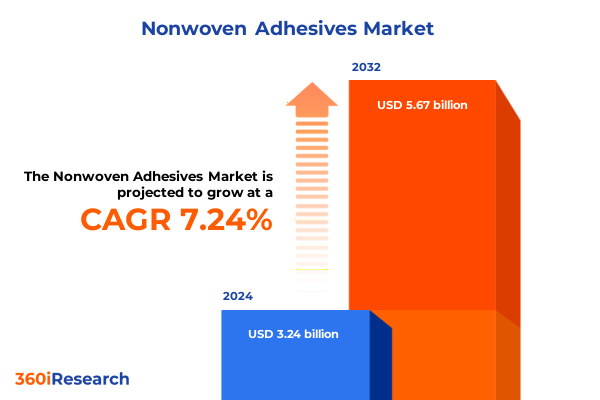

The Nonwoven Adhesives Market size was estimated at USD 3.45 billion in 2025 and expected to reach USD 3.68 billion in 2026, at a CAGR of 7.34% to reach USD 5.67 billion by 2032.

Exploring the Expanding Horizons of Nonwoven Adhesives Technology and Applications Across Diverse End-Use Sectors in Today’s Industrial Marketplace

Nonwoven adhesives have emerged as a critical enabler across multiple industries, offering tailored bonding solutions that drive performance and efficiency. This executive summary introduces the foundational concepts and highlights the versatile nature of adhesive substrates engineered to meet stringent application requirements. As end-use sectors demand lighter, stronger, and more sustainable bonding technologies, nonwoven adhesives offer a unique combination of mechanical properties and processing ease that traditional adhesive tapes and films cannot match.

Over recent years, advancements in polymer science and coating techniques have propelled nonwoven adhesives to the forefront of material innovation. They now play pivotal roles in automotive interiors, where acoustic non-wovens reduce cabin noise, and in building and construction applications, where specialized bonding layers enhance insulation and roofing durability. Beyond these uses, nonwoven adhesives contribute to hygiene products, medical dressings, and furniture manufacturing with formulations optimized for skin-friendliness, breathability, and long-term stability. This section sets the stage for understanding how nonwoven adhesives have transitioned from niche offerings to mainstream solutions that underpin critical performance attributes across disparate markets.

Analyzing Technological Breakthroughs and Regulatory Drivers That Are Reshaping the Global Nonwoven Adhesives Industry at a Critical Inflection Point

The landscape of nonwoven adhesives is undergoing transformative shifts driven by rapid technological innovation and stringent regulatory mandates. On the technology front, the maturation of hot melt systems has enabled faster curing cycles, while radiation-curable chemistries reduce volatile organic compound emissions, aligning with environmental objectives. At the same time, solvent-based and water-based formulations continue to evolve, balancing performance with compliance in regions enforcing low VOC thresholds. Consequently, manufacturers are reevaluating production lines to integrate more sustainable processes without sacrificing bonding efficacy.

In parallel, global regulatory bodies have intensified scrutiny on raw material sourcing and end-of-life disposal. This has galvanized investment in bio-based and recyclable polymers, such as silicone blends that deliver high thermal stability while easing recycling streams. Moreover, collaboration between adhesive producers and machinery suppliers has fostered modular coating stations capable of switching between chemistries with minimal downtime. As supply chains become more resilient, market entrants must anticipate both shifting legislative landscapes and emergent customer priorities emphasizing clean-label and circularity objectives.

Taken together, these dynamic forces underscore the need for strategic agility. Organizations that harness advanced formulation techniques and embrace eco-design principles stand to lead the next wave of adoption. In the sections that follow, readers will gain clarity on tariff implications, segmentation nuances, and regional performance variations that inform actionable strategies.

Evaluating How Recent U.S. Import Tariffs Have Transformed Raw Material Sourcing and Supply Chain Strategies in the Nonwoven Adhesives Market

In 2025, the cumulative impact of newly implemented tariffs has introduced complex challenges for the nonwoven adhesives supply chain in the United States. Duties on imported raw materials, including key chemistries used in hot melt and water-based adhesives, have driven domestic processors to reassess vendor relationships and production costs. As a result, some manufacturers have shifted to sourcing amorphous polyalphaolefin domestically, while others have sought alternative polyolefin grades from non-tariffed regions to maintain pricing competitiveness.

These tariff pressures have prompted a gradual reconfiguration of cross-border logistics, as companies evaluate near-shoring and dual-sourcing strategies to mitigate rate fluctuations. In particular, adhesives formulated with ethylene vinyl acetate have seen raw material price volatility, compelling formulators to optimize binder concentrations and streamline coating thicknesses. Meanwhile, suppliers of silicone-based adhesives have capitalized on tariff exemptions offered under specific trade agreements, reinforcing their positions in niche medical and hygiene applications.

Although increased duties have introduced cost headwinds, they have also spurred earlier adoption of locally produced polyurethane dispersions and radiation-curable systems. By investing in domestic R&D and partnering with regional chemical manufacturers, several adhesive producers have achieved more stable supply arrangements and reduced lead times. As tariff landscapes continue to evolve, industry participants must balance short-term cost impacts with long-term resilience strategies that prioritize supply diversity and regulatory compliance.

Uncovering Application, Technology, and Raw Material Nuances That Shape Performance Profiles and Drive Strategic Product Positioning

Delving into segmentation insights reveals distinctive performance attributes across application, technology, and raw material categories. Applications in automotive sectors such as acoustic damping layers, exterior sealants, and interior trim bonding exhibit diverse formulation requirements, with each sub-segment demanding tailored adhesion profiles. Similarly, floor underlayment, insulation bonding, and roofing felt within building and construction use cases necessitate adhesives that withstand temperature extremes and moisture exposure without compromising bond strength.

When turning attention to furniture and bedding, mattress assembly and upholstery applications prioritize comfort and durability. Adhesives optimized for these uses deliver consistent tack and shear resistance to endure repeated loading cycles. In hygiene applications ranging from adult incontinence and diapers to sanitary napkins and wet wipes, formulators emphasize skin safety and gentle peel-away performance. Meanwhile, medical dressings, surgical tapes, and wound care products require hypoallergenic compositions with secure adhesion over extended wear times.

From a technology standpoint, hot melt systems lead in rapid assembly processes, whereas radiation-curable coatings offer precise film thickness control and environmental benefits. Solvent-based adhesives maintain their stronghold in high-strength applications despite environmental concerns, and water-based variants continue to improve through enhanced polymer dispersion technologies. Each technology confers specific advantages depending on the end use.

Raw material choices further differentiate performance, with amorphous polyalphaolefin and ethylene vinyl acetate enabling flexible bonds, polyolefin frameworks offering cost-effective solutions, and polyurethane or silicone matrices delivering high-temperature stability and biocompatibility. Recognizing these nuanced preferences is crucial for developing targeted go-to-market approaches.

This comprehensive research report categorizes the Nonwoven Adhesives market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Technology

- Raw Material

- Application

Revealing How Regional Demand Drivers and Regulatory Frameworks Diverge Across the Americas, EMEA, and Asia-Pacific to Influence Adhesive Adoption

Regional dynamics exert a profound influence on demand patterns and innovation trajectories within the nonwoven adhesives arena. In the Americas, robust automotive production hubs and an emphasis on sustainable construction practices have fueled adoption of advanced hot melt and radiation-curable adhesives. Leading North American formulators collaborate closely with automotive OEMs to fulfill stringent acoustic insulation and interior trim requirements, while Latin American construction activity has driven interest in cost-effective floor underlayment solutions.

Across Europe, the Middle East, and Africa, rigorous environmental regulations have accelerated the shift toward low-VOC water-based and radiation-curable systems. European standards for building insulation and medical device compliance encourage formulators to leverage recyclable polymer chemistries, whereas Middle Eastern infrastructure projects underscore high-temperature roofing adhesives that withstand extreme climates. In select African markets, growing hygiene awareness and healthcare investments have elevated demand for specialized diaper and wound care products.

Within Asia-Pacific, rapid urbanization and expanding automotive assembly plants have created formidable growth trajectories for nonwoven adhesives. Regional formulators benefit from proximity to key raw material producers, facilitating competitively priced polyurethane blends and silicone adhesives. Moreover, burgeoning e-commerce and personal care sectors advocate for innovative wet wipe and sanitary napkin applications that meet diverse consumer preferences. These converging regional drivers highlight the importance of tailoring product portfolios to local regulatory frameworks, climatic conditions, and end-user needs.

This comprehensive research report examines key regions that drive the evolution of the Nonwoven Adhesives market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Mapping the Competitive Terrain and Strategic Alliances That Propel Innovation and Shape Growth Trajectories Within the Adhesives Landscape

A competitive analysis of leading players underscores the pivotal role of innovation and strategic partnerships in sustaining market positions. Major adhesive suppliers have concentrated efforts on establishing specialized R&D centers, forging alliances with resin producers, and investing in pilot-scale coating lines to expedite technology validation. Such collaborative ecosystems enable rapid iteration of formulations designed for emerging applications in sectors like medical wound care and next-generation acoustic insulation.

Strategic acquisitions have also reshaped the competitive terrain, allowing vertically integrated producers to secure critical raw material access and expand geographic footprints. These moves not only streamline supply chain complexities but also provide a platform for cross-selling advanced product variants across adjacent application segments. In addition, early adopters of digital manufacturing tools, such as predictive blending algorithms and automated coating analytics, have achieved greater operational efficiencies and minimized waste in high-volume production environments.

Emerging entrants, particularly those offering bio-based polymer adhesives or proprietary radiation-curable resins, have differentiated themselves through sustainable credentials and niche performance advantages. By positioning these technologies in high-growth applications-ranging from personal care hygiene to medical adhesives-they challenge incumbents to elevate eco-design commitments and accelerate new product introductions. Consequently, ongoing vigilance regarding competitive maneuvers and technology roadmaps remains essential for market leaders.

This comprehensive research report delivers an in-depth overview of the principal market players in the Nonwoven Adhesives market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 3M Company

- ADTEK Malaysia Sdn Bhd

- Arkema SA

- Avery Dennison Corporation

- Dow Inc.

- Eastman Chemical Company

- Evonik Industries AG

- H.B. Fuller Company

- Henkel AG & Co. KGaA

- Jowat SE

- Lohmann-Koester GmbH & Co. KG

- Palmetto Adhesives Company, Inc.

- Pidilite Industries Limited

- Sika AG

Strategic Pathways and Collaborative Approaches That Industry Leaders Should Embrace to Drive Growth Amid Evolving Market and Regulatory Conditions

Industry leaders must adopt multifaceted strategies to capitalize on evolving market opportunities and address emerging challenges. First, investment in flexible manufacturing capabilities will enable agile switching between hot melt, radiation-curable, solvent-based, and water-based production lines in response to shifting regulatory or customer demands. Coupling these capabilities with advanced analytics enhances decision-making around batch sizing, raw material utilization, and throughput optimization.

Second, fostering deep collaborations with resin suppliers and OEM integrators can accelerate co-development of next-generation adhesive formulations. By embedding technical experts within customer R&D teams, suppliers gain early insights into design changes and performance benchmarks, enabling faster validation cycles and reduced time to market. In parallel, prioritizing sustainability initiatives-such as integrating bio-based polyolefin or silicone alternatives-addresses stakeholder pressures while unlocking new market segments in hygiene and medical applications.

Finally, organizations should diversify supplier networks to mitigate tariff risks and ensure consistent access to critical polymers like ethylene vinyl acetate and polyurethane. Establishing regional production hubs or joint ventures in emerging markets further provides localized responsiveness and cost advantages. By executing these recommendations, industry participants position themselves to navigate regulatory headwinds, harness technological break-throughs, and maintain robust growth trajectories.

Detailing a Rigorous Multi-Stage Research Framework That Integrates Primary Interviews, Secondary Analysis, and Data Triangulation for Reliable Insights

This research employed a rigorous, multi-stage methodology to ensure comprehensive coverage and robust insights. Primary data collection involved in-depth interviews with adhesive formulators, OEM procurement managers, and regulatory experts to capture firsthand perspectives on performance requirements and compliance trends. Complementing this qualitative input, secondary research leveraged technical white papers, patent filings, and regulatory frameworks from leading standards organizations to validate technological and legislative developments.

Subsequently, data triangulation techniques aligned supplier press releases, trade association reports, and conference proceedings to corroborate emerging application trends and regional demand patterns. Raw material sourcing dynamics were analyzed through customs trade databases and government tariff notices to assess the tangible impact of duties on supply chain strategies. Finally, cross-analysis across segmentation dimensions-application, technology, and raw material-facilitated the identification of high-potential growth pockets and strategic imperatives for market participants.

Collectively, this methodology ensures that findings are grounded in empirical evidence and reflective of current industry practices. The resulting insights deliver actionable guidance for executives seeking to refine product portfolios, optimize operations, and navigate a rapidly evolving competitive landscape.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Nonwoven Adhesives market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Nonwoven Adhesives Market, by Technology

- Nonwoven Adhesives Market, by Raw Material

- Nonwoven Adhesives Market, by Application

- Nonwoven Adhesives Market, by Region

- Nonwoven Adhesives Market, by Group

- Nonwoven Adhesives Market, by Country

- United States Nonwoven Adhesives Market

- China Nonwoven Adhesives Market

- Competitive Landscape

- List of Figures [Total: 15]

- List of Tables [Total: 1431 ]

Synthesizing Key Insights on Performance Nuances, Supply Chain Resilience, and Collaborative Innovation to Navigate Market Complexities

Nonwoven adhesives stand at the confluence of material innovation and evolving end-use demands, offering versatile solutions that address performance and sustainability objectives. Throughout this summary, we have highlighted how application-specific requirements, advancing technologies, and shifting regulatory landscapes coalesce to shape strategic priorities. From the acoustic layers in automotive interiors to the specialized coatings used in medical wound care, understanding these nuances is critical for market participants seeking to maintain competitive advantage.

Furthermore, the interplay of U.S. import tariffs, regional regulatory frameworks, and raw material selection underscores the need for resilient supply chain strategies. By embracing collaborative R&D models and investing in flexible manufacturing infrastructures, companies can mitigate cost pressures and accelerate product development cycles. As the industry moves forward, those who align technological prowess with environmental stewardship will be best positioned to capture emerging opportunities and drive sustained growth.

In closing, this executive summary equips decision-makers with a consolidated view of the nonwoven adhesives landscape, offering clear segmentation insights, regional perspectives, and strategic recommendations. Leveraging these findings will enable stakeholders to make informed choices, drive innovation, and navigate the complexities of a dynamic market environment.

Unlock Strategic Growth with Expert Guidance from Ketan Rohom to Acquire the Definitive Nonwoven Adhesives Market Research Report

Engaging directly with the evolving needs of industrial stakeholders, Ketan Rohom, Associate Director, Sales & Marketing at our firm, invites leaders and decision-makers to secure this comprehensive analysis of the nonwoven adhesives sector. The report offers in-depth intelligence designed to empower procurement, R&D, and strategic planning functions. To gain immediate access to market drivers, technological breakthroughs, and regulatory insights that will shape supply chains and innovation roadmaps, reach out to Ketan Rohom today and elevate your organization’s competitive edge.

- How big is the Nonwoven Adhesives Market?

- What is the Nonwoven Adhesives Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?