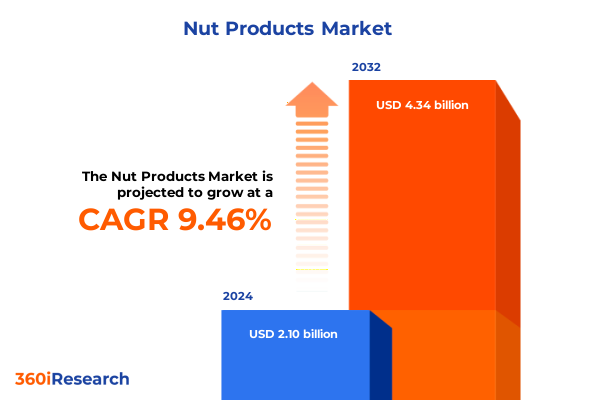

The Nut Products Market size was estimated at USD 2.30 billion in 2025 and expected to reach USD 2.52 billion in 2026, at a CAGR of 9.47% to reach USD 4.34 billion by 2032.

Exploring the Dynamic Evolution of Nut Products as Essential Staples in Global Nutrition and Their Rising Significance in Health-Driven Consumer Diets

The global nut products sector has rapidly transitioned from a niche specialty offering to a mainstream component of daily nutrition, driven by its exceptional nutritional value and versatile applications. Consumers worldwide are recognizing the benefits of nuts as rich sources of plant-based protein, essential fatty acids, and micronutrients. As dietary guidelines increasingly emphasize whole-food approaches, nuts have emerged as high-impact ingredients in snacks, spreads, dairy alternatives, bakery, and confectionery products, fostering significant growth across food and beverage categories.

Moreover, evolving lifestyles characterized by heightened health consciousness and on-the-go consumption have intensified demand for convenient, nutrient-dense options. This shift has spurred manufacturers to innovate through premiumization, novel flavor profiles, and value-added formats that balance indulgence with wellness. Against this backdrop, this executive summary offers a concise yet thorough exploration of the transformative forces shaping the nut products landscape, the latest regulatory and trade developments, segmentation nuances, regional opportunities, competitive dynamics, and strategic imperatives for market participants.

By synthesizing the most pertinent insights, this document equips decision-makers with a clear understanding of current conditions and future trajectories. It highlights how macro drivers, from tariff changes to consumer preferences, intersect with granular factors such as packaging, distribution channels, and end-use applications. This introduction lays the groundwork for a deeper examination of key findings and actionable recommendations designed to empower innovators, manufacturers, and distributors in aligning their portfolios with evolving market demands.

Uncovering the Pivotal Transformations Shaping the Nut Products Market and Driving Innovation Across Manufacturing Distribution and Consumer Engagement

Over the past several years, the nut products market has undergone pivotal transformations fueled by a confluence of consumer, technological, and sustainability imperatives. Heightened awareness of plant-based diets has elevated nuts as indispensable sources of protein and healthy fats, prompting manufacturers to expand beyond traditional roasted kernels into creamy butters, oils, and innovative composites that cater to flexitarian, vegan, and keto lifestyles. This progression toward greater product diversity is underscored by the rise of functional formulations enriched with adaptogens, probiotics, and natural sweeteners to meet sophisticated health and wellness demands.

Simultaneously, digital adoption has redefined how industry stakeholders engage with consumers and manage operations. E-commerce platforms and direct-to-consumer models now enable tailored subscription services and limited-edition releases, revealing new pathways to gather real-time feedback and foster brand loyalty. Furthermore, data-driven supply chain optimization and blockchain-enabled traceability solutions are gaining traction as manufacturers strive to enhance transparency, fortify food safety, and validate ethical sourcing claims.

Sustainability considerations have emerged as another transformative force, with an emphasis on water stewardship, regenerative agriculture, and carbon footprint reduction. The integration of circular economy principles is leading to packaging innovation, including compostable films and minimal-waste designs, and reinvesting byproducts such as shells into animal feed and bioenergy. Collectively, these shifts are redefining competitive benchmarks and creating fertile ground for differentiation, collaboration, and long-term value creation across the nut products ecosystem.

Evaluating the Far-Reaching Consequences of 2025 United States Tariff Measures on Nut Products Supply Chains and Trade Dynamics

At the start of 2025, updated tariff schedules implemented by the United States government introduced significant duties on certain imported nut products, aiming to protect domestic producers and address trade imbalances. These measures covered a range of items, including in-shell and shelled kernels, as well as value-added preparations such as nut butters and oils. As a result, importers faced higher landed costs, prompting some to renegotiate contracts, explore alternative origin countries, and adjust pricing strategies to maintain profitability and market share.

Consequently, supply chain networks have been reconfigured, with increased emphasis on sourcing from non-U.S. regions that benefit from favorable trade agreements or lower baseline costs. This shift has also triggered inventory management challenges, as importers recalibrate order volumes to mitigate cash flow impacts. Simultaneously, domestic producers are scaling capacity investments to capitalize on tariff-driven demand, though they must navigate crop variability, labor constraints, and sustainability commitments.

In addition, indirect effects of the tariff adjustments have rippled through distribution channels and retail pricing. Food service operators and industrial users have begun incorporating cost-sensitive ingredients or reformulating recipes to offset higher nut input costs, while consumers have encountered modest price uplifts in premium offerings. These evolving dynamics underscore the critical importance of adaptive sourcing strategies and robust scenario planning to thrive amid policy-driven market disruptions.

Revealing Critical Insights Across Essential Nut Product Segmentation Dimensions to Inform Strategic Market Positioning and Portfolio Optimization

Insights into market segmentation reveal nuanced preferences and adoption patterns across product types, consumption occasions, and value tiers. Almonds, cashews, peanuts, and walnuts each command unique nutritional profiles, flavor characteristics, and culinary applications that shape their competitive positioning. While almonds lead in the form of dairy alternatives and on-the-go snacks, cashew and peanut butters see robust traction in spreads and confectionery blends, and walnuts often feature in bakery and specialty health products due to their omega-3 content.

Form-driven segmentation further illuminates consumer behavior, with oil-roasted and dry-roasted variants distinguishing price points and taste experiences. Raw nuts attract purists seeking unprocessed foods, whereas roasted options cater to indulgent snacking and savory seasoning trends. Meanwhile, nut oils and butters have evolved from niche ingredients to mainstream pantry staples, supported by recipe innovation and elevated by gourmet infusions like truffle or chili.

Source considerations underscore the growing premium assigned to organic certification, which guarantees residue-free cultivation and appeals to eco-conscious consumers. Conventional offerings continue to dominate due to cost competitiveness and scale efficiencies, yet organic lines are expanding at a swifter pace within specialty retail and online platforms.

Packaging size distinctions-ranging from large-volume bulk formats for food service and industrial users to single-serve sachets for convenience-driven snacking-reinforce the importance of matching pack configurations to usage patterns. Standard retail packs bridge these extremes, balancing value and freshness retention.

Distribution channel analysis highlights the accelerated momentum of online retail, complementing the entrenched roles of supermarkets, specialty stores, and convenience outlets. Digital channels excel in reaching niche segments and facilitating subscription models, while brick-and-mortar outlets remain critical for impulse purchases and product discovery.

Finally, end-use segmentation delineates the split between food service, industrial processing, and retail consumption. Each application environment imposes distinct requirements for consistency, functionality, and cost-efficiency, thereby influencing formulation decisions and supplier partnerships. Together, these segmentation insights enable stakeholders to tailor offerings precisely to the demands of diverse customer cohorts.

This comprehensive research report categorizes the Nut Products market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Form

- Source

- Packaging Size

- Distribution Channel

- End Use

Assessing Regional Nuances in Nut Product Demand Across the Americas Europe Middle East Africa and Asia Pacific for Targeted Growth Strategies

Regional analysis exposes contrasting demand drivers and supply dynamics across major geographies. In the Americas, robust consumer familiarity with nut-based snacks and established processing infrastructure underpin high per-capita consumption, while evolving dietary preferences continue to fuel penetration of innovative formats. North American markets exhibit strong integration of nuts into plant-based alternatives and functional food categories, supported by substantial investment in processing technologies and quality assurance protocols.

Conversely, the Europe, Middle East & Africa region presents a tapestry of market maturity levels. Western Europe features growing interest in organic and value-added nut products, bolstered by stringent food safety regulations and sustainability mandates. In contrast, certain Middle Eastern and African markets demonstrate untapped potential, driven by traditional culinary incorporation of nuts and rising disposable incomes, yet constrained by underdeveloped cold-chain logistics and volatile import regulations.

Meanwhile, Asia-Pacific emerges as a high-growth corridor characterized by shifting consumption patterns and dietary transformation. Urbanization and expanding middle-class populations in China, India, and Southeast Asia are catalyzing demand for convenient, fortified nut snacks and spreads. Local production hubs are expanding, albeit challenged by climate variability and the need for capacity enhancements. Cross-border trade agreements and regional free-trade pacts are gradually simplifying market entry, while digital commerce platforms offer unprecedented reach into tier-two and tier-three cities.

These divergent regional narratives underscore the necessity of tailored market entry and expansion strategies. By aligning product innovation, sourcing arrangements, and distribution partnerships with the specific regulatory, cultural, and logistical contexts of each region, industry participants can effectively capture emerging opportunities and navigate localized challenges.

This comprehensive research report examines key regions that drive the evolution of the Nut Products market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Nut Industry Players Highlighting Their Differentiation Strategies Innovation Investments and Competitive Strengths

Leading companies in the nut products domain are distinguished by their strategic focus on innovation, vertical integration, and sustainability commitments. One prominent player has invested heavily in proprietary roasting technologies and flavor development centers, enabling rapid product iteration and premium line extensions. This emphasis on R&D has yielded a pipeline of differentiated offerings, spanning air-popped snacks to nut-based dairy analogs with competitive sensory profiles.

Another major supplier has pursued an integrated supply chain model, securing long-term partnerships with grower cooperatives and operating processing facilities proximal to key cultivation zones. This approach minimizes transportation emissions and enhances traceability, bolstering quality assurance from field to final package. Their sustainability program, which includes reforestation and water-saving initiatives, has become a brand hallmark and resonates strongly with environmental stewardship-minded consumers.

A third innovator in the space has targeted rapid e-commerce expansion, harnessing digital marketing and direct-to-consumer logistics to launch exclusive subscription boxes and limited-edition collaborations. By leveraging advanced analytics and personalized recommendation engines, they have achieved impressive customer retention rates and fostered a robust online community of brand advocates.

Additionally, a vertically integrated multinational has diversified its product suite through strategic acquisitions of specialty oil-pressing operations and plant-based dessert innovators. This consolidation strategy has expanded their addressable market and provided valuable cross-category synergies, such as co-marketing opportunities and streamlined packaging platforms.

Collectively, these company-level initiatives illustrate the varied pathways to competitive advantage in the nut products sector, from process innovation and sustainability leadership to digital-first engagement models and targeted M&A activity.

This comprehensive research report delivers an in-depth overview of the principal market players in the Nut Products market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Archer Daniels Midland Company

- Besana Group S.p.A.

- Blue Diamond Growers

- Borges International Group, S.A.U.

- Ferrero SpA

- Hormel Foods Corporation

- Intersnack Group GmbH & Co. KG

- John B. Sanfilippo & Son, Inc.

- Kerry Group PLC

- Kraft Heinz Company

- Olam International Limited

- Setton Pistachio of Terra Bella, Inc.

- The Wonderful Company, LLC

Driving Strategic Success Through Targeted Recommendations for Nut Product Manufacturers Distributors and Industry Stakeholders

To capitalize on the evolving nut products landscape, industry leaders should consider a multi-faceted strategic agenda. First, investing in sustainable sourcing and cultivation partnerships will not only safeguard supply chains against climate volatility but also enhance brand credibility among eco-conscious consumers. By collaborating with agricultural innovators to implement precision irrigation and soil health programs, manufacturers can drive both yield stability and environmental stewardship.

Concurrently, expanding the value proposition of nut products through functional and premiumized formulations is essential. Incorporating clean-label fortifications, such as plant-based proteins, probiotics, and adaptogens, can differentiate offerings within crowded retail shelves and command higher price points. Moreover, co-developing exclusive flavor profiles with culinary experts can stimulate trial and reinforce brand positioning.

Digital channel optimization is another critical lever. Brands and distributors should leverage direct-to-consumer platforms to gather first-party consumer insights and test limited-edition SKUs with minimal capital outlay. Integrating subscription models and bundled offerings can deepen consumer engagement and reduce reliance on promotional discounting prevalent in traditional trade channels.

From an operational perspective, adopting agile manufacturing practices and modular packaging lines will enable rapid SKU scale-up or down based on real-time demand signals, thereby minimizing waste and enhancing responsiveness. Aligning logistics networks through regional distribution hubs can curtail lead times and transportation costs, crucial in the face of geopolitical uncertainties and tariff fluctuations.

Finally, forging cross-sector collaborations-whether with plant-based dairy innovators, culinary institutions, or technology providers-can unlock new market applications and co-marketing synergies. By embracing an ecosystem mindset, industry participants can amplify their reach, share risk, and accelerate the pace of innovation within the nut products category.

Detailing the Rigorous Research Methodology Underpinning This Nut Products Market Analysis Including Data Collection and Analytical Techniques

This analysis is underpinned by a robust research methodology combining primary and secondary data sources, rigorous validation processes, and comprehensive qualitative assessments. Initially, an extensive review of trade publications, regulatory filings, and financial disclosures provided foundational insights into macroeconomic trends, policy shifts, and corporate developments. These secondary sources established the contextual framework for deeper exploration.

To enrich quantitative findings, in-depth interviews were conducted with key stakeholders across the nut products value chain, including senior executives at manufacturing firms, procurement managers at distribution houses, and category leaders within major retail chains. These discussions yielded nuanced perspectives on supply chain dynamics, innovation priorities, and emerging consumer preferences. Concurrently, proprietary surveys were administered to a diverse panel of food service operators and industrial users to gauge formulation requirements and cost sensitivity trends.

Analytical rigor was ensured through data triangulation, whereby findings from primary research instruments were cross-referenced against publicly available consumption statistics and trade data. Quality control protocols-such as respondent validation, outlier analysis, and consistency checks-were employed to safeguard accuracy and reliability. Furthermore, scenario planning exercises examined the potential trajectories of tariff policies and climate-related disruptions, providing contingency insights for strategic decision-making.

The culmination of these methodological steps delivers a well-rounded, evidence-based perspective on the nut products market, ensuring that the insights and recommendations presented herein are both actionable and grounded in real-world stakeholder experiences.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Nut Products market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Nut Products Market, by Type

- Nut Products Market, by Form

- Nut Products Market, by Source

- Nut Products Market, by Packaging Size

- Nut Products Market, by Distribution Channel

- Nut Products Market, by End Use

- Nut Products Market, by Region

- Nut Products Market, by Group

- Nut Products Market, by Country

- United States Nut Products Market

- China Nut Products Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1272 ]

Synthesizing Critical Findings to Illuminate the Future Trajectory of the Nut Products Market and Opportunities for Strategic Advancement

In summary, the nut products sector stands at the nexus of health-driven consumption trends, supply chain realignment due to policy changes, and relentless innovation in product formats and sustainability practices. The cumulative effect of these forces is reshaping competitive dynamics and creating differentiated paths to market leadership. Stakeholders equipped with deep segmentation insights, regionally tailored strategies, and operational agility will be best positioned to capture value.

Looking ahead, the interplay between evolving consumer expectations, technological advancements in processing and packaging, and the rigidity of global trade policies will continue to define industry dynamics. Those who proactively invest in sustainable sourcing, leverage digital engagement channels, and cultivate cross-sector partnerships will unlock new growth vectors and reinforce resilience against future disruptions.

Ultimately, strategic foresight, coupled with data-driven decision-making, will empower manufacturers, distributors, and retailers to transform challenges into opportunities. By aligning organizational capabilities with emerging market imperatives, stakeholders can chart a course toward enduring success in the thriving and ever-evolving nut products landscape.

Engage Ketan Rohom to Secure Comprehensive Nut Products Market Intelligence and Accelerate Strategic Decision Making with In-Depth Research

Don’t miss the opportunity to gain a comprehensive understanding of the nut products market landscape and equip your team with actionable intelligence. Engage Ketan Rohom, Associate Director, Sales & Marketing, to arrange a customized consultation and secure full access to the complete market research report. Propel your strategies forward with the insights you need to capitalize on emerging opportunities, mitigate evolving risks, and strengthen your competitive positioning. Contact Ketan Rohom today to take the next step toward informed decision-making and sustainable growth

- How big is the Nut Products Market?

- What is the Nut Products Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?