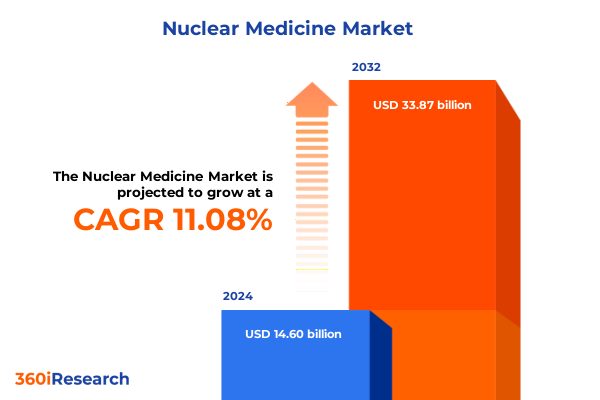

The Nuclear Medicine Market size was estimated at USD 16.05 billion in 2025 and expected to reach USD 17.72 billion in 2026, at a CAGR of 11.25% to reach USD 33.87 billion by 2032.

Unveiling the transformative potential of nuclear medicine through the convergence of precision diagnostics and targeted therapeutic breakthroughs

Nuclear medicine stands at the forefront of modern healthcare, offering unparalleled capabilities to diagnose and treat a broad spectrum of diseases with precision and minimal invasiveness. This report embarks on a comprehensive journey through the current landscape, highlighting how innovations in radiopharmaceuticals and imaging technologies are converging to redefine patient care pathways. As clinical demand escalates for early detection, personalized therapy, and real-time monitoring, nuclear medicine’s role has expanded, transcending traditional diagnostic boundaries and ushering in theranostic approaches.

Against this backdrop, industry stakeholders face a dynamic environment shaped by technological breakthroughs, regulatory evolutions, and shifting market forces. This introduction delineates the core motivations driving investments and research, from expanding diagnostic radiopharmaceutical pipelines to advancing therapeutic isotope development. By laying the foundational context, we set the stage for subsequent sections that dissect transformative trends, tariff impacts, segmentation intelligence, regional dynamics, and company strategies. Ultimately, this executive summary establishes the guiding questions that will steer decision-makers toward informed strategic choices and long-term value creation in the nuclear medicine domain.

Exploring the paradigm-shifting advances reshaping nuclear medicine from novel isotope developments to digital imaging and theranostic integration

In recent years, nuclear medicine has undergone a paradigm shift driven by novel isotope discoveries, digital imaging enhancements, and the rise of theranostics. Cutting-edge positron emission tomography isotopes have enabled higher sensitivity and specificity in detecting early-stage pathologies, while advances in single photon emission computed tomography tracers have broadened functional imaging capabilities. Simultaneously, digital PET systems, leveraging enhanced detector technology, are delivering faster scan times and lower radiation doses, thereby improving patient throughput and safety.

These technological strides have coincided with a growing emphasis on integrating diagnostic and therapeutic modalities. By pairing diagnostic isotopes with targeted therapies, theranostic protocols facilitate personalized treatment regimens, optimizing efficacy and minimizing off-target effects. Collaborative research between academic institutions, government agencies, and private enterprises has accelerated clinical trials for alpha-emitter and beta-emitter therapies. As a result, the boundaries between imaging and treatment are blurring, setting the stage for a holistic approach to disease management that promises both improved outcomes and more efficient care delivery.

Assessing the multifaceted repercussions of 2025 tariff implementations on nuclear medicine supply chains clinical access and operational cost structures

The United States introduced a series of tariffs affecting nuclear medicine imports in early 2025, prompting stakeholders to reassess supply chain configurations and cost structures. These measures, targeting key raw materials and precursor chemicals, have reverberated through the industry, increasing lead times for critical isotopes and heightening concerns over inventory security. As a consequence, diagnostic centers and hospitals have grappled with intermittent shortages, compelling them to adjust procurement protocols and explore alternative sourcing arrangements.

Moreover, manufacturers and distributors have been forced to absorb elevated logistics expenses or pass them on through pricing adjustments, reshaping contractual negotiations with end users. In response, some organizations are diversifying supplier networks, investing in domestic isotope production capabilities, and engaging policymakers to advocate for streamlined regulatory pathways. While short-term challenges persist, proactive strategies aimed at bolstering resilience-such as inventory buffering and joint public–private manufacturing initiatives-are emerging as critical countermeasures, underscoring the importance of strategic agility in navigating tariff-driven market disruptions.

Deriving profound intelligence from product type administration usage application and end user segmentation to inform strategic market positioning

A nuanced understanding of segmentation reveals critical insights for strategic market engagement. In the realm of product types, diagnostic radiopharmaceuticals encompass positron emission tomography isotopes and single photon emission computed tomography tracers, each offering unique diagnostic advantages. Therapeutic nuclear medicine divides into brachytherapy isotopes-such as Cesium-131, Iodine-125, Iridium-192, and Palladium-103-and radiopharmaceutical therapies leveraging alpha and beta emitters to maximize treatment precision. This layered structure underscores the necessity of tailored product development and targeted distribution efforts.

Transitioning to mode of administration, the dichotomy between intravenous injections and oral ingestion influences patient compliance, clinical workflow integration, and reimbursement pathways. Usage patterns further shape service offerings, as diagnostic procedures utilizing PET and SPECT scanners-and the distinctions between analog and digital PET platforms-dictate capital investment decisions for imaging centers. Across applications in cardiology, endocrinology, gastroenterology, neurology, oncology, orthopedics, and pulmonology, each specialty presents distinct tracer requirements and therapeutic protocols. Finally, end-user segmentation-from academic and research institutions to diagnostic centers and government and private hospitals-highlights divergent purchasing criteria, regulatory considerations, and value propositions, enabling stakeholders to align solutions with market-specific needs.

This comprehensive research report categorizes the Nuclear Medicine market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Mode Of Administration

- Usage

- Application

- End Users

Unpacking regional dynamics across the Americas Europe Middle East Africa and Asia Pacific to reveal nuanced nuclear medicine growth trajectories

Regional dynamics exert a powerful influence on nuclear medicine adoption, reimbursement frameworks, and R&D priorities. In the Americas, mature infrastructure, established reimbursement protocols, and supportive regulatory bodies have fostered high utilization of both diagnostic and therapeutic modalities. Nevertheless, access disparities persist in remote and rural areas, prompting initiatives to deploy mobile imaging units and tele-nuclear medicine solutions.

Within Europe, the Middle East, and Africa, regulatory harmonization efforts are progressing unevenly, creating pockets of advanced clinical trials and localized manufacturing hubs alongside jurisdictions still establishing foundational policies. Stakeholders in this region are collaborating with government agencies to streamline approval processes for innovative isotopes and digital imaging systems. Conversely, in the Asia-Pacific landscape, rapid economic growth, expanding healthcare budgets, and burgeoning life sciences ecosystems have catalyzed investment in indigenous isotope production and hybrid imaging technologies. Yet, challenges remain in standardizing quality control measures and addressing geographic supply chain complexities. Recognizing these regional distinctions is pivotal for crafting market entry strategies, forging strategic partnerships, and tailoring value propositions to diverse end-user requirements.

This comprehensive research report examines key regions that drive the evolution of the Nuclear Medicine market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Illuminating the strategic moves mergers innovations and competitive dynamics defining the leading corporate players in nuclear medicine technology

Corporate activity in nuclear medicine is marked by strategic collaborations, targeted mergers, and relentless innovation. Leading multinational imaging companies have deepened their portfolios through alliances with specialized radiopharmaceutical developers, integrating advanced tracer pipelines with state-of-the-art imaging platforms. Simultaneously, emerging biotech firms are securing significant venture capital funding to advance next-generation alpha-emitting therapies, underscoring the sector’s high-risk, high-reward nature.

In parallel, incumbent distributors and contract manufacturing organizations are enhancing their operational footprints, establishing dedicated isotope production facilities to mitigate supply constraints and capitalize on in-country manufacturing incentives. This wave of consolidation and expansion is balanced by nimble startups focusing on breakthrough radiochemistry techniques and modular imaging solutions designed for lower-cost deployment. As competitive intensity escalates, differentiation hinges on the ability to integrate end-to-end value chains-from isotope generation through imaging interpretation and therapeutic follow-up-positioning leading companies to capture synergies and drive sustainable growth in the evolving nuclear medicine ecosystem.

This comprehensive research report delivers an in-depth overview of the principal market players in the Nuclear Medicine market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 3B Pharmaceuticals GmbH

- Actinium Pharmaceuticals, Inc.

- B J Madan & Co.

- Bayer AG

- Bracco S.p.A.

- BWX Technologies, Inc.

- Clarity Pharmaceuticals

- Curium

- Eli Lilly and Company

- GE HealthCare

- IBA

- Institute of Isotopes Co., Ltd

- Isotopia Molecular Imaging Ltd.

- Jubilant Pharma Limited

- Lantheus Holdings, Inc.

- Medi-Radiopharma Co., Ltd.

- Nordion

- Northstar Medical Technologies LLC

- Novartis AG

- Nusano, Inc.

- PeptiDream Inc.

- Radiopharm Theranostics Limited

- SHINE Technologies, LLC

- Siemens Healthineers AG

- Sinotau Pharmaceuticals Group

- South African Nuclear Energy Corporation

- State Atomic Energy Corporation Rosatom

- Thor Medical AS by Nordic Nanovector ASA

Crafting actionable strategies for industry leaders to navigate evolving regulatory landscapes technological innovations and competition within nuclear medicine

Industry leaders must proactively adopt strategies that address evolving scientific, regulatory, and competitive imperatives. Cultivating partnerships with academic and clinical research centers can accelerate isotope development, streamline clinical validation pathways, and enhance market credibility. At the same time, diversifying supply channels-through investments in domestic production facilities and strategic alliances with global suppliers-will buffer tariff-induced disruptions and fortify operational continuity.

Additionally, leaders should prioritize the integration of digital solutions, leveraging artificial intelligence for image reconstruction, predictive maintenance of scanners, and precision dosimetry planning. Engaging early with regulatory agencies to clarify guidelines for novel theranostic agents will shorten time-to-market and reduce compliance risk. Finally, customizing solutions to address the unique demands of each end-user segment-ranging from high-volume hospitals to specialized research institutes-will drive adoption and unlock new revenue streams. By executing these initiatives in concert, organizations can secure competitive advantages and position themselves at the vanguard of nuclear medicine innovation.

Detailing rigorous methodologies from data sourcing to analysis frameworks underpinning robust insights for nuclear medicine market research

The research underpinning this report combines rigorous primary and secondary data collection methodologies to ensure comprehensive and objective insights. Primary research involved structured interviews and workshops with key opinion leaders, clinical practitioners, and procurement specialists, providing qualitative perspectives on adoption drivers, clinical workflows, and purchasing criteria. Secondary research integrated peer-reviewed literature, patent filings, regulatory documents, and industry white papers to construct a reliable foundation of historical context and technological trajectories.

Data triangulation was employed to reconcile insights across sources, while analytical frameworks-including Porter’s Five Forces, SWOT analysis, and PESTEL evaluation-offered robust lenses through which to interpret market dynamics. Quality assurance measures, such as cross-functional expert reviews and consistency checks, were incorporated to validate findings and mitigate bias. By adhering to these rigorous methodological standards, this report delivers credible, actionable intelligence that empowers stakeholders to navigate the complexities of the nuclear medicine landscape with confidence.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Nuclear Medicine market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Nuclear Medicine Market, by Product Type

- Nuclear Medicine Market, by Mode Of Administration

- Nuclear Medicine Market, by Usage

- Nuclear Medicine Market, by Application

- Nuclear Medicine Market, by End Users

- Nuclear Medicine Market, by Region

- Nuclear Medicine Market, by Group

- Nuclear Medicine Market, by Country

- United States Nuclear Medicine Market

- China Nuclear Medicine Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 2067 ]

Synthesizing core findings to delineate the evolving landscape the strategic imperatives and future pathways in nuclear medicine

Drawing together the insights from technological trends, policy shifts, segmentation intelligence, regional dynamics, and corporate strategies, several strategic imperatives emerge. The fusion of diagnostic and therapeutic approaches, enabled by digital imaging and advanced isotopes, heralds a new era of personalized patient care. Concurrently, tariff pressures and supply chain vulnerabilities underscore the critical need for diversified production and agile sourcing models.

Segmentation-driven initiatives reveal that tailored value propositions-aligned with product types, administration modes, clinical applications, and end-user expectations-can unlock underserved market niches. Geographically, the contrasts between mature markets, heterogeneous regulatory environments, and high-growth regions necessitate bespoke market entry and expansion tactics. Finally, the competitive landscape is defined by collaborative innovation, vertical integration, and digital transformation. Stakeholders who embrace these imperatives and foster adaptive capabilities will be well-positioned to capitalize on the next wave of nuclear medicine advancements.

Inviting decision makers to engage with Associate Director Sales & Marketing for customized insights and solutions that catalyze growth in nuclear medicine

For tailored strategic insights and bespoke solutions, reach out directly to Ketan Rohom, Associate Director of Sales & Marketing, to secure access to the full nuclear medicine market research report. Engage in a consultation that aligns our industry expertise with your organizational priorities, ensuring that your team benefits from deep analysis, nuanced regional perspectives, and actionable recommendations. By partnering with Ketan, you will receive personalized guidance on leveraging segmentation intelligence, navigating regulatory complexities, and capitalizing on emerging technological shifts.

Connect with Ketan to explore customization options, unlock executive briefings, and obtain license details for immediate deployment of findings across your business units. Whether you are seeking competitive benchmarking, supply chain resilience strategies, or forward-looking innovation roadmaps, Ketan’s expertise will guide your next steps and accelerate your growth trajectory in nuclear medicine.

- How big is the Nuclear Medicine Market?

- What is the Nuclear Medicine Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?