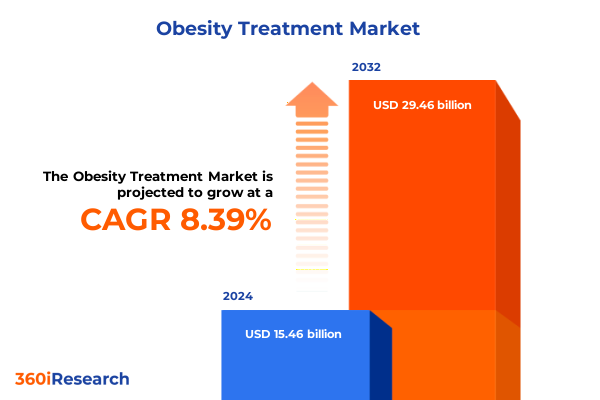

The Obesity Treatment Market size was estimated at USD 16.69 billion in 2025 and expected to reach USD 18.02 billion in 2026, at a CAGR of 8.45% to reach USD 29.46 billion by 2032.

Understanding the Rising Imperative of Obesity Treatment in the Face of Escalating Chronic Disease Burden and Therapeutic Innovation

Obesity has emerged as one of the most pressing public health challenges of the 21st century, with prevalence rates soaring across populations and driving an urgent need for effective therapeutic interventions. In the United States, nearly two out of every five adults meet the clinical criteria for obesity, underscoring the scale of the epidemic and its profound implications for healthcare systems and patient well-being. Over the past decade, the healthcare community has witnessed a steady rise in severe obesity, which now affects nearly one in ten adults, amplifying the risk of comorbidities such as type 2 diabetes, cardiovascular disease, and certain cancers. As the chronic disease burden intensifies, the imperative to advance both preventive strategies and treatment modalities has never been clearer.

Driven by a convergence of scientific innovation, shifting patient preferences, and evolving regulatory landscapes, the obesity treatment arena is undergoing a period of transformative change. Historically rooted in lifestyle modification and bariatric surgery, the field now encompasses a robust pharmacotherapy segment powered by novel drug classes, alongside refinements in surgical techniques and digital health solutions. This report sets the stage by framing the multifaceted drivers of change, highlighting the critical juncture at which clinical efficacy, patient access, and economic considerations intersect. Through this lens, stakeholders are better equipped to understand the dynamics shaping the future of obesity treatment and to craft strategies that deliver both clinical impact and sustainable growth.

Mapping the Transformative Shifts Reshaping Obesity Treatment Driven by Next-Generation Pharmacotherapies and Evolving Surgical Practices

The landscape of obesity treatment is being redefined by groundbreaking pharmacological breakthroughs and parallel advancements in procedural care. At the forefront, GLP-1 receptor agonists have emerged as game-changers, with semaglutide and tirzepatide driving unprecedented weight loss outcomes in clinical trials and real-world settings. While semaglutide-based therapies demonstrated robust efficacy in reducing body weight by more than 15% in obese patients, dual agonists such as tirzepatide have surpassed these results, prompting a wave of investment and innovation in this drug class. Beyond GLP-1 agents, appetite suppressants and lipase inhibitors continue to evolve, with new formulations aimed at enhancing tolerability and patient adherence.

Simultaneously, surgical practices are adapting to the changing therapeutic paradigm. Although bariatric surgery remains the gold standard for durable weight loss, recent data indicate a shift in health system priorities as pharmacotherapy use surges. Some hospitals have reported declines in surgical volume as much as 30% over two years, driven by expanding access to medical weight management and patient preference for non-invasive options. Moreover, advances in laparoscopic and endoscopic procedures are reducing recovery times and broadening candidacy, ensuring that surgical interventions remain a vital component of a comprehensive obesity treatment ecosystem.

Assessing the Cumulative Impact of 2025 United States Tariffs on Pharmaceutical Supply Chains and Healthcare Cost Structures

In April 2025, the United States implemented a sweeping 10% tariff on nearly all imported goods, encompassing active pharmaceutical ingredients, medical devices, and diagnostic equipment. These global tariffs have introduced immediate cost pressures for drug manufacturers and healthcare providers, compelling companies to reevaluate their sourcing strategies and supply chain resilience. The impact has been most acute for generic manufacturers, which rely heavily on foreign APIs; production costs are rising, and some providers are warning of potential drug shortages if alternative supply arrangements cannot be secured swiftly.

Heightened tariffs on Chinese imports-peaking at 245% for certain APIs-have further exacerbated the situation, particularly for medications integral to obesity and metabolic disease management. Healthcare executives project that pharmaceutical costs could climb by at least 10% in the next six months, while hospital budgets may face cost escalations of 15% due to increased import expenses. Although temporary exemptions for select pharmaceutical products have provided short-term relief, the uncertain trajectory of future trade policies underscores the need for strategic diversification of manufacturing and logistical operations to mitigate supply disruptions and contain cost inflation.

Unveiling Key Segmentation Insights Across Treatment Modalities, Drug Classes, Administration Routes, Demographics, Channels, and End-User Profiles

A comprehensive segmentation framework reveals the multifaceted nature of the obesity treatment market and underscores the importance of tailoring strategies to distinct patient and product cohorts. The market analysis begins with treatment type, recognizing the complementary roles of pharmacotherapy-segmented into over-the-counter drugs and prescription medications-and surgical procedures, which include bariatric surgery, gastric bypass, and laparoscopic surgery. Within the pharmacotherapy domain, further clarity emerges through drug class distinctions: appetite suppressants, GLP-1 receptor agonists, lipase inhibitors, and metabolism boosters, each addressing obesity through unique mechanistic pathways.

Market stakeholders must also account for the route of administration, whether oral or parenteral, as patient convenience and adherence considerations vary widely. Demographically, the market is classified by patient age group-adults, elderly, and pediatric populations-each presenting different treatment needs and risk profiles. Distribution channels split between offline and online retail, reflecting evolving consumer purchasing behaviors. Finally, end-user segmentation spans hospitals and clinics, specialty clinics, and weight loss and wellness centers, highlighting the diverse care settings that deliver obesity treatments and necessitating differentiated engagement approaches.

This comprehensive research report categorizes the Obesity Treatment market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Treatment Type

- Drug Class

- Route of Administration

- Patient Age Group

- Distribution Channel

- End-User

Synthesizing Key Regional Insights into the Obesity Treatment Ecosystem Across the Americas, EMEA, and Asia-Pacific Markets

Regional dynamics play a critical role in shaping obesity treatment access and adoption, driven by economic, regulatory, and cultural factors. In the Americas, the United States leads with well-established reimbursement frameworks for novel therapies and a robust network of specialty clinics that facilitate rapid product uptake. Canada and Brazil are expanding public health initiatives to integrate obesity management into primary care, reflecting growing recognition of obesity as a chronic disease requiring sustained intervention.

Europe, the Middle East, and Africa (EMEA) exhibit a heterogeneous landscape: Western European markets benefit from expedited regulatory pathways and favorable reimbursement policies for GLP-1 therapies, while in parts of the Middle East, strategic partnerships and regional manufacturing hubs are reducing dependency on imports. Africa presents nascent but promising opportunities, as rising urbanization contributes to an increasing obesity burden that public health systems are beginning to address. In the Asia-Pacific region, rapid growth is fueled by urbanization, rising disposable incomes, and heightened health awareness, with India, China, and Japan at the forefront of adopting both pharmacological and non-pharmacological obesity solutions. Governments across the region are leveraging public-private collaborations to increase treatment accessibility and invest in preventive health measures.

This comprehensive research report examines key regions that drive the evolution of the Obesity Treatment market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Strategic Company Insights from Leading Pharmaceutical and Medical Device Innovators Driving the Obesity Treatment Arena

Leading pharmaceutical players continue to reshape the obesity treatment landscape through aggressive R&D investments, strategic partnerships, and capacity expansions. Novo Nordisk reported fourth-quarter 2024 sales approaching $12 billion for its GLP-1 products, driven by Wegovy and Ozempic, yet forecasted a milder growth trajectory in 2025 amidst intensifying competition and the emergence of copycat compounding pharmacies. In response, the company is accelerating development of an oral semaglutide formulation and next-generation candidates such as amycretin to bolster its market position and address patient aversion to injections.

Eli Lilly has made significant inroads with tirzepatide (Zepbound), which demonstrated superior weight loss compared to semaglutide in the Phase 3 SURMOUNT-5 trial and received FDA approval as an adjunct for obstructive sleep apnea in obese adults. Lilly’s commitment to expanding manufacturing capacity, including the construction of a new oral GLP-1 production facility and strategic alliances for supply chain resilience, underscores its ambition to lead in both efficacy and accessibility. AstraZeneca’s $50 billion U.S. investment announcement in July 2025 further highlights industry momentum toward on-shore production of critical drug ingredients and advanced manufacturing technologies, driven in part by recent trade policy shifts.

This comprehensive research report delivers an in-depth overview of the principal market players in the Obesity Treatment market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AbbVie Inc.

- Apollo Endosurgery, Inc.

- AstraZeneca PLC

- Atkins Nutritionals, Inc.

- BTL Aesthetics

- C.H. Boehringer Sohn AG & Ko. KG

- Eli Lilly and Company

- F. Hoffmann-La Roche Ltd

- GlaxoSmithKline plc.

- Herbalife Ltd.

- Johnson & Johnson Services, Inc.

- Kellogg Company

- Medtronic PLC

- Merck & Co.

- Novo Nordisk A/S

- NutriSystem, Inc.

- Olympus Corporation

- Pfizer, Inc.

- ReShape Lifesciences, Inc.

- Rhythm Pharmaceuticals, Inc.

- Sanofi SA

- Takeda Pharmaceutical Company Limited

- Viking Therapeutics, Inc.

- VIVUS LLC

- Zealand Pharma A/S

Delivering Actionable Recommendations for Industry Leaders to Navigate Market Volatility, Regulatory Dynamics, and Innovation Pathways

Industry leaders must adopt diversified supply chain strategies to navigate ongoing tariff uncertainties and safeguard the continuity of essential APIs and devices. Prioritizing alternative sourcing partnerships in low-tariff jurisdictions and investing in domestic or near-shoring capabilities will mitigate cost inflation and minimize supply disruptions. Furthermore, executives should engage proactively with trade associations to advocate for targeted tariff exemptions that preserve access to life-saving treatments without compromising broader policy objectives.

Innovation pathways will increasingly hinge on integrated care models that combine pharmacotherapy, surgical interventions, and digital health tools. Collaborations between pharmaceutical and device manufacturers, alongside telehealth and remote monitoring platforms, can deliver personalized treatment regimens and improve long-term adherence. Lastly, crafting compelling value propositions for payers-anchored in real-world evidence of clinical effectiveness and healthcare cost offsets-will be essential to secure favorable formulary placement and broaden patient access across both public and private reimbursement schemes.

Detailing a Rigorous Multiphase Research Methodology Combining Primary Interviews, Secondary Analysis, and Expert Validation

This research employs a robust multistage methodology integrating both qualitative and quantitative approaches. Primary research consisted of in-depth interviews with key opinion leaders, endocrinologists, bariatric surgeons, and pharmaceutical executives across major markets to capture real-time perspectives on treatment adoption and pipeline dynamics. Secondary research leveraged authoritative sources including peer-reviewed journals, industry associations, government trade publications, and proprietary databases to compile historical and contextual data.

Data triangulation was performed to validate findings through cross-comparison of multiple data points, ensuring consistency and accuracy. Market segmentation analyses were rigorously applied to delineate insights across treatment type, drug class, administration route, patient demographics, distribution channels, and end-user categories. Finally, iterative expert reviews were conducted to refine conclusions and align strategic recommendations with practical industry considerations.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Obesity Treatment market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Obesity Treatment Market, by Treatment Type

- Obesity Treatment Market, by Drug Class

- Obesity Treatment Market, by Route of Administration

- Obesity Treatment Market, by Patient Age Group

- Obesity Treatment Market, by Distribution Channel

- Obesity Treatment Market, by End-User

- Obesity Treatment Market, by Region

- Obesity Treatment Market, by Group

- Obesity Treatment Market, by Country

- United States Obesity Treatment Market

- China Obesity Treatment Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1431 ]

Concluding Perspectives on Seizing Opportunities and Addressing Challenges in the Evolving Obesity Treatment Landscape

The obesity treatment market stands at an inflection point where scientific breakthroughs converge with shifting patient expectations and policy imperatives. The maturation of GLP-1 therapies, coupled with evolving surgical and digital health solutions, offers unprecedented opportunities to deliver meaningful clinical outcomes. Yet, external pressures such as trade policy upheavals and reimbursement complexities necessitate proactive, integrated strategies.

Stakeholders who successfully navigate these challenges will be those that harness data-driven insights, cultivate collaborative ecosystems, and remain agile in the face of regulatory and market fluctuations. By aligning therapeutic innovation with patient access imperatives and operational resilience, companies and providers can contribute to reversing the obesity epidemic and capturing the significant value inherent in this rapidly evolving sector.

Connect with Ketan Rohom to Secure Comprehensive Obesity Treatment Market Intelligence and Accelerate Strategic Decision-Making

To explore in-depth insights, data-driven analyses, and tailored strategic frameworks, reach out directly to Ketan Rohom, Associate Director of Sales & Marketing. Ketan can guide you through the report’s comprehensive findings and discuss how our expert intelligence can be customized to support your organization’s objectives in the obesity treatment landscape. Engage with Ketan to secure access to the full market research report and accelerate your strategic decision-making process with actionable intelligence.

- How big is the Obesity Treatment Market?

- What is the Obesity Treatment Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?