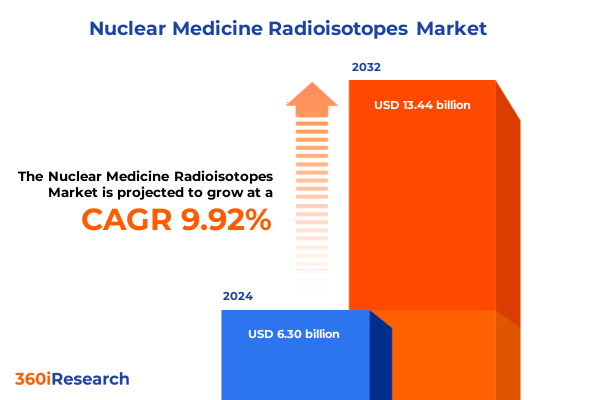

The Nuclear Medicine Radioisotopes Market size was estimated at USD 6.89 billion in 2025 and expected to reach USD 7.55 billion in 2026, at a CAGR of 9.99% to reach USD 13.44 billion by 2032.

Exploring the Key Catalysts and Innovation Drivers Revolutionizing Nuclear Medicine Radioisotopes in Modern Healthcare Practice

The nuclear medicine radioisotopes market stands at the confluence of diagnostic precision and targeted therapy. The ability to trace physiological processes at a molecular level has transformed how clinicians approach cancer, cardiovascular conditions and neurological disorders. Recent breakthroughs in radiotracers and imaging platforms have enabled earlier disease detection, personalized treatment planning and improved patient outcomes.

This executive summary provides a concise yet comprehensive overview of the nuclear medicine radioisotopes landscape. It begins with an introduction to foundational concepts, followed by an exploration of transformative shifts driven by technological innovation. It then assesses the cumulative impact of recent tariff policies on supply chain stability, and examines segmentation based on both diagnostic and therapeutic agents. Regional perspectives shed light on market dynamics across major geographies. Furthermore, an analysis of leading companies highlights competitive positioning and strategic initiatives. Finally, the report offers actionable recommendations for industry leaders, outlines the research methodology and presents a conclusion to underscore critical insights and opportunities.

Analyzing the Revolutionary Technological Breakthroughs and Therapeutic Innovations Disrupting the Nuclear Medicine Radioisotopes Field

Over the past decade, nuclear medicine has undergone a profound transformation fueled by advances in radiopharmaceutical development and imaging technology. The rise of theranostics has bridged the gap between diagnosis and therapy, enabling clinicians to deploy the same molecular targets for both imaging and treatment. Agents such as ^177Lu-PSMA and ^177Lu-DOTATATE have moved from research settings to clinical practice, offering precision therapy options for prostate and neuroendocrine tumors. At the same time, improvements in cyclotron capabilities and generator technologies have reduced production bottlenecks and enhanced tracer availability, while integrated PET/CT and SPECT/CT systems deliver simultaneous functional and anatomical information with unprecedented clarity.

In addition to radiotracer innovation, automation and digital workflow enhancements have accelerated radiopharmaceutical synthesis and quality control. Automated synthesis modules now achieve higher yields with reduced human intervention, increasing reproducibility and safety. Artificial intelligence algorithms have begun to support image reconstruction, lesion detection and dosimetry calculation, enabling faster scans and more precise quantification. Furthermore, collaborative research between academic institutions and industry consortia has fostered standardized protocols for emerging tracers, streamlining regulatory pathways and expediting patient access to novel diagnostic and therapeutic agents.

Evaluating the Compound Consequences of the 2025 United States Tariff Policies on the Radiopharmaceutical Supply Chain

In early 2025, the United States government advanced Section 232 national security investigations that could impose reciprocal tariffs on pharmaceutical imports, including medical isotopes critical to nuclear medicine. Industry stakeholders have warned that such measures risk disrupting an already fragile supply chain, where more than half of the country’s technetium-99m originates from overseas sources. The Society of Nuclear Medicine and Molecular Imaging has articulated concerns that steep duties would elevate costs for providers and potentially delay essential diagnostic and therapeutic procedures.

Physician advocacy groups have urged policymakers to exempt radiopharmaceuticals, medical isotopes and related equipment from tariff measures until domestic production capacity can be fully established. Leaders from the American Society of Nuclear Cardiology and the American College of Cardiology emphasized that molybdenum-99 remains vital for myocardial perfusion imaging and bone scans, and that sustained access is imperative for patient safety and outcome accuracy. They highlighted that building domestic Mo-99 production could span a decade or more, underscoring the need for interim tariff relief to maintain clinical continuity.

Beyond policy debates, leading suppliers have quantified the immediate economic impact of trade tensions. GE Healthcare projected tariff-related expenses of nearly $500 million in 2025, driven largely by bilateral levies on imports from China and other trading partners. The company outlined mitigation strategies, including localizing manufacturing footprints and diversifying raw material sources to shield operations from volatility. Despite these efforts, healthcare providers face uncertainty around pricing and supply security, prompting renewed collaboration between industry associations, regulators and commercial stakeholders to safeguard the radiopharmaceutical ecosystem.

Simultaneously, China’s restrictions on rare earth exports have highlighted the geopolitical dimensions of supply chain resilience. With critical elements like lutetium and yttrium subject to approval delays under new export controls, manufacturers of contrast agents and radiotracers are exploring alternative chemistries and sourcing strategies to mitigate dependency. These developments illustrate the interconnected nature of global trade and underscore the urgency of comprehensive policy frameworks that balance national security objectives with patient access imperatives.

Uncovering Strategic Market Dimensions through Advanced Segmentation of Diagnostic and Therapeutic Radiopharmaceutical Agents

The nuclear medicine radioisotopes landscape can be delineated through rigorous segmentation that illuminates both diagnostic and therapeutic applications. Diagnostic agents form the cornerstone of molecular imaging, guiding clinical decision-making through PET and SPECT modalities. Positron emission tomography tracers such as fluorine-18–labeled compounds have become indispensable for cancer staging and neurological assessments, with F18 FDG leading the portfolio and F18 PSMA advancing prostate cancer detection. Single-photon emission computed tomography agents continue to offer cost-effective solutions for cardiac and bone imaging, with technetium-99m–based formulations dominating the practice environment.

Beyond diagnostics, therapeutic radiopharmaceuticals have emerged as precision tools for targeted treatment. Peptide receptor radionuclide therapy harnesses receptor-specific peptides to deliver cytotoxic radiation directly to tumor cells, achieving profound clinical responses in neuroendocrine malignancies. Radioembolization techniques infuse microspheres labeled with yttrium-90 into hepatic vessels to treat liver tumors, combining interventional radiology and radiopharmaceutical expertise. Radioimmunotherapy leverages monoclonal antibodies conjugated to beta-emitting isotopes, offering a versatile platform for hematological and solid tumor interventions. The interplay between diagnostics and therapeutics reinforces a holistic paradigm shift toward theranostics, where visualization and treatment converge on shared molecular targets.

This segmentation framework enables stakeholders to identify growth pockets and prioritize resource allocation. Investment decisions can target high-growth tracers with robust clinical validation, while clinical centers can optimize workflow by integrating complementary imaging and treatment modalities. Regulatory bodies can tailor approval pathways that account for the nuanced safety profiles of diagnostic versus therapeutic agents. Ultimately, segmentation insights empower evidence-based strategies that align scientific innovation with clinical and commercial goals.

This comprehensive research report categorizes the Nuclear Medicine Radioisotopes market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Isotope Function

- Mode Of Administration

- Production Technology

- End User

- Disease Area

Illuminating Regional Market Dynamics through Comparative Analysis of the Americas, EMEA, and Asia-Pacific Nuclear Medicine Ecosystems

The Americas region has sustained leadership in nuclear medicine radioisotope utilization, driven by robust reimbursement frameworks, established clinical guidelines and extensive research infrastructures. The United States, in particular, benefits from a network of academic medical centers and commercial radiopharmacies that ensure rapid distribution of short-lived tracers. Healthcare systems have invested heavily in hybrid imaging platforms, facilitating widespread adoption of PET/CT and SPECT/CT technologies. Meanwhile, Latin American markets are experiencing a gradual expansion, supported by governmental initiatives to enhance diagnostic capacity and training programs for nuclear medicine specialists.

Europe, the Middle East and Africa exhibit a diverse spectrum of market maturity, ranging from leading Western European nations with advanced radiopharmaceutical manufacturing capabilities to emerging markets in Eastern Europe and North Africa that face infrastructure constraints. The European Union’s centralized regulatory processes and collaborative research consortia have propelled the approval of novel tracers, while Middle Eastern healthcare hubs invest in cutting-edge imaging centers to serve regional and international patients. In contrast, parts of Africa contend with supply chain and logistical challenges, prompting international partnerships to build capacity and improve isotope access.

Asia-Pacific reflects a dynamic growth trajectory characterized by expanding clinical trials, regulatory acceleration and infrastructure development. Japan has solidified its position as a key manufacturing center for clinical trial yields of novel isotopes, supported by recent investments in cyclotron facilities. China’s healthcare modernization initiatives, coupled with increasing cancer prevalence, have amplified demand for PET and SPECT imaging, while Australia and South Korea advance domestic production capabilities. Across the region, governments are forging public-private collaborations to bolster isotope supply chains and training pipelines, ensuring sustainable expansion of nuclear medicine services.

This comprehensive research report examines key regions that drive the evolution of the Nuclear Medicine Radioisotopes market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Industry Leaders and Innovative Disruptors Shaping Competitive Strategies in the Nuclear Medicine Radioisotope Market

Global radiopharmaceutical leaders are forging strategic alliances and expanding production footprints to meet surging demand. Novartis established a new research and manufacturing hub in Sasayama, Japan, following a significant capital investment aimed at scaling PET agent production for Asian and global markets. This initiative aligns with the company’s broader objective to streamline clinical trial supply chains and accelerate the commercialization of novel radiotracers in key therapeutic areas.

GE Healthcare has responded to tariff-induced cost pressures by diversifying its supplier network and localizing critical manufacturing steps. Despite anticipating nearly $500 million in tariff costs for 2025, the company plans to deploy agile production models across multiple geographies, minimizing exposure to trade disruptions and enhancing service reliability for diagnostic and therapeutic radiopharmaceuticals.

Meanwhile, emerging players and academic spin-outs are driving niche innovation in targeted alpha therapies and next-generation PET tracers. Collaborative ventures between reactor facilities and biotech start-ups have yielded promising advances in actinium-225 and novel technetium-99m generators. These partnerships leverage academic expertise and specialized infrastructure to de-risk early-stage development and attract venture capital into high-potential radiotherapeutic modalities.

Companies such as Siemens Healthineers and Philips Healthcare leverage their imaging hardware portfolios to deliver integrated solutions that encompass radiopharmaceutical production, quality assurance and image analysis software. Their AI-enabled platforms and digital workflows aim to optimize tracer utilization and improve diagnostic throughput, underscoring the competitive imperative to offer end-to-end solutions that transcend traditional scanner sales.

This comprehensive research report delivers an in-depth overview of the principal market players in the Nuclear Medicine Radioisotopes market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- BWX Technologies Inc

- Cardinal Health

- China Isotope & Radiation Corporation

- Curium Pharma

- Eckert & Ziegler AG

- GE HealthCare Technologies Inc

- Ionetix Corporation

- IRE ELiT

- ISOFLEX USA

- ITM Isotope Technologies Munich SE

- Life Molecular Imaging

- NECSA Ltd

- NorthStar Medical Radioisotopes LLC

- NTP Radioisotopes SOC Ltd

- Nusano

- Orano Med

- SOFIE Biosciences Inc

- Telix Pharmaceuticals Ltd

Implementing Strategic Initiatives to Enhance Resilience, Innovation and Collaboration in the Nuclear Medicine Radioisotopes Sector

Industry leaders should prioritize collaborative partnerships with academic institutions and contract manufacturing organizations to foster innovation in radiotracer development. By establishing shared-development platforms and co-funded research programs, companies can mitigate the high costs of early-stage discovery and streamline regulatory submissions for novel diagnostic and therapeutic agents.

Simultaneously, organizations must invest in decentralized production models that leverage regional cyclotron networks and modular generator technologies. Deploying compact production facilities closer to clinical sites reduces logistical risks associated with short-lived isotopes and enhances supply chain agility, ensuring consistent patient access even amid trade or geopolitical disruptions.

A proactive policy engagement strategy is essential to influence tariff and trade frameworks that impact radiopharmaceutical imports. Industry coalitions should engage with regulatory authorities to advocate for targeted exemptions on critical medical isotopes and to establish incentive programs for domestic manufacturing. Such initiatives will preserve affordability and maintain service continuity for diagnostic and therapeutic procedures.

Finally, embracing digital transformation through automation and artificial intelligence will empower organizations to optimize operations, from tracer synthesis to image interpretation. Integrating AI-driven quality control tools and predictive maintenance systems can enhance production yield, minimize downtime and accelerate time-to-clinic for emerging radiopharmaceuticals, positioning companies at the forefront of precision medicine.

Employing Rigorous Data Collection and Analytical Techniques to Ensure Comprehensive Insights into Nuclear Medicine Radioisotope Trends

The research methodology combines qualitative and quantitative approaches to deliver a holistic assessment of the nuclear medicine radioisotopes market. Primary research interviews were conducted with industry executives, radiochemistry experts and clinical end users to capture firsthand perspectives on technological adoption, supply chain challenges and regulatory developments.

Complementing primary insights, secondary research involved an exhaustive review of scientific literature, regulatory filings, government reports and reputable industry publications. Data triangulation and cross-validation enhanced the reliability of findings, ensuring that presented insights reflect current market realities and emerging trends.

Analytical frameworks such as SWOT analysis, Porter’s Five Forces and value chain mapping provided structured lenses to evaluate competitive dynamics, market drivers and potential barriers. Scenario modeling and sensitivity testing were applied to assess the impact of policy shifts, supply constraints and innovation trajectories on strategic decision-making.

Finally, the research adheres to stringent data governance standards, maintaining confidentiality of proprietary information and ensuring ethical considerations in stakeholder engagement. The methodology’s transparency and reproducibility enable readers to trace the derivation of key insights and to apply the framework to adjacent domains within healthcare diagnostics and therapeutics.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Nuclear Medicine Radioisotopes market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Nuclear Medicine Radioisotopes Market, by Isotope Function

- Nuclear Medicine Radioisotopes Market, by Mode Of Administration

- Nuclear Medicine Radioisotopes Market, by Production Technology

- Nuclear Medicine Radioisotopes Market, by End User

- Nuclear Medicine Radioisotopes Market, by Disease Area

- Nuclear Medicine Radioisotopes Market, by Region

- Nuclear Medicine Radioisotopes Market, by Group

- Nuclear Medicine Radioisotopes Market, by Country

- United States Nuclear Medicine Radioisotopes Market

- China Nuclear Medicine Radioisotopes Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1590 ]

Synthesizing Critical Insights to Illuminate Opportunities and Challenges in the Evolving Nuclear Medicine Radioisotope Arena

This executive summary has outlined the pivotal forces reshaping the nuclear medicine radioisotopes landscape, from granular segmentation insights to the broader impact of tariff policies. Rapid innovation in theranostics, coupled with emerging production modalities, is redefining clinical practice and expanding therapeutic horizons.

Stakeholders must navigate complex geopolitical and regulatory environments while capitalizing on collaborative frameworks that accelerate tracer development and distribution. The strategic integration of AI and automation presents a unique opportunity to enhance operational efficiency and clinical throughput.

Looking ahead, resilient supply chain architectures, targeted policy engagement and robust partnerships will underpin sustainable growth and patient-centric care. By proactively addressing emerging challenges and seizing transformative opportunities, industry participants can secure leadership positions in this high-potential field.

Act Now to Secure Unparalleled Market Intelligence and Gain a Competitive Edge by Connecting Directly with Ketan Rohom Today

To obtain the full market research report and unlock comprehensive analysis, detailed data and actionable strategic guidance, please reach out to Ketan Rohom (Associate Director, Sales & Marketing at 360iResearch). His expertise will ensure you receive tailored insights that directly support your organizational objectives.

Engage with our research team now to explore custom advisory services, schedule a personalized briefing and access exclusive data visualizations that will illuminate hidden growth avenues. Contact Ketan Rohom today to accelerate your strategic decision-making and capitalize on emerging trends in nuclear medicine radioisotopes.

- How big is the Nuclear Medicine Radioisotopes Market?

- What is the Nuclear Medicine Radioisotopes Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?