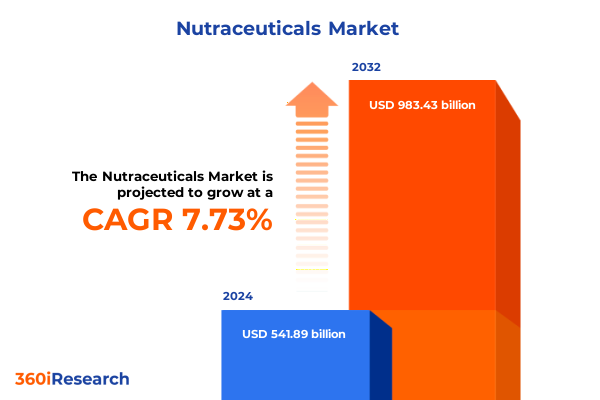

The Nutraceuticals Market size was estimated at USD 581.94 billion in 2025 and expected to reach USD 625.41 billion in 2026, at a CAGR of 7.60% to reach USD 972.13 billion by 2032.

Discover How Nutraceuticals Are Reshaping Consumer Wellness and Driving Strategic Opportunities in a Rapidly Evolving Health Landscape

In an era where consumer wellness is at the forefront of everyday decision-making, nutraceuticals have emerged as a pivotal force redefining the contours of health and nutrition. From formulation innovations that blend science with natural ingredients to heightened regulatory scrutiny, the landscape is witnessing rapid evolution. As stakeholders navigate diverse market channels and fluctuating consumer expectations, the imperative to understand underlying growth drivers and emerging challenges has never been greater.

Amid these dynamics, this executive summary offers a concise gateway into critical developments shaping the nutraceuticals sector. It highlights transformational trends that are forging new product categories, underscores the repercussions of recent trade policies, and delivers a nuanced segmentation framework to guide strategic planning. Moreover, it previews regional nuances and competitive strategies employed by leading players, culminating in practical recommendations designed to catalyze market leadership. By setting the stage with clear, actionable intelligence, this introduction equips decision-makers with the essential context to engage with subsequent insights and position their organizations for sustained success.

Uncover the Key Drivers and Emerging Trends That Are Catalyzing Transformative Shifts Across the Global Nutraceuticals Ecosystem

The nutraceuticals arena is undergoing seismic changes driven by converging factors that redefine product innovation and consumer engagement. First, advances in biotechnology have accelerated the development of precision-targeted supplements, enabling formulations that address specific physiological needs such as cognitive performance and gut microbiome balance. Concurrently, digital transformation has empowered brands to harness real-time consumer data, facilitating personalized recommendations and subscription-based commerce models that deepen customer loyalty.

Furthermore, sustainability imperatives have reshaped sourcing practices, prompting an industry-wide pivot toward ethically harvested botanicals, responsibly farmed marine extracts, and upcycled food byproducts. This shift not only mitigates environmental impact but also resonates with an increasingly eco-conscious consumer segment. Regulatory environments have also adapted, with agencies in key markets refining labeling standards and safety protocols, thereby elevating industry credibility and consumer trust.

As a result of these catalysts, market participants are forging strategic alliances, investing in R&D partnerships, and embracing digital platforms to capture emerging opportunities. This transformational nexus of scientific innovation, technological integration, and sustainability commitment is charting a new course for the global nutraceuticals ecosystem, setting the stage for sustained growth and diversification.

Understand the Comprehensive Consequences of the United States Tariffs Enacted in 2025 on Nutraceutical Ingredients Supply Chains and Market Dynamics

The implementation of new import duties by the United States in early 2025 has exerted pronounced repercussions on the nutraceuticals supply chain, mandating swift adaptation from ingredient sourcing to cost management. Notably, tariffs imposed on a broad spectrum of botanical extracts and high-purity marine oils have elevated landed costs, compelling manufacturers to reassess global procurement strategies. In response, many organizations have diversified their supplier base, fostering partnerships in Southeast Asia and Latin America to mitigate exposure to elevated duties and safeguard ingredient continuity.

Additionally, the imposition of additional tariffs on select microbial-derived enzymes and specialty minerals has prompted a reevaluation of domestic production capabilities. To alleviate pressure, several stakeholders have accelerated investment in regional processing facilities and embraced near-shoring initiatives, thereby reducing lead times and currency-related volatility. These strategic moves have been complemented by enhanced collaborative forecasting with logistics partners, ensuring resilient inventory buffers without resorting to speculative stockpiling.

Consequently, the cumulative impact of the 2025 tariff adjustments has underscored the importance of agile supply-chain architectures, bolstered cross-border supplier relationships, and incentivized innovation in ingredient alternatives. By leveraging these lessons, industry leaders are better positioned to navigate evolving trade landscapes and maintain competitive agility amid persistent geopolitical uncertainties.

Gain Actionable Segment-Level Perspectives Emphasizing Product Type, Form, Source, Application, End User, and Distribution Channels in Nutraceuticals

A granular examination of the nutraceuticals market reveals that product innovation and consumer targeting hinge on multidimensional segmentation. When dissected by product type, the landscape encompasses core dietary supplements subdivided into amino acids, enzymes, herbal supplements, minerals, and vitamins, alongside functional beverages that span dairy-based beverages, energy drinks, fortified juices, and sports drinks. Functional foods further expand the scope, featuring fortified foods, omega-3 enriched products, and probiotic-infused offerings, each catering to distinct health objectives.

From a form perspective, the market extends across bars, capsules, gummies, liquids, powders, soft gels, and tablets-formats chosen based on efficacy, convenience, and consumer preference. Equally pivotal is the source dimension, where animal-derived proteins, marine oils, microbial fermentations, and plant-based extracts each contribute unique bioactive profiles, compliance considerations, and sustainability credentials. Application areas further exacerbate this complexity, with digestive health addressed through prebiotic and probiotic formulations, mental health supported by cognitive boosters and mood enhancers, sports nutrition encompassing pre-workout energizers, protein supplements, and recovery drinks, and weight management anchored by appetite suppressants and meal replacement solutions.

End-user classification spans professional athletes and fitness enthusiasts seeking performance advantages, individual consumers driven by personalized wellness goals, and institutional purchasers focused on bulk procurement for clinical or organizational programs. Lastly, distribution channels bifurcate into offline outlets-such as pharmacies, drugstores, supermarkets, and hypermarkets-and online platforms, including brand websites and e-commerce marketplaces. By integrating these segmentation lenses, stakeholders can pinpoint niche opportunities, tailor value propositions, and optimize product portfolios to resonate with evolving consumer demands.

This comprehensive research report categorizes the Nutraceuticals market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Form

- Source

- Application

- End-User

- Distribution Channel

Explore Distinct Regional Dynamics and Growth Drivers Shaping the Nutraceuticals Landscape Across the Americas, Europe Middle East Africa, and Asia Pacific

Regional dynamics continue to play a defining role in shaping strategic priorities within the nutraceuticals sector. In the Americas, a robust foundation of health-conscious consumers and advanced regulatory frameworks has propelled innovations in high-potency supplements and fortified functional beverages. Moreover, collaborative research initiatives between academic institutions and industry players have accelerated the commercialization of novel bioactives, reinforcing North America’s leadership in R&D and premium positioning.

Conversely, Europe, the Middle East, and Africa are characterized by a mosaic of regulatory regimes and diverse consumer segments. In Western Europe, stringent safety standards and clear health claims guidance have fostered trust in probiotic and omega-3 enriched functional foods, while emerging Middle Eastern markets show growing appetite for botanical supplements aligned with traditional remedies. In parallel, African markets are witnessing nascent growth fueled by rising urbanization and increasing awareness of sports nutrition, signaling untapped potential for localized manufacturing and education campaigns.

Across the Asia-Pacific region, high growth rates are underpinned by expanding middle-class populations and elevated investments in preventive healthcare infrastructure. Countries such as China, Japan, and Australia are at the forefront of personalized nutrition and digital health integration, while Southeast Asian nations leverage rich biodiversity to develop regionally sourced ingredients. Collectively, these varied regional drivers underscore the necessity for market participants to adopt nuanced strategies, balancing global best practices with localized execution to capture emerging opportunities and navigate regulatory intricacies.

This comprehensive research report examines key regions that drive the evolution of the Nutraceuticals market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Evaluate the Strategic Positioning, Innovation Initiatives, R&D Focus, and Competitive Landscape of Leading Nutraceutical Industry Participants

Leading industry participants have adopted divergent yet complementary strategies to secure competitive advantage within the nutraceuticals space. Large ingredient processors are investing heavily in proprietary extraction and purification technologies to enhance bioavailability and ensure consistent quality across global supply chains. This is paralleled by supplement brands focusing on direct-to-consumer digital platforms, leveraging data analytics to refine product offerings and bolster customer engagement through personalized subscription models.

Simultaneously, established conglomerates are forging strategic alliances with biotech startups to accelerate innovation in next-generation probiotics and cognitive enhancers. In addition, forward-thinking companies are embedding sustainability criteria into their product roadmaps, implementing circular economy practices-from renewable packaging to waste valorization-to meet evolving regulatory benchmarks and consumer expectations. Research collaborations between leading firms and academic consortia are also driving pipeline diversification, enabling rapid translation of emerging science into market-ready formulations.

As competitive pressures intensify, these focal points-technological differentiation, digital channel optimization, strategic partnerships, and sustainability stewardship-have become central pillars of success. By studying these approaches, organizations can extract best practices and tailor them to their unique value proposition, thereby enhancing innovation velocity and reinforcing brand equity in a crowded marketplace.

This comprehensive research report delivers an in-depth overview of the principal market players in the Nutraceuticals market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Nestle S.A.

- Unilever PLC

- Kerry Group PLC

- Abbott Laboratories

- Amway Corporation

- Bayer AG

- Archer Daniels Midland Company

- Herbalife International, Inc.

- Yakult Honsha Co., Ltd.

- NOW Health Group, Inc.

- Nutricia by Danone S.A.

- Ajinomoto Co., Inc.

- Associated British Foods PLC

- Balchem Corporation

- Barentz International B.V.

- BASF SE

- BIONAP S.R.L.

- Cargill Incorporated

- Chr. Hansen Holding A/S

- Divi's Laboratories Limited

- DSM-Firmenich AG

- DuPont de Nemours, Inc.

- Fonterra Co-Operative Group Limited

- Glanbia PLC

- Ingredion Incorporated

- Jamieson Wellness Inc.

- Kyowa Hakko USA, Inc.

- Lonza Group Ltd

- Martin Bauer Group

- Pfizer Inc.

- Sydler India Pvt. Ltd.

- ZIVO Bioscience, Inc.

Implement Actionable Strategic Recommendations for Industry Leaders to Accelerate Innovation, Optimize Supply Chains, Enhance Digital Engagement, and Drive Sustainable Growth

To thrive amid accelerating competition and evolving trade policies, industry leaders should prioritize a multifaceted strategic agenda. First, by diversifying ingredient sourcing and forging cooperative partnerships in emerging markets, organizations can mitigate tariff-driven cost pressures while unlocking access to novel bioactives. Simultaneously, investing in modular, scalable manufacturing facilities can facilitate rapid response to regional regulatory changes and reduce reliance on centralized production hubs.

Furthermore, adopting advanced digital engagement tools-including AI-powered recommendation engines and immersive e-commerce experiences-can deepen consumer relationships and yield insights for product optimization. By integrating loyalty programs and subscription services, brands can establish predictable revenue streams and tailor offerings to individual health goals. In parallel, embedding sustainability metrics into product development and supply-chain operations will strengthen brand credibility, appease regulators, and resonate with environmentally conscious consumers.

Finally, forging alliances with academic institutions and clinical research organizations can expedite validation of health claims and support evidence-based marketing. By implementing these strategic imperatives in concert, industry players can enhance resilience, spur innovation, and secure a differentiated position in the global nutraceuticals market.

Review the Rigorous Research Methodology Incorporating Primary Interviews, Secondary Insights, Data Triangulation, and Robust Quality Control Measures

This report’s findings are underpinned by a rigorous research methodology that blends both primary and secondary intelligence. Initially, extensive interviews were conducted with a cross-section of industry stakeholders, including ingredient suppliers, product formulators, regulatory experts, and distribution channel partners, yielding qualitative perspectives on emerging trends and operational challenges. These insights were meticulously triangulated with secondary sources such as peer-reviewed scientific literature, public policy documents, and trade association reports to ensure a robust evidentiary base.

Complementing these efforts, a detailed segmentation framework was developed to categorize market dynamics across product types, forms, sources, applications, end-user profiles, and distribution channels. This enabled systematic analysis of growth vectors and competitive positioning. Quantitative validation was achieved through the compilation of historical shipment data, trade statistics, and consumer adoption rates, which were aligned with thematic insights from thought-leadership publications.

Throughout the research lifecycle, stringent quality control protocols-comprising data verification, consistency checks, and peer review-were applied to safeguard analytical integrity. This methodological rigor ensures that stakeholders can rely on the report’s conclusions to inform strategic decision-making and operational planning with confidence.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Nutraceuticals market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Nutraceuticals Market, by Product Type

- Nutraceuticals Market, by Form

- Nutraceuticals Market, by Source

- Nutraceuticals Market, by Application

- Nutraceuticals Market, by End-User

- Nutraceuticals Market, by Distribution Channel

- Nutraceuticals Market, by Region

- Nutraceuticals Market, by Group

- Nutraceuticals Market, by Country

- United States Nutraceuticals Market

- China Nutraceuticals Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 2544 ]

Synthesize Core Findings Highlighting Growth Catalysts, Market Shifts, Segmentation Insights, and Strategic Priorities Driving the Nutraceuticals Industry Forward

In synthesizing the analysis, it becomes clear that nutraceuticals are at the nexus of scientific innovation, consumer empowerment, and global trade dynamics. Growth catalysts span personalized nutrition technologies, sustainability commitments, and digital commerce evolution, while the cumulative impact of recent tariff measures has underscored the value of supply-chain agility and strategic sourcing. Segmentation insights reveal diverse avenues for product differentiation, addressing needs from digestive health to mental wellness, across a spectrum of delivery formats and channels.

Regional intelligence highlights that success hinges on localized strategies, balancing centralized R&D prowess with culturally resonant product portfolios. Competitive analyses demonstrate that technology-driven differentiation, collaborative research, and sustainability stewardship are non-negotiable for market leadership. By embracing the actionable recommendations-ranging from near-shoring investments to digital ecosystem development-industry participants can navigate uncertainty and capitalize on emerging opportunities.

Ultimately, this executive summary offers a cohesive blueprint for stakeholders to chart a path toward sustainable growth. It underscores the imperative of innovation, collaboration, and adaptability as foundational pillars guiding the next chapter of the nutraceuticals sector’s evolution.

Contact Ketan Rohom to Secure Your Comprehensive Nutraceuticals Market Research Report Offering In-Depth Analysis, Strategic Insights, and Actionable Recommendations

To delve deeper into these insights and access the full scope of strategic analyses, market dynamics, and actionable recommendations, reach out directly to Ketan Rohom, Associate Director of Sales & Marketing. By engaging with an expert liaison, you will secure privileged entry to the comprehensive report that synthesizes primary research findings, regional intelligence, and segmentation analytics across the nutraceuticals value chain. Take the next step toward informed decision-making and sustainable growth by leveraging our bespoke research solutions tailored to your organization’s strategic objectives. Connect with Ketan today to transform market intelligence into competitive advantage and ensure your leadership in the evolving nutraceuticals ecosystem

- How big is the Nutraceuticals Market?

- What is the Nutraceuticals Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?