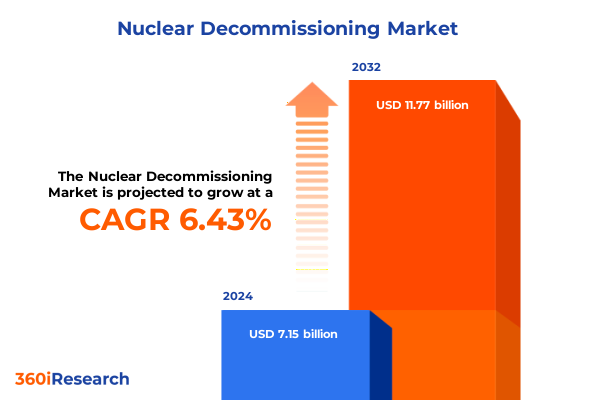

The Nuclear Decommissioning Market size was estimated at USD 7.57 billion in 2025 and expected to reach USD 8.04 billion in 2026, at a CAGR of 6.49% to reach USD 11.77 billion by 2032.

Understanding the Imperative of Decommissioning Aging Nuclear Facilities and Strategic Necessity in a Rapidly Evolving Global Energy Landscape

Decommissioning nuclear power plants has emerged as one of the most critical undertakings in the global energy sector, propelled by an unprecedented wave of reactors reaching the end of their operational life. As of mid-2024, 213 reactors have been permanently closed worldwide, and 190 of these units are in various stages of decommissioning. Yet only 23 reactors have been fully cleared and released for unrestricted use, underscoring the complexity and duration of the process. Concurrently, the International Atomic Energy Agency projects that nearly half of the 423 nuclear power reactors currently in operation are slated to enter the decommissioning phase by 2050, with individual projects spanning up to two decades or more.

This accelerating decommissioning pipeline places significant demands on governments, regulators, and service providers to balance safety, environmental protection, and cost control. As more facilities transition from power generation to site remediation, stakeholders must navigate evolving regulatory frameworks, engage with local communities, and implement rigorous project plans. The imperative to restore sites to safe conditions aligns with broader commitments to circular economy principles, where materials are recycled, waste volumes are minimized, and land reuses are optimized. Against this backdrop, a deep understanding of operational workflows, risk management strategies, and technological enablers forms the foundation for achieving efficient, transparent, and socially responsible decommissioning outcomes.

Analyzing Monumental Transformations Shaping the Future of Nuclear Decommissioning with Innovation, Policy, and Stakeholder Engagement

The nuclear decommissioning sector is undergoing transformative shifts driven by emergent technologies, progressive policies, and heightened stakeholder collaboration. Robotics, artificial intelligence, and advanced data analytics are revolutionizing site characterization and waste handling, allowing teams to map contamination, plan dismantling sequences, and monitor radiological parameters with unprecedented accuracy and safety. These digital tools are complemented by modular robotics solutions that automate repetitive or hazardous tasks, thereby reducing personnel exposure and compressing project timelines.

In parallel, policy frameworks are evolving to encourage harmonization across jurisdictions, streamline licensing processes, and incentivize early planning of end-of-life strategies. The adoption of standardized decommissioning reference tools and best practices by multilateral bodies has facilitated knowledge sharing and benchmarking, enabling emerging programs to leverage lessons from veteran markets. Moreover, leading service providers are expanding their portfolios beyond core dismantling to include turnkey site redevelopment, waste processing, and even land repurposing for next-generation energy projects. This broadening of scope is exemplified by firms that now offer integrated project management, cost-risk modeling, and stakeholder engagement services to address the full lifecycle of decommissioning efforts.

Collectively, these shifts are redefining competitive dynamics. New entrants and established players alike are forming strategic alliances, investing in research and development, and piloting novel technologies to capture value across the decommissioning continuum. As a result, the sector is poised for a new era of efficiency and innovation, anchored by robust policy support and cutting-edge operational capabilities.

Evaluating the Complex and Cumulative Impact of 2025 United States Tariffs on the Economics and Logistics of Nuclear Decommissioning

The cumulative impact of United States tariffs imposed in 2025 has introduced profound cost and logistical challenges for nuclear decommissioning projects. Effective March 12, a broad 25 percent tariff on all steel and aluminum imports was reinstated, encompassing countries previously exempt under Section 232 and expanding to new derivative products. This measure, aimed at protecting domestic metal industries, has raised the price of critical structural materials used in reactor dismantling, storage casks, and site infrastructure. The tariffs also extend stringent reporting requirements for melt-pour and smelt-cast origin, adding administrative burdens and compliance costs for procurement teams. Simultaneously, proposed 20 percent levies on goods from the European Union and 10 percent on imports from the United Kingdom and Australia threaten to escalate equipment costs further, as decommissioning firms often rely on specialized tools and components manufactured in these regions.

Beyond base metals, the nuclear fuel supply chain faces its own set of levies. A proposed 25 percent tariff on Canadian uranium and a 10 percent duty on Chinese nuclear fuel imports would disrupt the fuel procurement landscape for utilities preparing for defueling and dismantling. Given Canada’s status as the largest uranium supplier to the U.S. market, the ripple effects could increase upstream costs and necessitate contract renegotiations with major producers such as Cameco and Orano. The uncertainty surrounding these tariffs has already prompted utilities to reassess inventory strategies and explore alternative supply routes, potentially exposing them to spot market volatility and longer lead times.

Tariffs on electrical equipment and transformer components have compounded these pressures. With approximately 80 percent of distribution transformers imported, primarily from Mexico, and grain-oriented electrical steel subject to steel tariffs, key procurement channels face cost surges and extended delivery schedules. These constraints risk delaying site power upgrades, waste processing installations, and remote handling systems, all of which are critical to safe and efficient decommissioning workflows. Stakeholders must now navigate a more fragmented supply chain landscape, balancing tariff-driven cost increases with the imperative to maintain project schedules and regulatory compliance.

Unveiling Key Segmentation Insights on How Diverse Types, Reactor Designs, Capacities, Technologies, Applications, and End Users Shape Decommissioning Strategies

Segmenting the nuclear decommissioning market provides clarity on how strategic approaches vary according to project attributes and stakeholder objectives. Based on type, strategies range from entombment to immediate dismantling and safe storage, with entombment subdivided into in-situ disposal and on-site containment to reflect varying levels of radiological isolation and site recovery requirements. When viewed through reactor type, the diversity of design-with boiling water reactors, pressurized water reactors, fast breeder reactors, gas-cooled units, and small modular reactors-necessitates tailored methodologies that account for unique structural materials, coolant systems, and containment characteristics. Capacity segmentation distinguishes projects below 300 MWe, those within the 300–800 MWe band, and large units above 800 MWe, each presenting distinct scale-related logistical and financial considerations.

Technological segmentation highlights the critical role of decontamination techniques, dismantling technologies, and waste processing and treatment solutions in determining project scope and resource allocation. Application segmentation spans industrial and medical isotope production facilities, nuclear power generation sites, and research reactors and test facilities, reflecting differences in operational history, contamination profiles, and regulatory oversight. Finally, end-user segmentation divides the landscape into government and state-owned entities versus private sector utilities, underscoring how ownership models influence funding mechanisms, risk tolerance, and long-term site redevelopment objectives. By analyzing these dimensions in concert, industry participants can better identify optimal service offerings, align capabilities with project demands, and anticipate future market shifts.

This comprehensive research report categorizes the Nuclear Decommissioning market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Reactor Type

- Capacity

- Technology

- Application

- End-Users

Highlighting Region-Specific Dynamics That Define Nuclear Decommissioning Opportunities and Challenges Across Americas, EMEA, and Asia-Pacific Territories

Regional dynamics exert a powerful influence on nuclear decommissioning priorities and capabilities, reflecting differences in regulatory environments, infrastructure maturity, and stakeholder ecosystems. In the Americas, the United States leads with the most extensive decommissioning portfolio, challenged by its reliance on imports for reactor components, power equipment, and nuclear fuel. Approximately 94 operational reactors consume nearly 47 million pounds of uranium annually, while domestic production accounts for less than 5 percent, creating an acute dependency on global suppliers and exposing decommissioning schedules to external trade policies. Canada and Latin American nations, though hosting smaller reactor fleets, face resource constraints and are beginning to develop localized decommissioning expertise and waste management frameworks to support future retirements.

Europe, Middle East & Africa has a rich legacy of nuclear power deployment, with over 200 reactors closed since inception and 190 currently in various decommissioning stages. Germany exemplifies the challenges, having fully decommissioned only four units despite decades of closures, while other countries rely heavily on long-term enclosure strategies. The United Kingdom has recently shifted major gas-cooled reactors from extended safe storage to active dismantling, reflecting policy shifts toward accelerated site recovery. Meanwhile, emerging nuclear markets in Eastern Europe and Africa are formulating decommissioning roadmaps alongside new build programs, seeking to integrate waste management and decontamination solutions into nascent regulatory frameworks.

The Asia-Pacific region presents a spectrum of maturity levels, from veteran programs in Japan and South Korea to emerging considerations in Southeast Asia. Japan’s experience with defueling and decontamination at Fukushima has yielded lessons in soil remediation and interim storage management, where contaminated soil storages reached 90 percent capacity by mid-2024, emphasizing the need for robust waste processing and regional collaboration. South Korea and China are preparing for the retirement of early generation units while establishing domestic supply chains for waste processing and dismantling equipment. Meanwhile, Australia explores regulatory pathways ahead of potential future facility retirements, laying the groundwork for comprehensive decommissioning governance.

This comprehensive research report examines key regions that drive the evolution of the Nuclear Decommissioning market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Global Companies Driving Innovation, Partnership, and Competitive Advantage in the Nuclear Decommissioning Sector

The competitive landscape of nuclear decommissioning is shaped by a mix of global conglomerates, specialized service providers, and engineering consultancies, each leveraging distinct capabilities to secure contracts and deliver comprehensive solutions. EnergySolutions has expanded beyond waste disposal to project management and life extension services, capitalizing on its infrastructure to support decommissioning and new build projects while exploring repurposing former sites for future energy generation. Jacobs Solutions has demonstrated expertise in complex dismantling plans, such as the consortium-led Ignalina project in Lithuania, which served as a pilot for graphite-moderated reactor decommissioning methodologies applicable to advanced gas-cooled and Magnox plants.

Westinghouse Electric Company holds over a dozen active contracts across Europe and North America, reflecting its deep experience in dismantling and environmental services. With major projects at Gundremmingen, Fort Calhoun, and Bohunice V1, the firm emphasizes technical rigor and a holistic approach that integrates site restoration and stakeholder engagement. SNC-Lavalin and AECOM offer end-to-end consultancy and execution, while specialized niche players like Navarro Research and Bartlett Nuclear focus on radiation protection and waste characterization. This diversified vendor ecosystem prompts collaborative bids and joint ventures, as scale, regulatory knowledge, and technical innovation become critical differentiators in securing long-term decommissioning frameworks.

This comprehensive research report delivers an in-depth overview of the principal market players in the Nuclear Decommissioning market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ABB Ltd.

- AECOM Technology Corporation

- Alliant Energy Corporation

- AtkinsRéalis Group Inc.

- ATS Corporation

- Babcock International Group PLC

- Bechtel Corporation

- China National Nuclear Corporation

- Dominion Energy, Inc.

- EDF ENERGY LIMITED

- Enercon Services, Inc.

- EnergySolutions Inc.

- Exelon Corporation

- Fluor Corporation

- Framatome SA

- GE Vernova

- Holtec International, Inc.

- i3D robotics Ltd

- KUKA AG

- Mitsubishi Heavy Industries, Ltd.

- Northstar Group Services, Inc.

- NUKEM Technologies Engineering Services GmbH by Muroosystems Corporation

- NuScale Power, LLC

- Ontario Power Generation Inc.

- Orano Technologies SA

- Sellafield Ltd

- Studsvik AB

- Toshiba Energy Systems & Solutions Corporation

- Veolia Environnement SA

- Westinghouse Electric Corporation

Actionable Strategies for Industry Leaders to Capitalize on Emerging Trends and Accelerate Safe and Efficient Nuclear Decommissioning Programs

Industry leaders must adopt proactive strategies to thrive in the evolving decommissioning landscape. First, cultivating robust supplier ecosystems is paramount: diversifying procurement channels for metals, equipment, and specialized robotics minimizes exposure to tariff-induced price volatility and supply delays. Forging strategic partnerships with domestic fabricators and technology firms can further stabilize costs and enhance resilience against trade disruptions.

Second, prioritizing digital transformation accelerates project planning and elevates safety outcomes. Integrating building information modeling (BIM), advanced remote monitoring, and machine learning analytics enables precise contamination mapping, optimized waste routing, and real-time progress tracking. These tools not only reduce overall timelines but also improve transparency for regulators and local communities.

Third, embedding sustainability into every phase-from waste reduction and recycling to site repurposing-aligns with societal expectations and regulatory incentives. Establishing clear circular economy goals, such as maximizing material reclamation and incorporating renewable energy in site redevelopment, can attract government support and fortify social license.

Finally, investing in workforce development ensures a steady pipeline of specialized talent. Tailored training programs, collaborative research initiatives with academia, and cross-disciplinary certifications in radiological safety, robotics operation, and project management build organizational capacity. By championing these actionable recommendations, industry stakeholders can enhance competitiveness, mitigate risks, and deliver superior decommissioning outcomes.

Outlining a Robust Research Methodology Combining Primary Insights, Secondary Analysis, and Rigorous Validation for Decommissioning Market Studies

Our research methodology integrates rigorous primary and secondary processes to deliver reliable, actionable insights into the nuclear decommissioning market. Through in-depth interviews with C-suite executives, plant operators, regulatory authorities, and technology vendors, we capture firsthand perspectives on strategic priorities, technology adoption, and risk management practices. These qualitative insights are complemented by detailed secondary analysis of industry reports, peer-reviewed journals, government publications, and international agency data, ensuring a comprehensive understanding of global trends, policy shifts, and technological innovations.

We then employ a multi-tier validation framework, cross-referencing data points across diverse sources and engaging subject-matter experts for peer review. Scenario analyses and sensitivity tests refine our findings, accounting for uncertainties such as policy changes, tariff fluctuations, and technology maturation. Finally, our segmentation approach-across type, reactor design, capacity, technology, application, and end user-enables us to tailor insights to specific market niches, providing stakeholders with targeted strategies for market entry, partnership formation, and investment prioritization. This robust methodology underpins the credibility and relevance of our market research, empowering decision-makers to navigate the complexities of nuclear decommissioning with confidence.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Nuclear Decommissioning market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Nuclear Decommissioning Market, by Type

- Nuclear Decommissioning Market, by Reactor Type

- Nuclear Decommissioning Market, by Capacity

- Nuclear Decommissioning Market, by Technology

- Nuclear Decommissioning Market, by Application

- Nuclear Decommissioning Market, by End-Users

- Nuclear Decommissioning Market, by Region

- Nuclear Decommissioning Market, by Group

- Nuclear Decommissioning Market, by Country

- United States Nuclear Decommissioning Market

- China Nuclear Decommissioning Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1272 ]

Synthesizing Core Findings and Forward-Looking Perspectives on Operational, Policy, and Strategic Decisions in Nuclear Decommissioning Initiatives

This executive summary synthesizes key insights that illuminate the multifaceted nature of nuclear decommissioning and its evolving market dynamics. From an expanding pipeline of end-of-life reactors to the technological revolution in robotics and data analytics, the sector is at a pivotal juncture characterized by both opportunities and challenges. Tariffs and trade measures in 2025 have underscored the importance of resilient supply chains and strategic partnerships, while segmentation analysis has highlighted the need for tailored service offerings aligned with project type, reactor design, and end-user requirements.

Regional perspectives reveal distinct market conditions, whether it be the supply chain dependencies in the Americas, the decommissioning legacy in Europe, Middle East & Africa, or the emerging frameworks in the Asia-Pacific. A competitive review identifies leading firms that are reshaping the space through integrated service models, collaborative ventures, and technological leadership. Actionable recommendations focus on supply diversification, digital transformation, sustainability integration, and workforce development as critical levers for success. Grounded in a robust research methodology that blends primary interviews, secondary data, and expert validation, these findings equip stakeholders with a strategic roadmap to navigate regulatory complexities, optimize project execution, and achieve sustainable outcomes in nuclear decommissioning.

Drive Your Strategic Advantage Today by Engaging Our Expert Team and Securing Comprehensive Nuclear Decommissioning Insights for Informed Investment Decisions

The complexities of nuclear decommissioning demand a strategic partnership between industry experts and stakeholders to ensure environmental stewardship and operational excellence in the transition from active power generation to safe site restoration. Engaging with our expert team provides you with tailored insights into the multifaceted decommissioning landscape, including evolving regulatory frameworks, technological innovations, and stakeholder dynamics. With our comprehensive report, you gain access to in-depth analysis and practical guidance that empowers your organization to make informed investment decisions, optimize project execution, and mitigate risks. Reach out to Ketan Rohom, Associate Director of Sales & Marketing, to secure your copy and unlock the strategic intelligence that will guide your next steps in nuclear decommissioning initiatives.

- How big is the Nuclear Decommissioning Market?

- What is the Nuclear Decommissioning Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?