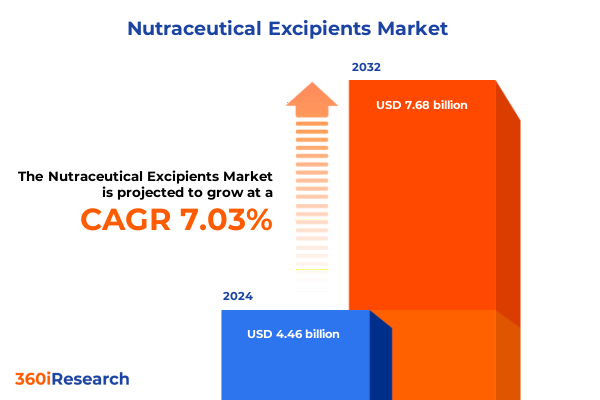

The Nutraceutical Excipients Market size was estimated at USD 4.77 billion in 2025 and expected to reach USD 5.07 billion in 2026, at a CAGR of 7.04% to reach USD 7.68 billion by 2032.

Unveiling the Critical Role of Excipients in Driving Innovation, Stability, and Consumer Confidence in the Nutraceutical Industry

Excipients serve as the fundamental building blocks in the formulation of nutraceutical products, ensuring that active ingredients deliver the intended health benefits with optimal stability, bioavailability, and consumer appeal. By functioning as binders, fillers, coatings, disintegrants, and lubricants, these ancillary components not only facilitate manufacturing efficiency but also impact taste masking, controlled release, and overall product performance. As dietary supplement formulations become increasingly sophisticated, the role of excipients has evolved from inert additives to multi-functional enablers of innovation.

Consumer demand for dietary supplements remains robust, driven by an ongoing emphasis on preventive health and wellness. According to the Council for Responsible Nutrition’s 2024 Consumer Survey, three-quarters of Americans continue to use dietary supplements, reflecting enduring trust in regulated products and a growing appetite for specialty formulations that address targeted health needs across life stages. The survey also highlights subtle shifts toward personalized solutions, as consumers seek products tailored to their unique nutritional and lifestyle requirements, further elevating the strategic importance of versatile excipient technologies.

Supply chain complexity and regulatory scrutiny underscore the necessity for comprehensive market insights. With a global sourcing footprint that spans natural, bio-identical, semi-synthetic, and synthetic materials, excipient manufacturers must navigate evolving quality standards and trade policies while maintaining cost-effectiveness. Consequently, stakeholders across the value chain-from ingredient suppliers and contract manufacturers to brand owners-require data-driven analysis to inform product development roadmaps and sourcing strategies.

Navigating Transformative Shifts in Nutraceutical Excipients Triggered by Clean Label Demand, Digitalization, and Custom Delivery Technologies

The nutraceutical excipients landscape is undergoing a paradigm shift as consumer preferences gravitate toward clean-label, naturally derived ingredients. This trend compels manufacturers to accelerate the development of plant-based binders and fillers that resonate with demand for organic and minimally processed formulations. A majority of consumers now scrutinize product labels for transparency, with 63% prioritizing “natural” statements when selecting health products, according to a 2024 Industry Food Innovation Council report. As a result, the sector is witnessing an influx of excipient solutions sourced from starch, cellulose, and plant gums that fulfill both functional and marketing imperatives.

Concurrently, advancements in controlled-release and personalization technologies are redefining formulation capabilities. Next-generation excipients engineered for hydrophilic matrices and multi-layer tablet systems enable precise nutrient delivery profiles, enhancing absorption rates and prolonging efficacy. The U.S. Food and Drug Administration has underscored the importance of these technologies in supporting individualized nutrition strategies, paving the way for excipient innovation that aligns with precision health objectives. These developments are particularly salient as formulators pursue novel dosage forms-such as chewable films and effervescent granules-to optimize consumer convenience and therapeutic outcomes.

Regulatory landscapes are adapting to foster responsible innovation in excipient development. In 2024, revised guidance from the FDA clarified safety and transparency requirements for dietary supplement excipients, streamlining approval pathways for new ingredients while reinforcing allergen labeling and purity criteria. International authorities, including the European Food Safety Authority, are likewise harmonizing standards to expedite global market entry. This evolving framework underscores the imperative for stakeholders to integrate compliance considerations into R&D investments and supply chain planning, thereby translating regulatory rigor into competitive differentiation.

Assessing the Comprehensive Impact of 2025 United States Tariffs on Nutraceutical Excipients Supply Chains and Production Economics

In April 2025, the United States implemented a two-tier tariff framework affecting nutraceutical excipients: a universal 10% levy on imports from non-exempt countries and reciprocal duties ranging from 11% to 50% for identified trading partners deemed to engage in unfair practices. This policy recalibration also maintains existing Section 301 tariffs on Chinese origin materials, which can stack to as much as 34% in certain classifications. The broad scope of these measures has introduced new cost considerations and supply chain risks for excipient suppliers and manufacturers alike.

Amid these tariff adjustments, the Natural Products Association secured Annex II exemptions for essential dietary supplement ingredients, preventing an estimated $218–247 million in annual tariffs from being applied to vitamins, minerals, amino acids, CoQ10, and other specialty compounds. While these carve-outs provide relief for key inputs, a substantial portion of botanicals, extracts, and non-listed excipients remain subject to elevated duties. The exemption process underscores the importance of advocacy and industry engagement in shaping trade policy outcomes.

Tariff-driven cost inflation and sourcing disruptions have prompted immediate strategic responses. Contract manufacturers report that ingredient costs have surged by 20–50%, particularly for botanical extracts now facing stacked duties under the new regime. Companies are evaluating dual-sourcing arrangements, inventory hedging, and onshore packaging to mitigate margin erosion. These adaptive measures reflect a broader industry imperative to reinforce resilience amidst evolving trade dynamics.

Leveraging Segmentation Insights to Optimize Product Portfolios Across Type, Function, Form, Source, and Application in Nutraceutical Excipients

Insights drawn from type-based segmentation reveal that binders and fillers dominate formulation strategies, with natural gelatin and starch variants addressing clean-label mandates while synthetic alternatives such as HPMC and PVP deliver precise functional performance. Coatings have also diversified to encompass enteric, film, and sugar layers that optimize protection and palatability. Disintegrants like croscarmellose sodium and sodium starch glycolate facilitate rapid tablet breakdown, whereas lubricants including magnesium stearate and stearic acid ensure smooth processing. These distinctions influence ingredient sourcing decisions and formulation roadmaps.

Functional categories underscore evolving excipient roles beyond inert carriers. Anti-caking agents and antioxidants safeguard product integrity over extended shelf life, while emulsifiers-spanning gums, lecithin, and polysorbates-enhance solubility and sensory attributes. Stabilizers maintain homogeneity in complex matrices, supporting both liquid and solid formulations. Manufacturers are tailoring blends of these functional excipients to achieve targeted product claims and regulatory compliance.

The rise of advanced dosage forms further amplifies formulation versatility. Powdered and granulated mixtures remain industry mainstays, yet film and pellet presentations have gained traction for controlled nutrient release. Oil-in-water and water-in-oil emulsions cater to specialized applications, offering improved bioavailability for lipophilic actives and bespoke textural experiences. This spectrum of form factors enables formulators to engineer consumer-centric products with differentiated delivery profiles.

Source segmentation-from bio-identical and animal-derived to plant-derived, microbial, and petrochemical origins-reflects a delicate balance between natural credentials and performance requirements. Nutrient applications span dietary supplements, functional foods, and pharmaceutical contexts, with the latter requiring excipient grades suitable for both oral liquids and solid dosages. Tailoring excipient selection across these application domains is critical to achieving desired functional, regulatory, and marketing objectives.

This comprehensive research report categorizes the Nutraceutical Excipients market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Form

- Source

- Application

Capitalizing on Regional Dynamics in the Americas, Europe Middle East Africa, and Asia Pacific to Unlock Growth in Nutraceutical Excipients Market

The Americas region, anchored by the United States, continues to lead nutraceutical excipient demand, driven by high consumer engagement in preventive health and a mature contract manufacturing ecosystem. North America accounted for over 41% of global market activity in recent years, underpinned by robust regulatory frameworks and strong ingredient innovation initiatives. This dominance reflects both a solid domestic supply base and significant imports of specialty excipients used in cutting-edge formulations.

In Europe, Middle East & Africa, the landscape is characterized by stringent safety standards and harmonized regulatory processes that facilitate cross-border trade. The European Food Safety Authority’s alignment with global guidelines has accelerated product approvals, while emerging markets in the Gulf Cooperation Council are increasingly investing in nutraceutical infrastructure to meet local demand. The region’s growth trajectory, marked by a compound annual rate exceeding 7%, underscores a strategic opportunity for suppliers to target value-added excipient segments and regional collaboration frameworks.

Asia-Pacific exhibits the most dynamic expansion, fueled by rising health awareness, burgeoning middle-class purchasing power, and government support for domestic ingredient manufacturing. China, India, and Japan are focal points, with China’s excipient sector forecasted to grow at over 9% annually through 2030. Regional clusters are investing in research hubs and capacity expansions, positioning APAC as both a significant consumer base and an export platform for natural and synthetic nutraceutical excipients.

This comprehensive research report examines key regions that drive the evolution of the Nutraceutical Excipients market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Analyzing Strategic Moves and Competitive Strengths of Leading Nutraceutical Excipients Providers Driving Innovation and Market Leadership

Leading excipient providers are solidifying market positions through strategic partnerships, product launches, and capacity investments. Global agrifood conglomerates such as Cargill and Ingredion leverage extensive raw material networks and R&D platforms to deliver scalable, label-friendly solutions. Specialty chemicals pioneers like DuPont and Dow emphasize advanced functional excipients, incorporating proprietary polymer technologies to enable controlled release and moisture protection. Strategic collaborations between these players and contract manufacturers are accelerating time-to-market for novel nutraceutical offerings.

Market pioneers such as Roquette Frères and Kerry Group have introduced co-processed excipients that combine mannitol, starch, and moisture-barrier components to enhance probiotic stability and tablet robustness. These multi-functional blends address rising demands for moisture-resistant and bio-available formats, particularly in high-humidity environments. Regional specialists in Asia are similarly innovating plant-derived excipient lines, positioning themselves as competitive alternatives to established Western suppliers.

Smaller niche players are capitalizing on emerging segments-such as prebiotic carriers and flavor-masking agents-by offering tailored, high-purity excipient grades. Many of these specialists are forging supply agreements with contract producers to integrate excipient R&D early in the formulation cycle, thereby securing preferred supplier status. Collectively, these strategic moves are elevating the competitive landscape, creating a tiered ecosystem of full-service multinationals, regional champions, and agile innovators.

This comprehensive research report delivers an in-depth overview of the principal market players in the Nutraceutical Excipients market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Akzo Nobel N.V.

- Ashland Global Holdings Inc.

- BASF SE

- Cargill, Incorporated

- Colorcon Inc.

- Croda International PLC

- DuPont de Nemours, Inc.

- Evonik Industries AG

- Gattefossé

- Grain Processing Corporation (GPC)

- Hilmar Ingredients

- IMCD N.V.

- Ingredion Incorporated

- Innophos Holdings Inc.

- Innospec Inc.

- Kerry Group PLC

- Kewpie Corporation

- Lonza Group Ltd.

- Lubrizol Corporation

- Meggle Group

- Merck KGaA

- Mitsubishi Chemical Holdings Corporation

- Nutra Healthcare

- Roquette Frères

- Sensient Technologies Corporation

- Signet Chemical Corporation Pvt. Ltd.

- Wacker Chemie AG

Implementing Actionable Strategies for Industry Leaders to Enhance Supply Chain Resilience, Regulatory Compliance, and Innovation Roadmaps

To navigate the evolving nutraceutical excipient landscape, industry leaders should diversify sourcing channels by integrating dual and near-shoring strategies, thereby minimizing exposure to trade disruptions and tariff volatility. Investing in supplier qualification programs and long-term contracts with strategic partners will bolster supply chain security and cost predictability.

Simultaneously, organizations must prioritize R&D initiatives that align with clean-label and personalized nutrition trends. Allocating resources toward co-processed and multi-functional excipient development, supported by robust regulatory intelligence, will accelerate product innovation cycles. Engaging with regulatory bodies early to clarify safety requirements and secure timely approvals will further cement competitive advantage.

Ensuring Rigorous Multimodal Research Methodology to Deliver Deep Insights and Unbiased Analysis on Nutraceutical Excipients Market Trends

This analysis synthesizes primary research involving in-depth interviews with excipient suppliers, contract manufacturers, and regulatory experts, complemented by secondary data from trade publications, industry associations, and government databases. Information was triangulated through cross-verification to ensure accuracy and relevance.

Quantitative inputs were derived from customs and trade data, while qualitative insights emerged from stakeholder workshops and expert roundtables. Rigorous coding techniques and thematic analysis underpinned the interpretation of emerging trends, ensuring an unbiased, comprehensive perspective on the nutraceutical excipients market.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Nutraceutical Excipients market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Nutraceutical Excipients Market, by Type

- Nutraceutical Excipients Market, by Form

- Nutraceutical Excipients Market, by Source

- Nutraceutical Excipients Market, by Application

- Nutraceutical Excipients Market, by Region

- Nutraceutical Excipients Market, by Group

- Nutraceutical Excipients Market, by Country

- United States Nutraceutical Excipients Market

- China Nutraceutical Excipients Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 2703 ]

Concluding Insights on the Future Trajectory of Nutraceutical Excipients in a Dynamic Regulatory and Consumer-Driven Marketplace

The nutraceutical excipients industry stands at the intersection of scientific innovation, shifting consumer preferences, and evolving trade dynamics. As clean-label, personalized, and multi-functional formulations gain precedence, excipient providers and manufacturers must synchronize product development with regulatory compliance and supply chain fortification.

Looking ahead, those who adeptly integrate advanced excipient technologies, strategic sourcing approaches, and collaborative partnerships will shape the trajectory of the market, ultimately delivering high-impact, consumer-focused nutraceutical solutions.

Drive Growth and Strategic Advantage by Partnering Today to Access In-Depth Nutraceutical Excipients Market Intelligence and Expert Guidance

We invite you to secure unparalleled market intelligence and strategic guidance by collaborating with Associate Director, Sales & Marketing Ketan Rohom. His expertise in tailoring insights to specific business challenges will empower your organization to navigate complexities and seize emerging opportunities within the nutraceutical excipients landscape. Reach out today to unlock actionable recommendations, in-depth executive analysis, and comprehensive data that will drive your competitive advantage and accelerate growth.

- How big is the Nutraceutical Excipients Market?

- What is the Nutraceutical Excipients Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?