverage market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- aelo

- AJE Group

- Appalachian Brewing Company

- AriZona Beverages USA, LLC

- Asahi Group Holdings, Ltd.

- Bisleri International Pvt. Ltd.

- Danone S.A.

- Flavorchem Corporation

- Freixenet Mionetto USA

- ITO EN, LTD.

- Jones Soda Co.

- Jøyus

- Keurig Dr Pepper Inc.

- LaCroix Beverages, Inc.

- Molson Coors Beverage Company

- Nestlé S.A.

- Niagara Bottling, LLC

- Otsuka Holdings Co., Ltd.

- Parle Agro Pvt. Ltd.

- PepsiCo, Inc.

- Red Bull GmbH

- Reeds Inc.

- Refresco Group

- St. Regis

- Starbucks Corporation

- Suntory Beverage & Food Limited

- The Coca-Cola Company

- The Drink Ink

- The Kraft Heinz Company

- Waterloo Sparkling Water Corp.

Delivering Actionable Strategic Recommendations to Enhance Competitive Positioning Innovation and Growth in the Non-Alcoholic Beverage Sector

To thrive in this dynamic environment, industry leaders should prioritize a rigorous innovation agenda by leveraging consumer insights to anticipate emerging wellness trends and flavor preferences. Embedding modular manufacturing platforms and flexible packaging lines will enable rapid product diversification while minimizing time-to-market and capital intensity. Furthermore, strengthening supplier ecosystems through joint sustainability commitments and multi-tier sourcing agreements can safeguard material continuity and reduce exposure to tariff-induced cost fluctuations.

Equally critical is the optimization of digital and omnichannel capabilities. Investing in predictive analytics for demand planning, personalization engines for targeted marketing, and seamless e-commerce experiences will foster deeper consumer engagement and enhance lifetime value. Companies should also explore collaborative ventures with technology firms and logistics providers to pilot pilotless warehousing, crowdsourced delivery models, and smart vending solutions that expand reach and capture incremental sales.

Finally, cultivating strategic partnerships-whether through co-branding with health and wellness authorities or alliances with regional distributors-can accelerate market penetration and reinforce brand credibility. By integrating these initiatives into a coherent strategic roadmap, businesses can build resilience, capture emerging opportunities, and maintain a leading market position amid evolving industry dynamics.

Outlining Rigorous Research Methodology Data Collection and Analytical Approaches Underpinning Comprehensive Non-Alcoholic Beverage Market Insights

This analysis is grounded in a multilayered research methodology combining primary interviews with senior executives, supply chain partners, and retail channel representatives across core regions. Extensive secondary research was conducted, encompassing trade publications, industry whitepapers, regulatory filings, and financial disclosures to triangulate critical data points. Proprietary databases were queried to extract historical pricing trends, import/export volumes, and ingredient sourcing patterns.

Quantitative models were developed to assess tariff impacts and scenario analyses were performed to test alternative supply chain configurations. Consumer sentiment analysis, based on a mix of social media listening tools and targeted online surveys, provided granular insights into flavor preferences, packaging perceptions, and purchasing behaviors. Validation panels comprising industry experts and academic advisors were convened to review preliminary findings and strengthen analytical rigor, ensuring that conclusions reflect both market realities and emerging trajectories.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Non-Alcoholic Beverage market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Non-Alcoholic Beverage Market, by Product Type

- Non-Alcoholic Beverage Market, by Consumer Type

- Non-Alcoholic Beverage Market, by Packaging

- Non-Alcoholic Beverage Market, by Distribution Channel

- Non-Alcoholic Beverage Market, by End-Use

- Non-Alcoholic Beverage Market, by Region

- Non-Alcoholic Beverage Market, by Group

- Non-Alcoholic Beverage Market, by Country

- United States Non-Alcoholic Beverage Market

- China Non-Alcoholic Beverage Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1272 ]

Summarizing Key Insights and Strategic Considerations to Drive Decision-Making and Foster Sustainable Growth in the Non-Alcoholic Beverage Industry

In conclusion, the non-alcoholic beverage industry stands at the intersection of transformative consumer expectations, regulatory shifts, and technological advancements. The combined effects of 2025 tariffs, evolving segmentation dynamics, and regional performance differentials underscore the necessity for agile strategies and robust operational frameworks. Companies that adeptly navigate supply chain complexities, harness data-driven insights, and cultivate strategic collaborations will unlock resilient growth pathways.

As the sector continues to evolve, maintaining a future-focused perspective-emphasizing sustainability, digital integration, and consumer-centric innovation-will be paramount. Executives equipped with a comprehensive understanding of product trends, market segmentation, regional drivers, and competitive moves can make informed decisions that drive sustainable value. Armed with these insights, market participants are well-positioned to capitalize on the burgeoning opportunities within the vibrant and ever-changing world of non-alcoholic beverages.

Engage with Ketan Rohom to Unlock Exclusive Market Research Insights and Strategize Your Next Move in the Non-Alcoholic Beverage Space

Ready to elevate your strategic initiatives with unparalleled market intelligence? Reach out to Ketan Rohom, Associate Director of Sales & Marketing, to explore customized report packages and unlock the insights that will empower your organization to outpace competitors in the non-alcoholic beverage arena. Whether you aim to refine your product portfolio, optimize your supply chain, or capitalize on emerging consumer trends, Ketan is poised to guide you through tailored solutions that align with your business objectives. Don’t miss the opportunity to transform data into actionable strategy-contact Ketan today to secure your competitive edge and chart a roadmap for sustained success.

- How big is the Non-Alcoholic Beverage Market?

- What is the Non-Alcoholic Beverage Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?