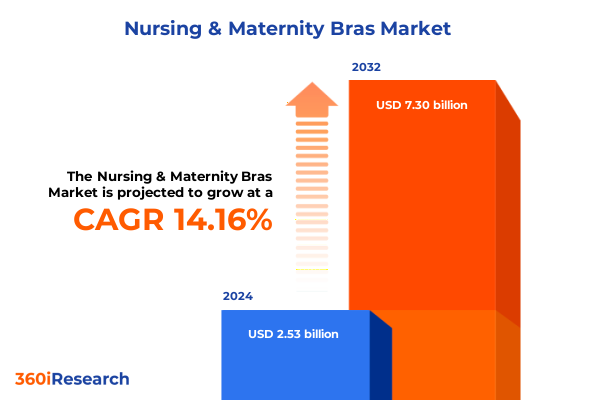

The Nursing & Maternity Bras Market size was estimated at USD 2.89 billion in 2025 and expected to reach USD 3.27 billion in 2026, at a CAGR of 14.15% to reach USD 7.30 billion by 2032.

Setting the Stage for the Rapid Evolution of Nursing and Maternity Bra Markets Driven by Unprecedented Demand for Comfort, Digital Innovation, and Sustainability

The nursing and maternity bras segment has emerged as a focal point for brands seeking to balance maternal health needs with evolving lifestyle preferences. Over the past two years, consumers have placed an unparalleled premium on comfort and seamless functionality, gravitating toward bras that adapt to their changing bodies without sacrificing style. Wireless and seamless constructions, once niche offerings, now command significant attention as more than one in five consumers express a preference for wire-free designs that minimize discomfort during both pregnancy and breastfeeding. At the same time, sustainability has become a core consideration, with nearly two-thirds of buyers prioritizing organic cotton or recycled fabrics in their intimate wear purchases.

Digital innovation is reshaping how expectant and nursing mothers discover and purchase bras. E-commerce platforms now account for more than half of all nursing bra sales, as brands leverage online exclusives, subscription models, and social media collaborations to captivate a digitally native clientele. Influencer partnerships and targeted content have amplified product education, enabling consumers to make more informed decisions about fit and fabric. Moreover, direct-to-consumer label launches and AI-powered sizing tools are rapidly reducing returns and enhancing customer satisfaction, underscoring the importance of a seamless omnichannel experience.

As this market evolves, manufacturers and retailers must anticipate shifting regulatory landscapes, particularly around import costs and supply chain resilience. A nuanced understanding of regional variances, emerging consumer insights, and the competitive positioning of leading players will be critical for any organization aiming to capture value in the nursing and maternity bras arena.

Charting the Transformative Shifts That Are Redefining Supply Chains, Product Innovation, and Consumer Engagement in the Nursing and Maternity Bra Industry

The nursing and maternity bras landscape is undergoing transformative shifts driven by geopolitical, technological, and consumer behavior changes. Supply chain diversification has moved to the forefront, as brands seek to hedge against concentrated sourcing risks and rising import levies. Leading apparel firms have reduced China’s share of U.S. imports from over thirty-three percent in 2017 to approximately twenty-one percent in early 2025 through tactical multi-sourcing strategies, while discussions about nearshoring and regional manufacturing partnerships have gained urgency. At the same time, the pandemic era’s acceleration of reshoring debates has underscored the need for agile production networks that can pivot quickly to new materials and technologies.

On the consumer front, the expectation for personalized fit and premium fabrication is reshaping product portfolios. Brands are increasingly integrating memory foam cups, temperature-regulating textiles, and antimicrobial finishes to address specific postpartum and nursing needs. Meanwhile, wireless and seamless bra variants now represent a quarter of new product introductions, reflecting a broader shift toward minimal-hardware designs that cater to active and mobile lifestyles. This evolution is further supported by digital tools that enable consumers to engage with interactive fit assessments and virtual try-ons, reducing the friction traditionally associated with intimate apparel purchases.

Furthermore, the industry’s marketing playbook has expanded to include partnerships with lactation experts, online communities, and maternity-focused influencers. These collaborations not only build trust but also create authentic narratives that resonate with new mothers navigating their breastfeeding journeys. Taken together, these shifts underscore a market in flux-one where operational resilience, material innovation, and consumer empowerment converge to define future success.

Assessing the Cumulative Impact of 2025 U.S. Tariffs on Pricing Structures, Sourcing Strategies, and Competitive Dynamics in the Nursing and Maternity Bra Sector

The cumulative impact of recent U.S. tariff measures on imported apparel has introduced new complexities for manufacturers and retailers in the nursing and maternity segment. In early April 2025, a universal ten-percent baseline tariff was reinstated, and incremental “reciprocal” duties were applied to major sourcing countries, including a thirty-four percent levy on China and a forty-six percent tariff on Vietnam. These changes have effectively raised the cost of importing core materials such as cotton and spandex, as well as finished bras, leading many brands to reevaluate their pricing and sourcing strategies.

Industry forecasts suggest that tariffs have already driven short-term apparel price increases of up to sixty-four percent, with long-term prices remaining more than a quarter higher than pre-tariff levels. As a result, apparel firms are pursuing targeted price adjustments and renegotiations with suppliers to absorb portions of the incremental duties, while concurrently liquidating pre-tariff inventory to mitigate cost pressures. In parallel, discussions around supply chain localization have intensified, although high capital requirements and infrastructure gaps have tempered expectations for rapid reshoring.

Navigating this tariff environment demands a strategic balance between cost management and value preservation. Brands that proactively segment their product lines by price tier, material composition, and end-use can better manage margin compression and sustain consumer loyalty. Additionally, enhanced scenario planning and continuous dialogue with trade experts have become indispensable for aligning import flows with dynamic policy landscapes.

Illuminating Key Segmentation Insights That Reveal Critical Demand Drivers Across Distribution Channels, Product Types, Materials, Pricing Tiers, and Usage Stages

A precise understanding of market segments is essential for crafting differentiated strategies that resonate with diverse consumer cohorts. Distribution channels now bifurcate into traditional brick-and-mortar outlets-spanning department stores, hypermarkets, supermarkets, and specialty retailers-and digital platforms, which include brand-owned websites and third-party e-commerce portals. Growing consumer comfort with online shopping has prompted many legacy retailers to integrate virtual fitting rooms and subscription services to replicate the in-store experience and capture incremental share of digitally native parents.

Product portfolios are further refined across five bra types: seamless maternity bras, sleep nursing bras, support maternity bras, underwire nursing bras, and wireless nursing bras. Each variant addresses unique functional demands-whether seamless construction for sensitive skin, targeted lift for support during feeding, or simplified clip-down access for nocturnal nursing routines. Material selection, encompassing cotton, nylon, polyester, and spandex, underpins performance attributes such as breathability, stretch recovery, moisture management, and durability.

Price positioning remains a critical touchpoint for consumers. Economy-tier bras attract budget-conscious buyers and first-time mothers seeking basic functionality, while midrange offerings balance cost and quality through value-added features. Premium segments deliver high-performance fabrics, advanced ergonomic design, and curated styling for mothers who expect both functionality and fashion appeal. Lastly, usage stage classification-pregnancy versus postpartum-ensures that product design, marketing messaging, and retailer training align with the distinctive comfort and support requirements of each phase.

This comprehensive research report categorizes the Nursing & Maternity Bras market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Material

- Price Range

- Usage Stage

- Distribution Channel

Revealing Key Regional Insights to Navigate Diverse Consumer Expectations, Trade Complexities, and Channel Maturities Across the Americas, EMEA, and Asia-Pacific Territories

Regional dynamics in the nursing and maternity bras market underscore the heterogeneity of consumer expectations and trade environments. In the Americas, North America leads adoption of premium and midrange product tiers, supported by high disposable incomes and well-established specialty chains. Online penetration in this region surpasses forty percent, as consumers leverage virtual consultations and subscription models for ongoing replenishment. Central and Latin American markets, by contrast, exhibit stronger demand for value-oriented economy bras, with consumers often prioritizing affordability and basic support features.

In Europe, the Middle East, and Africa, premium branding and sustainability narratives drive purchase decisions in Western Europe, where organic fabrics and eco-certifications command a price premium. Specialty lingerie boutiques and department stores remain influential in metropolitan centers, while e-commerce growth is fueled by targeted social media campaigns and local digital payment solutions. In Middle Eastern markets, cultural considerations and modesty standards shape design aesthetics and fabric weight, whereas African markets present pockets of growth through organized retail and mobile commerce adoption.

The Asia-Pacific region is characterized by rapid urbanization and a burgeoning middle class with an increasing appetite for midrange and premium nursing bras. China, India, and Southeast Asian economies are witnessing significant e-commerce expansion, often led by mobile-first platforms. However, tariff barriers and local manufacturing capabilities introduce variability in pricing and product availability. Strategic partnerships with regional contract manufacturers have enabled several international brands to mitigate cost pressures, while local players leverage agile production to introduce trend-responsive collections. By understanding these regional contours, companies can tailor market entry and expansion plans that reflect the nuanced interplay of consumer preferences, channel maturity, and trade policy.

This comprehensive research report examines key regions that drive the evolution of the Nursing & Maternity Bras market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Exposing Key Company Insights to Highlight How Leading Brands Are Innovating, Competing, and Collaborating in the Nursing and Maternity Bra Arena

The competitive landscape of nursing and maternity bras is anchored by established and emerging players who differentiate through design, technology integration, and brand positioning. Bravado Designs, commanding approximately eighteen percent of global sales, is widely recognized for its functional yet stylish bras, often recommended by lactation consultants and healthcare professionals. Destination Maternity (Motherhood Maternity) follows closely with a broad range of essentials that appeal to cost-conscious mothers, leveraging its extensive North American retail footprint.

Medela’s focus on incorporating one-handed nursing clips and removable padding exemplifies the intersection of health-tech and intimate apparel, targeting mothers who value ease of use and clinical endorsement. Cake Maternity has carved out a premium niche by blending lingerie-inspired aesthetics with maternity-specific features, supported by influencer collaborations that bring real-world style cues to expectant consumers. Kindred Bravely and Lansinoh are notable for their sustainable material choices and direct-to-consumer approaches, attracting eco-conscious parents through subscription models and transparent manufacturing practices.

Regional brands such as Anita and Triumph maintain stronghold positions in European markets, offering heritage-driven design and inclusive sizing. Meanwhile, new entrants continue to challenge incumbents by introducing adaptive fabrics, temperature-regulating technologies, and rapid-response production. Collectively, these companies highlight a market in which product innovation, omnichannel distribution, and purpose-driven narratives define leadership.

This comprehensive research report delivers an in-depth overview of the principal market players in the Nursing & Maternity Bras market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Bravado Designs

- Cake Maternity

- Cake Maternity Pty Ltd

- Hatch Collection LLC

- Hotmilk Lingerie Ltd

- Ingrid & Isabel LLC

- Kindred Bravely

- Kindred Bravely LLC

- Latched Mama LLC

- Majamas Baby LLC

- Medela AG

- Melinda G Nursing Bras

- Nyssa Nursing Bras

- Royce Lingerie

- Seraphine Ltd

Crafting Actionable Recommendations to Empower Industry Leaders to Navigate Tariff Pressures, Harness Digital Innovation, and Foster Sustainable Growth in the Maternity Bra Market

To thrive amid shifting trade policies, evolving consumer demands, and intensifying competition, industry leaders should pursue a multi-pronged strategic agenda. First, brands must diversify their supply chains by forging partnerships with regional contract manufacturers and exploring nearshoring options to alleviate tariff burdens and shorten lead times. Scenario planning that incorporates potential duty escalations will ensure greater agility in inventory management.

Second, organizations should continue to invest in digital capabilities, including AI-driven fit assessments, virtual try-ons, and tailored subscription services. These tools not only enhance customer engagement but also reduce return rates and elevate brand loyalty. Third, premium and mid-range product lines should integrate sustainable and health-focused materials, such as organic cotton and antimicrobial finishes, to meet consumer expectations and differentiate offerings.

Additionally, leaders ought to deepen collaborations with healthcare providers and lactation experts to formalize product endorsements and educational initiatives, thereby reinforcing trust and driving word-of-mouth advocacy. Lastly, dynamic pricing models that factor in real-time cost inputs and competitive positioning will help maintain margins without compromising value perceptions. By executing these recommendations, companies can build resilient operations and deliver compelling value propositions.

Detailing the Comprehensive Research Methodology That Underpins Robust, Peer-Reviewed Market Intelligence on the Nursing and Maternity Bra Sector

This research initiative employs a rigorous, multi-stage methodology designed to ensure comprehensive and unbiased market intelligence. We began with an extensive secondary review of industry publications, trade journals, government tariff schedules, and financial filings to establish macro-environmental factors and regulatory developments. Next, we conducted primary interviews with supply chain executives, retail buyers, product designers, and healthcare professionals to capture firsthand perspectives on emerging trends and pain points.

Quantitative data was aggregated from proprietary sales databases and reputable market research firms, then triangulated against public datasets to validate accuracy. Segmentation analyses were performed by distribution channel, product type, material composition, price range, and usage stage, facilitating nuanced demand profiling. Regional market dynamics were assessed through country-level import/export statistics and localized consumer surveys.

Finally, data integrity and methodological robustness were upheld through peer reviews by subject-matter experts and statistical validation techniques. This layered approach ensures that the insights presented are both actionable and reflective of the current market realities.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Nursing & Maternity Bras market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Nursing & Maternity Bras Market, by Product Type

- Nursing & Maternity Bras Market, by Material

- Nursing & Maternity Bras Market, by Price Range

- Nursing & Maternity Bras Market, by Usage Stage

- Nursing & Maternity Bras Market, by Distribution Channel

- Nursing & Maternity Bras Market, by Region

- Nursing & Maternity Bras Market, by Group

- Nursing & Maternity Bras Market, by Country

- United States Nursing & Maternity Bras Market

- China Nursing & Maternity Bras Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1272 ]

Concluding the Executive Summary by Synthesizing Strategic Imperatives and Underscoring the Path Forward for Nursing and Maternity Bra Stakeholders

The nursing and maternity bras market stands at a critical juncture where consumer expectations, regulatory dynamics, and competitive activities intersect. The drive toward comfort, sustainability, and seamless digital engagement is reshaping product portfolios and distribution strategies. At the same time, tariff adjustments have redefined cost structures, compelling brands to diversify sourcing and refine pricing models.

Segmentation insights underscore the importance of tailoring offerings across channels, product types, materials, price points, and usage stages, while regional analyses reveal distinct consumer behaviors and trade environments in the Americas, EMEA, and Asia-Pacific. Leading companies continue to innovate through technology integration, sustainable practices, and collaborative partnerships, setting benchmarks for the broader industry.

As the sector evolves, the ability to anticipate policy shifts, leverage digital tools, and differentiate through purpose-driven narratives will determine market leadership. Armed with these insights, decision-makers can chart informed strategies that balance growth aspirations with operational resilience.

Engage with Ketan Rohom Today to Unlock Premium Market Insights and Propel Your Strategies in the Nursing and Maternity Bras Domain

If you are ready to transform your strategic approach and gain an in‐depth understanding of the nursing and maternity bras market, connect with Ketan Rohom, Associate Director of Sales & Marketing. His expertise in market intelligence and client engagement can help you tailor solutions that address the unique challenges posed by evolving consumer demands and regulatory environments. By partnering with Ketan, you can secure immediate access to the full executive report, complemented by personalized insights and dedicated support. Take this opportunity to empower your organization with the actionable data and expert guidance necessary to stay ahead in a competitive landscape. Reach out to Ketan Rohom today to discuss how this comprehensive research can drive your growth and innovation efforts

- How big is the Nursing & Maternity Bras Market?

- What is the Nursing & Maternity Bras Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?