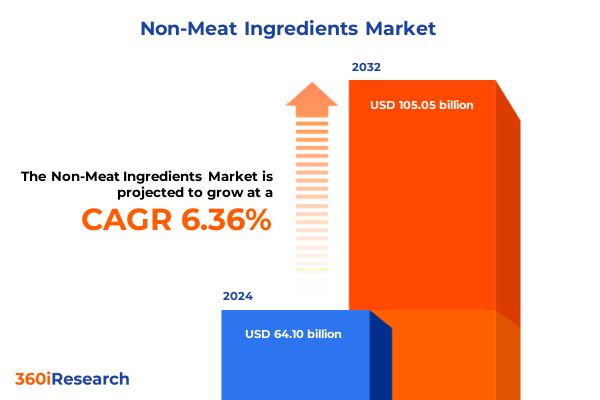

The Non-Meat Ingredients Market size was estimated at USD 68.05 billion in 2025 and expected to reach USD 72.26 billion in 2026, at a CAGR of 6.39% to reach USD 105.05 billion by 2032.

Unveiling the Strategic Imperative of Non-Meat Ingredients to Drive Innovation, Sustainability, and Consumer Appeal in Evolving Global Food Systems

Non-meat ingredients have emerged as a transformative force within the broader food innovation ecosystem, driven by consumers’ heightened awareness of health, sustainability, and ethical sourcing. As dietary preferences shift and regulatory landscapes evolve, a comprehensive understanding of this category becomes imperative for stakeholders seeking to maintain competitive agility. This report illuminates the critical drivers, from breakthrough fermentation technologies to the rising appeal of plant-derived nutrition, mapping the trajectory of non-meat solutions in the context of contemporary market demands.

In this introduction, we establish the strategic imperative for industry participants to integrate non-meat ingredients into their R&D pipelines and product offerings. Companies that effectively harness algae protein’s nutritional density, exploit the functional versatility of fermentative approaches, or unlock alternative sources such as insect protein will differentiate themselves in an increasingly crowded marketplace. By setting the stage with a clear articulation of current dynamics and underlying motivations, this section prepares readers to engage with the detailed analyses that follow.

Mapping the Pivotal Technological, Consumer, and Regulatory Transformations Reshaping the Non-Meat Ingredients Landscape Worldwide

The non-meat ingredients landscape has undergone a series of transformative shifts in recent years, propelled by rapid advancements in biotechnology and shifting consumer mindsets toward wellness and environmental stewardship. One pivotal change involves the maturation of precision fermentation platforms, which now enable cost-effective, scalable production of high-purity proteins previously attainable only through animal systems. Concurrently, plant protein innovations-in particular those derived from pea and soy isolates-have achieved textural and sensory benchmarks that rival traditional animal-based counterparts, further bolstering adoption in mainstream applications.

Alongside technological leaps, evolving dietary philosophies have redefined value propositions. A growing demographic prioritizes clean-label solutions and transparent ingredient sourcing, pressing manufacturers to validate claims through third-party certifications and life-cycle assessments. Regulatory bodies have also stepped in to harmonize standards for novel protein sources such as insect-derived powders, creating a clearer pathway to commercialization. These intersecting vectors of technology, consumer preference, and policy reform are collectively redrawing the competitive map, demanding that companies remain agile in both product development and go-to-market strategies.

Assessing the Far-Reaching Consequences of 2025 United States Tariffs on Non-Meat Ingredient Supply Chains and Competitive Dynamics

The introduction of United States tariffs on a range of non-meat inputs has reverberated across global supply chains, prompting manufacturers to reevaluate import dependencies and recalibrate sourcing strategies. With tariffs taking effect in 2025, key inputs such as algae-derived extracts and specialty protein concentrates encountered heightened duty structures, elevating landed costs and shrinking margin profiles for downstream processors. This shift galvanized the search for alternate supply corridors, as companies in North America and beyond sought to mitigate exposure by diversifying procurement to regions offering preferential trade agreements.

Moreover, the tariff landscape intensified competitive pressures among domestic and international suppliers. U.S.-based processors capitalized on proximity advantages and lower inbound costs, positioning domestically produced pea and soy proteins as more attractive options. At the same time, non-U.S. exporters focused on value-added formulations-such as microgranulated powders and flavor concentrates-to justify higher landed costs. Collectively, these dynamics reshuffled traditional sourcing paradigms, compelling organizations to adopt more robust risk management frameworks and to explore nearshoring and co-manufacturing arrangements.

Deconstructing the Multifaceted Non-Meat Ingredients Market Through Type, Application, Formulation, and Distribution Channel Segmentation

A nuanced segmentation lens reveals significant variations in growth drivers and strategic imperatives across product categories, usage contexts, delivery formats, and market access channels. Within the ingredient-type taxonomy, algae protein segments such as chlorella and spirulina stand out for their high nutrient density and functional versatility, while fermentatively produced proteins offer a customizable amino acid profile that appeals to premium nutrition brands. Insect-derived proteins continue to carve out niche applications where sustainability credentials outweigh cost considerations, even as plant-based proteins-ranging from pea protein isolate to textured soy protein-dominate mainstream formulations.

Equally critical is the application dimension, where culinary sectors such as bakery, dairy alternatives, and meat alternatives have become primary battlegrounds for innovation. Bread and cracker formulators integrate specialized protein concentrates to enhance texture and protein content without compromising taste, whereas functional beverages and smoothies rely on microgranulated powders for rapid solubility. Beyond formulating potential, the four distinct product forms-from liquid extracts suited for sauces and soups to spray-dried powders optimized for bars and nutrition shakes-demand tailored processing expertise. Distribution channels further shape go-to-market approaches, as convenience stores and online retail carve dedicated category space while restaurants and catering services experiment with novel non-meat applications to meet guest expectations.

This comprehensive research report categorizes the Non-Meat Ingredients market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Application

- Form

- Distribution Channel

Analyzing Regional Dynamics and Growth Trajectories Across the Americas, EMEA, and Asia-Pacific Non-Meat Ingredients Markets

Regional variation in non-meat ingredient adoption has emerged as a defining factor in global strategy formulation. In the Americas, robust investment in domestic pea and soy processing infrastructure has lowered entry barriers for plant-protein innovations, enabling rapid portfolio extensions in snacks and functional beverages. Shoppers in Europe, the Middle East, and Africa increasingly favor sustainably sourced algae and emergent fermentation-derived proteins, supported by comprehensive policy initiatives and research grants channeling resources toward local biomanufacturing hubs. In parallel, evolving food-service landscapes in EMEA cater to premium plant-based dining experiences, with major quick-service restaurant chains integrating meat alternatives into core menus.

Across Asia-Pacific, consumer demand exhibits notable regional differentiation: East Asian markets invest heavily in fermented protein technologies, aligning with traditional fermentation practices, while Southeast Asian nations leverage abundant insect biomass for cost-competitive protein ingredients. Australia and New Zealand have emerged as early adopters of regenerative algal cultivation, exporting high-purity extracts to North America and Europe. These regional insights underscore the necessity of tailoring investment priorities and collaboration frameworks to align with unique consumer preferences, regulatory environments, and supply-chain capabilities.

This comprehensive research report examines key regions that drive the evolution of the Non-Meat Ingredients market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Strategic Initiatives, Competitive Positioning, and Innovation Portfolios of Leading Non-Meat Ingredient Providers and Collaborators

Leading non-meat ingredient suppliers have responded to intensifying competition by sharpening their focus on innovation pipelines and strategic partnerships. Key players have forged alliances with biotechnology firms to accelerate the commercialization of precision fermentation platforms, simultaneously establishing joint ventures with foodservice groups to co-develop applications that resonate with end consumers. These collaborative models often integrate pilot-scale production facilities, enabling rapid proof-of-concept trials that inform scalable manufacturing designs.

In parallel, top-tier ingredient providers have placed a premium on vertical integration to secure intellectual property assets and to capture margin through proprietary extraction and drying techniques. Investments in microencapsulation and flavor-concentrate technologies have yielded differentiated solutions tailored for soups, sauces, and ready-meal segments, where taste and shelf stability are paramount. This dual emphasis on horizontal partnerships and vertical capabilities has propelled a competitive environment in which nimble, innovation-led organizations can quickly outmaneuver larger incumbents.

This comprehensive research report delivers an in-depth overview of the principal market players in the Non-Meat Ingredients market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Advanced Food Systems, Inc.

- Aliseia SRL

- Archer Daniels Midland Company

- Associated British Foods plc

- Axiom Foods, Inc.

- BASF SE

- Beneo GmbH

- Cargill, Incorporated

- Corbion N.V.

- CP Kelco

- Danisco

- DuPont de Nemours, Inc.

- Emsland Group

- Essentia Protein Solutions Holdings, Inc.

- Givaudan SA

- Glanbia plc

- Ingredion Incorporated

- Kerry Group plc

- Koninklijke DSM N.V.

- MGP Ingredients, Inc.

- Redbrook Ingredient Services Limited

- Roquette Frères S.A.

- Tate & Lyle PLC

- Wenda Ingredients

- Wiberg GmbH

Providing Targeted Strategic and Tactical Recommendations to Propel Industry Leaders Toward Sustainable Growth and Unmatched Market Leadership

To maintain and expand market leadership, industry stakeholders must adopt a suite of targeted strategic actions. First, establishing integrated R&D consortia that unify ingredient suppliers, technology innovators, and brand owners will accelerate the translation of novel protein platforms into commercially viable products. Second, companies should prioritize modular manufacturing investments-such as scalable fermentation vessels and advanced spray-drying units-to adapt production capacity swiftly in response to demand fluctuations.

In addition, organizations should refine their procurement strategies by cultivating a diversified supply base across multiple geographies, thereby mitigating tariff-related exposure and logistical disruptions. Parallel efforts must address sustainability imperatives, with a focus on securing certifications and conducting full life-cycle assessments to substantiate environmental claims. Finally, amplifying consumer engagement through targeted education campaigns-highlighting the nutritional and ecological benefits of non-meat ingredients-will foster broader acceptance and premium positioning.

Detailing the Robust, Multi-Modal Research Framework Underpinning Comprehensive Insights into Non-Meat Ingredient Market Dynamics

This report’s insights derive from a robust research framework that combines quantitative data analysis with qualitative expert input. Primary research included structured interviews with senior executives across ingredient suppliers, food processors, and brand marketers, as well as consultations with regulatory authorities and trade associations. Secondary research encompassed the systematic review of peer-reviewed journals, industry white papers, and technical patents to capture emerging innovations and intellectual property trends.

Analytical rigor was ensured through the triangulation of multiple data sources, including global trade flows, tariff schedules, and consumption patterns across key regions. A custom database tracked shipment volumes and price indices for major non-meat ingredient categories, while scenario modeling projected the impact of policy variables-such as the 2025 United States tariffs-on supply chain dynamics. Throughout this methodology, stringent validation protocols guaranteed accuracy, enabling stakeholders to trust the report’s foresights.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Non-Meat Ingredients market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Non-Meat Ingredients Market, by Type

- Non-Meat Ingredients Market, by Application

- Non-Meat Ingredients Market, by Form

- Non-Meat Ingredients Market, by Distribution Channel

- Non-Meat Ingredients Market, by Region

- Non-Meat Ingredients Market, by Group

- Non-Meat Ingredients Market, by Country

- United States Non-Meat Ingredients Market

- China Non-Meat Ingredients Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 3180 ]

Synthesizing Critical Findings From Market Dynamics and Technological Advances to Illuminate the Path Forward for Non-Meat Ingredients Stakeholders

The convergence of technological innovation, evolving consumer preferences, and regulatory recalibrations is redefining the non-meat ingredients landscape at an unprecedented pace. Algae and precision-fermented proteins now rival conventional sources in both performance and sustainability metrics, while plant-based isolates continue to enhance textural and functional attributes across a myriad of applications. These developments, when coupled with regional policy drivers and shifting tariff regimes, underscore a period of dynamic recalibration for supply chains and go-to-market strategies.

As companies navigate this complexity, the ability to synthesize detailed segmentation insights with agile procurement and production approaches will differentiate winners from laggards. Embracing collaborative innovation models, investing in adaptive manufacturing platforms, and engaging consumers with transparent sustainability narratives will collectively shape the sector’s trajectory. By leveraging the comprehensive analyses and foresights provided herein, decision-makers can confidently chart a course that aligns with both near-term imperatives and long-term growth ambitions.

Partner With Ketan Rohom to Acquire In-Depth Non-Meat Ingredients Market Research and Secure Your Competitive Advantage Today

The future of your product development and market strategy hinges on timely, data-driven insights tailored to the non-meat ingredients sector. Engage directly with Ketan Rohom to gain privileged access to a meticulously crafted report that delves into evolving consumer preferences, regulatory shifts, and technological breakthroughs across the global landscape. With an emphasis on granular segmentation, competitive intelligence, and actionable foresights, this report equips decision-makers with the strategic clarity required to outpace competitors and capitalize on emerging opportunities.

By partnering with Ketan Rohom, you leverage a consultative approach that blends rigorous analysis with industry know-how, ensuring that your organization can navigate tariff fluctuations, optimize supply chains, and refine product portfolios in real time. Whether your focus lies in algae proteins or plant-based innovations, this research report offers the clarity and confidence needed to drive sustainable revenue growth. Reach out now to secure your copy and transform strategic ambition into market leadership.

- How big is the Non-Meat Ingredients Market?

- What is the Non-Meat Ingredients Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?