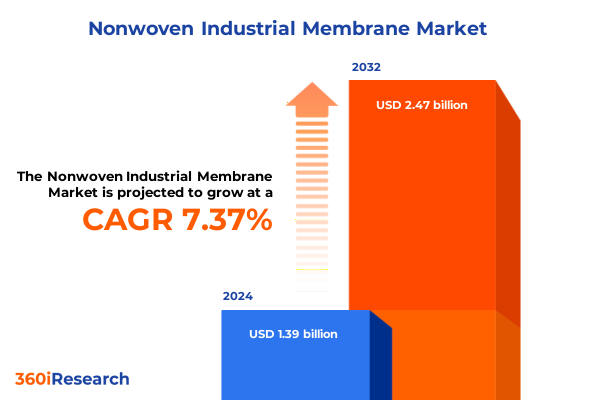

The Nonwoven Industrial Membrane Market size was estimated at USD 1.50 billion in 2025 and expected to reach USD 1.61 billion in 2026, at a CAGR of 7.38% to reach USD 2.47 billion by 2032.

Introducing the Strategic Imperatives and Technological Foundations Driving the Evolution of Nonwoven Industrial Membrane Applications in Advanced Industries

In recent years, the nonwoven industrial membrane sector has emerged as a critical enabler across a wide range of advanced applications, from energy storage and water purification to protective apparel and chemical processing. Technological breakthroughs in material science have propelled nonwoven membranes to the forefront of innovation by offering unique combinations of porosity, strength, and chemical resistance. This convergence of attributes has positioned nonwovens as a preferred choice for industries seeking high-performance filtration, battery separation, and separation technologies that can withstand increasingly demanding operating conditions.

Amidst this backdrop, the imperative for sustainability has driven manufacturers and end users to reevaluate traditional supply chains and material selections. The ability to integrate recyclable or bio-based polymer types while maintaining rigorous performance standards has become a defining competitive advantage. Simultaneously, enhancements in manufacturing processes-from meltblown to spunbond and needlepunched techniques-have unlocked new opportunities to tailor membrane characteristics such as pore size distribution and mechanical durability. These developments underscore the pivotal role of R&D investment in achieving both technical differentiation and cost-effectiveness.

With rising global demand for cleaner water, safer industrial environments, and cleaner energy solutions, decision makers are seeking deeper insight into how nonwoven membranes can be optimized for specific contexts. This executive summary provides a structured analysis of the forces shaping the landscape, including transformative technological shifts, policy headwinds, granular segmentation perspectives, and regional dynamics. It lays the foundation for understanding the strategic imperatives that will guide stakeholders toward sustainable growth and resilient supply chain architectures.

Uncovering the Transformative Market Shifts Propelled by Technological Innovation and Sustainability Imperatives in Nonwoven Industrial Membrane Sectors

Over the past several years, the nonwoven industrial membrane ecosystem has undergone a fundamental transformation driven by the twin engines of innovation and sustainability. Advanced materials such as high-performance polyester and polytetrafluoroethylene have enabled membrane developers to push the boundaries of chemical compatibility and thermal stability. At the same time, next-generation manufacturing techniques have allowed for finer control over pore architecture, elevating the efficacy of ultrafiltration, nanofiltration, and microfiltration systems in critical water treatment and process separation roles.

Another seismic shift has emerged from the growing integration of data analytics and digital monitoring into membrane operations. Embedded sensors and real-time diagnostics now allow facility managers to predict fouling cycles, optimize backwash protocols, and extend membrane life cycles, thereby reducing operational expenditures and downtime. This digital overlay is complemented by circular economy initiatives that aim to reclaim and recycle membrane substrates at end of life, further reducing the industry’s environmental footprint.

Consequently, strategic partnerships between membrane innovators and end users have become increasingly prevalent. Collaboration with chemical processing firms, medical device suppliers, and oil and gas operators accelerates the development of application-specific membranes that deliver targeted performance benefits. As organizations pursue emission reduction targets and cost containment measures, these cross-sector alliances underscore the importance of flexible, tailored solutions. Together, these trends are redefining the competitive battleground for nonwoven industrial membranes, creating fresh opportunities for market entrants and incumbents alike.

Assessing the Cumulative Impact of the 2025 United States Tariff Measures on the Global Supply Chain Dynamics of Nonwoven Industrial Membrane Manufacturing

The introduction of new U.S. tariffs in 2025 has introduced a complex layer of cost and logistical challenges for manufacturers and end users of nonwoven industrial membranes. These measures, which target a range of imported polymer resins and finished membrane products, have amplified raw material expense pressures and triggered a reevaluation of sourcing strategies. As a result, many suppliers have accelerated efforts to diversify their procurement networks, seeking alternative resin grades from domestic producers or low-tariff jurisdictions to mitigate sudden cost spikes.

Moreover, the elevated import duties have had a ripple effect across the value chain, influencing design decisions and pricing strategies. Original equipment manufacturers have begun to explore higher-value membrane formulations that can justify premium price points, while aftermarket suppliers are under pressure to demonstrate long-term cost of ownership benefits through improved membrane longevity and reduced maintenance requirements. These adjustments have prompted a surge in strategic inventories and nearshoring initiatives, as firms look to buffer against future policy shifts and ensure uninterrupted production schedules.

At the same time, governmental incentive programs aimed at bolstering domestic manufacturing have begun to gain traction. Through direct subsidies, tax credits for capital investments, and streamlined approval pathways for advanced production facilities, policymakers are incentivizing onshore membrane fabrication. Industry leaders can leverage these programs to offset tariff-driven cost escalations, supporting resilient supply chains that balance global scale with regional agility. In this rapidly evolving policy environment, proactive engagement with trade and regulatory stakeholders will remain a critical competency for maintaining competitive advantage.

Deciphering Key Segmentation Insights to Illuminate Critical Application, Material and Process Drivers Shaping the Nonwoven Membrane Market Trajectory

An in-depth examination of market segmentation reveals the nuanced drivers shaping demand across applications, materials, industries, manufacturing processes, product grades, fabric weights, and sales channels. When viewed through the lens of application, membrane demand is anchored by battery separators for next-generation energy storage, diaphragms utilized in electrochemical cells, and a broad array of filtration roles spanning air filtration, liquid filtration, microfiltration, nanofiltration, and ultrafiltration. The protective apparel segment is gaining momentum as workplaces prioritize safety and compliance, while separation applications continue to underpin critical industrial workflows.

Shifting focus to material types, polyester and polypropylene remain staple substrates due to their favorable mechanical properties and cost profiles, whereas polyethylene and polytetrafluoroethylene deliver enhanced chemical resistance for specialty applications. Each polymer type offers a distinct performance envelope that can be matched to the requirements of sectors ranging from food and beverage to aggressive chemical processing. Selection criteria are increasingly influenced by lifecycle assessments and regulatory mandates governing single-use plastics, further impacting material mixes.

Beyond material composition, the end use industry lens underscores diverse market dynamics. Chemical processing applications demand membranes that exhibit robust fouling resistance and precise pore control, while electronics manufacturing requires ultra-clean filtration media. The food and beverage sector emphasizes hygienic design and traceability, contrasting with the medical field’s need for healthcare apparel, medical devices, and surgical membranes tested to stringent sterility standards. Oil and gas operations, from drilling and completion to exploration, production, and refining, apply specialized membranes for separation and purification. Water treatment spans industrial, municipal, and residential contexts, each with unique performance and durability thresholds.

Manufacturing process distinctions further refine market understanding, with meltblown nonwovens delivering fine fiber distributions for high-efficiency capture, needlepunch techniques producing mechanically robust mats, spunbond processes enabling continuous filament structures, spunlace methods generating uniform webs through hydroentanglement, and thermal bonding securing fiber junctions for enhanced tensile strength. Product grading-from custom-engineered formulations to high-performance specialty grades and standard offerings-reflects the trade-off between tailored functionality and cost efficiencies. Fabric weight considerations subdivide into heavy weight constructions for demanding environments, medium weight options balancing performance and manageability, and light weight variants for low-load filtration. Finally, sales channels bifurcate into original equipment manufacturer partnerships, which support integrated design cycles, and aftermarket suppliers focused on replacement and retrofit opportunities.

This comprehensive research report categorizes the Nonwoven Industrial Membrane market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Material Type

- Manufacturing Process

- Product Grade

- Fabric Weight

- Application

- End Use Industry

- Sales Channel

Exploring Key Regional Insights Highlighting Distinct Growth Patterns and Strategic Priorities Across Americas, EMEA, and Asia-Pacific Nonwoven Markets

Regional dynamics play a defining role in shaping competitive strategies and investment decisions within the nonwoven industrial membrane arena. In the Americas, the interplay between established North American manufacturing hubs and dynamic Latin American markets has fostered a dual focus on innovation and cost optimization. Technologies developed in the United States and Canada often set performance benchmarks, while emerging economies in the region are leveraging more competitive labor and feedstock costs to attract production and distribution investment.

Meanwhile, the Europe, Middle East & Africa cluster presents a mosaic of regulatory frameworks and end use scenarios. Europe’s stringent environmental regulations have accelerated the adoption of sustainable materials and circular design principles, driving demand for recyclable polyester and bio-based substitutes. Across the Middle East, large-scale water treatment and petrochemical projects in oil-rich economies are generating opportunities for high-capacity filtration and separation solutions. Africa’s nascent infrastructure development is creating greenfield opportunities, particularly in municipal water treatment and agricultural irrigation systems.

In the Asia-Pacific region, growth trajectories are shaped by a combination of rapid industrialization, population density pressures, and significant investment in renewable energy and water management. China and India remain central to global membrane production volumes, with domestic R&D investments supporting continuous improvements in membrane performance. Southeast Asian markets, buoyed by expanding manufacturing exports, are increasingly adopting stringent quality standards, prompting membrane suppliers to localize production and establish regional service networks.

Across each geography, cross-border partnerships and joint ventures are emerging as preferred models to accelerate technology transfer and risk sharing. Supply chain resilience has become a strategic imperative, with companies balancing global sourcing efficiencies against the need for regional responsiveness. In this environment, tailored regional approaches that account for regulatory complexity, infrastructure maturity, and end user requirements are essential to securing sustainable growth pathways.

This comprehensive research report examines key regions that drive the evolution of the Nonwoven Industrial Membrane market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Industry Players Driving Innovation Collaboration and Competitive Positioning in the Evolving Nonwoven Industrial Membrane Landscape

A number of leading players are driving the competitive intensity within the nonwoven industrial membrane landscape through differentiated innovation, strategic M&A activity, and expanded service offerings. These industry pioneers are investing aggressively in advanced R&D centers focused on novel polymer chemistries and manufacturing technologies that enhance membrane selectivity and durability. Collaborative research programs with academic institutions and technical consortia have yielded breakthroughs in bio-based substrates and recyclable membrane solutions.

In parallel, select manufacturers are leveraging digital transformation platforms to integrate process automation, real-time quality control, and end-to-end traceability across their production networks. This digital backbone enables rapid scaling of new membrane formats tailored to end user specifications and supports predictive maintenance regimes that reduce unplanned downtime. Strategic partnerships with instrumentation suppliers and software providers have further strengthened these capabilities, creating a compelling value proposition for customers seeking turnkey membrane filtration systems.

On the commercial front, leading companies have established global service hubs to provide on-site installation support, performance monitoring, and membrane regeneration services. These after-sales offerings reinforce customer loyalty and drive recurring revenue streams beyond initial equipment sales. Additionally, some players have pursued targeted joint ventures in emerging water-stressed regions, aligning local market insights with global technical expertise to co-develop customized membrane solutions.

Through a blend of technical leadership, digital-enabled operations, and comprehensive customer engagement models, these key firms are shaping the strategic contours of the nonwoven membrane sector. Their ability to anticipate shifting end use requirements and rapidly deploy novel solutions positions them at the vanguard of market growth and sets new performance benchmarks for the broader industry.

This comprehensive research report delivers an in-depth overview of the principal market players in the Nonwoven Industrial Membrane market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 3M Company

- Ahlstrom Oyj

- Asahi Kasei Corporation

- Berry Global Group, Inc.

- DuPont de Nemours, Inc.

- Fibertex Nonwovens A/S

- Fitesa S.A.

- Freudenberg SE

- Glatfelter Corporation

- Hollingsworth & Vose Company

- Johns Manville Corporation

- Kimberly-Clark Corporation

- Lydall, Inc.

- Mitsui Chemicals, Inc.

- Toray Industries, Inc.

Delivering Actionable Recommendations to Empower Industry Leaders with Strategic Priorities and Tactical Roadmaps for Nonwoven Membrane Market Leadership

Industry leaders aiming to capitalize on the evolving nonwoven membrane landscape should prioritize the integration of digital monitoring and predictive analytics into production and operational workflows. By implementing smart sensor networks and advanced data visualization tools, manufacturers can proactively address performance deviations, extend membrane lifespan, and optimize resource utilization. Equally important is the pursuit of strategic supply chain diversification, which may involve establishing partnerships with domestic resin producers or nearshoring critical manufacturing capabilities to mitigate tariff-related cost exposures.

Concurrent investment in sustainable materials R&D can yield long-term competitive differentiation, especially as end use industries heighten focus on circular economy objectives and regulatory compliance. Collaborations with universities and contract research organizations can accelerate the development of bio-based polymer formulations and recyclable membrane platforms without imposing undue capital burdens on internal teams. At the same time, tailored pilot programs with key customers can validate novel solutions under real-world conditions, fast-tracking commercialization timelines.

Furthermore, engaging proactively with policy stakeholders and participating in industry associations can help shape favorable regulatory frameworks and incentive programs. This advocacy approach ensures that emerging performance standards and environmental regulations evolve in a manner that recognizes the value proposition of nonwoven membranes. Finally, organizations should explore innovative commercial models, such as performance-based contracts and subscription services, to align membrane costs with delivered outcomes and strengthen long-term customer relationships.

Taken together, these strategic priorities and tactical roadmaps provide a comprehensive playbook for industry leaders to navigate shifting market dynamics, unlock new revenue streams, and build resilient operations that can adapt to future disruptions.

Detailing the Comprehensive Research Methodology Employed to Capture Robust Insights Validate Data Quality and Ensure Analytical Rigor

The research methodology underpinning this analysis combines rigorous data triangulation, expert validation, and comprehensive secondary research. Initially, a wide array of trade journals, patent filings, regulatory databases, and technical white papers were reviewed to map the technology landscape and identify key performance parameters of nonwoven membranes. This secondary research established a baseline understanding of materials, processes, and application requirements across diverse end use industries.

To enrich these findings, targeted interviews were conducted with membrane technologists, operations executives, and procurement leaders from leading chemical processing, water treatment, medical device, and energy storage companies. These primary discussions provided qualitative insights into supply chain challenges, performance bottlenecks, and emerging innovation priorities. The feedback loop created through iterative expert reviews ensured that the analysis remains grounded in practical, field-tested perspectives.

Quantitative validation involved assessing trade flow data, import-export records, and tariff schedules to evaluate the impact of recent 2025 U.S. duty measures on material sourcing and pricing dynamics. Wherever possible, data points were corroborated through multiple independent sources to enhance reliability. Additionally, regional market nuances were analyzed by synthesizing macroeconomic indicators, infrastructure development plans, and environmental policy trends.

Finally, the study’s analytical framework was stress-tested through scenario modeling to account for potential policy shifts, raw material supply disruptions, and technology adoption rates. This multi-dimensional approach ensures that the resulting insights and recommendations are robust, actionable, and tailored to the needs of decision makers across the nonwoven industrial membrane value chain.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Nonwoven Industrial Membrane market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Nonwoven Industrial Membrane Market, by Material Type

- Nonwoven Industrial Membrane Market, by Manufacturing Process

- Nonwoven Industrial Membrane Market, by Product Grade

- Nonwoven Industrial Membrane Market, by Fabric Weight

- Nonwoven Industrial Membrane Market, by Application

- Nonwoven Industrial Membrane Market, by End Use Industry

- Nonwoven Industrial Membrane Market, by Sales Channel

- Nonwoven Industrial Membrane Market, by Region

- Nonwoven Industrial Membrane Market, by Group

- Nonwoven Industrial Membrane Market, by Country

- United States Nonwoven Industrial Membrane Market

- China Nonwoven Industrial Membrane Market

- Competitive Landscape

- List of Figures [Total: 19]

- List of Tables [Total: 1908 ]

Summarizing Strategic Imperatives and Emerging Opportunities Framing the Future Growth and Resilience of the Nonwoven Industrial Membrane Sector

In conclusion, the nonwoven industrial membrane sector stands at an inflection point where technological breakthroughs, sustainability imperatives, and policy dynamics converge to redefine competitive landscapes. Stakeholders who embrace advanced materials engineering, digital-enabled operations, and agile supply chain strategies will be best positioned to deliver the performance and durability demanded by critical applications across energy, water treatment, medical, and industrial markets.

Moreover, the imposition of new U.S. tariffs in 2025 underscores the urgent need for portfolio diversification and regional manufacturing resilience. Organizations that proactively engage in supply chain reconfiguration, leverage domestic manufacturing incentives, and develop high-value membrane offerings can mitigate cost pressures while reinforcing market leadership. Collaborative R&D partnerships and strategic advocacy efforts will be instrumental in shaping future regulatory frameworks and accelerating the adoption of recyclable, bio-based membrane platforms.

Ultimately, the path forward requires a balanced approach that integrates deep technical expertise with forward-looking business models. By synthesizing the insights presented in this summary, industry participants can chart a course toward sustainable growth and operational excellence in an increasingly complex and dynamic environment.

Engage with Ketan Rohom for Tailored Market Insights and Secure Your Comprehensive Nonwoven Industrial Membrane Report to Drive Competitive Advantage

Engaging directly with Ketan Rohom opens the door to tailored strategic support designed to elevate your competitive positioning within the nonwoven industrial membrane sector. With a deep understanding of market dynamics, supply chain intricacies, and emerging technology trends, Ketan can guide you through the complexities of application-driven materials selection, cost optimization strategies, and regulatory compliance considerations. This high-touch consultation ensures that each insight is aligned with your organization’s unique priorities and growth objectives. Beyond a standard report, you will receive personalized briefings, interactive workshops, and priority access to updated intelligence as market conditions evolve.

By partnering with Ketan as your trusted advisor, you gain a direct line to ongoing expert analysis and scenario planning that can inform product development roadmaps, operational resilience measures, and go-to-market tactics. His collaborative approach emphasizes actionable takeaways, ensuring that you can translate research findings into immediate performance improvements and strategic advantages. Reach out now to secure this comprehensive market research report and begin leveraging unparalleled insights for accelerated decision-making and sustainable growth in the nonwoven industrial membrane landscape.

- How big is the Nonwoven Industrial Membrane Market?

- What is the Nonwoven Industrial Membrane Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?