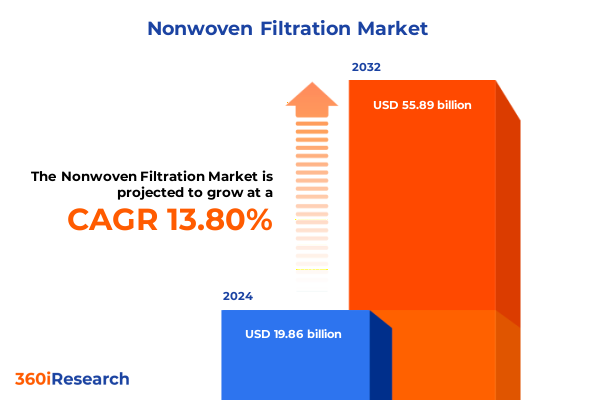

The Nonwoven Filtration Market size was estimated at USD 22.37 billion in 2025 and expected to reach USD 25.19 billion in 2026, at a CAGR of 13.97% to reach USD 55.89 billion by 2032.

Exploring How Engineered Fiber Matrices Are Revolutionizing Filtration Standards Amidst Intensifying Regulatory and Environmental Demands

Nonwoven filtration has emerged as a cornerstone technology across a spectrum of critical sectors, driven by intensifying environmental regulations, rising air and water quality concerns, and the imperative for enhanced product performance. As industries strive to reduce emissions, improve public health outcomes, and optimize operational efficiency, nonwoven filter media deliver versatile solutions that meet stringent purity and safety requirements. This report’s introduction sets the stage for understanding how nonwoven structures-characterized by engineered fiber matrices that balance permeability, strength, and specificity-underpin modern filtration applications from residential HVAC systems to sophisticated industrial processes.

Against this backdrop, the executive summary outlines key factors reshaping the nonwoven filtration space, articulates the impact of recent regulatory and trade dynamics, and previews the granular segmentation and regional insights that inform strategic decision-making. By exploring the technological innovations propelling material performance, the evolving customer needs shaping application priorities, and the competitive forces altering cost structures, this section frames the critical questions every stakeholder must address. Ultimately, the introduction unifies the report’s thematic threads and emphasizes why a rigorous, data-driven approach is indispensable for companies seeking to safeguard health, enhance sustainability, and capture market share in an increasingly complex environment.

Advancing Filtration Through Nanofiber Innovations, Digital Integration, and Circular Economy Strategies

A convergence of sustainability imperatives, advanced manufacturing techniques, and digital transformation is radically redefining the nonwoven filtration paradigm. Material science breakthroughs-such as electrospun nanofibers and hybrid composites-are delivering unprecedented filtration efficiencies while minimizing pressure drop and raw material usage. Meanwhile, data-driven process control and Industry 4.0 integrations enable real-time quality monitoring, reducing waste and accelerating innovation cycles. These technological inflection points are fundamentally altering how companies conceptualize and produce nonwoven media, shifting from legacy roll and sheet formats toward customizable, high-performance structures tailored to specific application profiles.

Simultaneously, heightened focus on circular economy principles is catalyzing new business models that emphasize reuse, recovery, and end-of-life recyclability. Forward-looking organizations are forging partnerships with waste management and recycling firms to capture spent filter material and reintegrate it into production streams. This holistic approach not only reduces environmental impact but also insulates supply chains against raw material scarcity and price volatility. In addition, customers are increasingly demanding transparency about the lifecycle footprint of filter media, pushing providers to embed traceability and sustainability metrics into product specifications.

Amid these transformative shifts, the competitive playing field is widening to include technology start-ups, chemical manufacturers, and specialty equipment providers. As emerging players leverage modular production lines and digital design platforms, established firms are responding by strengthening innovation pipelines, pursuing strategic acquisitions, and deploying advanced simulation tools to compress time-to-market. Consequently, the ecosystem is evolving toward a more collaborative, multidisciplinary model where agility and scalability determine long-term success.

Navigating Elevated Cost Structures and Supply Chain Realignments Following the Introduction of 2025 Nonwoven Filter Media Tariffs

The introduction of new United States tariffs in early 2025 on imported nonwoven filter media and key raw materials has generated a complex web of cost pressures and supply chain realignments. These measures, aimed at protecting domestic manufacturing and reducing dependency on foreign suppliers, have increased duties on imported polypropylene meltblown media and polyester-based substrates. As a result, procurement teams now face significantly higher landed costs for conventional filter materials sourced from established export markets. Although the policy goal targets strengthening local capacity, immediate consequences include elevated operating expenses and margin compression for downstream converter and end-user segments.

In response to the tariff landscape, several filter media producers have accelerated investments in domestic polymer production and equipment upgrades. This strategic pivot is designed to capture incentives tied to onshore manufacturing, optimize logistics footprints, and hedge against further trade-related uncertainties. The reshoring initiatives are supported by government grants and capacity-building programs that defray capital expenditures on new meltblown and spunbond lines. However, given the multi-stage nature of filter media production, transitioning to self-sufficient supply chains will require sustained collaboration across polymer suppliers, machinery OEMs, and specialized maintenance services.

Despite these long-term efforts, many end users continue to confront short-term volatility in material pricing and availability. This has prompted a wave of cross-functional task forces that unify sourcing, engineering, and finance functions to develop adaptive procurement strategies. By leveraging forward purchase agreements, diversified supplier portfolios, and selective material substitutions-such as integrating glass fiber or cellulose blends-organizations are mitigating the most acute impacts of tariff fluctuations. Nonetheless, the evolving trade framework underscores the critical need for dynamic risk management and proactive policy engagement to ensure supply chain resilience.

Uncovering Strategic Growth Avenues Through a Multilens Analysis of Product Type, Material, Technology, Application, End Use, and Filtration Efficiency

In analyzing the nonwoven filtration market through multiple segmentation lenses, distinct patterns emerge that inform targeted growth strategies. When evaluating product types including bags, cartridges, pads and discs, roll goods, and sheets, industry participants must weigh factors such as installation complexity, replacement frequency, and scalability. The bags and cartridges segment, for instance, demonstrates a preference in heavy-duty industrial applications where high particulate loads and ease of maintenance are paramount. Conversely, roll goods and sheets are gaining traction in EPC and original equipment manufacturing contexts due to their flexibility for custom die-cut parts and continuous processing.

Material selection also plays a pivotal role in shaping performance characteristics and cost profiles. With cellulose offering biodegradability for low-temperature water and oil filtration, glass fiber providing high-temperature resistance and chemical inertness, and synthetic polymers like polyester and polypropylene balancing filtration efficiency with mechanical strength, organizations must align material choices to target operational parameters. The ongoing shift toward polyester-based media underscores a broader industry trend favoring durable, recyclable substrates that support circularity objectives.

Technological segmentation-spanning composite, meltblown, needlepunch, spunbond, and spunlace processes-further illuminates how production methods influence filter morphology, pore size distribution, and hydraulic performance. Composite configurations that combine multiple layers tailored to specific particulate retention can command premium pricing in demanding gas or liquid filtration systems. Meltblown media, distinguished by its fine fiber diameter, remains the standard for HEPA-level applications. Meanwhile, needlepunch and spunbond processes are valued for cost-effective volume production and structural robustness in HVAC and industrial filter settings.

Application-focused segmentation across air, gas, liquid, oil, and water filtration underscores the diverse performance requirements that filter media must satisfy. Air filtration demand is buoyed by indoor air quality mandates and building certification programs, while gas filtration is critical to protecting downstream equipment in petrochemical and power generation plants. Liquid and water filtration markets are expanding in response to potable water safety regulations and increasing industrial wastewater management complexity. Oil filtration, concentrated in automotive and heavy machinery sectors, demands media that can endure high pressures, elevated temperatures, and contamination by both particulate and chemical species.

Finally, end use industry insights reveal automotive manufacturers leveraging nonwoven technologies to reduce emissions and extend engine life, food and beverage processors prioritizing sterile filter media to ensure product integrity, healthcare providers integrating high-efficiency barrier filters in medical devices, HVAC system suppliers addressing indoor air quality benchmarks, and industrial firms applying robust nonwoven mats in dust collection and catalyst support roles. Filtration efficiency segmentation-encompassing high, medium, and low tiers-enables solution providers to match media performance to both regulatory thresholds and cost constraints. Through this multifaceted segmentation framework, stakeholders can pinpoint high-opportunity niches, optimize product portfolios, and tailor value propositions to evolving customer needs.

This comprehensive research report categorizes the Nonwoven Filtration market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Material

- Technology

- Filtration Efficiency

- Application

- End Use Industry

Mapping Regional Demand Drivers and Innovation Hotspots Across the Americas, EMEA, and Asia-Pacific Nonwoven Filtration Markets

Regional dynamics in nonwoven filtration are shaped by a combination of regulatory frameworks, industrial growth trajectories, and supply chain configurations. In the Americas, strong procurement momentum for high-efficiency air and liquid filter media reflects stringent environmental and public health standards. The United States remains a leading innovation hub, with domestic producers capitalizing on tariff incentives and federal research funding to refine polymer chemistry and manufacturing automation. Meanwhile, Latin American markets are progressing at a measured pace, driven by growing infrastructure investments and a rising awareness of water treatment imperatives.

Across Europe, Middle East, and Africa, a heterogeneous regulatory landscape coexists with advanced manufacturing capabilities and emerging opportunities. European Union directives on chemical safety, circularity, and indoor air quality have accelerated adoption of certified filter media, prompting suppliers to secure REACH compliance and expand production of recyclable and compostable substrates. In the Middle East, substantial investments in petrochemicals and power generation have spurred demand for robust gas and liquid filtration solutions, with a premium on high-temperature and corrosion-resistant media. In select African markets, nascent industrialization and water scarcity challenges are fostering partnerships between global filter media suppliers and local infrastructure developers.

Asia-Pacific exhibits the fastest rate of nonwoven filtration expansion, propelled by rapid urbanization, escalating ambient pollution levels, and robust manufacturing ecosystems in China, India, Japan, and Southeast Asian economies. China leads in production capacity, leveraging economies of scale to serve both domestic and export markets, while India is emerging as a high-potential growth frontier with investments in clean energy and water treatment projects. Japan remains a technology pioneer, focusing on ultrafine fiber development and integrated filter systems. Southeast Asia is benefitting from supply chain diversification as companies relocate or augment production beyond coastal China. This regional mosaic underscores the imperative for tailored market strategies and localized partnerships that align with each area’s regulatory and industrial priorities.

This comprehensive research report examines key regions that drive the evolution of the Nonwoven Filtration market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Examining How Leading Filter Media Producers Are Leveraging Strategic Alliances, Digitalization, and Sustainability Certifications to Fortify Market Leadership

Global nonwoven filtration leaders are redefining competitive boundaries through strategic investments, collaborative ventures, and targeted innovation efforts. Major polymer producers have forged alliances with equipment OEMs and research institutes to co-develop next-generation meltblown and spunbond lines with enhanced throughput and energy efficiency. Concurrently, specialized filter media companies are strengthening their portfolios by integrating functional additives-such as antimicrobial agents, catalytic coatings, and self-cleaning nanocoatings-into existing substrates to address evolving regulatory requirements and customer performance expectations.

In addition to technological partnerships, leading firms are pursuing geographic expansion to secure proximity to key end markets and raw material sources. Greenfield facilities and joint ventures in strategic locations are enabling rapid response to regional demand surges, while mergers and acquisitions provide scale advantages and broaden product offerings. At the same time, companies are optimizing operational excellence by deploying digital twins, predictive maintenance systems, and advanced process control platforms that minimize downtime and ensure consistent product quality. These digital initiatives not only lower total cost of ownership but also generate troves of performance data that feed continuous improvement cycles.

Looking ahead, industry frontrunners are also investing in sustainable feedstock research-exploring bio-based polymers, recyclable composites, and low-emission production pathways. They are engaging with certification bodies to secure labels such as Cradle to Cradle, Blue Angel, and UL GREENGUARD, thereby differentiating their offerings in price-sensitive and environmentally conscious customer segments. Through these multifaceted strategies, key companies are consolidating leadership positions and setting new benchmarks for filtration performance, efficiency, and sustainability.

This comprehensive research report delivers an in-depth overview of the principal market players in the Nonwoven Filtration market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 3M Company

- Ahlstrom-Munksjö Oyj

- Alkegen LLC

- Asahi Kasei Corporation

- Berry Global Group, Inc.

- Camfil AB

- Clean Solutions Group

- Don & Low Ltd.

- Donaldson Company, Inc.

- DuPont de Nemours, Inc.

- Fibertex Nonwovens A/S

- Fitesa S.A.

- Freudenberg SE

- Hollingsworth & Vose Company

- Johns Manville Corporation

- Kimberly-Clark Corporation

- Magnera Corporation

- MANN+HUMMEL International GmbH & Co. KG

- Mativ Holdings, Inc.

- MOGUL TEKSTİL SANAYİ VE TİC.A.Ş.

- Monadnock Non-Wovens LLC

- PFNonwovens a.s.

- Sandler AG

- Toray Industries, Inc.

- TWE GmbH & Co. KG

- Welspun Advanced Materials (India) Limited

Building Competitive Advantage by Integrating Advanced Fiber Innovation, Strategic Sourcing Flexibility, and Circular Economy Practices

Industry leaders seeking to unlock value in the nonwoven filtration sector should prioritize a dual strategy of targeted innovation and supply chain resilience. To begin with, channel investments toward advanced fiber technologies-such as electrospinning and composite layering-that deliver superior particulate removal and lower energy consumption. By partnering with material science experts and pilot facility operators, organizations can de-risk development efforts and accelerate product commercialization timelines. At the same time, embedding digital monitoring and predictive analytics into production lines will enhance operational agility, enabling rapid adaptation to shifts in raw material availability or changing customer specifications.

Concurrently, companies must fortify supply chains against geopolitical and trade uncertainties by diversifying logistics networks and forging strategic sourcing alliances. Establish supply agreements that include flexible volume commitments and option-based purchasing structures to insulate against tariff volatility. Pursue nearshoring initiatives for critical polymer feedstocks, while exploring alternative materials such as glass fiber or cellulose blends to buffer commodity price fluctuations. Additionally, engaging with policymakers through industry associations can help shape balanced trade policies that support both domestic manufacturing and global competitiveness.

Lastly, executives should embrace circular economy principles by integrating lifecycle assessments into product development and offering end-of-life takeback programs for spent filter media. This not only aligns with tightening environmental regulations but also unlocks new revenue streams through recycling partnerships. By adopting these actionable recommendations, industry players can enhance their strategic positioning, drive sustainable growth, and deliver measurable value across the filtration value chain.

Applying a Comprehensive Primary and Secondary Research Framework Enhanced by Advanced Analytics and Expert Validation to Ensure Rigorous Market Intelligence

This research report synthesizes insights from a structured approach combining primary and secondary data sources, rigorous analysis, and stakeholder validation. Primary research comprised in-depth interviews with filtration experts spanning material suppliers, equipment manufacturers, converters, and end users across key industries. These interviews yielded qualitative perspectives on emerging technologies, regulatory impacts, and strategic priorities. In parallel, a comprehensive review of secondary literature-including industry journals, patent filings, and regulatory releases-provided a quantitative foundation for understanding market dynamics and technological trajectories.

Analysts employed a multi-step process to ensure data integrity, beginning with a thorough validation of input variables against multiple independent sources. Proprietary databases were cross-checked with third-party publications to confirm production capacities, trade flows, and cost benchmarks. Advanced analytical techniques, such as scenario modeling and sensitivity analysis, were applied to assess the implications of policy shifts, raw material price movements, and adoption rates for new filter media technologies.

To enhance the robustness of findings, the research incorporated feedback loops with an expert panel comprising R&D leaders, operations executives, and regulatory consultants. This iterative validation process refined assumptions, clarified regional nuances, and quantified the relative impact of critical drivers. The result is a research methodology that delivers both depth and reliability, equipping decision-makers with a clear, evidence-based understanding of the nonwoven filtration market.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Nonwoven Filtration market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Nonwoven Filtration Market, by Product Type

- Nonwoven Filtration Market, by Material

- Nonwoven Filtration Market, by Technology

- Nonwoven Filtration Market, by Filtration Efficiency

- Nonwoven Filtration Market, by Application

- Nonwoven Filtration Market, by End Use Industry

- Nonwoven Filtration Market, by Region

- Nonwoven Filtration Market, by Group

- Nonwoven Filtration Market, by Country

- United States Nonwoven Filtration Market

- China Nonwoven Filtration Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1113 ]

Synthesizing Market Forces and Strategic Imperatives to Guide Decision-Makers Toward Sustainable Growth and Resilient Operations in Nonwoven Filtration

In summary, the nonwoven filtration market stands at a pivotal juncture, propelled by technological breakthroughs, shifting trade policies, and intensifying environmental imperatives. The adoption of nanofiber-enhanced media, the integration of digital process controls, and the pursuit of circular economy models have collectively redefined the filtration landscape. At the same time, the 2025 tariff adjustments have underscored the necessity for adaptive procurement strategies and agile supply chain redesigns.

Detailed segmentation analysis reveals that opportunities abound across diverse product formats, material choices, and application environments, while regional insights highlight the strategic importance of tailored market approaches in the Americas, EMEA, and Asia-Pacific. Leading companies are fortifying their positions through strategic partnerships, digital transformation, and sustainability certifications, setting the stage for robust competition and continued innovation.

By following the actionable recommendations outlined in this summary-centering on fiber technology advancement, supply chain resilience, and lifecycle stewardship-industry stakeholders can capitalize on emerging growth corridors and navigate policy headwinds with confidence. This report equips executives, product managers, and investors with the clarity needed to make informed decisions and accelerate progress toward cleaner air, safer water, and more sustainable industrial operations.

Reach Out to Ketan Rohom for Expert Guidance on Acquiring the Definitive Nonwoven Filtration Market Intelligence

For decision-makers seeking to deepen their understanding of the global nonwoven filtration landscape and capitalize on emerging opportunities, the comprehensive market research report provides the definitive source of strategic intelligence. To secure access to actionable insights, in-depth analysis, and a customized consultation, please reach out directly to Ketan Rohom, Associate Director, Sales & Marketing at 360iResearch. Ketan will guide you through the report’s highlights, demonstrate how the findings align with your organizational priorities, and facilitate a seamless purchasing process. Engage now to leverage robust data and expert interpretation that will empower your team to navigate industry headwinds and accelerate growth in the nonwoven filtration market.

- How big is the Nonwoven Filtration Market?

- What is the Nonwoven Filtration Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?