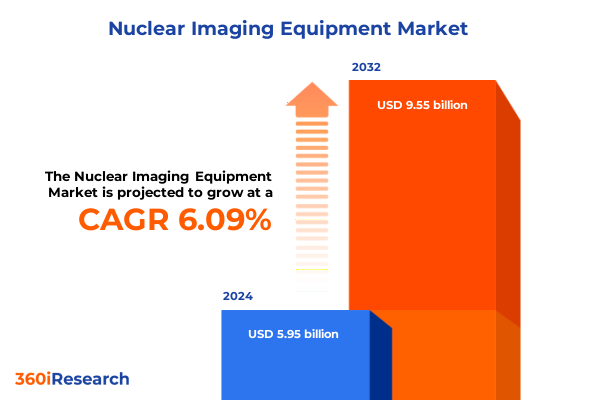

The Nuclear Imaging Equipment Market size was estimated at USD 6.29 billion in 2025 and expected to reach USD 6.66 billion in 2026, at a CAGR of 6.14% to reach USD 9.55 billion by 2032.

An Overview of Nuclear Imaging Equipment Market Dynamics and Foundational Insights Shaping Industry Trajectories for Informed Decision-Making

The nuclear imaging equipment market stands at a pivotal juncture, shaped by converging forces that span technological ingenuity, regulatory evolution, and escalating demand for precise diagnostic modalities. The foundational principles of nuclear imaging-tracing radiolabeled compounds within the body to reveal physiological and molecular phenomena-have underpinned clinical breakthroughs in oncology, neurology, and cardiology. Yet modern advances have transcended legacy modalities, integrating high-resolution digital detectors, sophisticated image reconstruction algorithms, and hybrid platforms that combine anatomical and functional insights.

Recent years have witnessed a paradigm shift toward hybrid imaging systems that blend Single Photon Emission Computed Tomography (SPECT) with computed tomography, as well as synergistic Positron Emission Tomography (PET)–CT configurations. This convergence of anatomical detail with metabolic precision has elevated diagnostic confidence and streamlined clinical workflows. As a result, healthcare providers are increasingly prioritizing nuclear imaging investments to support personalized medicine initiatives, guide therapeutic interventions, and optimize patient outcomes. Moreover, the rejuvenated focus on theranostics-using the same radiopharmaceutical agent for diagnosis and targeted therapy-underscores the strategic importance of robust imaging platforms within multidisciplinary care pathways.

Against this backdrop, the industry is also navigating complex reimbursement landscapes, stringent safety protocols, and supply chain considerations for radiopharmaceuticals. Strategic investments in infrastructure, workforce training, and cross-border collaboration are critical to harness the full potential of nuclear imaging technologies. With clinical demand intensifying and innovation accelerating, an informed, strategic approach is essential for stakeholders seeking to capitalize on emerging opportunities in this dynamic market environment.

Key Technological Innovations and Emerging Trends Driving Transformational Shifts in the Nuclear Imaging Equipment Landscape Globally

The nuclear imaging landscape is undergoing a transformative shift, driven by a confluence of technological breakthroughs, evolving clinical paradigms, and data-centric innovations. Cutting-edge detector materials, including advanced cadmium zinc telluride crystals and silicon photomultipliers, have ushered in unprecedented gains in spatial resolution and energy discrimination. These components facilitate sharper, more quantitative images, while reducing scan times and radiation doses. In parallel, artificial intelligence and deep learning algorithms are being integrated into image reconstruction and lesion detection workflows, enabling real-time image enhancement, anomaly recognition, and automated reporting.

Furthermore, modular and scalable system architectures are redefining procurement strategies, allowing healthcare facilities to tailor imaging suites to specific clinical volumes and budgets. The advent of portable PET systems expands access to remote and resource-constrained settings, democratizing advanced diagnostics. Equally impactful is the rise of cloud-based data management platforms that streamline cross-institutional collaboration, centralized quality control, and longitudinal studies. This digital ecosystem facilitates decision support tools that leverage big data analytics, predictive modeling, and outcome-driven benchmarks.

Complementing these developments, the diversification of radiopharmaceutical pipelines has catalyzed new applications in immuno-oncology, neurometabolic disorders, and infectious disease mapping. Non-traditional tracers targeting specific receptors, enzymes, or disease biomarkers are gaining regulatory clearance, broadening the clinical utility of nuclear imaging beyond conventional FDG-based protocols. Collectively, these advances are reshaping diagnostic standards, enhancing patient-centric care, and enabling a new era of precision medicine in nuclear imaging.

Evaluating the Cumulative Impact of United States Tariff Adjustments Announced in 2025 on Production Cost Structures and Supply Chain Resilience

In 2025, the United States implemented a series of tariff adjustments affecting the import of nuclear imaging equipment components and radiopharmaceutical precursors. These measures, aimed at bolstering domestic manufacturing capabilities, have reverberated across production networks, prompting OEMs and vendors to reassess global sourcing and inventory strategies. The imposed tariffs on detector crystals, collimators, and key electronic modules have elevated input costs, which has, in turn, influenced pricing strategies for end-user equipment while incentivizing nearshoring of critical components.

Simultaneously, supply chain resilience has emerged as a strategic imperative. Manufacturers have diversified supplier portfolios, forging partnerships with regional foundries and local distributors to mitigate exposure to tariff volatility. Equipment developers are also investing in vertically integrated production lines for critical subassemblies, reducing reliance on cross-border logistics and streamlining quality assurance processes. On the radiopharmaceutical front, the tariffs have accelerated the adoption of domestically produced radionuclide generators and cyclotron-derived isotopes, fostering an ecosystem of regional radiopharmacy hubs that can more effectively navigate regulatory compliance and reduce logistical bottlenecks.

Overall, the cumulative impact of these US tariff adjustments in 2025 has catalyzed a structural realignment of manufacturing footprints, supply networks, and pricing models. Companies that proactively adapted to the new tariff regime by reconfiguring operations and deepening local partnerships have managed to maintain delivery timelines and uphold competitive positioning. Meanwhile, stakeholders that deferred strategic realignment faced margin compression and shipment delays, underscoring the criticality of agile supply chain management in a tariff-sensitive trading environment.

In-Depth Exploration of Core Market Segmentation Revealing Distinct Patterns Driven by Product Types Radiopharmaceuticals Applications and End-Users

A nuanced exploration of product segmentation reveals pronounced distinctions across planar scintigraphy systems, PET scanners, and SPECT scanners-with particular emphasis on hybrid SPECT configurations versus standalone models. Planar scintigraphy remains a foundational tool in routine diagnostics, yet the surge in demand for high-throughput hybrid SPECT imaging reflects its superior contrast resolution and multi-modal flexibility. Meanwhile, PET scanners continue to capture market attention through their unparalleled sensitivity and quantitative capabilities, driving adoption in both clinical and research settings.

Turning to radiopharmaceutical segmentation, fluorodeoxyglucose stands as the most ubiquitous tracer, yet newer isotopes such as gallium-68 and technetium-99m are rapidly carving out application niches. Gallium-68’s affinity for neuroendocrine and somatostatin receptor imaging has expanded the diagnostic arsenal, while technetium-99m’s favorable half-life and broad availability sustain its role in cardiac and bone imaging. Iodine-131 retains a strong foothold in targeted thyroid therapies, illustrating the dual diagnostic–therapeutic nature of nuclear medicine.

In terms of application segmentation, oncology dominates due to the imperative for molecular-level tumor characterization, while cardiology’s focus on myocardial perfusion and neurology’s demand for functional brain mapping continue to drive growth. Infectious disease diagnosis has gained prominence in post-pandemic healthcare protocols, and orthopedic applications are increasingly leveraging SPECT/CT for prosthetic evaluation and bone turnover assessment. Finally, end-user segmentation underscores the diversified demand profiles: diagnostic imaging centers prioritize throughput and operational efficiency, hospitals and clinics emphasize integrated care delivery, and research institutes require cutting-edge systems for trial protocols and translational studies.

This comprehensive research report categorizes the Nuclear Imaging Equipment market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product

- Radiopharmaceuticals

- Application

- End-User

Regional Market Dynamics Unveiled Highlighting Comparative Insights across Americas Europe Middle East Africa and Asia-Pacific Geographies

The Americas region stands out for its advanced healthcare infrastructure, robust reimbursement frameworks, and early adoption of cutting-edge imaging modalities. Leading centers in North America drive demand for hybrid PET/CT and SPECT/CT systems, with an emphasis on theranostic workflows and personalized treatment pathways. Latin American markets, while more cost-sensitive, are steadily upgrading nuclear imaging capabilities through public–private collaborations and targeted government initiatives aimed at expanding oncology screening programs.

In the Europe, Middle East & Africa (EMEA) region, heterogeneous healthcare environments yield diverse investment patterns. Western European nations prioritize innovation and regulatory harmonization, fostering rapid deployment of novel radiotracers and AI-enabled imaging software. The Middle East has emerged as a hub for medical tourism, investing heavily in state-of-the-art nuclear imaging suites, whereas parts of Africa are focusing on foundational capacity building through partnerships with international aid organizations and academic institutions.

Asia-Pacific exhibits a dynamic growth trajectory driven by aging populations, rising chronic disease prevalence, and expanding ambulatory care networks. Markets such as China, Japan, and South Korea lead in large-scale cyclotron installations and domestically developed tracers, while Southeast Asian countries are accelerating adoption through leasing models and technology transfer agreements. Throughout the region, strategic government policies to bolster local manufacturing of imaging equipment and radiopharmaceuticals are shortening supply chains and enhancing cost efficiencies.

This comprehensive research report examines key regions that drive the evolution of the Nuclear Imaging Equipment market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Strategic Profiles of Leading Industry Players Illustrating Competitive Positioning Technological Differentiation and Collaborative Ecosystem Strategies

The competitive landscape is characterized by a handful of global leaders alongside innovative specialized entrants. Prominent multinational corporations are driving market progress through continuous investment in R&D, strategic acquisitions, and collaborations with academic research centers. These industry leaders are distinguished by their extensive portfolios that encompass planar, SPECT, and PET modalities, and by their ability to offer end-to-end solutions ranging from radiopharmaceutical supply to integrated imaging informatics platforms.

Conversely, agile niche players are capitalizing on emerging opportunities in portable imaging systems and application-specific radiotracers. Their focused strategies allow for rapid development cycles and targeted market penetration, particularly within regional clusters where flexibility and customization are valued. Partnerships between established OEMs and specialized startups are creating a symbiotic ecosystem, combining scale with innovation agility.

Moreover, collaborations between equipment manufacturers and software developers are accelerating the integration of cloud-native analytics and AI-driven decision support. Such alliances are redefining service models, enabling subscription-based imaging workflows, remote performance monitoring, and predictive maintenance. This confluence of hardware expertise and digital capabilities is setting new benchmarks for productivity, patient throughput, and diagnostic accuracy.

This comprehensive research report delivers an in-depth overview of the principal market players in the Nuclear Imaging Equipment market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Absolute Imaging Inc.

- Advanced Accelerator Applications S.A. by Norvatis

- Agfa-Gevaert N.V

- Bayer AG

- Bozlu Holding A. Ş.

- Bracco Imaging S.p.A.

- Canon Medical Systems Corporation

- CMR Naviscan Corporation

- Cubresa Inc.

- DDD-Diagnostic A/S

- Digirad Corporation

- Edge Medical Solutions Private Limited

- GE HealthCare Technologies Inc.

- Koninklijke Philips N.V.

- Mediso Ltd.

- MR Solutions Ltd.

- Neusoft Medical Systems Co., Ltd.

- PerkinElmer Inc.

- Revvity Inc

- Rigaku Corporation

- Shimadzu Corporation

- Siemens AG

- Surgiceye GmbH

- United Imaging Healthcare Co., Ltd.

Actionable Strategic Recommendations Empowering Industry Leaders to Enhance Market Penetration Operational Efficiency and Sustainable Growth Trajectories

Industry leaders should prioritize investments in system modularity and digital integration to enhance service adaptability and future-proof imaging portfolios. By adopting open architecture platforms that support incremental upgrades, organizations can align CAPEX with emerging clinical requirements while mitigating obsolescence risks. Moreover, forging alliances with radiopharmaceutical developers and AI software providers will enable comprehensive solutions that resonate with value-based care models.

Operational excellence can be advanced through predictive maintenance protocols and remote monitoring services, reducing equipment downtime and optimizing asset utilization. Training initiatives that upskill technical staff in advanced image processing, radiation safety, and clinical workflow design will further maximize the return on imaging investments. Furthermore, diversifying end-user engagement strategies-such as offering pay-per-scan models or outcome-based pricing-can attract a broader range of healthcare providers and expand market reach.

At the strategic level, companies should evaluate the benefits of localizing critical components and collaborating with regional manufacturing partners to mitigate geopolitical risks. Establishing radiopharmacy hubs with in-house cyclotron capabilities can ensure a steady supply of novel tracers while capitalizing on theranostic trends. Finally, leadership teams must embrace data-driven decision-making by integrating real-world evidence and cross-institutional registries, thereby substantiating the clinical and economic value of advanced nuclear imaging modalities.

Comprehensive Research Methodology Detailing Multi-Tiered Data Collection Analytical Frameworks and Validation Processes Ensuring Robust Industry Insights

The research employed a multi-tiered methodology combining extensive secondary research, expert consultations, and data triangulation techniques. Initially, public domain sources, peer-reviewed journals, and regulatory filings were analyzed to map the technological evolution of nuclear imaging equipment. This foundational intelligence was supplemented by analyzing patent databases, clinical trial registries, and radiopharmaceutical approvals to capture emerging innovations.

Subsequently, in-depth interviews were conducted with key opinion leaders, including nuclear medicine physicians, medical physicists, supply chain specialists, and industry executives. These discussions provided nuanced perspectives on adoption drivers, reimbursement dynamics, and clinical workflow challenges. Quantitative data was gathered from proprietary surveys distributed across imaging centers, hospitals, and research institutions to validate segmentation frameworks and application-specific demand patterns.

Finally, the findings were synthesized through a rigorous triangulation process, reconciling disparate data points to ensure consistency and robustness. Analytical frameworks such as SWOT, Porter’s Five Forces, and value chain mapping were applied to elucidate competitive dynamics and identify potential disruption vectors. The combined insights were reviewed by an expert panel to verify accuracy and objectivity, ensuring the report delivers actionable, high-confidence intelligence.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Nuclear Imaging Equipment market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Nuclear Imaging Equipment Market, by Product

- Nuclear Imaging Equipment Market, by Radiopharmaceuticals

- Nuclear Imaging Equipment Market, by Application

- Nuclear Imaging Equipment Market, by End-User

- Nuclear Imaging Equipment Market, by Region

- Nuclear Imaging Equipment Market, by Group

- Nuclear Imaging Equipment Market, by Country

- United States Nuclear Imaging Equipment Market

- China Nuclear Imaging Equipment Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 954 ]

Synthesis of Key Findings and Critical Understanding of the Evolutionary Trajectory in Nuclear Imaging Market Informing Future Strategic Directions

The analysis underscores an industry at the cusp of accelerated innovation, driven by hybrid imaging platforms, next-generation radiotracers, and AI-enabled workflows. Core findings highlight that hybrid SPECT and PET configurations are increasingly considered indispensable within advanced clinical settings, while novel tracers are redefining diagnostic applications across oncology and neurology. Supply chain realignments, catalyzed by the 2025 tariff adjustments, have prompted a shift toward localized manufacturing and collaborative partnerships to enhance resilience.

Moreover, segmentation insights reveal that end-users have divergent priorities: high-volume diagnostic centers focus on throughput optimization, hospitals demand integrated care delivery, and research institutes pursue cutting-edge capabilities for translational studies. Regionally, the Americas lead in early technology adoption, EMEA reflects heterogeneous investment strategies, and Asia-Pacific exhibits rapid growth fueled by demographic shifts and local manufacturing initiatives.

In conclusion, stakeholders who embrace modular system architectures, foster strategic collaborations, and leverage data-driven decision-making will be best positioned to navigate the evolving landscape. The confluence of technological innovation, regulatory shifts, and refined business models presents a wealth of opportunities for companies that proactively adapt to emerging demands and operational complexities.

Take Proactive Action Today Connect with Associate Director of Sales Marketing to Secure the Definitive Nuclear Imaging Equipment Market Research Report

To gain a comprehensive understanding of the nuclear imaging equipment landscape, we encourage you to take action now and secure your copy of the detailed market research report. Reaching out directly to Ketan Rohom, Associate Director of Sales & Marketing, will ensure you receive personalized guidance on selecting the right package and uncovering the insights most relevant to your strategic priorities. Engage with our expert team to explore custom data modules, discuss licensing options, and schedule a briefing tailored to your organization’s unique objectives. By partnering today, you will position your business to anticipate market shifts, refine product development roadmaps, and unlock new avenues for competitive differentiation. Don’t miss this opportunity to leverage authoritative research that drives informed decision-making in a rapidly evolving industry. Connect with Ketan Rohom to purchase the definitive nuclear imaging equipment market report and chart your path to sustained growth and innovation.

- How big is the Nuclear Imaging Equipment Market?

- What is the Nuclear Imaging Equipment Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?