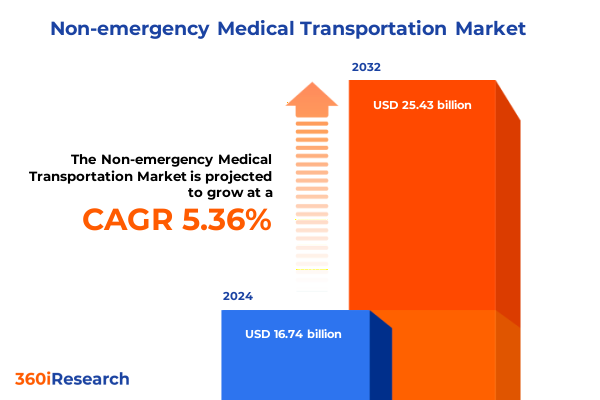

The Non-emergency Medical Transportation Market size was estimated at USD 17.45 billion in 2025 and expected to reach USD 18.19 billion in 2026, at a CAGR of 5.52% to reach USD 25.43 billion by 2032.

Setting the Stage for Non-Emergency Medical Transportation As a Critical Link in Healthcare Access and Patient Continuity

Non-emergency medical transportation serves as an indispensable bridge between vulnerable patient populations and the critical healthcare services they require. This sector ensures that individuals who lack access to private vehicles or require specialized assistance can attend routine medical appointments dialysis sessions and follow-up visits without the high stakes associated with missed care or delayed treatment. By connecting ambulatory patients bariatric wheelchair-dependent individuals and those requiring stretcher accommodations with reliable transport options this service reduces hospital readmissions and strengthens care continuity while upholding patient dignity and safety.

As the U.S. population continues to age and chronic disease prevalence rises the demand for reliable non-emergency transport solutions has grown exponentially. Recent demographic analyses reveal that the share of Americans aged 65 and older reached 18.0% in 2024 up from 12.4% two decades earlier highlighting a demographic shift that magnifies the need for accessible medical mobility services. Concurrently value-based care models have elevated the importance of timely outpatient visits to manage disease progression and optimize outcomes emphasizing the strategic role that non-emergency medical transportation plays in modern healthcare delivery.

Identifying the Transformative Shifts Redefining Efficiency Safety and Accessibility in the Non-Emergency Medical Transportation Ecosystem

The non-emergency medical transportation landscape is undergoing profound change driven by policy reforms and evolving payer requirements. State Medicaid agencies are recalibrating brokered transportation programs to balance cost containment with quality assurance while Medicare Advantage plans reevaluate rider benefits under the sunset of Value-Based Insurance Design at the end of 2025. These shifts have prompted providers to diversify service offerings and forge new partnerships with health plans to maintain coverage levels amid tighter reimbursement frameworks.

Simultaneously technology adoption is accelerating operational transformation within the sector. Industry leaders report that AI-powered billing and scheduling platforms have reduced administrative workloads by up to 50% while enhancing compliance through real-time eligibility checks and automated performance reporting. The integration of GPS-enabled dispatch systems and mobile apps not only streamlines trip coordination but also provides patients and caregivers with transparent updates on driver credentials and ETA notifications improving service reliability and user satisfaction.

Moreover the rise of ride-hailing alliances is reshaping traditional NEMT models as providers and brokers integrate TNCs under regulated frameworks to augment capacity and reduce wait times. Concurrent public-private collaborations now pilot hybrid fleets combining ambulatory vans wheelchair-lift-equipped vehicles and volunteer networks to address transportation gaps in rural and underserved communities while upholding stringent safety and credentialing standards.

Examining the Cumulative Impact of Newly Imposed United States Tariffs on Costs Supply Chains and Vehicle Procurement in 2025

Tariff changes enacted in early 2025 have introduced new cost pressures across the transportation supply chain significantly affecting vehicle procurement and maintenance budgets for non-emergency medical transport providers. A 25% tariff on commercial vehicle imports from Canada and Mexico has disrupted the medium- and heavy-duty truck market which underpins stretcher and bariatric transport services. At the same time a 25% levy on imported vehicle components including chassis braking systems and steel frames has translated into year-over-year parts cost increases of 18%–25% for specialized fleet maintenance.

Logistics providers are contending with higher shipping and equipment costs driven by tariffs on maritime and airfreight assets essential to NEMT infrastructure modernization. Tariffs ranging from 20%–30% on cranes aircraft components and port automation systems have delayed upgrade timelines for transport hubs. These cost inflations are further amplified by bottlenecks in cross-border freight flows where surcharges and capacity constraints have elevated last-mile delivery expenses.

The cumulative impact of these policy measures has spurred many NEMT operators to explore alternative sourcing strategies and accelerate fleet electrification initiatives leveraging federal grant programs. Providers are partnering with local manufacturers to mitigate reliance on import-dependent supply lines while investing in battery-electric and hybrid vans to offset tariff-induced fuel and parts cost volatility over the long term.

Uncovering Key Segmentation Insights Across Service Types Vehicle Configurations and End Users Driving Tailored Non-Emergency Medical Transport Solutions

Diverse patient mobility needs have prompted NEMT stakeholders to refine service-level frameworks that span ambulatory transport for routine doctor visits bariatric solutions designed for high BMI riders and specialized dialysis transport orchestrated in sync with treatment schedules. Pediatric and mental health transportation segments demand stringent safety protocols and privacy controls integrating trained staff and secure confidentiality measures. Additionally stretcher transports cater to patients requiring supine positioning while wheelchair services employ lift-equipped vehicles to ensure seamless boarding and disembarkation across varied physical ability levels.

Fleet composition has evolved from standard ambulatory vans to an array of minivan configurations stretcher vans and wheelchair-lift-equipped vehicles optimized for diverse care environments. Operators continuously evaluate vehicle ergonomics capacity and maintenance profiles to match trip profiles ranging from long-distance patient transfers to frequent short-haul medical visits. This vehicle diversification aligns with regulatory mandates for accessible transport and enables providers to allocate resources dynamically across peak and off-peak service windows.

End users exert a pronounced influence on service design as demand flows from dialysis centers where timely round-trip coordination is vital to treatment adherence hospitals and clinics requiring rapid turnaround for outpatient scans and consultations and mental health facilities where consistency and patient comfort are key to therapy engagement. Nursing homes and assisted living communities depend on dedicated shuttle agreements to manage group transports for routine care while rehabilitation centers leverage fixed-route programs to support patients recovering mobility post-surgery or injury.

This comprehensive research report categorizes the Non-emergency Medical Transportation market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Service Type

- Vehicle Type

- End-User

Highlighting Key Regional Insights Spotlighting Variation in Non-Emergency Medical Transportation Dynamics Across Americas EMEA and Asia-Pacific

In the Americas non-emergency medical transportation is deeply influenced by expansive Medicaid and Medicare frameworks that underwrite a majority of routine care trips. North American providers have accelerated digital platform adoption to comply with evolving CMS satisfaction-linked payment rules and leverage data analytics for on-time performance tracking. Canada’s provincially managed NEMT systems emphasize collaborative broker networks while the U.S. landscape is characterized by a mix of public-sector programs and private pay arrangements addressing urban and rural mobility gaps.

Across Europe Middle East & Africa the NEMT market is shaped by public health initiatives emphasizing social determinants of health and sustainable transport solutions. Germany France and the U.K. lead in regulatory integration of eco-friendly electric fleets supported by national subsidies and low-emission zones. In contrast emerging markets in the Middle East and Africa benefit from NGO-backed programs targeting remote patient populations with affordable ambulance-based transport models and community-driven volunteer networks.

Asia-Pacific stands out as the fastest growing region fueled by rapid demographic aging and healthcare infrastructure expansion. China and India dominate regional demand as government-subsidized programs and telehealth integration bridge urban-rural divides. Japan and South Korea have scaled public-private partnerships to ensure elderly patients secure reliable transport to critical follow-up visits under universal healthcare systems.

This comprehensive research report examines key regions that drive the evolution of the Non-emergency Medical Transportation market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Revealing Key Company Strategies and Competitive Moves Shaping Innovation And Partnership in the Non-Emergency Medical Transportation Sector

Industry consolidation remains a defining trend as technology-led brokers and traditional providers expand service portfolios and geographic reach. Leading players such as American Medical Response (AMR) enhance offerings through acquisitions while emerging digital-first entrants invest heavily in AI-driven dispatch and real-time tracking capabilities to differentiate on reliability and cost efficiency. Partnerships between healthcare systems and NEMT specialists continue to mature with focus on performance-based service metrics and shared accountability for patient outcomes.

Ridesharing giants Uber Health and Lyft Health have carved out specialized NEMT divisions integrating seamlessly with managed care organizations to absorb overflow demand and provide on-demand flexibility for ambulatory trips. Meanwhile traditional carriers like Southeastrans and Veyo have established robust broker ecosystems supporting a broad network of third-party operators under unified credentialing and compliance protocols. This hybrid model balances scalability with local expertise enhancing network density and service responsiveness.

Specialized niche operators focusing on pediatric bariatric and dialysis transport are also gaining traction by offering tailored fleet customization and highly trained staff to meet stringent care requirements. Companies such as Elite Medical Transport and CareSafe Transportation prioritize rigorous driver training and vehicle retrofitting investments to uphold safety standards while addressing complex mobility needs across patient cohorts.

This comprehensive research report delivers an in-depth overview of the principal market players in the Non-emergency Medical Transportation market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Acadian Ambulance Service, Inc.

- Aero Medical Ambulance Service Ltd.

- CJ Medical Transportation

- Compass Group PLC

- Door2Door GmbH

- EgyCross Europe SL

- ERS Transition Ltd.

- Express Medical Transporters, Inc.

- Ezy Mov Solutions Pvt. Ltd.

- Falck A/S

- Global Medical Response, Inc.

- IRM

- KING METRO, LLC

- London Medical Transportation Systems Inc.

- Lyft, Inc.

- Medical Transportation Management, Inc.

- MedicVan Patient Transfer Services Inc.

- Modivcare Inc.

- Reliance Ambulance Service Ltd.

- RNR Patient Transfer Services Inc.

- Southeastrans, Inc.

- Transdev Group SA

- TransMedCare LLC

- Uber Technologies, Inc.

- UK Event Medical Services

Actionable Recommendations for Industry Leaders To Navigate Regulatory Shifts Harness Technology and Strengthen Patient-Centered Transport Models

Industry leaders should prioritize integrating advanced analytics and AI-powered routing solutions to strengthen operational resilience and reduce no-show rates. By leveraging predictive modeling they can optimize fleet utilization dynamic pricing strategies and proactive maintenance schedules to mitigate tariff-induced cost fluctuations and regulatory uncertainties. Establishing cross-functional innovation teams will accelerate pilot deployments of electric and hybrid vehicles aligning sustainability goals with long-term cost management.

Engaging with state Medicaid agencies and payer networks through joint governance forums will enable providers to shape reimbursement frameworks favoring performance-based outcomes. Proactive advocacy for standardized contract provisions that reward on-time performance and quality metrics can unlock incentives that support technology investments and network expansion. Additionally forming strategic alliances with telehealth platforms will position NEMT providers as integral partners in holistic care delivery models where transport acts as a continuum bridging virtual and in-person visits.

Diversifying service portfolios by offering specialized transports for mental health pediatric bariatric and long-distance patient transfers can create new revenue streams while addressing unmet mobility needs. Providers may also explore public-private partnerships to co-develop volunteer driver programs and shared mobility corridors in rural areas reducing dependency on costly fixed fleets. By embedding innovation and collaboration at their core transportation companies will be better equipped to respond to evolving patient expectations and policy landscapes.

Detailing a Rigorous Research Methodology Underpinning This Report Including Data Collection Validation And Analytical Frameworks

This report synthesizes insights drawn from a comprehensive research framework combining secondary data analysis primary interviews and proprietary databases. Primary research involved structured interviews with executives from leading NEMT providers brokers payers and regulatory bodies to validate emerging trends and quantify impact factors across service, vehicle and end-user dimensions. Secondary research spanned industry publications healthcare policy filings and trade association reports to ensure contextual accuracy and capture diverse stakeholder perspectives.

Quantitative modeling leveraged historical demographic and healthcare utilization data to assess demand drivers while scenario analyses examined tariff and policy variables shaping cost structures. Rigorous data validation employed cross-referencing of corporate disclosures and government databases to enhance reliability. Segmentation and regional assessments were grounded in standardized taxonomies for service types, vehicle configurations, and payer relationships enabling consistent comparative analysis across geographies and market subsegments.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Non-emergency Medical Transportation market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Non-emergency Medical Transportation Market, by Service Type

- Non-emergency Medical Transportation Market, by Vehicle Type

- Non-emergency Medical Transportation Market, by End-User

- Non-emergency Medical Transportation Market, by Region

- Non-emergency Medical Transportation Market, by Group

- Non-emergency Medical Transportation Market, by Country

- United States Non-emergency Medical Transportation Market

- China Non-emergency Medical Transportation Market

- Competitive Landscape

- List of Figures [Total: 15]

- List of Tables [Total: 636 ]

Drawing Conclusive Perspectives on Critical Findings To Guide Future Investments Partnerships And Innovations in Non-Emergency Medical Transportation

The evolving dynamics of non-emergency medical transportation underscore its pivotal role in enabling equitable healthcare access and driving value-based care outcomes. As regulatory, technological and demographic forces converge providers that embrace innovation, collaboration and performance-driven partnerships will emerge as preferred transport partners for health systems and managed care organizations. Strategic investments in digital platforms, fleet diversity and sustainability initiatives will be critical to navigating cost pressures and policy shifts while upholding service quality and patient satisfaction.

Looking ahead, the sector’s ability to integrate data-driven insights across the care continuum, advocate for supportive reimbursement models, and tailor solutions for specialized patient cohorts will determine competitive leadership. Providers that proactively adapt to emerging market needs and engage as trusted stakeholders in broader care networks are poised to capitalize on growth opportunities and contribute meaningfully to improved patient outcomes in non-emergency medical transportation.

Engage Ketan Rohom Today To Secure In-Depth Market Intelligence and Unlock Growth Opportunities in the Non-Emergency Medical Transportation Industry

Elevate your strategic decision–making with unparalleled access to comprehensive market intelligence in the Non–Emergency Medical Transportation industry. Reach out directly to Ketan Rohom Associate Director Sales & Marketing to discuss tailored research insights or to secure your copy of the full market research report and stay ahead of evolving trends.

- How big is the Non-emergency Medical Transportation Market?

- What is the Non-emergency Medical Transportation Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?