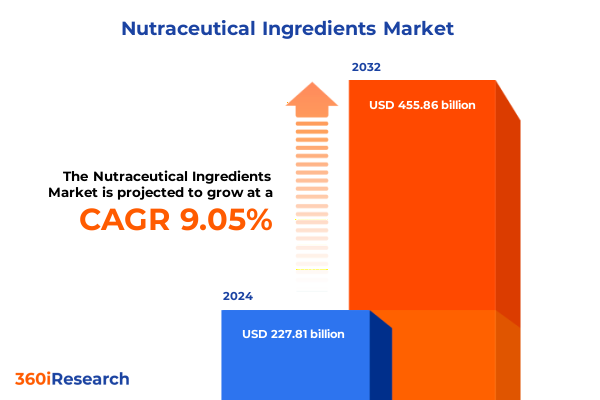

The Nutraceutical Ingredients Market size was estimated at USD 248.10 billion in 2025 and expected to reach USD 269.09 billion in 2026, at a CAGR of 9.07% to reach USD 455.86 billion by 2032.

Unveiling the dynamic nutraceutical ingredients ecosystem and setting the stage for strategic decision-making in a rapidly evolving global marketplace

The nutraceutical ingredients market has emerged as a pivotal arena at the intersection of nutrition and pharmaceuticals, propelled by a global wave of health-conscious consumers seeking preventive and therapeutic benefits from their diets. This expansive ecosystem encompasses a diverse array of components ranging from botanical extracts and omega-3 fatty acids to probiotics, proteins, amino acids, vitamins, and minerals. The convergence of scientific research, technological advancements, and shifting consumer perceptions is redefining how industry stakeholders perceive and utilize these ingredients. As food and beverage manufacturers, supplement developers, and personal care brands compete to deliver efficacious, evidence-based solutions, the demand for high-quality, traceable, and sustainable raw materials has never been more pronounced.

In the United States, the aging population combined with rising incidences of chronic diseases such as cardiovascular conditions, metabolic disorders, and cognitive decline has catalyzed a surge in interest toward nutraceutical fortification and functional formulations. Regulatory bodies have simultaneously tightened quality and safety standards, prompting ingredient suppliers to invest heavily in rigorous testing, clinical validation, and supply chain transparency. Moreover, the integration of digital health platforms, artificial intelligence, and personalized nutrition paradigms is enabling brands to tailor ingredient blends to individual physiological profiles and lifestyle preferences. As a result, the nutraceutical ingredients market is undergoing a profound transformation that demands both agility and strategic foresight from key players.

This report offers a comprehensive overview of the current landscape, highlights emerging trends, and sets the stage for detailed analyses of tariff impacts, segmentation insights, regional dynamics, and competitive positioning, equipping decision-makers with the intelligence required to capitalize on evolving opportunities.

Exploring groundbreaking shifts in consumer preferences sustainability imperatives and technological innovations reshaping the nutraceutical ingredients landscape

Industry dynamics within the nutraceutical ingredients space have shifted dramatically in recent years, driven by a confluence of transformative factors. Consumer preferences have evolved beyond basic health maintenance toward targeted, condition-specific outcomes such as cognitive enhancement, joint support, and immune resilience. This shift has spurred a flight to transparency, compelling suppliers to prioritize clean-label certifications, sustainable sourcing practices, and non-GMO verification. In parallel, the industry has embraced cutting-edge extraction technologies-including supercritical CO₂ and enzymatic methods-to obtain high-purity compounds with superior bioavailability. These innovations are not only enhancing ingredient efficacy but are also unlocking novel functionalities that extend into personalized nutrition and medical food applications.

Sustainability has emerged as a critical imperative across the supply chain, influencing cultivation practices, waste reduction measures, and packaging solutions. Brands are increasingly forging partnerships with regenerative agriculture initiatives and blockchain-based traceability platforms to substantiate environmental claims and appeal to ethically minded consumers. Meanwhile, advancements in biotechnology and synthetic biology are enabling the scalable production of rare or endangered botanical compounds, alleviating pressure on natural resources while maintaining consistency in quality. Collectively, these trends underscore a fundamental shift from volume-driven commodity sourcing toward value-added, innovation-led strategies that prioritize efficacy, safety, and environmental stewardship.

Analyzing the compounding effects of newly implemented United States import tariffs in 2025 on supply chains cost structures and strategic sourcing initiatives

The introduction of new United States tariffs on imported nutraceutical ingredients in early 2025 has introduced a layer of complexity across global supply chains. In an effort to bolster domestic manufacturing and mitigate reliance on offshore suppliers, authorities expanded Section 301 measures to include select vitamins, botanical extracts, and amino acids, applying additional duties of up to 15 percent on key product categories. These measures, while designed to encourage onshore production, have led to increased procurement costs for raw material buyers, prompting many to reevaluate supplier agreements and consider dual-sourcing strategies to hedge against tariff volatility.

In response to the heightened duty environment, a growing number of manufacturers have accelerated investments in domestic extraction and fermentation facilities, with a particular focus on plant-based and microbial production platforms that align with sustainability objectives. At the same time, supply chain teams have intensified efforts around tariff engineering-modifying product specifications and harmonizing codes to minimize duty liabilities. However, the process of requalifying ingredients from alternate sources or processing locations has extended lead times and increased inventory carrying costs, underscoring the trade-offs between cost optimization and operational resilience.

Moreover, the tariff landscape has spurred strategic alliances between ingredient suppliers and nutraceutical brands to co-invest in value chain integration. By securing long-term offtake agreements and joint venture partnerships, stakeholders aim to stabilize input costs and ensure continuity of supply. These collaborative frameworks are gradually shifting the market paradigm toward a more vertically integrated model, reshaping competitive dynamics and laying the groundwork for future innovation across ingredient development and manufacturing processes.

Delving into multifaceted segmentation insights spanning ingredient types forms sources applications and distribution channels driving nuanced market dynamics

The nutraceutical ingredients market exhibits a rich tapestry of segments that collectively inform product development, positioning, and growth strategies. On the basis of ingredient type the landscape encompasses botanical extracts such as ginkgo, ginseng, and turmeric alongside omega-3 fatty acids including ALA, DHA, and EPA; probiotics cover strains like bifidobacterium, lactobacillus, and streptococcus; proteins and amino acids span pea, soy, and whey formulations; and the vitamins and minerals category bifurcates into minerals such as calcium, iron, and magnesium, and vitamins ranging from B complex to vitamin C and vitamin D. In parallel, form segmentation spans liquid preparations featuring suspensions and syrups, powdered solutions available in both instant and standard formats, soft gels, and solid dosage options segmented into capsules and tablets.

Beyond form and ingredient classification, source-based segmentation differentiates between natural and synthetic inputs, with natural routes further delineated into animal-based, microbial, and plant-derived origins that cater to clean-label and vegan market niches. Application-driven segments span animal nutrition-encompassing both livestock and pet formulations-dietary supplements offered in over-the-counter and prescription variants, functional foods and beverages across bakery, beverage, confectionery, and dairy matrices, and personal care systems targeting hair, oral, and skin health. Finally, distribution channels split into offline retail networks including pharmacies, specialty stores, and supermarkets and hypermarkets, as well as online avenues via direct-to-consumer platforms and broader e-commerce marketplaces. Each segmentation dimension yields distinct value propositions and competitive tensions, informing go-to-market strategies and R&D investments.

This comprehensive research report categorizes the Nutraceutical Ingredients market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Ingredient Type

- Form

- Source

- Application

- Distribution Channel

Examining critical regional variances across Americas Europe Middle East Africa and Asia Pacific to identify growth hot spots and emerging opportunities

Regional market dynamics in the nutraceutical ingredients industry reveal divergent growth trajectories driven by regulatory frameworks, consumer behavior, and infrastructure maturity. In the Americas, the United States leads with stringent quality standards, a strong emphasis on clinical substantiation, and a mature retail landscape that spans mass-market distribution to specialized health channels. Latin American markets are witnessing rising health awareness, albeit tempered by economic fluctuations and diversity in regulatory regimes, creating pockets of opportunity for value-oriented formulations.

Across Europe, the Middle East, and Africa, regulatory harmonization under bodies such as EFSA and GCC standards has elevated ingredient compliance requirements, fostering a premiumization trend that favors organic and branded extracts. Consumer demand for natural and sustainable solutions is particularly pronounced in Western Europe, while emerging markets in Africa present nascent demand underpinned by youthful demographics and increasing urbanization. In the Middle East, high per capita spending on health and wellness is driving interest in personalized nutrition and advanced delivery formats.

The Asia-Pacific region continues to exhibit robust growth underpinned by traditional herbal medicine practices, expanding middle-class populations, and the proliferation of online retail channels. China and India remain dominant manufacturing hubs for botanical extracts and fermentation-derived compounds, even as both markets experience tightening of quality regulations and a pivot toward export-oriented compliance. Southeast Asian economies are embracing functional food fortification and indigenous botanical research, while Japan and South Korea lead in advanced formulation technologies and premium positioning. These distinct regional profiles necessitate tailored market entry and engagement strategies for global and local players alike.

This comprehensive research report examines key regions that drive the evolution of the Nutraceutical Ingredients market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting competitive positioning innovation strategies and collaborative ventures among leading companies shaping the future of nutraceutical ingredients

A competitive landscape analysis of the nutraceutical ingredients sector highlights a tiered ecosystem of global conglomerates, specialized ingredient innovators, and emerging biotechnology ventures. Leading multinational suppliers leverage extensive R&D pipelines and integrated manufacturing platforms to deliver standardized extracts with clinically validated health benefits. At the same time, smaller, niche-focused companies differentiate through proprietary fermentation processes, unique strain development, or vertically integrated farming operations that ensure traceability from field to finished good.

Strategic partnerships and acquisitions have become hallmarks of this space, as larger players acquire boutique brands or technology-focused start-ups to bolster their portfolios and accelerate time to market. Collaboration between ingredient houses and academic institutions has intensified, particularly around next-generation delivery systems such as microencapsulation, liposomal encapsulation, and novel carrier matrices that enhance bioefficacy. Additionally, biotechnology firms specializing in synthetic biology and precision fermentation are emerging as disruptors capable of producing consistent, high-purity nutraceutical actives with lower environmental footprints.

Amidst this competitive tapestry, alliances between raw material suppliers and consumer brands are forging integrated value chains that shift beyond transaction-based models toward co-creation. These joint efforts, often formalized through long-term supply agreements or equity partnerships, aim to align innovation roadmaps, secure raw material availability, and jointly navigate evolving regulatory landscapes. As the sector matures, the interplay between scale-driven economies and specialized differentiation will continue to define competitive positioning and strategic growth initiatives.

This comprehensive research report delivers an in-depth overview of the principal market players in the Nutraceutical Ingredients market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Advanced Enzyme Technologies Limited

- Applied Food Sciences, Inc.

- Archer-Daniels-Midland Company

- Arjuna Natural Private Limited

- BASF SE

- Beneo GmbH

- Botanic Healthcare Private Limited

- DSM-Firmenich AG

- Epax Norway AS

- Euromed S.A.

- Givaudan SA

- Glanbia plc

- Ingredion Incorporated

- International Flavors & Fragrances Inc.

- Kemin Industries, Inc.

- Lallemand Health Solutions Inc.

- OmniActive Health Technologies Limited

- PLT Health Solutions, Inc.

- Sami-Sabinsa Group Limited

- Tate & Lyle PLC

Recommending actionable strategies for industry leaders to enhance supply chain resilience accelerate innovation and capture evolving consumer demands

Industry leaders must adopt multifaceted strategies that address supply chain resilience, regulatory compliance, and consumer-centric innovation to maintain a competitive edge. Establishing dual- or multi-sourcing frameworks for critical raw materials can mitigate tariff-induced cost pressures and potential geopolitical disruptions. Investing in domestic production capabilities, whether through greenfield facilities or partnerships with regional producers, not only reduces exposure to import duties but also aligns with growing demand for localized, sustainable sourcing.

Regulatory intelligence teams should closely monitor evolving global standards, particularly around novel ingredient approvals and health claims substantiation. Proactive engagement with regulatory bodies and participation in industry associations can accelerate product registration timelines and safeguard market access. Concurrently, R&D departments need to prioritize next-generation delivery systems and bioavailability enhancements by leveraging nanotechnology, encapsulation techniques, and formulation synergies that cater to evolving consumer preferences for convenience and efficacy.

Finally, brands and ingredient suppliers should harness digital platforms and data analytics to gain deeper insights into consumer behavior, personalize ingredient offerings, and optimize supply chain traceability. Collaborations with blockchain providers and IoT-enabled traceability solutions can strengthen transparency claims and foster consumer trust. By adopting an integrated approach that weaves together sourcing, innovation, regulatory strategy, and digital engagement, industry leaders will be well-positioned to navigate complexity and capture sustainable growth.

Detailing rigorous research methodology encompassing data collection secondary research expert interviews and comprehensive data triangulation processes

This research was conducted using a robust multi-step methodology designed to ensure data accuracy, comprehensiveness, and objectivity. The process began with extensive secondary research, examining peer-reviewed journals, regulatory filings, patent databases, and reputable trade publications to develop a foundational understanding of ingredient technologies, regulatory landscapes, and competitive activities. Primary research followed, comprising in-depth interviews with industry stakeholders including R&D leaders, supply chain executives, regulatory experts, and end-user brand managers to validate hypotheses and gather qualitative insights.

Quantitative data collection involved the compilation of global trade statistics, import-export records, and publicly available corporate disclosures to map supply chain flows and tariff structures. Advanced data triangulation techniques were applied to reconcile information from multiple sources, enhancing the reliability of insights related to sourcing patterns, form factor preferences, and application adoption rates across regions. A cross-functional panel of subject-matter experts reviewed interim findings to ensure alignment with market realities and to identify emerging trends warranting further investigation.

The final deliverable integrates both qualitative and quantitative analyses, supported by detailed segmentation frameworks and case study examples, providing a holistic view of the nutraceutical ingredients market. Rigorous quality checks, including internal peer reviews and data validation by external consultants, underpin the credibility of the report and its utility as a strategic decision-making tool.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Nutraceutical Ingredients market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Nutraceutical Ingredients Market, by Ingredient Type

- Nutraceutical Ingredients Market, by Form

- Nutraceutical Ingredients Market, by Source

- Nutraceutical Ingredients Market, by Application

- Nutraceutical Ingredients Market, by Distribution Channel

- Nutraceutical Ingredients Market, by Region

- Nutraceutical Ingredients Market, by Group

- Nutraceutical Ingredients Market, by Country

- United States Nutraceutical Ingredients Market

- China Nutraceutical Ingredients Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 3657 ]

Synthesizing key findings to present cohesive conclusions that underscore strategic imperatives and forward-looking considerations for stakeholders

This executive summary has distilled the most critical insights from the nutraceutical ingredients market, spanning transformative consumer and technological shifts, the tangible effects of new US tariff measures, and intricate segmentation and regional profiles. The synthesis underscores the imperative for supply chain diversification, regulatory vigilance, and continued investment in bioavailability and delivery innovations to meet evolving consumer demands. Competitive dynamics are increasingly shaped by collaboration, whether through strategic alliances, M&A activity, or co-development partnerships that bridge ingredient expertise with brand-driven market access.

Collectively, these findings point to a market that is maturing toward greater sophistication, with an emphasis on transparency, efficacy, and sustainability. Stakeholders who successfully align their innovation roadmaps, sourcing strategies, and regulatory approaches while leveraging digital and traceability technologies will be best positioned to capture growth and navigate ongoing uncertainty. As the nutraceutical ingredients landscape continues to evolve, a strategic, data-driven mindset will be essential in unlocking new opportunities and driving sustained competitive advantage.

Encouraging industry professionals to connect with Ketan Rohom Associate Director Sales Marketing to access comprehensive nutraceutical ingredients market research report

For industry professionals seeking in-depth insights into global nutraceutical ingredient trends and market dynamics, reaching out to Ketan Rohom Associate Director Sales Marketing will unlock access to the comprehensive report that delves into every critical dimension of this rapidly evolving sector. With tailored analyses on transformative shifts, tariff impacts, granular segmentation details, regional nuances, competitive benchmarking, and strategic recommendations, this report serves as an indispensable tool for making informed decisions and driving sustainable growth in your organization. Connect with Ketan today to secure your copy and gain a competitive edge through actionable intelligence designed specifically for leaders in the nutraceutical ingredients industry

- How big is the Nutraceutical Ingredients Market?

- What is the Nutraceutical Ingredients Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?