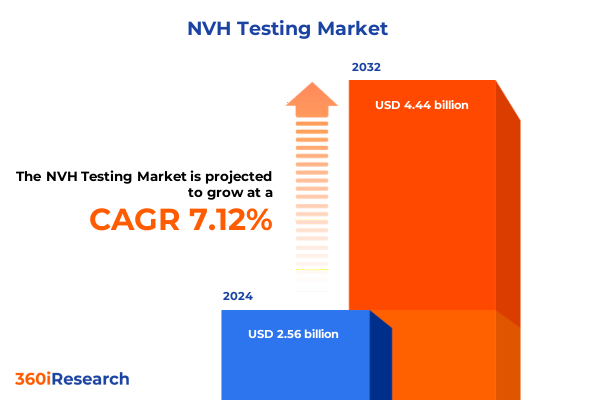

The NVH Testing Market size was estimated at USD 2.73 billion in 2025 and expected to reach USD 2.92 billion in 2026, at a CAGR of 7.16% to reach USD 4.44 billion by 2032.

Recognizing the Critical Significance of Advanced Noise Vibration Harshness Testing in Driving Product Excellence Across Transportation and Industrial Sectors

NVH testing has evolved into an indispensable component of modern product development, enabling manufacturers to deliver quieter, more comfortable, and safer solutions across transportation and industrial sectors. As consumer expectations rise and regulatory bodies impose stringent noise and vibration standards, organizations are increasingly compelled to integrate advanced NVH testing methodologies at the earliest stages of design. This proactive approach not only mitigates risk but also accelerates time to market by identifying critical performance issues before they manifest in physical prototypes. Recognizing the profound implications for both product integrity and end-user satisfaction, engineering teams are now collaborating with specialized testing facilities to harness the full potential of comprehensive noise vibration harshness assessments.

Transitioning from traditional laboratory-based evaluations, the NVH testing landscape now encompasses a diverse array of solutions that span hardware analyzers, data acquisition systems, sensors, shakers and controllers, as well as sophisticated software platforms for data analysis and simulation. This integration of hardware and software capabilities empowers engineers to conduct more precise diagnostics, perform real-time condition monitoring, and simulate complex operating environments. Consequently, stakeholders gain deeper insights into acoustic and vibrational phenomena, supporting informed decision-making and fostering innovation. With noise vibration harshness testing poised to influence every stage of the product lifecycle, its critical role in shaping next-generation transportation and manufacturing solutions is indisputable.

Embracing Electrification Digital Twins and Autonomous Mobility Intersecting with Simulation Software to Transform Noise Vibration Harshness Testing Paradigms

Over the past decade, the NVH testing domain has experienced transformative shifts as emerging technologies and evolving market demands converge. Electrification of vehicles has introduced a new suite of acoustic signatures that require meticulous analysis to preserve the desired in-cab experience while suppressing unwanted electric motor whine. Simultaneously, the rise of autonomous mobility platforms has elevated the importance of environmental noise mapping and in-service condition monitoring, driving adoption of portable noise source localization tools. These developments have accelerated investments in digital twin environments, where virtual prototypes undergo rigorous acoustic and vibration simulations before physical trials commence.

Industry 4.0 paradigms have also catalyzed the integration of connected sensors and cloud-based platforms, enabling real-time data aggregation and machine learning–driven anomaly detection. As organizations pursue deeper insights into component behavior under varying load conditions, the convergence of Internet of Things connectivity and advanced simulation software has redefined testing workflows. Engineers now leverage these capabilities to conduct parallel evaluations across global development centers, expediting root-cause analysis and fostering a more collaborative innovation ecosystem. These technological inflection points underscore how noise vibration harshness testing continues to evolve, ensuring that solutions remain attuned to both regulatory requirements and end-user expectations.

Analyzing the Far Reaching Consequences of 2025 United States Tariff Policies on Equipment Pricing Supply Chains and Strategic Sourcing in NVH Testing

In 2025, the United States implemented a series of tariff adjustments under Section 301 that have exerted considerable influence on the NVH testing equipment supply chain. With levies reaching up to 25 percent on select imports of analyzers, data acquisition systems, sensors, and related hardware components originating from key manufacturing hubs, procurement teams have faced notable cost escalations. These increased expenses have prompted many organizations to reevaluate their sourcing strategies, shifting toward domestic suppliers or alternate low-cost regions that can maintain quality while offsetting tariff burdens.

This recalibration has also spurred greater interest in software-centric solutions and service offerings, as these intangible assets remain largely unaffected by goods-focused duties. Consequently, test facilities are prioritizing upgrades to data analysis and simulation software capabilities, enabling remote and cloud-based testing scenarios that minimize dependence on imported instrumentation. At the same time, collaborative agreements between OEMs and local system integrators have emerged as an effective mechanism for mitigating tariff impacts, fostering knowledge transfer while ensuring continuity of access to state-of-the-art NVH testing technologies. As the ripple effects of the 2025 tariff landscape continue to unfold, organizations that proactively adapt their procurement and partnership models will position themselves to sustain innovation momentum amid shifting trade dynamics.

Unveiling Segmentation to Illuminate Diverse Noise Vibration Harshness Testing Requirements across Products Tests Applications and End User Verticals

A nuanced understanding of market segmentation is fundamental to tailoring noise vibration harshness testing solutions that align precisely with diverse client needs. From a product perspective, the market comprises hardware components such as analyzers, data acquisition systems, sensors, shakers and controllers, and transducers, complemented by services and software offerings, the latter encompassing robust data analysis applications as well as advanced simulation suites. Each of these elements addresses distinct aspects of the testing continuum, enabling end users to deploy either turnkey lab installations or modular testing rigs that integrate seamlessly with existing development processes.

When considering test modalities, harshness testing, noise testing, and vibration testing each play a pivotal role in characterizing system performance under real-world stimuli. Conversely, application segments like buzz, squeak and rattle investigations, noise source mapping exercises, pass-by noise trials, and powertrain performance evaluations reflect the critical stages at which NVH specialists pinpoint anomalies and validate corrective measures. Equally important, end users across aerospace, automotive, electronics, and marine sectors-where commercial and passenger vehicle variants demand tailored NVH protocols-rely on these differentiated offerings to uphold rigorous safety standards and reputational benchmarks. By integrating these multiple segmentation vectors, stakeholders can develop targeted testing strategies that balance precision, cost efficiency, and regulatory compliance.

This comprehensive research report categorizes the NVH Testing market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Test Type

- Application

- End User

Exploring Regional Dynamics to Uncover Demand Variations Regulatory Influences and Technology Adoption Trends in Americas EMEA and Asia Pacific NVH Testing

Regional dynamics imprint unique characteristics on the noise vibration harshness testing landscape, with the Americas, Europe Middle East and Africa, and Asia Pacific each demonstrating distinct demand drivers and regulatory pressures. In the Americas, stringent North American regulatory frameworks coupled with vocal consumer expectations for cabin comfort have propelled widespread adoption of comprehensive noise and vibration evaluation protocols, particularly within automotive and aerospace innovation centers. This environment has fostered strong collaborations between OEMs and specialized test laboratories, underpinning the region’s reputation for cutting-edge NVH methodologies.

Conversely, Europe, the Middle East, and Africa present a heterogeneous tapestry of regulatory regimes, from the European Union’s rigorous harmonized noise standards to the Gulf Cooperation Council’s nascent testing guidelines. These factors have catalyzed growth in service-based offerings, where on-site testing and consultancy services help clients navigate evolving compliance landscapes. In the Asia Pacific region, rapid industrialization and the ascendancy of electric vehicle manufacturing hubs have driven significant investments in both hardware test rigs and simulation platforms. Localized government incentives targeting noise pollution reduction have further galvanized demand, positioning the region as a hotbed for innovation in both portable and fixed NVH testing solutions.

This comprehensive research report examines key regions that drive the evolution of the NVH Testing market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Leading Players Innovations Collaborations and Initiatives Shaping the Competitive Terrain of Noise Vibration Harshness Testing Technologies

The competitive landscape of noise vibration harshness testing is shaped by established instrument manufacturers, innovative software developers, and specialized service providers. Leading equipment vendors continue to expand their portfolios through strategic acquisitions and platform integrations, bridging the gap between hardware measurement capabilities and cloud-based analytics. Simultaneously, software companies are differentiating their offerings by embedding artificial intelligence and machine learning algorithms for predictive diagnostics and automated anomaly detection.

Collaborations between test facility operators and technology partners have become increasingly prevalent, enabling turnkey testing solutions that blend on-site instrumentation with remote monitoring services. Such alliances also facilitate regional customization, ensuring that NVH testing programs align with local regulatory and operational requirements. Moreover, a new cohort of agile start-ups focused on niche simulation tools and portable sensor arrays is gaining traction, compelling incumbent players to innovate rapidly and streamline their go-to-market strategies. As convergence between hardware and software intensifies, partnerships characterized by co-development agreements and joint research initiatives are emerging as a key differentiator, reinforcing the critical role of collaboration in driving future growth.

This comprehensive research report delivers an in-depth overview of the principal market players in the NVH Testing market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AB Dynamics plc

- ATESTEO GmbH & Co. KG

- Autoneum Holding Ltd.

- Axiometrix Solutions

- Benstone Instruments Inc.

- Bertrandt AG

- Data Physics Corporation by NVT Group

- DEWESoft d.o.o

- ECON TECHNOLOGIES CO., LTD

- EDAG Engineering GmbH

- Emerson Electric Co.

- ERBESSD INSTRUMENTS TECHNOLOGIES INC.

- ESI Group

- FEV Group GmbH

- HEAD acoustics GmbH

- Honeywell International Inc.

- Hottinger Brüel & Kjær A/S

- Illinois Tool Works Inc.

- IMV Corporation

- King Design Industrial Co., Ltd.

- Kistler Group

- m+p international Mess- und Rechnertechnik GmbH

- OROS DIGITAL S.A.S.

- Polytec GmbH

- Prosig Ltd

- RION Co., Ltd.

- Schaeffler AG

- SGS SA

- Siemens AG

- Signal.X Technologies LLC

- Thermotron Industries

- THP Systems Ltd.

Driving Advantage through Strategic Investments in Digital Twin Simulation Software and Supplier Diversification for Noise Vibration Harshness Testing

Industry leaders seeking to maintain a competitive edge in NVH testing should prioritize investments that align with emerging technological paradigms. Embracing digital twin frameworks offers the dual benefit of accelerated design iterations and reduced physical prototyping costs, enabling engineering teams to evaluate acoustic and vibrational behaviors in a virtual environment before committing to hardware builds. Concurrently, bolstering simulation software capabilities with machine learning modules can enhance predictive maintenance workflows, providing actionable insights that preempt costly system failures and unplanned downtime.

To mitigate external supply chain pressures, companies are advised to cultivate relationships with a diversified supplier network, encompassing domestic manufacturers and strategic partners in alternative geographies. This proactive approach not only cushions against tariff volatility but also encourages knowledge transfer and co-innovation. Additionally, establishing collaborative ecosystems that integrate test labs, academic institutions, and cross-industry consortia can accelerate the development of standardized protocols and accelerate technology adoption. By implementing these targeted measures, organizations will fortify their operational resilience and position themselves to capitalize on the next wave of NVH testing opportunities.

Detailing a Research Framework Integrating Primary Expert Interviews Secondary Technical Data and Triangulation for Noise Vibration Harshness Testing Insights

This market intelligence leverages a comprehensive research framework that integrates primary expert interviews with a broad spectrum of secondary technical data and rigorous triangulation. In the primary phase, seasoned NVH engineers, laboratory managers, and OEM decision-makers provided candid insights into evolving testing requirements and technology adoption barriers. Their firsthand perspectives were supplemented by secondary research encompassing industry white papers, regulatory documentation, and peer-reviewed publications that elucidate performance standards and emerging methodologies.

To ensure analytical integrity, data points from disparate sources underwent cross-verification, identifying and resolving disparities through iterative validation. Market segmentation variables were defined based on product architecture, testing modalities, application domains, and end-user verticals, while regional dynamics were examined through localized case studies and policy analyses. This blended research approach not only underpins the robustness of the insights but also affords a granular understanding of both macroeconomic drivers and micro-level operational considerations within the noise vibration harshness testing ecosystem.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our NVH Testing market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- NVH Testing Market, by Product Type

- NVH Testing Market, by Test Type

- NVH Testing Market, by Application

- NVH Testing Market, by End User

- NVH Testing Market, by Region

- NVH Testing Market, by Group

- NVH Testing Market, by Country

- United States NVH Testing Market

- China NVH Testing Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1272 ]

Bringing Together Strategic Observations Critical Trends and Imperatives to Emphasize the Value of Noise Vibration Harshness Testing in Evolving Industries

In summary, the noise vibration harshness testing sector stands at the nexus of regulatory imperatives, technological innovation, and evolving consumer expectations. Organizations that harness advanced testing methodologies-from state-of-the-art hardware analyzers to cloud-enabled simulation software-will be best positioned to deliver products that excel in performance and comfort. Strategic adaptations to address tariff-driven supply chain disruptions are essential, with software-driven solutions and diversified sourcing strategies serving as effective countermeasures.

Looking ahead, the convergence of artificial intelligence, digital twin environments, and real-time connectivity will redefine testing paradigms, enabling more predictive and proactive approaches to acoustic and vibrational assessment. By embracing these transformative shifts and applying segmentation-driven insights, stakeholders can forge a path toward sustained innovation and operational excellence. The time to act is now: organizations that invest in people, processes, and platforms aligned with these emerging trends will shape the future of NVH testing and unlock new avenues for competitive differentiation.

Engage with Ketan Rohom Associate Director Sales Marketing to Secure Comprehensive Noise Vibration Harshness Testing Insights That Empower Strategic Impact

Embarking on your next strategic initiative in noise vibration harshness testing begins with a single decisive step. Engage directly with Ketan Rohom Associate Director Sales Marketing to gain immediate access to unparalleled research intelligence designed to address the most pressing NVH challenges facing your organization. By collaborating closely with industry veterans, you will receive tailored insights that align with your unique operational requirements, ensuring you stay ahead of regulatory mandates and technological advancements. Seize this opportunity to transform your product development roadmap and solidify your competitive positioning by harnessing comprehensive analysis that empowers strategic impact

- How big is the NVH Testing Market?

- What is the NVH Testing Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?