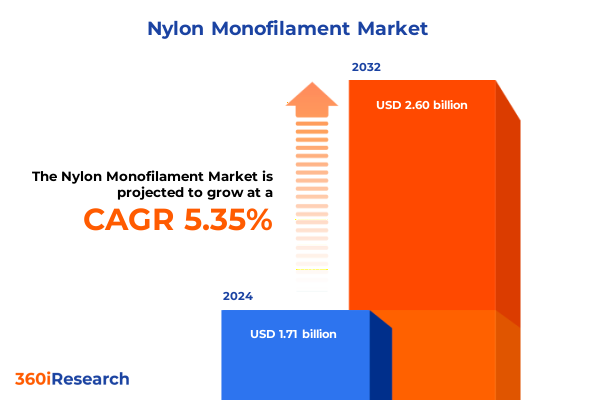

The Nylon Monofilament Market size was estimated at USD 1.80 billion in 2025 and expected to reach USD 1.90 billion in 2026, at a CAGR of 5.37% to reach USD 2.60 billion by 2032.

Unveiling the Pivotal Significance of Nylon Monofilament as a Foundation for Innovative and High-Performance Industrial Solutions

The introduction establishes the critical relevance of nylon monofilament as a cornerstone material renowned for its combination of tensile strength, chemical resistance, and versatility across industrial and consumer applications. Originating from the polymerization of simple yet highly adaptable building blocks, nylon monofilament has evolved into a strategic resource for sectors that range from precision agriculture to advanced electronics. Its unique properties, including high abrasion resistance and consistent diameter control, have made it a defining element in numerous supply chains.

Transitioning from its early applications in fishing and textile manufacturing, nylon monofilament now underpins sectors such as construction reinforcement, consumer products requiring delicate filament performance, and protective packaging solutions. The continuous innovation in production techniques has further refined filament uniformity and mechanical performance, enabling its integration into emerging usage scenarios like surgical sutures and filtration membranes. In addition, growing sustainability considerations have prompted material scientists to explore bio-based feedstocks and closed-loop recycling opportunities, signaling a transformative era for the monofilament landscape.

This executive summary will offer a condensed yet insightful overview of the sector’s recent shifts, the ramifications of trade policy adjustments, granular segmentation insights, and region-specific growth drivers. By setting the stage here, decision-makers can appreciate the nuanced interplay of technological, regulatory, and market forces that collectively shape the nylon monofilament sector’s future trajectory.

Examining the Fundamental Transformations Reshaping the Nylon Monofilament Landscape in Response to Technological and Sustainability Imperatives

Over recent years, the nylon monofilament industry has undergone a paradigm shift driven by technological breakthroughs, environmental imperatives, and evolving end-use requirements. Advanced polymerization techniques and precision extrusion processes have significantly enhanced filament consistency and mechanical properties. These innovations have unlocked new applications in fields such as medical devices, where stringent quality standards are paramount, and in electronics, where microfilament precision is essential for high-frequency signal transmission.

Concurrently, heightened focus on sustainability has spurred the adoption of eco-efficient production methods. Manufacturers are increasingly implementing energy-efficient drying systems and solvent recovery units, reducing the carbon footprint of monofilament production. This sustainable orientation has augmented the appeal of nylon monofilament in applications where regulatory compliance and corporate responsibility converge, including food-safe packaging and automotive interiors.

Meanwhile, end users are redefining performance benchmarks, demanding filaments with enhanced UV resistance and faster biodegradation options. This shift has triggered collaborative research initiatives between material science institutes and industry leaders. As a result, the landscape now exhibits a dynamic equilibrium between cost management, performance optimization, and environmental stewardship. The following sections will delve into the impact of trade policies, detailed segmentation dynamics, and regional drivers, all of which are integral to understanding the current transformational milieu.

Assessing the Comprehensive Implications of United States Tariff Adjustments in 2025 on Nylon Monofilament Supply Chains and Cost Structures

The tariff adjustments implemented by the United States in 2025 have had multifaceted implications for the nylon monofilament value chain. At the import level, increased duties on raw polymer inputs have reverberated throughout the supply chain, elevating upstream procurement costs and prompting reassessments of sourcing strategies. In response, several filament producers have pursued strategic partnerships with domestic polymer suppliers to mitigate exposure to variable import duties.

Downstream manufacturers, particularly those in the agricultural and packaging sectors, have encountered higher input price volatility. To counter these pressures, many have accelerated inventory optimization efforts and explored alternative synthetic fibers where performance trade-offs are manageable. Simultaneously, the elevated cost base has reinforced the imperative for production efficiency, driving greater investment in process automation and inline quality monitoring to reduce scrap rates and operational waste.

From a longer-term perspective, the policy changes have incentivized the onshore expansion of certain extrusion and finishing facilities. These localized operations not only buffer companies against further tariff fluctuations but also support ‘made-in-America’ branding strategies that resonate with end consumers. While initial capital expenditures have increased, the resultant supply chain resilience and reduced lead times are positioning domestic players to better navigate geopolitical uncertainties.

Extracting Strategic Insights from Multi-Dimensional Segmentation to Inform End-Use, Product Type, Diameter Range, and Sales Channel Strategies

By mapping performance across end use industries such as agriculture, construction, consumer goods, electronics, and packaging, nuanced usage patterns emerge. In agricultural applications, relentless demand for durable, UV-stable monofilament has spurred enhancements in lightfastness and tensile strength, whereas in construction, reinforcement strands now integrate higher-modulus variants to endure exposure and mechanical loads. Meanwhile in consumer goods, the priority has shifted toward tactile finesse and colorfastness. Electronics leverage microfilament grades to facilitate precision winding and signal isolation. Packaging segments emphasize barrier performance paired with recyclable monofilament blends.

Product type distinctions-coated filament, multifilament, and single filament-underscore divergent R&D and manufacturing priorities. Coated variants now offer tailored surface chemistries to optimize compatibility with adhesives and printing inks, whereas multifilament assemblies focus on load distribution and impact resilience. Single filament grades continue as the workhorse for high-tension applications that demand uniform mechanical properties.

Varying diameter ranges from micron-scale to bulkier structural profiles influence processing throughput and downstream adaptability. Filaments less than 0.1 mm find favor in precision filtration and medical instrumentation, while those exceeding 0.5 mm cater to heavy-duty applications like geotextiles. Intermediate diameter ranges balance strength and cost for general-purpose uses.

Sales channels ranging from direct sales engagements and distributor partnerships to online platforms shape customer experience and logistical frameworks. Direct sales force interactions often drive co-development projects for specialized applications, whereas distributors enable wider geographic reach. Online channels are gaining prominence for commodity grades, facilitating rapid reordering and streamlined procurement.

This comprehensive research report categorizes the Nylon Monofilament market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Diameter Range

- End Use Industry

- Sales Channel

Analyzing Regional Dynamics and Emerging Opportunities for Nylon Monofilament Across Americas, Europe Middle East Africa, and Asia Pacific Markets

Across the Americas, end users have displayed a pronounced preference for locally manufactured filaments, correlating with reshored production facilities and strengthened domestic supply networks. This has translated into shorter lead times and enhanced service levels for the agricultural and construction segments, where just-in-time delivery and consistent quality are nonnegotiable. In contrast, Europe, Middle East & Africa markets emphasize stringent regulatory compliance and eco-design credentials, pushing producers to validate recycled-content monofilaments and to secure certifications that address food contact and chemical resistance standards. Within this region, a rising focus on circular economy initiatives has also spurred collaborative recycling programs and take-back schemes.

In Asia-Pacific, rapid urbanization and infrastructure expansion are driving robust demand for construction-grade filaments and for advanced packaging solutions that support burgeoning e-commerce ecosystems. Meanwhile, innovations in electronics assembly and the growth of medical device manufacturing clusters have fueled demand for ultra-precision monofilament. Manufacturers serving the Asia-Pacific region are adapting by localizing their R&D centers and forging joint ventures with regional polymer producers to fine-tune formulations for ambient and climatic stresses.

This regional mosaic of demand dynamics underlines the importance of tailoring commercial strategies to local end-user priorities while maintaining global best practices in quality assurance and sustainability reporting. As supply chains become more intertwined, successful actors will be those who blend regional responsiveness with the operational excellence of a globally integrated network.

This comprehensive research report examines key regions that drive the evolution of the Nylon Monofilament market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Key Industry Participants Driving Innovation, Strategic Collaborations, and Competitive Differentiation in the Nylon Monofilament Ecosystem

The competitive landscape features a spectrum of established chemical conglomerates and specialized filament producers. Leading polymer innovators continue to deepen their technology portfolios through strategic acquisitions and collaborative R&D alliances, especially in areas such as bio-polymer integration and nanocomposite enhancements. These collaborations underscore a wider industry trend toward open innovation models that accelerate time-to-market for enhanced monofilament grades.

Tier-one participants drive differentiation through proprietary process controls that deliver unparalleled filament uniformity and by offering tailored application support from formulation through to final product integration. At the same time, agile mid-tier companies leverage niche expertise in customizing diameter profiles and texturing techniques to serve specialized sub-sectors like surgical sutures and high-frequency cable insulation.

In addition, key players are investing in digital platforms to enhance customer engagement and service delivery. Interactive online configurators and real-time order tracking systems are becoming standard offerings, reflecting a broader strategic pivot toward omnichannel distribution. By balancing scale-driven cost advantages with customer-centric service innovations, these companies are positioning themselves to capture share across both emerging and mature end-use segments.

As competitive intensity rises, alliances between chemical producers and end users are expected to deepen, with joint ventures serving as catalysts for the next wave of material breakthroughs in performance and sustainability.

This comprehensive research report delivers an in-depth overview of the principal market players in the Nylon Monofilament market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Asahi Kasei Corporation

- AstenJohnson

- Atkins & Pearce

- BASF SE

- DuPont

- EMS-Chemie Holding AG

- Evonik Industries AG

- Hinafil India Ltd

- Honeywell International Inc

- Hyosung Corporation

- INVISTA

- Jarden Applied Materials

- Lanxess AG

- Luftking Enterprise Co Ltd

- Mitsubishi Chemical Corporation

- Ningbo Judin Special Monofilament Co Ltd

- Perlon GmbH

- Shakespeare Company LLC

- Solvay SA

- Superfil Products Ltd

- Teijin Limited

- Toray Industries Inc

- Wenzhou Ruichang Special Monofilament Factory

Defining Actionable Strategic Imperatives for Leadership to Navigate Market Complexities and Capitalize on Growth Opportunities in Nylon Monofilament

Industry leaders should prioritize strategic investments that enhance both operational resilience and product differentiation. Specifically, aligning R&D portfolios to target emerging application niches-such as biodegradable monofilament for agrotextiles and ultra-fine grades for precision medical devices-can yield significant competitive advantages. By channeling resources into pilot lines and leveraging partnerships with academic institutions, companies can refine new formulations while mitigating development risk.

Simultaneously, streamlining supply chain complexity by forging closer relationships with polymer suppliers and transport partners will help buffer against geopolitical disruptions and duty shifts. Establishing regional sourcing hubs or cross-docking facilities can optimize lead times and reduce inventory burdens. Incorporating digital supply chain monitoring tools will also enable real-time responsiveness to fluctuations in raw material availability and logistics costs.

On the commercial front, cultivating account-based marketing strategies through direct engagement teams and interactive digital portals can deepen customer relationships and drive co-development opportunities. Complementing these efforts with sustainability certifications and transparent reporting will resonate with increasingly eco-conscious end users.

Finally, embracing modular production cells that can switch rapidly between filament grades or diameter profiles will empower manufacturers to respond to custom orders and minimize changeover downtime. Such flexibility will be critical in capturing value amid shifting end-use demands and regulatory landscapes.

Detailing the Rigorous Research Methodology Underpinning Insights into Nylon Monofilament through Primary Secondary and Expert Data Triangulation

The research underpinning this executive summary integrates a systematic combination of primary and secondary data gathering, underpinned by rigorous validation protocols. Primary research encompassed interviews with industry stakeholders, including polymer scientists, production managers, and procurement executives representing end-use industries. These discussions provided granular insights into performance expectations, raw material sourcing trends, and emerging application requirements.

Secondary research efforts involved the comprehensive review of trade association reports, patent filings, and technical white papers to chart recent technological breakthroughs and regulatory developments. This was complemented by analysis of publicly available corporate disclosures, sustainability reports, and procurement guidelines to validate market behavior and compliance trajectories.

Data triangulation ensured consistency across multiple sources, employing qualitative coding techniques to detect thematic patterns and quantitative cross-referencing to corroborate key assertions. Quality checks, such as cross-industry benchmarking and methodological peer reviews, further reinforced the accuracy and relevance of the findings.

Ethical research principles guided all phases of data collection and analysis, with confidentiality agreements in place for proprietary information shared during interviews. This methodological framework delivers a robust foundation for the conclusions and recommendations presented herein.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Nylon Monofilament market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Nylon Monofilament Market, by Product Type

- Nylon Monofilament Market, by Diameter Range

- Nylon Monofilament Market, by End Use Industry

- Nylon Monofilament Market, by Sales Channel

- Nylon Monofilament Market, by Region

- Nylon Monofilament Market, by Group

- Nylon Monofilament Market, by Country

- United States Nylon Monofilament Market

- China Nylon Monofilament Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 795 ]

Concluding Synthesis on the Evolutionary Trajectory of Nylon Monofilament and Its Strategic Implications for Future Industry Stakeholders

Through a comprehensive examination of production innovations, supply chain dynamics, and policy shifts, this report illuminates the multifaceted trajectory of nylon monofilament. Technological advancements have elevated performance benchmarks, while strategic realignments in sourcing and manufacturing have fortified resilience amid tariff fluctuations. Granular segmentation analysis has revealed distinct opportunities and challenges across end-user industries, product types, diameter specifications, and sales channels.

Regional analysis has underscored the divergent priorities and regulatory landscapes that characterize the Americas, Europe Middle East & Africa, and Asia-Pacific markets. Industry participants have responded by refining their value propositions, leveraging digital tools, and pursuing collaborative partnerships to navigate complexity. The recommendations laid out herein offer actionable pathways to enhance R&D efficacy, optimize supply chain architectures, and deepen customer engagement.

Ultimately, nylon monofilament stands at the intersection of performance, sustainability, and strategic agility. As decision-makers chart their course forward, they must integrate technological prowess with operational excellence and an unwavering commitment to environmental stewardship. This synthesis provides the essential context for stakeholders seeking to harness the full potential of this indispensable material.

Engaging with Associate Director Ketan Rohom for Exclusive Insights and Access to the Comprehensive Nylon Monofilament Market Research Report

To explore the full depth of insights and enrich your strategic decision-making with robust data and analytical rigor, reach out to Ketan Rohom, Associate Director, Sales & Marketing. His expert guidance will enable you to tailor the findings to your organization’s unique priorities and operational challenges. Engage with Ketan to unlock exclusive access to the complete comprehensive report on nylon monofilament, ensuring you capitalize on the actionable intelligence covering cutting-edge developments, risk mitigations, and partnership opportunities. Secure your copy today to transform insights into impact and stay ahead of competitive and regulatory shifts with the most authoritative research available.

- How big is the Nylon Monofilament Market?

- What is the Nylon Monofilament Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?