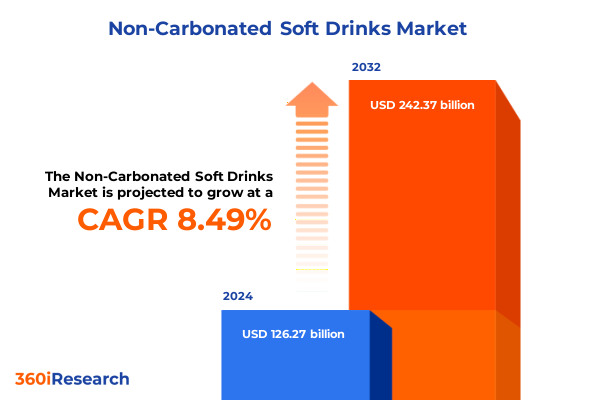

The Non-Carbonated Soft Drinks Market size was estimated at USD 136.23 billion in 2025 and expected to reach USD 146.98 billion in 2026, at a CAGR of 8.57% to reach USD 242.37 billion by 2032.

Exploring the Dynamic Landscape of Non-Carbonated Soft Drinks A Comprehensive Executive Overview of Market Drivers and Growth Opportunities

The non-carbonated soft drinks sector is experiencing a renaissance as consumers increasingly prioritize health, convenience, and premium experiences. Once overshadowed by traditional carbonated sodas, non-carbonated beverages now occupy prime shelf space driven by demand for hydration, functional benefits, and premium ingredients. From mineral and spring water subcategories defining bottled water innovation to dairy-based beverages integrating probiotics and plant-based proteins, the landscape is more diverse than ever.

Continued urbanization and busy lifestyles have fueled the growth of ready-to-drink offerings, especially in coffee and tea, where cold brew and artisan blends appeal to discerning palates. Meanwhile, juice drinks have evolved beyond single-fruit varieties to embrace cold-pressed blends, concentrates, and nutrient-enriched formulations that resonate with wellness trends. Across each category, packaging innovations-ranging from eco-friendly cartons to lightweight PET and glass bottles-reflect a balance between sustainability and convenience.

As we delve deeper into industry dynamics, this executive overview sets the stage for assessing transformative shifts and strategic insights. By exploring health-driven product innovation, tariff-driven cost management, and segmentation nuances, stakeholders will gain a comprehensive understanding of the forces shaping the non-carbonated soft drinks market and the opportunities that lie ahead.

Key Industry Forces Reshaping the Non-Carbonated Soft Drinks Sector Through Health Innovation and Advanced Packaging Technologies

A powerful shift toward health and wellness has redefined what consumers expect from their beverages. Functional offerings enriched with prebiotics, vitamins, and adaptogens are now mainstream, with functional drinks sales jumping 54 percent to reach $9.2 billion in the U.S. between March 2020 and March 2024, outpacing overall non-alcoholic beverage growth by more than 10 percentage points. Leading manufacturers are responding with gut-health sodas and immune-support tonics that blend taste with tangible benefits. Prebiotic soda brands like Olipop and Poppi garnered combined U.S. retail sales of approximately $817 million last year, prompting beverage giants to launch their own variants under health-focused subbrands.

Technological advancements in cold-chain logistics, aseptic filling, and carton retort processing have enabled more delicate juice and dairy-based formulations to reach consumers without sacrificing nutritional integrity. Cold brew coffee and artisan tea, once niche in specialty cafés, now feature prominently in ready-to-drink portfolios, opening new revenue streams and driving category premiumization. Simultaneously, digital commerce and subscription models have evolved from experimental pilots into core distribution channels, offering personalized flavor profiles and automated replenishment that deepen consumer engagement.

Meanwhile, sustainability has emerged as a non-negotiable pillar. Brands are increasingly adopting recycled PET, exploring advanced bioplastics, and investing in refillable glass solutions to meet stringent corporate and regulatory targets. These shifts in consumer expectations, product innovation, and sustainability imperatives are collectively reshaping the competitive landscape, demanding agility and investment in both R&D and supply chain resilience.

Assessing the Multifaceted Impact of 2025 United States Trade Tariffs on the Production Packaging and Distribution of Non-Carbonated Soft Drinks

The implementation of a 25 percent tariff on imported aluminum and steel in March 2025 has reverberated across the non-carbonated soft drinks industry, challenging stakeholders to reassess packaging strategies and cost structures. While the additional cost on a single aluminum can production increases by only a fraction-from roughly four cents to five cents-such changes can accumulate across millions of units, prompting manufacturers to explore alternative materials and source recycled content aggressively. Recycled aluminum now accounts for more than 70 percent of the material in domestic beverage cans, cushioning the full brunt of import duties and reinforcing the closed-loop economy in North America.

Glass bottle imports from China and select Asian markets are subject to newly imposed duties ranging between 10 and 25 percent, heightening production costs and extending lead times by up to eight weeks for some clients. Domestic glass manufacturers have seen an uptick in orders, yet capacity constraints limit their ability to fully absorb demand. This scenario is accelerating the shift toward PET bottles-especially recycled PET-where pre-existing investments in blow moulding machinery are now being prioritized to mitigate volatility in metal and glass pricing.

As the industry navigates this tariff environment, strategic partnerships with packaging suppliers and forward-buying strategies have become essential. Companies are negotiating long-term contracts to lock in favorable rates, while also collaborating on lightweighting initiatives that reduce material usage. Although consumer prices are unlikely to rise dramatically due to healthy profit margins and competitive dynamics, the cumulative cost pressures underscore the need for integrated supply chain visibility and scenario planning to maintain both profitability and sustainability.

Uncovering Critical Segmentation Insights Product Packaging Channels Sweetener Choices and Flavor Profiles Shaping Consumer Behavior

A nuanced understanding of market segments uncovers critical levers for growth and differentiation. When viewed through the lens of product type, bottled water’s subdivisions-mineral, purified, and spring-highlight the premiumization trend, with consumers paying more for clarity around source and mineral content. Dairy-based innovations span cultured drinks, flavored milk, and milkshakes, each addressing distinct taste profiles and nutritional needs. Juice offerings further diversify into blended mixes, concentrates, and single-fruit portfolios, enabling manufacturers to tailor recipes that cater to both indulgence and functional health demands. In parallel, ready-to-drink coffee ranges from robust Americanos to velvety lattes and smooth cold brews, while tea extensions traverse black, green, and herbal infusions. Sports and energy drink formats continue to bifurcate into performance hydration and stimulant-based formulations.

Packaging type segmentation underscores the tension between sustainability and consumer convenience. Glass and PET bottles each possess unique recycling profiles, with glass bottles reinforcing brand prestige even as PET dominates in lightweight logistics. Cans offer recyclable efficiency but face tariff uncertainties, whereas cartons and pouches provide aseptic convenience and reduced carbon footprints. Distribution channels reveal shifting consumer journeys, where traditional supermarkets and hypermarkets coexist with convenience stores and e-commerce portals. Sweetener choices split between sugar-sweetened offerings and low- or zero-calorie alternatives as health-conscious consumers scrutinize label claims. Flavor segmentation encompasses chocolate and coffee indulgences, fruit varieties that stretch from berry and citrus to tropical blends, and tea infusions that leverage botanical nuances.

Collectively, these segmentation dimensions allow manufacturers to align innovation pipelines with consumer insights, optimize cost structures by balancing premium and value tiers, and craft differentiated propositions that resonate in an increasingly fragmented marketplace.

This comprehensive research report categorizes the Non-Carbonated Soft Drinks market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Packaging Type

- Distribution Channel

- Sweetener Type

- Flavor

Strategic Examination of Regional Variances Across Americas Europe Middle East & Africa and Asia Pacific Markets in Non-Carbonated Soft Drinks

Regional dynamics in the non-carbonated soft drinks market are defined by distinct consumer behaviors and regulatory landscapes. In the Americas, the United States remains the largest single market, driven by health trends, strong retail infrastructure, and a growing beverage culture that embraces functional waters, alternative milks, and nutrient-fortified juices. Market maturation in Canada highlights opportunities for premium niche brands, while Mexico’s expanding middle class is fueling demand for ready-to-drink teas and energy beverages.

Across Europe, the Middle East & Africa, regulatory scrutiny on health claims and sugar content drives reformulation efforts and opens avenues for low- and zero-calorie offerings. Western Europe’s sustainability mandates encourage the adoption of recycled packaging and refill systems, whereas emerging markets in Eastern Europe and the Middle East are receptive to global flavors and functional blends. In Africa, urbanization supports growth in bottled water and ready-to-drink coffee, albeit logistical challenges persist in rural distribution.

The Asia-Pacific region exhibits robust innovation, led by Japan and South Korea’s premium tea and coffee cultures and China’s accelerating uptake of protein-enriched and nutrient-dense beverages. Southeast Asian markets are experimenting with botanical infusions and culturally resonant flavors, such as pandan and lemongrass, reflecting local preferences. Across the region, digital commerce and mobile payment ecosystems amplify direct-to-consumer models and enable targeted marketing campaigns to tech-savvy millennials and Gen Z consumers.

This comprehensive research report examines key regions that drive the evolution of the Non-Carbonated Soft Drinks market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Analyzing Competitive Dynamics Key Players Driving Innovation Collaborations and Market Leadership in Non-Carbonated Soft Drinks

The competitive landscape of non-carbonated soft drinks is anchored by established global players and agile challengers. Market leaders leverage expansive distribution networks, R&D budgets, and brand equity to extend beverage portfolios into healthier and premium segments. Coca-Cola has augmented its water and tea divisions while testing prebiotic soda formulations. PepsiCo continues to diversify its juice and ready-to-drink coffee offerings, bolstered by strategic partnerships and acquisitions in functional brands. Keurig Dr Pepper maintains strength in flavored and sparkling water through targeted marketing and portfolio rationalization.

Nestlé and Danone support dairy-based innovation and bottled water breadth with investments in microbiome-focused cultured drinks and sustainable sourcing initiatives. Meanwhile, privately held companies and startups such as Olipop, Poppi, and Celsius leverage niche positioning and direct-to-consumer models to capture health-conscious consumers. These challengers often spearhead emerging trends-such as adaptogenic ingredients and subscription-based replenishment-and influence larger competitors to respond or acquire. Across this landscape, competitiveness is measured not only by scale but by speed of innovation, supply chain resilience, and an ability to articulate authentic brand stories that resonate with evolving consumer values.

This comprehensive research report delivers an in-depth overview of the principal market players in the Non-Carbonated Soft Drinks market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Arizona Beverages USA LLC

- Asahi Group Holdings, Ltd.

- Britvic PLC

- Celsius Holdings

- Danone S.A.

- Dydo Group Holdings, Inc.

- FEMSA

- ITO EN, Ltd.

- JAB Holding Company

- Keurig Dr Pepper Inc.

- Monster Beverage Corporation

- National Beverage Corp.

- Nestlé S.A.

- Ocean Spray Cranberries, Inc.

- PepsiCo, Inc.

- Red Bull GmbH

- Sinalco International

- Spindrift Beverage Co., Inc.

- Suntory Holdings Limited

- The Coca-Cola Company

- The Hain Celestial Group, Inc.

- The Kraft Heinz Company

- Unilever PLC

- Vita Coco Company

Strategic Imperatives for Industry Leaders Actionable Recommendations to Capitalize on Emerging Trends and Market Opportunities

Industry leaders should prioritize portfolio agility by accelerating the development of products that align with the health and wellness paradigm. By embedding functional ingredients such as prebiotics, nootropics, or plant-based proteins into new formulations, brands can differentiate their offerings and command premium positioning. At the same time, diversifying packaging strategies-optimizing recycled PET, lightweight glass, and innovative carton options-ensures resilience against tariff volatility and regulatory pressures. Supply chain partnerships and long-term procurement contracts can further anchor cost predictability and secure critical raw materials.

To deepen consumer engagement, companies must integrate digital commerce solutions and personalized marketing. Voice-activated reordering, subscription-based deliveries, and tailored flavor recommendations can enhance loyalty and reduce acquisition costs. Additionally, leaders should continue forging strategic alliances, whether through co-branding with nutrition and wellness influencers or through targeted acquisitions that bring niche capabilities in sustainable packaging or functional ingredients.

Fostering a culture of rapid experimentation-enabled by agile product development and iterative consumer feedback loops-allows for swift market entry and course correction. By leveraging advanced analytics and real-time data from e-commerce channels, organizations can detect emerging trends early and pivot resources accordingly. This dual emphasis on innovation and operational excellence positions industry players to capture value in an increasingly competitive non-carbonated soft drinks marketplace.

Transparent Research Methodology Overview Data Collection Analysis Framework Expert Validations and Quality Control Procedures

Primary research for this report combined quantitative data from proprietary trade databases, regulatory filings, and financial disclosures with qualitative insights from executive interviews and expert panels. Secondary sources included industry journals, government publications on trade measures, and technical white papers on packaging innovations. Data points were triangulated through cross-verification with third-party analytics platforms and industry associations to ensure consistency and accuracy.

The segmentation framework was developed by mapping product, packaging, distribution, sweetener, and flavor dimensions against consumer behavior studies and retailer assortments. Regional analyses incorporated trade data from the U.S. International Trade Commission and customs authorities, as well as sustainability and regulatory reports to capture the evolving policy environment. Competitive benchmarking leveraged corporate announcements, patent filings, and social listening metrics to gauge the speed and impact of innovation.

To maintain methodological rigor, findings underwent peer review by beverage industry consultants and supply chain experts. A structured validation process, including scenario testing for tariff impacts and stress testing of supply chain shifts, was applied to key assumptions. This comprehensive approach ensures that the insights presented are grounded in empirical evidence and reflect the multifaceted nature of the non-carbonated soft drinks market.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Non-Carbonated Soft Drinks market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Non-Carbonated Soft Drinks Market, by Product Type

- Non-Carbonated Soft Drinks Market, by Packaging Type

- Non-Carbonated Soft Drinks Market, by Distribution Channel

- Non-Carbonated Soft Drinks Market, by Sweetener Type

- Non-Carbonated Soft Drinks Market, by Flavor

- Non-Carbonated Soft Drinks Market, by Region

- Non-Carbonated Soft Drinks Market, by Group

- Non-Carbonated Soft Drinks Market, by Country

- United States Non-Carbonated Soft Drinks Market

- China Non-Carbonated Soft Drinks Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 2226 ]

Conclusive Reflections on the Future Trajectory of the Non-Carbonated Soft Drinks Market and Strategic Considerations for Stakeholders

The non-carbonated soft drinks market stands at a crossroads defined by health-driven innovation, sustainability imperatives, and geopolitical cost pressures. Consumer demand for functional benefits will continue to drive product diversification, while packaging and distribution strategies must adapt to tariff-induced volatility and evolving retail landscapes. Regional disparities present both challenges and opportunities, underscoring the importance of localized product development and channel optimization.

Competitive dynamics will favor companies that combine scale with nimbleness-leveraging robust supply chains, advanced analytics, and collaborative partnerships to accelerate innovation and manage costs. As digital commerce cements its role, data-driven personalization and subscription models will become essential for deepening consumer relationships and securing recurring revenue streams.

Ultimately, success in the non-carbonated soft drinks sector will hinge on a holistic strategy that aligns product innovation, sustainable practices, and market agility. Organizations that can synchronize these elements will be best positioned to capture the upside in a rapidly transforming beverage landscape.

Join Ketan Rohom for Personalized Insights and Secure Your Market Intelligence in the Non-Carbonated Soft Drinks Sector

For tailored insights or to discuss how this report can directly address your strategic objectives, connect with Ketan Rohom, Associate Director of Sales & Marketing. Ketan’s expertise in non-carbonated soft drinks can guide you through the report’s findings and outline how your organization can leverage emerging trends and overcome industry challenges. Reach out today to schedule a personalized briefing or to secure your copy of the comprehensive market research report and unlock actionable intelligence that drives growth.

- How big is the Non-Carbonated Soft Drinks Market?

- What is the Non-Carbonated Soft Drinks Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?