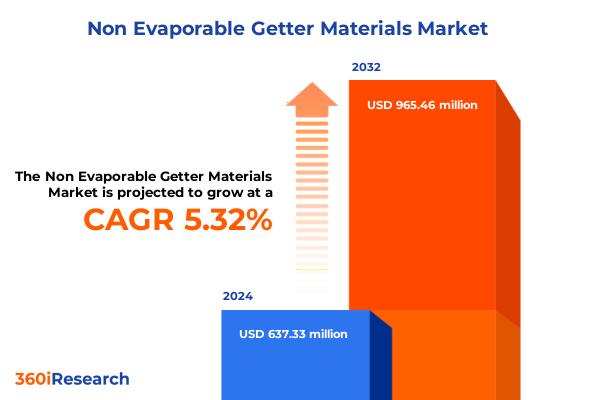

The Non Evaporable Getter Materials Market size was estimated at USD 669.45 million in 2025 and expected to reach USD 704.06 million in 2026, at a CAGR of 5.36% to reach USD 965.46 million by 2032.

Introduction to Non-Evaporable Getter Materials Highlighting Their Critical Functions and Impact on High-Tech Vacuum Systems Worldwide

Non-evaporable getter materials have become indispensable in maintaining high-vacuum and ultra-high-vacuum environments across a spectrum of advanced technologies, from semiconductor fabrication to medical imaging systems. These specialized alloys, typically activated through controlled thermal processes, function by adsorbing residual gases, thereby preserving vacuum integrity without continuous pumping. Over the past decade, as precision manufacturing and analytical instrumentation have reached new heights of sensitivity and scale, the role of getters has expanded accordingly. Their ability to remove trace contaminants in sealed volumes ensures optimal device performance and longevity, safeguarding both product quality and operational efficiency.

This introduction lays the foundation for understanding why industry leaders increasingly prioritize getter selection within complex supply chains. Beyond their chemical affinity for gases like oxygen, nitrogen, and hydrogen, modern getter materials exhibit tailored activation profiles and mechanical forms designed to integrate with varied system architectures. Continued evolution in alloy compositions-driven by collaborations between material scientists and end-user engineers-creates opportunities to meet stringent purity requirements in next-generation applications. As such, this overview underscores both the critical nature of getter functionality and the strategic impetus for organizations to remain abreast of material innovations that enhance vacuum-based operations.

Emerging Technological Disruptions and Material Innovations Reshaping the Future of Non-Evaporable Getter Applications in Diverse Industries

Over the past several years, transformative shifts have reshaped the landscape of non-evaporable getter materials, driven by breakthroughs in material science and the surging demands of emerging technologies. At the forefront is the semiconductor sector, where nodes continue to shrink below ten nanometers even as wafer sizes expand. To support this trend, getter alloys now incorporate optimized zirconium-cobalt and zirconium-iron formulations that lower activation temperatures while boosting gas absorption capacity. As a consequence, vacuum chambers achieve rapid pump-down times without compromising process purity.

Simultaneously, renewable energy and photovoltaic technologies have introduced a wave of demand for specialized getters suited to solar panel encapsulation and thin-film silicon deposition. These applications call for pellet and powder forms that can be seamlessly integrated during panel lamination, ensuring long-term barrier properties against moisture ingress. Meanwhile, burgeoning research in space exploration and satellite communications leverages lightweight rod getters capable of enduring the thermal cycles of low-Earth orbit. Collectively, these developments signify a departure from one-size-fits-all solutions toward highly specialized getter profiles, marking a pivotal shift in how materials are engineered to meet the evolving requirements of diverse industries.

Assessing the Multifaceted Effects of United States Tariff Policies Introduced in 2025 on the Non-Evaporable Getter Materials Supply Chain

In January 2025, the United States enacted a revised set of tariff measures targeting imported zirconium-based materials, which constitute the foundational elements of most getter alloys. These duties, designed to encourage domestic production of strategic materials, have had immediate ripple effects across the global supply chain. Organizations reliant on foreign sources for zirconium aluminum and zirconium cobalt precursors face increased input costs, necessitating adjustments in procurement strategies and price negotiations with downstream partners.

As import duties elevated material pricing by up to 15 percent, manufacturers responded by accelerating investments in localized refining operations and exploring alternative alloy blends with reduced zirconium content. At the same time, pressure has mounted to diversify supplier networks beyond traditional exporters. While short-term impacts include tighter inventory levels and lead-time variability, mid-term outcomes point to enhanced resilience. Companies have begun forging joint ventures with North American mining and processing entities to mitigate exposure and secure stable feedstock. In this context, tariff policies have catalyzed a strategic realignment of getter materials sourcing that underscores the interplay between trade regulations and supply chain robustness.

In-Depth Examination of Material, Application, Form, End-User, and Distribution Segmentation Revealing Critical Getter Material Insights

A nuanced view of market segmentation reveals distinct performance and adoption trends across material types, applications, forms, end-use industries, and distribution channels. In the realm of material type, zirconium aluminum alloys excel at balancing activation energy with gas uptake kinetics, while zirconium cobalt variants deliver superior hydrogen absorption rates ideal for vacuum insulation panels. Meanwhile, zirconium iron alloys maintain structural integrity in high-temperature environments, making them a primary choice for space launch vehicle systems. Each alloy composition addresses unique operational constraints, guiding engineers toward the optimal getter solution for their design parameters.

When examining applications, medical imaging equipment frequently employs foil getters to preserve vacuum in X-ray tubes and MRI systems, whereas semiconductor manufacturing sectors demand a combination of chemical vapor deposition, ion implantation, and physical vapor deposition processes that each benefit from tailored getter integration. Solar panel manufacturers incorporate pellet getters during lamination to extend module lifetimes, while vacuum tube producers in defense sectors rely on rod forms for durability under thermal cycling. Form factors-from ultrathin foil to precision-engineered powder-align with specific activation procedures and spatial allocations within equipment chambers, ensuring compatibility without compromising system architecture.

The end-user industries further underscore the critical nature of segmentation. Aerospace and defense applications prioritize getters that can withstand extreme pressure differentials, whereas electronics companies seek high-throughput solutions for wafer fabrication environments. Energy sector players focus on getters that reinforce solar and hydrogen storage systems, while healthcare providers demand consistency and safety in device maintenance protocols. Finally, distribution strategies vary according to customer profiles: direct sales channels facilitate bespoke alloy customization and technical support, whereas distributors expand geographic reach and provide inventory buffering for just-in-time manufacturing needs.

This comprehensive research report categorizes the Non Evaporable Getter Materials market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Material Type

- Form

- Activation Temperature

- Application

- End-User Industry

- Distribution Channel

Analyzing Regional Dynamics and Demand Drivers Across Americas, Europe Middle East Africa, and Asia-Pacific for Non-Evaporable Getter Deployment

Regional dynamics exert a powerful influence on the trajectory of non-evaporable getter development and deployment. In the Americas, robust semiconductor clusters centred in the United States and Canada have driven steady demand for advanced getter formulations tailored to cutting-edge lithography and deposition equipment. Cooperative ventures between North American research institutions and private entities have accelerated innovation cycles, promoting domestic sourcing of zirconium precursors and advanced manufacturing of getter components.

Contrastingly, the Europe, Middle East & Africa corridor presents a blend of mature markets and emerging hotspots. Germany and the United Kingdom host leading accelerator research facilities that depend on custom getter rods and pellets engineered for particle physics instrumentation. Simultaneously, Middle Eastern solar initiatives and African telecommunications infrastructure projects are beginning to integrate specialized getter solutions to ensure system longevity under harsh environmental conditions. This region’s multifaceted landscape drives a hybrid approach where established suppliers partner with local assemblers to cater to diverse technical and regulatory requirements.

Asia-Pacific remains the most dynamic arena, with China’s relentless expansion in photovoltaic capacity and semiconductor fabs generating unprecedented volume needs for getters. Japan continues to lead in precision manufacturing, pushing the envelope on micro-PVD and ion implantation techniques that demand getter materials with exacting purity standards. South Korean memory and logic chipmakers likewise invest in close collaborations with alloy developers to refine cobalt-enhanced formulations. These regional patterns underscore the importance of geographically tailored strategies, as each zone contends with distinct technological priorities, supply chain infrastructures, and policy environments.

This comprehensive research report examines key regions that drive the evolution of the Non Evaporable Getter Materials market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Industry Players Driving Innovation, Strategic Partnerships, and Technological Advancements in the Non-Evaporable Getter Market Landscape

Leading industry players are driving the getter materials market forward through targeted R&D investments, strategic collaborations, and selective mergers. One prominent company has established a dedicated alloys innovation center that focuses on next-generation zirconium-iron composites optimized for space applications. This initiative complements its recent partnership with a major satellite manufacturer, ensuring early integration of getter rods tailored to low-Earth-orbit requirements.

Another key competitor has leveraged its global distribution network to introduce modular pellet packages for solar panel laminators, backed by joint testing protocols with leading renewable energy firms. By aligning manufacturing scale with sustainability goals, this player has secured preferred supplier status in multiple Asia-Pacific markets. Meanwhile, a third organization has enhanced its physical vapor deposition getter lines through automation technologies, reducing cycle times while maintaining stringent purity benchmarks. Strategic acquisitions of smaller specialty firms have further amplified its material portfolio, enabling cross-licensing of activation processes and accelerating new product roll-out.

Collectively, these leading entities exemplify how orchestration of technical expertise, customer collaboration, and supply chain integration fosters competitive advantage. Their actions set benchmarks for performance, quality, and responsiveness. As emerging entrants seek footholds, incumbents will continue to refine proprietary formulations, scale advanced manufacturing platforms, and explore alliance models that underpin the next wave of getter material innovation.

This comprehensive research report delivers an in-depth overview of the principal market players in the Non Evaporable Getter Materials market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Agilent Technologies, Inc.

- American Elements

- Gamma Vacuum, LLC

- Goodfellow by Advanced Scientific Materials Limited

- IBVC Vacuum S.L.U.

- KBM Affilips B.V.

- Nanjing Huadong Electronics Vacuum Material Co., Ltd

- SAES Getters S.p.A.

- TT Advanced elemental materials Co., Ltd.

- ULVAC, Inc.

- Vac Coat Ltd.

- VACOM GmbH

Practical Strategic Recommendations Empowering Industry Leaders to Capitalize on Market Opportunities and Navigate Challenges in Getter Material Applications

To capitalize on the burgeoning opportunities in getter materials, industry leaders should prioritize several strategic initiatives. First, accelerating alloy development programs through co-investment with advanced research institutions will yield breakthrough compositions that lower activation energy and enhance gas absorption profiles. By integrating simulation tools and high-throughput experimentation, companies can shorten innovation cycles and rapidly iterate on promising candidates.

Furthermore, diversifying supply chains by establishing partnerships with domestic zirconium refiners and exploring alternative alloying elements will mitigate risks associated with tariff fluctuations and geopolitical uncertainties. Organizations should also collaborate with end-user equipment manufacturers to co-design getter forms and activation protocols, ensuring seamless integration and performance validation at the system level.

Adopting digital manufacturing technologies-such as additive fabrication for custom powder geometries or automated quality control systems-will boost operational efficiency while maintaining strict purity standards. Additionally, incorporating lifecycle assessments and circular economy principles will appeal to customers’ sustainability mandates, creating differentiation in a crowded marketplace. Finally, active engagement with regulatory bodies and industry consortia will shape favorable standards for getter activation and handling, enabling smoother market entry and wider application horizons. These actionable recommendations empower businesses to navigate complexities, drive material performance, and secure lasting competitive positions.

Comprehensive Overview of Research Design, Data Collection Methods, and Analytical Techniques Underpinning the Getter Materials Study

The research methodology underpinning this study combined extensive primary and secondary research phases to ensure both breadth and depth of insight. Initially, a rigorous desk review assessed publicly available literature, patent filings, and technical white papers on non-evaporable getter materials. This phase established a comprehensive taxonomy of alloy compositions, activation techniques, and performance metrics.

Subsequently, primary research involved structured interviews with more than two dozen industry experts, including materials scientists, vacuum equipment engineers, and procurement executives. These conversations provided qualitative perspectives on emerging needs, supply chain constraints, and technology adoption barriers. In parallel, supplier surveys captured quantitative data on production capacities, lead times, and distribution practices, facilitating triangulation that validated insights across multiple sources.

Analytical techniques included a detailed supply chain mapping exercise, technology readiness assessments, and comparative benchmarking of activation processes. The study also incorporated scenario analysis to explore the implications of policy shifts, such as the 2025 U.S. tariff adjustments. Throughout, outputs underwent strict quality checks via peer reviews and data consistency audits, ensuring the final report provides a balanced and authoritative view of the getter materials landscape.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Non Evaporable Getter Materials market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Non Evaporable Getter Materials Market, by Material Type

- Non Evaporable Getter Materials Market, by Form

- Non Evaporable Getter Materials Market, by Activation Temperature

- Non Evaporable Getter Materials Market, by Application

- Non Evaporable Getter Materials Market, by End-User Industry

- Non Evaporable Getter Materials Market, by Distribution Channel

- Non Evaporable Getter Materials Market, by Region

- Non Evaporable Getter Materials Market, by Group

- Non Evaporable Getter Materials Market, by Country

- United States Non Evaporable Getter Materials Market

- China Non Evaporable Getter Materials Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1431 ]

Synthesizing Critical Findings and Strategic Implications to Reinforce the Importance of Getter Materials in Modern Technology Ecosystems

This study’s critical findings underscore the strategic importance of non-evaporable getter materials in enabling high-performance vacuum environments across multiple technology sectors. By identifying transformative alloy innovations, regional demand drivers, and tariff-induced supply chain realignments, stakeholders gain a holistic perspective on the dynamic forces at play. Segmentation analysis highlights how tailored material, form factor, and application-specific strategies can unlock efficiency gains and mitigate operational risks.

Moreover, profiling of leading companies reveals success factors that include collaborative R&D models, flexible manufacturing platforms, and proactive regulatory engagement. The actionable recommendations underscore the need for integrated approaches that combine material science prowess, digital manufacturing, and supply chain resilience. Collectively, these insights equip industry participants to make informed decisions, prioritize investments, and forge partnerships that drive long-term growth.

As vacuum-dependent technologies evolve-from next-generation semiconductors to advanced medical diagnostic tools-the relevance of finely tuned getter materials will only intensify. Therefore, aligning strategic plans with the study’s conclusions will position organizations at the forefront of innovation, ready to address emerging challenges and capitalize on new application domains.

Connect with Ketan Rohom to Access the Full Report and Uncover In-Depth Insights on Getter Material Innovations and Strategic Pathways

Inevitably, decision-makers seeking to unlock the full potential of non-evaporable getter innovations and strategic pathways will find deeper clarity and actionable data in the complete report offered by Ketan Rohom, Associate Director, Sales & Marketing at 360iResearch. By engaging directly with Ketan, stakeholders gain a tailored overview of critical market drivers, emerging technologies, and supply chain intricacies. His expertise ensures a personalized walkthrough of the findings, enabling teams to align their initiatives with proven strategies for material optimization, regulatory compliance, and partnership acceleration. Reach out today to secure comprehensive insights that drive confidence and precision in procurement, research collaborations, or investment decisions related to getter material applications.

- How big is the Non Evaporable Getter Materials Market?

- What is the Non Evaporable Getter Materials Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?