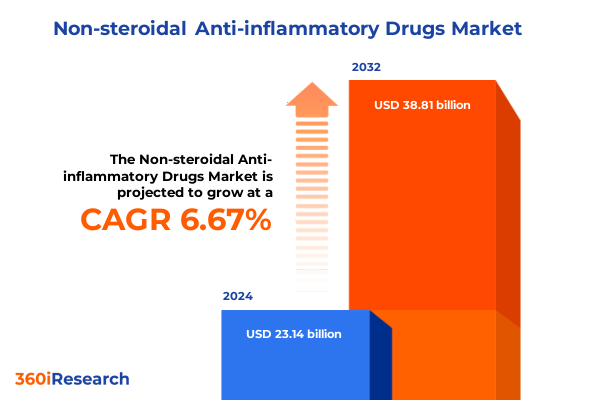

The Non-steroidal Anti-inflammatory Drugs Market size was estimated at USD 24.62 billion in 2025 and expected to reach USD 26.22 billion in 2026, at a CAGR of 6.71% to reach USD 38.81 billion by 2032.

Unveiling the Surging Demand and Strategic Importance of Non-Steroidal Anti-Inflammatory Drugs in Modern Healthcare Paradigms

To understand the pivotal role of non-steroidal anti-inflammatory drugs, it is essential to recognize their fundamental contribution to contemporary healthcare strategies. These therapeutic agents have become synonymous with the effective management of acute and chronic pain, supporting patient well-being across diverse clinical contexts. From alleviating post-operative discomfort to controlling long-term inflammatory conditions, their pharmacological profile has established them as cornerstones in treatment regimens worldwide. At the same time, the escalating emphasis on patient-centric care and safety protocols has driven manufacturers and healthcare providers to continuously refine formulations and delivery mechanisms.

In this context, the present analysis examines the evolving dynamics that define the NSAI drug sector. Beginning with the identification of disruptive trends reshaping research and development pipelines, it then explores regulatory adjustments that have influenced supply chain resilience. Moreover, the study illuminates the competitive landscape by spotlighting leading organizations and breakthrough collaborations. Through this structured approach, readers gain a holistic view of both the strategic imperatives and operational challenges that characterize the field, positioning stakeholders to make informed choices and anticipate future trajectories.

Navigating the Transformative Dynamics Shaping the Future of Non-Steroidal Anti-Inflammatory Drug Development and Delivery

In recent years, technological advances have exerted a transformative influence on drug discovery and formulation processes. Artificial intelligence and machine learning algorithms now expedite the identification of novel molecular targets, enabling research teams to predict anti-inflammatory efficacy with heightened accuracy. Simultaneously, digital health platforms have empowered patients to monitor their response to treatment regimens in real time, fostering a shift toward personalized medicine. Consequently, pharmaceutical developers are increasingly investing in adaptive clinical trials and companion diagnostics to optimize therapeutic outcomes and minimize adverse reactions.

Beyond digital integration, sustainability considerations have emerged as critical drivers of change. Green chemistry initiatives are reducing solvent usage and waste generation in active pharmaceutical ingredient production, while biodegradable excipients are gaining traction. Regulatory bodies, moreover, are introducing guidelines that incentivize eco-friendly manufacturing practices. As a result, companies that embrace circular economy principles and resource-efficient operations differentiate themselves within the NSAI drug arena. Collectively, these shifts underscore a broader transition toward agile, patient-focused ecosystems that balance innovation with environmental stewardship.

Assessing the Ripple Effects of 2025 United States Tariffs on Non-Steroidal Anti-Inflammatory Drug Supply Chains and Stakeholders

The implementation of new United States tariff policies in 2025 has introduced a complex set of considerations for manufacturers and distributors in the NSAI drug sector. Suppliers reliant on imported active pharmaceutical ingredients have experienced elevated input costs, compelling procurement teams to reassess sourcing strategies. In response, organizations have pursued diversified supplier portfolios, including partnerships with contract manufacturers in regions less affected by tariff burdens. Simultaneously, logistics operations have adapted through the consolidation of shipments and the optimization of freight routes to mitigate elevated duties.

Moreover, pricing structures have encountered pressure as cost increases ripple through distribution channels. Healthcare providers and payers have tightened reimbursement frameworks, prompting manufacturers to explore value-based contracting arrangements. At the same time, regulatory authorities are monitoring the situation to ensure patient access remains unaffected. Through collaborative dialogues with trade associations and policy advocates, industry leaders are shaping mitigation proposals designed to stabilize supply resilience. In this way, stakeholders continue to navigate tariff-related disruptions while safeguarding the availability and affordability of essential anti-inflammatory therapies.

Revealing Critical Segmentation Insights to Enhance Market Penetration and Stakeholder Targeting in the NSAI Drug Landscape

Insight into consumer and institutional preferences becomes clearer when evaluating how the NSAI drug landscape intersects with distribution and administration factors. When examining distribution channels such as over the counter and prescription, it is evident that self-care initiatives and pharmacist-led consultations have elevated the prominence of non-prescription formulations in managing everyday pain and inflammation. Meanwhile, specialized clinics and hospital settings continue to depend on prescription pathways to address acute and complex cases. Transitioning to route of administration perspectives, the oral format remains a mainstay thanks to its convenience and patient familiarity, yet parenteral alternatives provide controlled dosing in acute care environments and topical applications deliver targeted relief with reduced systemic exposure.

Alongside these considerations, drug class distinctions reveal strategic opportunities within the sector. While conventional nonselective COX inhibitors maintain broad utilization due to cost-effectiveness and established efficacy profiles, the selective COX-2 segment has attracted investment for its improved gastrointestinal tolerability. From a formulation standpoint, capsules and tablets offer standardized dosing, whereas gels, creams, and transdermal patches cater to localized treatment needs and patient lifestyle factors. Additionally, powders and suspensions address pediatric and geriatric challenges by facilitating dosage flexibility. Finally, the complex interplay of end user environments-from hospital pharmacy hubs to online pharmacy platforms and traditional retail pharmacy outlets-shapes go-to-market plans, underpinning tailored engagement and distribution strategies.

This comprehensive research report categorizes the Non-steroidal Anti-inflammatory Drugs market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Drug Class

- Formulation

- Route Of Administration

- Prescription Status

- Release Type

- Patient Group

- Indication

- End User

- Distribution Channel

Comparative Overview of Regional Market Dynamics Influencing Non-Steroidal Anti-Inflammatory Drug Adoption Across Global Territories

Regional dynamics within the Americas present a diverse tapestry of regulatory frameworks, healthcare infrastructure maturity, and patient access programs. In North America, robust insurance models and streamlined approval pathways have accelerated the adoption of novel formulations, particularly among populations managing chronic inflammatory conditions. Conversely, Latin American markets are characterized by variable reimbursement systems and emerging generic competition, which have collectively driven affordability initiatives and local production partnerships. These contrasts underscore the need for nuanced approaches that align pricing strategies with local payer expectations and patient economic realities.

Turning to Europe, Middle East & Africa, regulatory harmonization efforts within the European Union have facilitated cross-border distribution efficiencies, while initiatives aimed at reducing healthcare disparities are expanding access in underrepresented regions. In Middle East and North Africa, government-driven healthcare modernization plans are supporting investments in biologics and advanced delivery technologies. Meanwhile, sub-Saharan Africa’s market remains influenced by donor-funded programs and partnerships with international organizations. In Asia-Pacific, dynamic population demographics and rising disposable incomes are fueling demand for innovative NSAI drug formulations, especially in urbanized centers. At the same time, rapidly evolving regulatory environments-from accelerated review schemes in China to digital therapeutic approvals in Japan-highlight the critical importance of local expertise in market entry and lifecycle management.

This comprehensive research report examines key regions that drive the evolution of the Non-steroidal Anti-inflammatory Drugs market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Pharmaceutical Innovators Driving Competitive Intensity and R&D Advancements in the NSAI Drug Sector

Leading pharmaceutical organizations are shaping the NSAI drug arena through a combination of strategic collaborations, pipeline diversification, and technological integration. Among these, Pfizer has explored partnerships with biotechnology firms to co-develop next-generation anti-inflammatory compounds that leverage novel molecular scaffolds. Bayer, on the other hand, has emphasized formulation innovation, expanding its topical portfolio with enhanced penetration enhancers designed to improve patient adherence. Meanwhile, Merck & Co. continues to invest in data-driven clinical trial platforms that reduce development timelines and optimize candidate selection.

Similarly, Johnson & Johnson’s research initiatives have prioritized patient safety, exemplified by the integration of real-world evidence platforms to monitor post-market performance. Novartis has demonstrated agility by repurposing its advanced nanoparticle delivery expertise to support localized anti-inflammatory therapies. These collective efforts illustrate a competitive landscape defined by specialization and cross-industry alliances. As companies navigate pricing pressures and regulatory evolution, their differential strategies-from IP lifecycle management and geographic licensing deals to sustainability-focused manufacturing-underscore the importance of strategic foresight and operational excellence.

This comprehensive research report delivers an in-depth overview of the principal market players in the Non-steroidal Anti-inflammatory Drugs market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Abbvie, Inc

- Algen Healthcare Ltd.

- Allegiant Health

- Amgen Inc.

- Amneal Pharmaceuticals LLC

- Arcutis Biotherapeutics, Inc.

- Astellas Pharma Inc.

- AstraZeneca PLC

- BASF SE

- Bayer AG

- Boehringer Ingelheim GmbH

- Bristol-Myers Squibb Company

- Clearsynth Labs Limited

- Daiichi Sankyo Company, Limited

- Dr. Reddy’s Laboratories Ltd.

- Eisai Co., Ltd.

- Eli Lilly and Company

- EMS S.A.

- Genentech, Inc. by F. Hoffmann-La Roche AG

- Gilead Sciences, Inc.

- GlaxoSmithKline PLC

- Hikma Pharmaceuticals PLC

- Incyte Corporation

- Johnson & Johnson Services, Inc.

- Merck KGaA

- Novartis AG

- Pfizer Inc.

- Pharbest Pharmaceuticals, Inc.

- Sandoz International GmbH

- Sanofi S.A.

- Spectrum Chemical Mfg. Corp.

- Sun Pharmaceutical Industries Ltd.

- Takeda Pharmaceutical Co. Ltd.

- Teikoku Seiyaku Co., Ltd.

- Teva Pharmaceutical Industries Ltd.

- Verona Pharma plc

- Viatris Inc.

Strategic Roadmap for Industry Leaders to Capitalize on Emerging Trends and Optimize Operations in the NSAI Drug Industry

To excel within the NSAI drug domain, industry leaders should prioritize collaborative innovation models that streamline candidate discovery and accelerate regulatory approvals. By establishing consortia that unite academic researchers, contract research organizations, and patient advocacy groups, organizations can harness diverse expertise and secure earlier buy-in for complex clinical programs. Furthermore, integrating advanced analytics into supply chain management will facilitate real-time visibility, enabling rapid response to tariff fluctuations and raw material constraints.

Moreover, adopting risk-sharing agreements with payers can align incentives around patient outcomes and reinforce value-based care paradigms. Executives should also evaluate the potential of digital therapeutics as adjuncts to pharmacological interventions, enhancing patient engagement and adherence. Finally, embedding sustainability metrics across R&D and manufacturing operations will not only meet emerging regulatory expectations but also strengthen brand reputation. Implementing these recommendations will position companies to navigate uncertainty, drive continuous improvement, and deliver differentiated value to stakeholders.

Comprehensive Research Methodology Framework Underpinning the Non-Steroidal Anti-Inflammatory Drugs Market Analysis and Insights

This analysis is grounded in a robust methodology that combines primary and secondary research techniques to deliver comprehensive insights. Primary research included in-depth interviews with key opinion leaders, pharmaceutical executives, and healthcare practitioners, supplemented by workshops that facilitated interactive scenario planning. These engagements provided firsthand perspectives on unmet needs, pipeline challenges, and the operational realities of tariff impacts and regulatory adjustments.

Secondary research encompassed a thorough review of peer-reviewed journals, regulatory filings, clinical trial registries, and publicly available corporate disclosures. Data triangulation ensured consistency across multiple sources, enhancing the validity of segmentation and regional insights. Furthermore, proprietary analytical frameworks were applied to evaluate competitive positioning, product life cycle stages, and innovation trajectories. Quality control measures included peer debriefing and data verification protocols, guaranteeing the reliability and relevance of the findings presented herein.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Non-steroidal Anti-inflammatory Drugs market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Non-steroidal Anti-inflammatory Drugs Market, by Drug Class

- Non-steroidal Anti-inflammatory Drugs Market, by Formulation

- Non-steroidal Anti-inflammatory Drugs Market, by Route Of Administration

- Non-steroidal Anti-inflammatory Drugs Market, by Prescription Status

- Non-steroidal Anti-inflammatory Drugs Market, by Release Type

- Non-steroidal Anti-inflammatory Drugs Market, by Patient Group

- Non-steroidal Anti-inflammatory Drugs Market, by Indication

- Non-steroidal Anti-inflammatory Drugs Market, by End User

- Non-steroidal Anti-inflammatory Drugs Market, by Distribution Channel

- Non-steroidal Anti-inflammatory Drugs Market, by Region

- Non-steroidal Anti-inflammatory Drugs Market, by Group

- Non-steroidal Anti-inflammatory Drugs Market, by Country

- United States Non-steroidal Anti-inflammatory Drugs Market

- China Non-steroidal Anti-inflammatory Drugs Market

- Competitive Landscape

- List of Figures [Total: 21]

- List of Tables [Total: 2862 ]

Synthesizing Key Findings and Strategic Imperatives to Guide Decision-Making in the Evolving NSAI Drug Ecosystem

In summary, non-steroidal anti-inflammatory drugs continue to occupy a central role in global healthcare, supported by ongoing innovation in drug discovery, delivery technologies, and sustainable manufacturing. The transformative shifts driven by digital integration and green chemistry not only enhance patient-centric care but also redefine competitive differentiation among manufacturers. Amid these developments, the 2025 United States tariff adjustments underscore the importance of supply chain agility and collaborative policy engagement to maintain patient access and operational resilience.

Looking forward, stakeholders who embrace segmentation-driven strategies-spanning distribution channels, administration routes, formulation types, and diverse end user environments-will unlock targeted growth opportunities. Regional nuances across the Americas, Europe, Middle East & Africa, and Asia-Pacific further demand tailored market entry and lifecycle management approaches. By synthesizing these insights and adhering to the actionable recommendations outlined, industry leaders can confidently navigate the evolving NSAI drug landscape and secure sustainable competitive advantage.

Engage with Our Expert to Secure Exclusive Access to In-Depth Market Intelligence on NSAI Drugs for Informed Strategic Decisions

For strategic decision-makers seeking comprehensive, data-driven insights into the complexities of the non-steroidal anti-inflammatory drugs landscape, our full report provides unparalleled depth. By partnering with Ketan Rohom (Associate Director, Sales & Marketing), you gain access to a rich repository of intelligence that illuminates evolving regulatory influences, segmentation drivers, and competitive dynamics essential for shaping future initiatives. Engaging with our tailored advisory ensures you capitalize on emerging opportunities, mitigate supply chain disruptions, and refine your strategic roadmap with confidence. Don’t miss the chance to transform high-level analysis into actionable strategies that drive sustainable growth and leadership within the NSAI drug domain. Contact Ketan Rohom today to secure your copy and elevate your organizational impact.

- How big is the Non-steroidal Anti-inflammatory Drugs Market?

- What is the Non-steroidal Anti-inflammatory Drugs Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?