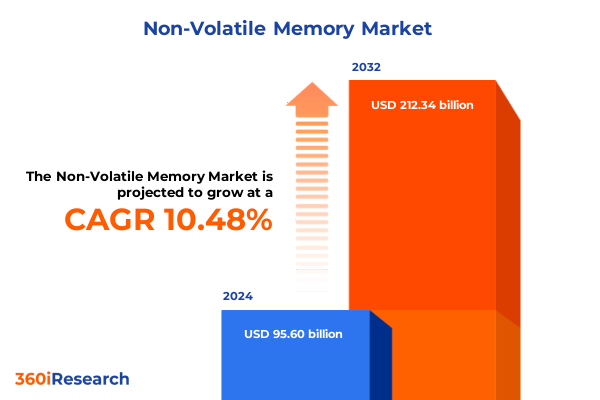

The Non-Volatile Memory Market size was estimated at USD 105.46 billion in 2025 and expected to reach USD 116.33 billion in 2026, at a CAGR of 10.51% to reach USD 212.34 billion by 2032.

Discovering the transformative power of non-volatile memory technologies shaping the future of data storage and digital innovation

Non-volatile memory technologies have emerged as foundational elements in the digital era, underpinning everything from consumer electronics to enterprise data centers. As data generation accelerates exponentially, the need for reliable, high-performance storage solutions has never been more critical. This executive summary introduces the transformative potential of non-volatile memory, highlighting how advances in materials science and device engineering are redefining storage paradigms. With persistent data retention, low power consumption, and scalable architectures, these technologies are fundamental to enabling next-generation applications such as edge computing, artificial intelligence inference, and immersive virtual reality experiences.

In this introduction, readers will gain an appreciation for the strategic importance of non-volatile memory across diverse end-use sectors. By examining recent innovations and industry drivers, we set the stage for a deeper exploration of market dynamics, regulatory developments, and competitive strategies. This section establishes the context for understanding why non-volatile memory is not merely a component but a catalyst for digital transformation. It also underscores the urgency for stakeholders to stay abreast of technological shifts and policy changes that influence supply chains and investment decisions.

Through a concise yet comprehensive overview, this introduction equips decision-makers with a clear understanding of the central themes that will be unpacked in subsequent sections. The stage is thus set to explore the disruptive trends, tariff impacts, segmentation insights, and actionable recommendations that define the modern non-volatile memory landscape.

Examining how breakthroughs in emerging memory architectures and materials are disrupting traditional storage paradigms and unlocking new possibilities

The non-volatile memory landscape is undergoing a period of unprecedented disruption driven by breakthroughs in emerging memory architectures and novel material innovations. Historically, NAND flash and NOR flash dominated the market by providing scalable solutions for persistent storage. However, the introduction of emerging non-volatile memory variants such as ferroelectric RAM, magnetoresistive RAM, phase-change memory, and resistive RAM is challenging traditional hierarchies. These technologies promise lower latency, higher endurance, and more energy-efficient operation, opening new frontiers in real-time analytics and ultra-fast system boot cycles.

Equally transformative are the advancements in 3D stacking and new fabrication techniques that enable higher density at competitive cost structures. As manufacturers refine process nodes and integrate heterogeneous memory arrays on a single die, system architects can now design devices with tiered storage that automatically migrate data based on performance requirements. This shift accelerates the convergence of memory and storage, blurring the lines between volatile and persistent layers.

The interplay between hardware innovation and software optimization further amplifies the impact of these shifts. Memory-aware file systems, intelligent caching algorithms, and real-time data orchestration platforms are co-evolving with device capabilities. Consequently, organizations that embrace both hardware and software co-design strategies are poised to unlock new levels of efficiency and responsiveness. In turn, this dynamic ecosystem is reshaping competitive landscapes and prompting stakeholders to revisit long-held assumptions about system architectures.

Analyzing the cascading effects of 2025 United States tariffs on semiconductor memory imports and their implications for supply chain resilience

In 2025, the United States implemented a new set of tariffs on imported semiconductor memory products, aimed at bolstering domestic manufacturing and securing critical supply chains. These measures introduced additional duties on both finished memory modules and component dies, influencing the cost structures for OEMs and contract manufacturers. Although designed to incentivize onshore production, the tariffs also generated ripple effects across global sourcing strategies, prompting companies to reassess supplier diversification and buffer inventory levels.

Many manufacturers faced near-term challenges as procurement teams scrambled to mitigate cost increases through contract renegotiations and dual sourcing agreements. At the same time, regional fabrication facilities ramped up capacity expansions under government subsidy programs, gradually offsetting higher import costs. This transitional period highlighted the tension between policy objectives and market realities, as stakeholders weighed the benefits of supply chain resilience against margin pressures.

Over the course of several months, downstream integrators and system assemblers adjusted pricing models to reflect the incremental duties. In parallel, design teams explored opportunities to optimize memory footprints, balancing performance requirements with cost containment. While tariff reductions or exemptions were negotiated in limited cases, the broader landscape emphasized the need for agile planning and real-time tariff tracking. Ultimately, the 2025 tariff paradigm underscored the strategic imperative for memory providers and end-users to embed policy foresight into their operational roadmaps, ensuring adaptability amid evolving trade regulations.

Deriving actionable segmentation insights by delving into memory types applications end users architectures and interface preferences driving market dynamics

A nuanced segmentation analysis reveals the multifaceted drivers influencing non-volatile memory demand across memory type, application, end-user, architecture, and interface dimensions. When examined by memory type, the market encompasses the established NAND flash and NOR flash technologies alongside an emerging category of non-volatile memories that include ferroelectric memory (FeRAM), magnetoresistive memory (MRAM), phase-change memory (PCM), and resistive memory (ReRAM). This intricate tapestry underscores how novel physics-based approaches are extending the boundaries of performance and durability beyond traditional silicon-based flash.

From an application perspective, memory usage spans embedded modules, removable flash cards, solid-state drives, and USB-based storage solutions. Embedded memory further segments into eMMC, NVMe BGA, and UFS formats optimized for mobile and IoT platforms. Flash cards diversify into microSD and SD variants, catering to consumer devices and specialized camera systems. Meanwhile, SSDs are tailored for enterprise data centers, large-scale cloud environments, and internal computing platforms, whereas USB drives range from encrypted and OTG-enabled models to standard high-capacity sticks, reflecting security and mobility requirements.

End-user verticals showcase the breadth of non-volatile memory applications, stretching from aerospace and defense avionics, defense electronics, and satellite systems to automotive use cases such as advanced driver assistance, electronic control units, in-vehicle infotainment, and telematics modules. The consumer electronics realm covers laptops, smartphones, tablets, and wearables, and the enterprise storage domain includes cloud storage infrastructures, data center clusters, and enterprise server farms. Industrial sectors rely on control systems, IIoT frameworks, power management units, and robotics, while telecommunications deployments span base station arrays, core network infrastructure, and high-availability servers.

Underpinning these segments are architectural choices spanning multi-level cell, quad-level cell, single-level cell, and triple-level cell configurations, each balancing cost per bit against performance and endurance. Complementing these are interface standards such as eMMC, PCIe, SATA, UFS, and USB, which determine data throughput, form factor constraints, and protocol compatibility. Together, this layered segmentation approach provides a comprehensive lens through which to evaluate competitive positioning, investment priorities, and emerging value propositions within the non-volatile memory ecosystem.

This comprehensive research report categorizes the Non-Volatile Memory market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Memory Type

- Architecture

- Interface

- Application

- End User

Highlighting regional dynamics and growth drivers across the Americas Europe Middle East Africa and Asia Pacific shaping non-volatile memory adoption patterns

Regional dynamics in the non-volatile memory market reveal distinct growth drivers and adoption patterns across the Americas, Europe Middle East and Africa (EMEA), and Asia Pacific. In the Americas, rapid expansion of hyperscale data centers and a thriving automotive technology sector underpin robust demand for high-performance SSDs and embedded memory solutions. The presence of leading chipmakers and an ecosystem of advanced packaging specialists further catalyzes innovation, positioning North America as a key hub for next-generation memory development.

Meanwhile, the EMEA region demonstrates a dual focus on defense applications and industrial automation. Aerospace systems and automated manufacturing lines are driving requirements for ruggedized non-volatile memory modules with stringent reliability specifications and extended operating ranges. Government investments in digital infrastructure and cybersecurity amplify the demand for secure storage solutions, particularly in satellite and defense electronics contexts. Moreover, the region’s commitment to sustainability is encouraging memory providers to pursue energy-efficient architectures and eco-friendly manufacturing practices.

Asia Pacific remains the epicenter of memory component production, with expansive fabrication facilities in China, Taiwan, South Korea, and Japan. End-user markets in consumer electronics and telecommunications further stimulate demand for memory cards, embedded modules, and high-density SSDs. Local supply chain integration and government incentives support accelerated capacity growth, while geopolitical considerations shape trade flows and strategic partnerships. This complex interplay of manufacturing might, policy initiatives, and end-market consumption cements Asia Pacific’s pivotal role in steering global non-volatile memory trends.

This comprehensive research report examines key regions that drive the evolution of the Non-Volatile Memory market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling leading non-volatile memory technology innovators and established manufacturers fueling competition with strategic investments and partnerships

Leading technology companies are driving the evolution of non-volatile memory through a combination of research investments, strategic partnerships, and capacity expansions. Global memory producers are intensifying efforts in emerging memory research alliances, collaborating with foundries and material science innovators to accelerate commercialization of ferroelectric and spin-based memory devices. These partnerships are essential in overcoming technical barriers such as scalability and endurance, while also ensuring supply chain security for critical raw materials.

At the same time, established flash manufacturers are ramping up production of high-density multi-level and quad-level cell architectures to address the needs of hyperscale data centers and enterprise storage arrays. They are also enhancing firmware and controller capabilities to optimize wear leveling and error correction, thereby extending device lifespans. In parallel, several integrated device manufacturers are expanding their footprint in embedded memory markets by offering turnkey solutions that combine logic and non-volatile memory on common substrates.

Recent mergers and acquisitions have further reshaped competitive dynamics, as companies seek to diversify product portfolios and secure intellectual property in advanced memory physics. By integrating complementary technology stacks, leading players are positioning themselves to capture value across multiple layers of the memory hierarchy. Additionally, newcomers in the memory space are attracting venture funding to develop niche applications, such as radiation-hardened ReRAM for space and defense use cases. Together, these strategic moves define a highly competitive environment characterized by rapid innovation cycles and evolving ecosystem alliances.

This comprehensive research report delivers an in-depth overview of the principal market players in the Non-Volatile Memory market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Avalanche Technology

- Crossbar Inc.

- Everspin Technologies Inc.

- Intel Corporation

- KIOXIA Corporation

- Micron Technology, Inc.

- Nanya Technology Corporation

- Powerchip Semiconductor Manufacturing Corporation

- Renesas Electronics Corporation

- Samsung Electronics Co., Ltd.

- SK hynix Inc.

- Texas Instruments Incorporated

- Western Digital Corporation

- Winbond Electronics Corporation

- Yangtze Memory Technologies Co., Ltd.

Outlining targeted strategies for industry leaders to navigate technological shifts tariff challenges and capitalize on emerging market segments for sustained growth

Industry leaders must adopt a multi-pronged approach to thrive amid rapid innovation and shifting policy landscapes. First, fostering close collaboration between hardware designers and software architects is critical for co-designing memory solutions that optimize system-level efficiency and performance. Early engagement in application profiling and algorithm mapping can unlock caching and tiering strategies that reduce latency and improve energy footprints.

Second, diversifying supply chains through strategic partnerships and dual sourcing agreements enhances resilience against tariff fluctuations and geopolitical disruptions. Companies should actively monitor trade policy developments and leverage localized manufacturing incentives to mitigate risks associated with import duties. Integrating real-time tariff intelligence into procurement workflows ensures agile responsiveness to regulatory changes.

Third, investing selectively in emerging memory technologies can yield competitive advantages in high-growth verticals. Establishing pilot programs for ferroelectric and phase-change memory in edge and AI inference applications allows organizations to evaluate performance benefits and integration challenges before committing to large-scale deployments. Concurrently, collaborative research initiatives with academic and industry consortia accelerate pathways to commercialization.

Finally, cultivating a data-driven culture through rigorous analytics and market intelligence empowers decision makers to anticipate technology inflection points. By synthesizing segmentation insights with regional demand patterns, leaders can refine go-to-market strategies and target high-value applications. These combined actions will position organizations to capitalize on the transformative potential of non-volatile memory innovations while navigating an increasingly complex global ecosystem.

Detailing the comprehensive research methodology integrating primary interviews quantitative analysis and secondary data sources to ensure rigorous insights validity

This research integrates a robust methodology designed to deliver actionable and reliable market insights. Primary data collection involved in-depth interviews with senior executives from leading memory manufacturers, system integrators, and end-user organizations across key verticals. These conversations provided firsthand perspectives on technology adoption timelines, supply chain strategies, and strategic priorities. Complementing these qualitative inputs, structured surveys captured quantitative metrics on deployment preferences and technology evaluations.

Secondary research encompassed comprehensive analysis of industry publications, white papers, patent filings, and regulatory filings. Technical journals and conference proceedings were reviewed to track material breakthroughs and fabrication process advancements. Trade association reports and government policy documents were analyzed to assess tariff frameworks and regional incentives. Financial disclosures from public companies offered insights into capital expenditure trends and R&D investments.

Analytical frameworks such as SWOT and Porter’s Five Forces were applied to evaluate competitive dynamics and market attractiveness across segments. Cross-validation techniques ensured consistency between primary findings and secondary data, while sensitivity analyses tested the robustness of thematic insights against varying policy scenarios. All gathered data underwent rigorous validation to eliminate biases and ensure representativeness of both established markets and emergent technology domains.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Non-Volatile Memory market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Non-Volatile Memory Market, by Memory Type

- Non-Volatile Memory Market, by Architecture

- Non-Volatile Memory Market, by Interface

- Non-Volatile Memory Market, by Application

- Non-Volatile Memory Market, by End User

- Non-Volatile Memory Market, by Region

- Non-Volatile Memory Market, by Group

- Non-Volatile Memory Market, by Country

- United States Non-Volatile Memory Market

- China Non-Volatile Memory Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 2703 ]

Summarizing core findings and strategic implications to equip decision makers with a clear understanding of non-volatile memory market trajectories and opportunities

The analysis underscores that non-volatile memory technologies are at a pivotal juncture, driven by material innovations, architectural shifts, and policy developments. Emerging memory types such as FeRAM, MRAM, PCM, and ReRAM are transitioning from laboratory prototypes to pilot deployments, signaling a reconfiguration of performance hierarchies and cost-efficiency trade-offs. At the same time, traditional NAND and NOR flash continue to evolve through advanced cell architectures and stacking techniques, preserving their relevance in mainstream storage applications.

Tariff adjustments in the United States during 2025 highlighted the strategic importance of supply chain diversification and onshore manufacturing incentives. Companies that proactively aligned procurement strategies with policy frameworks managed to minimize margin erosion and strengthen resilience. The segmentation analysis demonstrated extensive variability in performance requirements and form factor preferences across memory types, applications, end users, architectures, and interface standards, emphasizing the need for tailored go-to-market approaches.

Regional insights revealed that while the Americas and EMEA prioritize high-performance and secure storage implementations, Asia Pacific remains the primary manufacturing powerhouse. Competitive dynamics continue to intensify as established players pursue partnerships and M&A to secure technology leadership, while emerging entrants focus on niche high-value opportunities. Collectively, these findings provide a strategic roadmap for stakeholders to navigate evolving market conditions and capitalize on the next wave of memory innovation.

Inviting stakeholders to connect with Ketan Rohom for tailored insights and immediate access to the in-depth nonvolatile memory market research report

To explore the full breadth of insights uncovered in this comprehensive non-volatile memory analysis and to obtain the complete market research report tailored to your organization’s needs, we invite you to reach out directly to Ketan Rohom, Associate Director of Sales & Marketing. By engaging in a brief consultation call, you can gain immediate visibility into detailed segmentation analyses, regional dynamics, and strategic recommendations that will empower your decision-making and accelerate your competitive advantage. Ketan’s expertise in translating complex technical trends into actionable business strategies ensures that you receive a personalized briefing aligned with your priorities. Secure your access to this authoritative resource and position your team to lead in the rapidly evolving landscape of non-volatile memory technologies.

- How big is the Non-Volatile Memory Market?

- What is the Non-Volatile Memory Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?