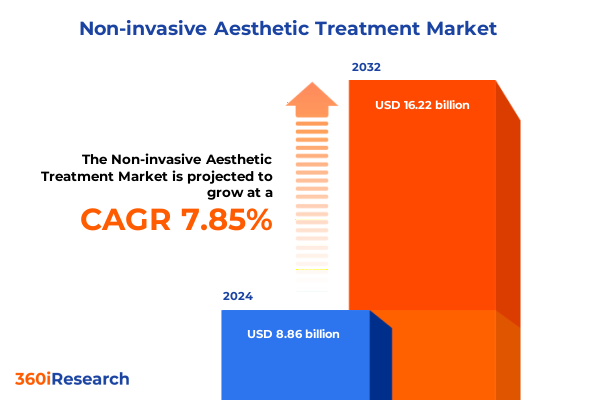

The Non-invasive Aesthetic Treatment Market size was estimated at USD 9.54 billion in 2025 and expected to reach USD 10.28 billion in 2026, at a CAGR of 7.87% to reach USD 16.22 billion by 2032.

An authoritative introduction outlining the converging clinical, consumer and supply chain forces reshaping non-invasive aesthetic treatments and provider choices

The non-invasive aesthetic treatment landscape is entering an era defined by converging clinical innovation, shifting consumer expectations, and elevated supply chain scrutiny. This introduction frames the high-level forces reshaping how devices, injectables and clinic services are developed, distributed and consumed. It highlights that patient preference now favors minimal downtime and natural results, while providers are balancing clinical efficacy expectations with reimbursement constraints and capital deployment decisions.

Across the sector, clinicians and investors are responding to technological advances in energy-based devices, refinements in injectable formulations, and new distribution models that reduce friction between prescription and patient. These shifts are producing strategic questions about training standards, regulatory compliance and channel economics that leaders must address today. As a starting point, this summary identifies the primary vectors of change and establishes the context for deeper analysis: evolving treatment modalities, tariff-driven sourcing risks, segmentation dynamics across treatment type, end user and distribution channel, and differentiated regional behaviors. Through that lens, the introduction sets expectations for the remainder of the report and prepares readers to weigh opportunity against operational and regulatory constraints.

How refinements in injectables, advanced energy platforms and digital access models are jointly redefining clinical practice, device use and consumer expectations

The aesthetic landscape is being transformed by three simultaneous shifts: refinements in minimally invasive procedures that prioritize subtlety and repeatability, rapid iteration of energy-based platforms that compress treatment time and broaden indications, and patient-driven demand for convenient access that drives new commercial models. Neuromodulators and hyaluronic acid fillers continue to be anchored by strong clinical demand as preventative and restorative tools, but their use is now tempered by a more nuanced patient preference for restrained, natural outcomes. At the same time, skin tightening and body-contouring technologies-particularly radiofrequency, ultrasound, and next-generation laser systems-are stepping into roles previously reserved for surgery because they can produce cumulative, less invasive results with shorter recovery windows.

Concurrently, the commercial environment is evolving: clinics and medical spas are adopting modular, multi-platform energy devices to expand service menus while managing capital intensity. Teleconsultation and e-commerce channels are lowering access friction, making it easier for patients to discover and book procedures, while brands experiment with direct-to-consumer engagement and subscription models for maintenance therapy. These technological and commercial shifts are prompting providers to rethink care pathways and revenue models. The net effect is a landscape that rewards integrated clinical protocols, flexible capital deployment, and a rigorous approach to training and quality assurance. Evidence-based protocols and provider credentialing are emerging as critical differentiators as the market matures toward standardized outcomes and patient safety expectations.

Practical analysis of how the 2025 U.S. tariff shifts are altering sourcing economics, procurement choices and resilience planning across the aesthetic device and consumables value chain

Trade policy developments in 2024–2025 have material implications for medical device sourcing, consumables and clinic operating costs. Recent increases in tariff rates targeting a range of medical products have raised cost pressure on items that supply many aesthetic practices, particularly consumables and components that are frequently manufactured or assembled abroad. These tariff actions have accelerated supplier risk discussions inside purchasing and procurement teams and are motivating nearshoring, dual-sourcing and inventory strategy changes to reduce exposure to sudden duty increases. Providers and device makers are evaluating the balance between short-term margin compression and the long-term resilience gained from diversifying supplier footprints.

Beyond immediate price impact, these tariff developments are changing supplier negotiation dynamics and investment calculus. Some global manufacturers are announcing mitigation plans that include shifting production lines, regionalizing distribution, or absorbing tariffs to protect market positioning; other smaller device makers are reassessing the economic viability of certain low-margin consumables that are tariff-sensitive. The policy environment has thus become a strategic input in capital planning, vendor selection and long-term partnerships, particularly for companies that rely on cross-border component flows or distribute high-volume disposable items to clinics and spas. Clinics and chains that actively model tariff exposure and build contingency plans will be better positioned to stabilize supply, control costs and maintain patient access in a changing trade landscape.

Actionable segmentation insights that translate treatment types, clinic end users and diverse distribution channels into clear priorities for product, training and channel strategies

Segment-level clarity is essential for clinical operators, manufacturers and channel partners to prioritize investments and refine go-to-market strategies. When examining treatment categories, the market should be viewed through the lens of cryolipolysis for targeted fat reduction, a broad energy-based devices category that includes intense pulsed light, laser treatments, radiofrequency and ultrasound, injectable therapies split between botulinum toxin and dermal fillers, and a distinct focus on skin-tightening devices. Within energy-based approaches, laser treatments bifurcate into fractionated and non-fractionated systems while injectable portfolios divide into botulinum toxin varieties and a range of filler chemistries; the botulinum class further segments into Type A and Type B formulations and dermal fillers span calcium hydroxyapatite, hyaluronic acid, poly-L-lactic acid and polymethyl methacrylate options.

End-user segmentation shows differentiated adoption patterns: dermatology clinics and medical aesthetics clinics typically lead on procedural sophistication and device mix, hospitals participate where procedures intersect with reconstructive needs or complex safety requirements, and medical spas prioritize throughput and customer experience metrics. Distribution channels are likewise varied: direct sales relationships with manufacturers remain crucial for capital devices, while hospital pharmacies, retail pharmacies and online pharmacies each play roles in delivering injectables and consumables to patients and providers. Online pharmacy models themselves range from e-commerce portals operated by third-party retailers to manufacturer-hosted websites that enable direct ordering or refill services. Understanding demand and margin drivers within each of these segments is foundational to setting product road maps, clinician training investments, and differentiated commercial outreach that aligns with where patients are most likely to seek care.

This comprehensive research report categorizes the Non-invasive Aesthetic Treatment market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Treatment Type

- End User

- Distribution Channel

Regional dynamics and differentiated adoption patterns across the Americas, EMEA and Asia-Pacific that determine where to invest in product, training and supply resilience

Regional dynamics create differentiated competitive advantages, regulatory constraints and adoption curves that matter for strategy. In the Americas, strong consumer acceptance of minimally invasive procedures and a dense clinical network of dermatology and medical aesthetics clinics make it a leading environment for both established injectable brands and sophisticated energy devices. Providers in this region are sensitive to reimbursement and cost pressures, and they monitor supply chain disruptions closely because of the heavy reliance on cross-border components and consumables.

Europe, the Middle East & Africa presents a heterogeneous picture: Western European markets emphasize regulatory rigor, clinician credentialing and evidence-backed device adoption, while parts of EMEA combine rapid private-sector expansion with price sensitivity and opportunistic medical tourism. In many countries across this super-region, consolidated hospital groups and specialty clinics influence adoption patterns, and regional regulatory agencies shape the pace at which newer modalities become mainstream. Asia-Pacific displays a spectrum from high-volume, innovation-hungry markets in East Asia to rapidly expanding demand in Southeast Asia and South Asia, where medical tourism, younger demographics and tech-forward clinics accelerate uptake of injectables and multi-modality energy platforms. Differences in procurement norms, price elasticity and patient preferences across these geographies mean that product positioning, marketing and partnership approaches must be tailored regionally to capture growth while managing regulatory compliance, training and supply-chain resilience.

This comprehensive research report examines key regions that drive the evolution of the Non-invasive Aesthetic Treatment market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Key competitive behaviors and strategic priorities among manufacturers and service providers that shape product innovation, channel defense and supplier selection

Company-level behavior in the non-invasive aesthetic space reflects three persistent priorities: expand clinical indications through incremental innovation, reduce total cost of ownership for clinic customers, and defend distribution relationships that secure recurring consumables revenue. Larger established device and injectable manufacturers are investing in modular platforms, improved applicators and procedural adjuncts that promise higher throughput and stronger outcome consistency, while smaller and mid-sized firms focus on niche innovations and responsive service models that can win specialized clinic accounts.

Strategic activity also points to consolidation and strategic partnerships: device OEMs are entering co-development agreements with clinical research centers to accelerate evidence generation, filler and toxin developers are deepening relationships with specialty distributors to protect channel access, and digital health and e-commerce players are experimenting with integrated customer journeys that combine education, booking and follow-up care. Additionally, cross-border trade and tariff pressures are compelling companies to re-evaluate manufacturing footprints and inventory strategies, with some prioritizing regional distribution centers and selective reshoring to protect margins and customer service levels. For purchasers, supplier selection now weighs clinical performance alongside supply-chain transparency and the ability to provide training, service, and bundled maintenance offerings that reduce clinic downtime.

This comprehensive research report delivers an in-depth overview of the principal market players in the Non-invasive Aesthetic Treatment market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AbbVie Inc.

- Alma Lasers Ltd.

- Bausch Health Companies Inc.

- Candela Corporation

- Classys Inc.

- Cutera, Inc.

- Cynosure, LLC

- El.En S.p.A.

- EndyMed Medical Ltd.

- Fotona d.o.o.

- Galderma S.A.

- Jeisys Medical Inc.

- Lumenis Ltd.

- Lutronic Corporation

- Merz Pharma GmbH & Co. KGaA

- Revance Therapeutics, Inc.

- Sciton Inc.

- Sinclair Pharma Ltd.

- Solta Medical, Inc.

- Venus Concept Group Inc.

- Viveve Medical Inc.

- ZELTIQ Aesthetics Inc.

Practical, revenue-focused recommendations to strengthen procurement resilience, elevate clinical standards and optimize multi-channel commercialization

Industry leaders should take three pragmatic steps to preserve growth, protect margins and strengthen patient safety as the market evolves. First, align procurement and clinical operations to create a single view of supplier risk: procurement must quantify tariff exposure and inventory lead times while clinical leads map which devices and consumables are mission-critical to patient throughput and outcomes. That joint view enables prioritized supplier diversification and targeted safety stocks.

Second, invest in outcome standardization and credentialed training programs that protect brands and clinicians. As provider choice becomes a central differentiator, manufacturers and large clinic groups that fund robust onboarding, competency assessments and data-backed outcome tools will reduce complication rates and improve repeat business. Third, embrace channel heterogeneity by building flexible go-to-market models: combine direct sales for capital equipment with partnerships with hospital pharmacies and compliant online pharmacy channels for consumables and maintenance therapy, while piloting manufacturer-direct platforms where regulations permit. Executing these actions will create durable commercial advantage, lower operational disruption risk, and deliver consistent patient experiences across sites of care.

A transparent research methodology combining primary interviews, secondary validation and scenario modelling to produce operationally relevant strategic insights

The research underpinning these insights combines qualitative interviews, secondary policy and clinical literature review, device and regulatory filings, and supply-chain mapping to create a multidimensional view of the non-invasive aesthetic landscape. Primary research included structured interviews with clinicians, procurement leaders, device manufacturers and distribution partners that informed supplier risk profiles and adoption barriers. Secondary sources were used to validate trends in procedural volumes, regulatory shifts and channel evolution, and to triangulate where tariff policy is materially affecting procurement choices.

Analytical methods included categorical segmentation across treatment types, end-user profiles, and distribution channels, scenario modelling of tariff impact on consumable pricing and procurement lead times, and a synthesis of clinical adoption drivers for energy-based and injectable therapeutics. The methodology prioritized transparent assumptions, reproducible scenarios, and an emphasis on operational implications so decision-makers can translate high-level trends into budgetary and clinical actions. Limitations were addressed by sensitivity testing across supply-shock scenarios and by soliciting independent clinician review to ensure clinical practicality and safety considerations are fully represented.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Non-invasive Aesthetic Treatment market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Non-invasive Aesthetic Treatment Market, by Treatment Type

- Non-invasive Aesthetic Treatment Market, by End User

- Non-invasive Aesthetic Treatment Market, by Distribution Channel

- Non-invasive Aesthetic Treatment Market, by Region

- Non-invasive Aesthetic Treatment Market, by Group

- Non-invasive Aesthetic Treatment Market, by Country

- United States Non-invasive Aesthetic Treatment Market

- China Non-invasive Aesthetic Treatment Market

- Competitive Landscape

- List of Figures [Total: 15]

- List of Tables [Total: 1590 ]

Concise conclusion that synthesizes growth opportunity with actionable imperatives to manage tariff risk, clinical standards and channel evolution

In conclusion, leaders in the non-invasive aesthetic treatment space face an environment of durable demand coupled with greater operational complexity. Technological advances and shifting patient expectations favor multi-modal, less invasive care pathways, yet evolving trade policy and channel innovation introduce novel execution risks. The right response is not to choose between growth and resilience but to embed both by synchronizing procurement, clinical governance and commercial strategy.

Practically, that means prioritizing supplier diversification where tariff exposure is highest, investing in clinician training and outcome measurement to protect brand and patient safety, and experimenting with distribution models that improve access without sacrificing regulatory compliance. Decision-makers who act early to align these elements can convert market uncertainty into strategic advantage, capture incremental revenue from new procedural bundles, and sustain patient trust as the industry professionalizes further.

Secure the full non-invasive aesthetic treatments market research report through a direct consultative briefing with the Associate Director of Sales and Marketing

To act on the findings in this executive summary and secure the full market research report, please reach out to Ketan Rohom (Associate Director, Sales & Marketing). Request access to the comprehensive dataset, methodology appendix, and tailored briefings to align the research insights with your strategic priorities. A direct conversation will allow us to walk through the report’s bespoke segmentation, regional breakdowns, regulatory scenarios, and supplier risk maps so you can prioritize investment, procurement, and partnership opportunities immediately.

For organizations seeking an enterprise briefing or a customized slide deck that extracts implications for procurement, clinical adoption, or commercial go-to-market, a consultation with Ketan will accelerate time-to-decision and translate the research into executable next steps. The full report contains operational playbooks, supplier scorecards, and example migration timelines that are essential for teams preparing capital requests, clinical pilots, or cross-border sourcing shifts.

If you are ready to move from insights to action, request a meeting with Ketan to arrange a preview briefing and receive a proposal for licensing the report and scheduling a tailored executive workshop. That conversation will establish timelines, deliverables, and the specific support packages available to help you operationalize the research findings.

- How big is the Non-invasive Aesthetic Treatment Market?

- What is the Non-invasive Aesthetic Treatment Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?