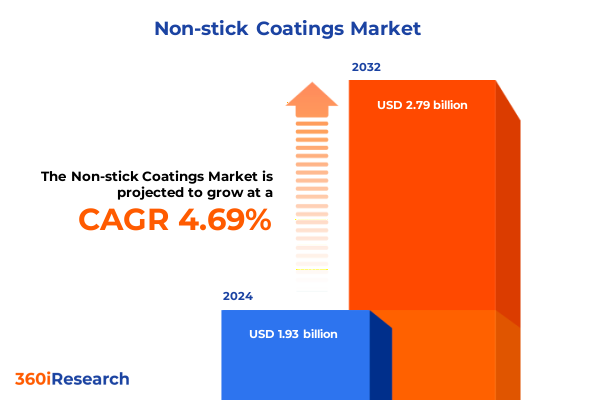

The Non-stick Coatings Market size was estimated at USD 2.03 billion in 2025 and expected to reach USD 2.10 billion in 2026, at a CAGR of 4.69% to reach USD 2.79 billion by 2032.

Navigating the Dynamic World of Non-Stick Coatings: An Overview of Market Drivers, Technologies, and Emerging Opportunities

In today’s rapidly evolving industrial landscape, non-stick coatings have transcended their traditional role to become critical enablers of efficiency, performance, and sustainability. This report opens by examining the multifaceted drivers behind the growing importance of advanced non-stick technologies, including heightened demand from consumer goods and industrial sectors for surfaces that reduce friction, resist abrasion, and simplify maintenance. Emerging applications in aerospace and electronics underscore the expansion of these coatings beyond cookware, illustrating how innovations in resin chemistry and application processes are unlocking new performance thresholds.

As environmental regulations tighten and consumer preferences shift toward eco-friendly solutions, the market is witnessing a convergence of technological innovation and regulatory compliance. Recent advancements in water-based formulations and sol-gel processes demonstrate how manufacturers are balancing performance requirements with sustainability mandates. These developments are complemented by digital transformation efforts in coating application, where robotics and precision spraying systems are enhancing uniformity and adhesion.

By setting the stage with a concise overview of key market stimuli-ranging from regulatory pressures to end-user expectations-this introduction establishes a framework for understanding the broader forces shaping non-stick coatings. It provides context for subsequent sections, offering a clear lens through which stakeholders can assess emerging trends, competitive dynamics, and strategic opportunities in this dynamic global market.

Unveiling the Forces Redefining Non-Stick Coatings: Technological Leapfrogs, Sustainability Imperatives, and Evolving Customer Expectations in Modern Industries

The non-stick coatings sphere is undergoing a paradigm shift driven by breakthroughs in material science and heightened sustainability imperatives. Cutting-edge resin systems such as ceramic hybrids and advanced PTFE composites are pushing the boundaries of thermal stability and chemical resistance, enabling performance levels previously unattainable. Concurrently, the rise of water-based and solvent-reduced formulations reflects a broader industry commitment to minimizing volatile organic compound emissions, lowering environmental impact without compromising on durability or ease of cleaning.

Beyond chemistry, application methodologies are being revolutionized through the adoption of automation and Industry 4.0 principles. Precision spraying robots and dipping technologies integrated with real-time monitoring systems are optimizing coating thickness and reducing material waste. These digital enhancements are paired with predictive maintenance frameworks, driven by data analytics, to proactively manage equipment health and ensure consistent quality across production lines.

Moreover, customer expectations are evolving in tandem with these technological strides. End users in cookware and automotive sectors increasingly demand coatings that deliver both aesthetic appeal and long-term performance under rigorous conditions. Sustainability considerations are now as critical as functionality, prompting manufacturers to pursue cradle-to-cradle lifecycle assessments and circular economy models. Together, these forces are reshaping the competitive landscape and setting new benchmarks for innovation in non-stick surface solutions.

Assessing the Ripple Effects of 2025 Tariff Adjustments: How US Trade Measures Reshaped Supply Chains, Pricing Dynamics, and Competitive Positioning in Non-Stick Coatings

The United States’ tariff adjustments implemented in early 2025 have generated notable shifts across non-stick coatings supply chains, affecting raw material sourcing, production costs, and market access. Import duties on key resin components led manufacturers to reassess procurement strategies, with some companies securing alternative suppliers in cost-advantaged regions while others invested in domestic production capabilities to mitigate exposure to fluctuating trade barriers.

These measures also influenced pricing structures across end-use applications. Cookware producers and industrial equipment manufacturers faced incremental cost pressures, which were partially offset through process optimizations and scale efficiencies. Meanwhile, segments more resilient to price sensitivities, such as aerospace coatings, absorbed tariff-related increases by emphasizing the value delivered through enhanced performance under extreme conditions.

Competitive dynamics experienced a subtle yet tangible rebalancing, as agile players with diversified supply networks gained market share. Companies that had previously established regional manufacturing footprints in Asia-Pacific or Europe were able to maintain supply continuity for North American customers, underscoring the importance of geographic flexibility. Overall, the cumulative impact of these tariffs underscored the critical need for supply chain resilience and strategic sourcing innovations within the non-stick coatings industry.

Insights Derived from Multifaceted Segmentation Analyses Reveal Application, Resin Type, End-Use, Form, Sales Channel, Packaging, and Process Trends Driving Market Nuances

Analyzing the market through the lens of application segmentation reveals that industrial uses, encompassing chemical processing, food processing, and textile processing, are increasingly driving demand for coatings engineered to withstand corrosive environments and repetitive thermal cycling. Within the consumer cookware domain, product lines focused on frying pans, grill pans, saucepans, and woks are experiencing differentiated growth trajectories, with frying pan variants demonstrating robust uptake due to shifting culinary trends. The aerospace and automotive sectors continue to adopt specialized ceramic and PTFE-based coatings to address stringent performance criteria relating to weight reduction and thermal management.

Resin type segmentation highlights the ascendancy of ceramic composites and sol-gel formulations, which offer superior scratch resistance and environmental compliance, while PTFE remains the backbone of many legacy applications. Silicone-based coatings are carving out niches in electronics, where their dielectric properties and high-temperature stability are paramount. Examining end-use segmentation further elucidates that consumer goods and food service equipment represent high-volume outlets for non-stick coatings, whereas industrial equipment and automotive applications contribute significant value through premium performance specifications.

When considering form factors, powder-based coatings are gaining traction for heavy industrial applications due to their minimal waste characteristics and ease of overspray recovery. Solvent-based systems, long favored for their glossy finish and adhesion properties, are gradually ceding ground to water-based alternatives. Insights into sales channels reveal that online distribution is emerging as a vital conduit for specialty and small-batch orders, complementing traditional brick-and-mortar routes. Packaging preferences indicate that aerosol formats are popular for end-user convenience, while buckets and cans remain standard for large-scale industrial operations. Finally, process segmentation underscores the strategic importance of spraying techniques for uniform coverage, with dipping, brushing, and rolling positioned as complementary methods for specialized or small-scale applications.

This comprehensive research report categorizes the Non-stick Coatings market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Application

- Resin Type

- End-Use Industry

- Form

- Sales Channel

- Packaging Type

- Process

Comparative Regional Dynamics Highlight How the Americas, EMEA, and Asia-Pacific Regions Exemplify Distinct Growth Drivers, Regulatory Contexts, and Market Maturity in Non-Stick Coatings

Regional dynamics in the non-stick coatings market underscore distinct patterns of demand, regulatory environments, and innovation across the Americas, Europe Middle East & Africa, and Asia-Pacific. In the Americas, a strong consumer cookware culture fuels steady consumption of PTFE-based coatings, while industrial sectors in the United States and Brazil pursue performance-driven formulations to support food processing and automotive OEMs. Regulatory authorities throughout North America have endorsed more stringent environmental guidelines, catalyzing a shift toward low-VOC and water-based systems.

The Europe Middle East & Africa region presents a complex mosaic of mature Western European markets and rapidly developing economies in the Middle East and Africa. Western Europe leads in adopting sol-gel and ceramic coating technologies, driven by rigorous environmental regulations and a focus on lightweighting in automotive and aerospace applications. In contrast, markets in the Middle East prioritize high-durability coatings for oil and gas infrastructure, whereas North African nations are beginning to explore water-based solutions to align with global sustainability frameworks.

Asia-Pacific remains the largest growth engine, propelled by robust manufacturing sectors in China, Japan, and South Korea. Demand from consumer electronics and automotive assembly lines has spurred investment in advanced fluoropolymer and silicone-based coatings. Concurrently, a burgeoning middle class across Southeast Asia is expanding the cookware segment, favoring multifunctional, non-stick products that cater to evolving culinary preferences. Across all regions, the interplay of regulation, end-user demands, and manufacturing capabilities is shaping differentiated strategies and growth trajectories.

This comprehensive research report examines key regions that drive the evolution of the Non-stick Coatings market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Industry Leaders and Emerging Competitors: Analyzing Strategic Collaborations, Innovation Portfolios, and Value Propositions of Key Non-Stick Coatings Manufacturers

The competitive landscape of non-stick coatings is characterized by a diverse array of established chemical conglomerates and agile specialty players seeking to differentiate through innovation and service excellence. Leading manufacturers have consolidated their positions by forging strategic partnerships with resin suppliers and equipment OEMs, thereby ensuring comprehensive solution portfolios that address both performance and application challenges. These companies are investing heavily in R&D centers to pioneer next-generation binder systems and eco-friendly solvent alternatives.

Simultaneously, emerging competitors are carving out niches by targeting underserved application segments, such as precision coatings for wearable electronic devices and customized formulations for artisanal cookware brands. These niche players often leverage regional manufacturing synergies to deliver rapid product development cycles and localized technical support. Collaboration between material science startups and academic institutions has also accelerated the commercialization of proprietary sol-gel processes and advanced ceramic composites.

Partnerships and joint ventures are further shaping market dynamics, as companies recognize the benefits of end-to-end service models that integrate coating formulation, application equipment, and after-sales maintenance. Value-added service offerings, including coating performance audits and predictive maintenance analytics, are becoming critical differentiators. This evolving landscape underscores the need for continuous strategic alignment to capture value in both high-volume and specialty segments of the non-stick coatings industry.

This comprehensive research report delivers an in-depth overview of the principal market players in the Non-stick Coatings market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 3M Company

- Akzo Nobel NV

- Arkema S.A

- Axalta Coating Systems

- BASF SE

- Chugoku Marine Paints Ltd

- Daikin Industries Ltd

- GMM Development Ltd

- Guangdong Huafu Fluorochemical Co Ltd

- Gujarat Fluorochemicals Ltd

- Hempel A/S

- Hengtong Fluorine

- Industrielack AG

- Jihua Polymer

- Jotun

- PPG Industries Inc

- Resonac Holdings Corporation

- RPM International Inc

- Shanghai 3F Materials Co Ltd

- Sherwin-Williams Company

- Sika AG

- Solvay S.A

- The Chemours Company

- Wacker Chemie AG

- Weilburger

Strategic Imperatives for Industry Leaders to Seize Opportunities: Recommendation Blueprint Encompassing Innovation, Sustainability, Supply Chain Resilience, and Market Expansion

Industry leaders should prioritize the development of eco-efficient formulations, leveraging advances in water-based and sol-gel technologies to meet tightening environmental regulations and appeal to sustainability-conscious end users. Establishing cross-functional innovation teams that integrate chemistry, process engineering, and digital solutions will be essential for accelerating time-to-market and enhancing product performance.

To build supply chain resilience, companies must diversify raw material sourcing by cultivating partnerships with regional suppliers and exploring alternative feedstocks. Investing in localized production hubs can mitigate geopolitical risks and reduce lead times. Embracing Industry 4.0 capabilities-such as predictive analytics and smart manufacturing platforms-will enable real-time monitoring of application processes and proactive maintenance, thereby ensuring consistent quality and minimizing downtime.

Expanding direct-to-consumer and e-commerce channels can capture emerging demand in specialty cookware and small-scale industrial markets, while traditional distribution networks should be optimized through data-driven inventory management. Furthermore, forging collaborative alliances with end users, equipment manufacturers, and research institutions will unlock co-innovation opportunities and foster ecosystem-based growth. By implementing these strategic imperatives, market participants can strengthen their competitive advantage and position themselves for sustainable long-term success.

Detailed Research Framework Explaining Data Collection, Validation Protocols, Analytical Tools, and Expert Consultations Employed to Ensure Rigorous Non-Stick Coatings Market Analysis

This research employs a multi-stage framework integrating primary and secondary data sources to ensure a robust analysis of the non-stick coatings market. Primary insights were gathered through structured interviews with coating formulators, equipment OEM executives, and end users across key industries, capturing firsthand perspectives on performance requirements and application challenges. Secondary research encompassed regulatory publications, industry journals, patent filings, and public company disclosures to map technological trends and competitive dynamics.

Data validation protocols included triangulation of stakeholder inputs with quantitative and qualitative indicators, ensuring consistency and reliability. Advanced analytical tools, such as statistical correlation models and scenario planning techniques, were applied to assess interdependencies among material innovations, process efficiencies, and end-use adoption. Expert consultations with material scientists and market strategists provided peer validation of key findings and ensured alignment with emerging industry benchmarks.

The overall methodology emphasizes transparency and reproducibility, with clearly documented assumptions, data sources, and analytical procedures. By combining empirical evidence with expert judgment, this study delivers a rigorous and actionable market overview that informs strategic decision-making across the non-stick coatings value chain.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Non-stick Coatings market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Non-stick Coatings Market, by Application

- Non-stick Coatings Market, by Resin Type

- Non-stick Coatings Market, by End-Use Industry

- Non-stick Coatings Market, by Form

- Non-stick Coatings Market, by Sales Channel

- Non-stick Coatings Market, by Packaging Type

- Non-stick Coatings Market, by Process

- Non-stick Coatings Market, by Region

- Non-stick Coatings Market, by Group

- Non-stick Coatings Market, by Country

- United States Non-stick Coatings Market

- China Non-stick Coatings Market

- Competitive Landscape

- List of Figures [Total: 19]

- List of Tables [Total: 1590 ]

Summarizing the Strategic Takeaways: Integrative Perspective on Technological Momentum, Market Dynamics, and Strategic Pathways Shaping the Future of Non-Stick Coatings

In synthesizing the insights from this report, it becomes evident that non-stick coatings are at the nexus of material innovation, environmental stewardship, and digital transformation. The convergence of advanced resin chemistries and automated application processes is setting new performance benchmarks, while evolving regulatory frameworks are accelerating the adoption of sustainable alternatives. Moreover, the interplay of regional market drivers-from the regulatory rigor in Europe to manufacturing scale in Asia-Pacific-highlights the importance of tailored strategies.

Key industry players must balance the pursuit of technological excellence with the imperative of supply chain resilience, particularly in light of recent trade policy shifts. Strategic segmentation analysis underscores the diverse requirements across applications, resin types, and end-use industries, pointing to significant opportunities in niche markets such as precision electronics coatings and high-durability industrial surfaces. Complementing these insights, actionable recommendations emphasize the need for cross-functional innovation, digital integration, and collaborative ecosystems.

Ultimately, the future trajectory of non-stick coatings will hinge on the ability of stakeholders to navigate complex market dynamics and harness emerging technologies. By adopting a holistic approach that aligns product development, regulatory compliance, and customer-centric service models, organizations can secure sustainable growth and drive the next wave of breakthroughs in surface engineering.

Engage with Associate Director Ketan Rohom to Access In-Depth Market Intelligence Report and Drive Your Non-Stick Coatings Strategy Forward with Comprehensive Insights

To gain a comprehensive understanding of non-stick coatings and their transformative potential, connect directly with Ketan Rohom, whose expertise bridges sales, marketing, and deep technical insights. Engaging Ketan will unlock access to a detailed market intelligence report that delves into emerging resin innovations, regulatory considerations, and competitive strategies. By partnering with Ketan, organizations can tailor their approach to capitalize on technological breakthroughs and evolving customer demands.

This call-to-action is designed to accelerate decision-making and guide resource allocation by offering unparalleled visibility into market dynamics. Ketan’s report provides comparative analyses across regional landscapes, strategic profiles of key industry players, and actionable recommendations grounded in rigorous methodology. Reaching out to Ketan will enable you to harness this wealth of information and refine your roadmap for growth, sustainability, and operational resilience.

Elevate your strategic initiatives by securing this market research asset today. Schedule a consultation with Ketan Rohom, Associate Director of Sales & Marketing, and transform insights into competitive advantage. The next leap forward in non-stick coatings innovation awaits-engage with Ketan to ensure your organization remains at the forefront of this rapidly evolving industry.

- How big is the Non-stick Coatings Market?

- What is the Non-stick Coatings Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?