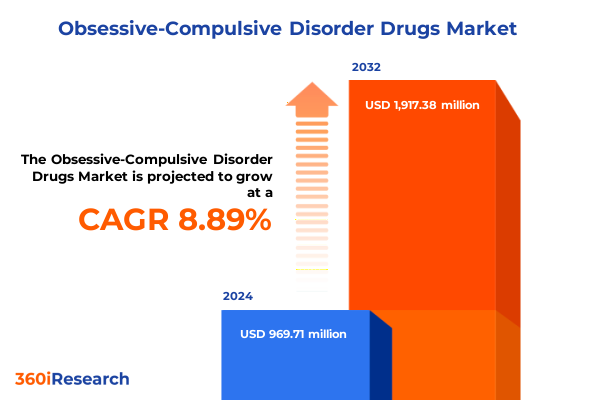

The Obsessive-Compulsive Disorder Drugs Market size was estimated at USD 1.05 billion in 2025 and expected to reach USD 1.13 billion in 2026, at a CAGR of 8.91% to reach USD 1.91 billion by 2032.

Unveiling the Contemporary Landscape of Obsessive-Compulsive Disorder Therapeutics and the Critical Role of Pharmacological Treatment Strategies

Obsessive-compulsive disorder stands as a chronic and often debilitating neuropsychiatric condition that affects a significant portion of the global population, manifesting through persistent intrusive thoughts and repetitive behaviors. Pharmacological treatments represent the cornerstone of therapeutic intervention, targeting neurochemical imbalances to ameliorate symptoms and enhance patient quality of life. The contemporary landscape of OCD therapeutics encompasses diverse drug classes, evolving formulations, and a growing emphasis on personalized medicine. Against this backdrop, the present report delivers a rigorous, multi-dimensional analysis designed to illuminate critical trends, industry drivers, and strategic imperatives shaping the market.

With the rising prevalence of OCD and heightened recognition of its societal impact, stakeholders across the healthcare continuum are intensifying efforts to develop novel compounds and optimize existing regimens. This introduction situates the report within the broader context of mental health innovation, emphasizing the symbiotic relationship between scientific breakthroughs, regulatory pathways, and commercial dynamics. Moreover, by synthesizing cross-functional insights drawn from clinical research, supply chain analysis, and patient segmentation, this report establishes a foundational framework for informed decision-making. As the industry confronts escalating demands for affordable, efficacious treatments, the ensuing sections explore transformative shifts, policy influences, market segmentation, regional differentiation, competitive positioning, and practicable recommendations to guide leaders through an increasingly complex therapeutic terrain.

Emerging Therapies and Digital Innovations Reshaping the Treatment Paradigm for Obsessive-Compulsive Disorder Worldwide

Over the past several years, the OCD therapeutics arena has undergone a paradigm shift fueled by advancements in molecular science, digital health integration, and patient-centric approaches. Novel agents targeting intracellular signaling pathways and glutamatergic mechanisms have progressed into late-stage clinical trials, promising alternative treatment modalities beyond traditional serotonergic interventions. Concurrently, digital therapeutics and telepsychiatry platforms have reshaped the patient journey, facilitating remote monitoring and adherence support that complement pharmacotherapy. These synergistic innovations are redefining efficacy benchmarks and elevating expectations for outcome-oriented care.

Furthermore, extended-release formulations and precision dosing strategies have gained traction, enabling clinicians to tailor regimens based on pharmacokinetic profiles and individual tolerability. As the landscape evolves, manufacturers are leveraging artificial intelligence to optimize compound screening and real-world evidence to refine therapeutic guidelines. Regulatory authorities have responded by streamlining pathways for breakthrough therapies and digital tools, thereby accelerating time to market. In this context, competition intensifies not only on the molecule level but also across value-added services that bolster engagement and long-term remission. Consequently, industry stakeholders must navigate a rapidly shifting ecosystem where technological convergence and patient empowerment drive transformative growth.

Assessing the Cumulative Impact of Recent United States Tariffs on the Cost Structure and Supply Chain Dynamics of OCD Drug Manufacturing

In early 2025, the United States enacted a suite of tariffs targeting active pharmaceutical ingredients and intermediates imported from major manufacturing hubs, primarily in Asia. These levies, cumulatively exceeding fifteen percent for certain product categories, have reverberated across the OCD drug supply chain, prompting raw material cost escalations and contracting margins for both branded and generic producers. As manufacturers confront heightened input expenses, several have accelerated initiatives to diversify sourcing strategies, including the establishment of alternative supplier networks and localized production capabilities.

Moreover, the tariff-driven reconfiguration of logistics infrastructures has influenced inventory management and distribution planning. Companies are increasingly adopting just-in-time manufacturing and strategic stockpiling to mitigate potential disruptions, while procurement teams emphasize long-term contracts to secure price stability. Regulatory bodies have also observed a shift in import patterns, with increased scrutiny on domestic API facilities meeting Good Manufacturing Practice standards. Although these measures aim to bolster supply chain resilience, stakeholders must reconcile short-term cost pressures with investments in R&D and capacity expansions. Ultimately, the cumulative impact of these trade policies underscores the imperative for agile, integrated supply chain strategies to sustain innovation and ensure patient access in a complex global ecosystem.

Holistic Examination of OCD Drug Market Segmentation Across Class, Channel, Type, Administration Route, End User, and Patient Demographics

A granular examination of market segmentation reveals critical insights into the heterogeneity of the OCD therapeutics landscape. By drug class, traditional monoamine oxidase inhibitors retain a niche position defined by agents such as phenelzine and tranylcypromine, while serotonin–norepinephrine reuptake inhibitors, including desvenlafaxine, duloxetine, and venlafaxine, progressively capture market share due to favorable tolerability. Meanwhile, selective serotonin reuptake inhibitors, comprising citalopram, fluoxetine, fluvoxamine, paroxetine, and sertraline, continue to serve as the mainstay of first-line therapy. Tricyclic antidepressants-amitriptyline, clomipramine, and imipramine-maintain relevance in treatment-refractory cases, underscoring the importance of diverse pharmacological mechanisms.

Transitioning to distribution channels, hospital pharmacies remain a pivotal conduit for acute care regimens, while retail pharmacies facilitate broad outpatient access. Simultaneously, the surge in online pharmacy adoption reflects shifting consumer preferences toward convenience and privacy. In terms of drug type, the competitive interplay between brand-name innovations and generic equivalents shapes pricing dynamics and formulary inclusion, compelling innovators to differentiate through value-added offerings. From the perspective of administration route, the dominance of oral formulations coexists with niche parenteral applications, particularly in controlled settings. End-user segmentation spans clinics and hospitals with specialized psychiatric services as well as households where long-term maintenance therapy prevails. Finally, patient age demographics bifurcate into adult cohorts, representing the majority of prescriptions, and pediatric populations, which are driving tailored clinical trials and formulation adjustments. Understanding these multifaceted segmentation dimensions is instrumental for stakeholders aiming to align product portfolios with evolving therapeutic and patient needs.

This comprehensive research report categorizes the Obsessive-Compulsive Disorder Drugs market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Drug Class

- Distribution Channel

- Drug Type

- Route Of Administration

- End User

- Patient Age Group

Comparative Regional Analysis Highlighting Key Trends and Growth Drivers in the Americas, Europe Middle East & Africa, and Asia-Pacific Markets

Regional dynamics in the obsessive-compulsive disorder therapeutics market vary markedly according to healthcare infrastructure, regulatory environments, and cultural attitudes toward mental health. In the Americas, established reimbursement frameworks and growing investment in digital health have accelerated adoption of novel treatments, while public-private partnerships facilitate large-scale clinical trials. This region also grapples with pricing pressures amidst regulatory scrutiny, incentivizing manufacturers to demonstrate real-world effectiveness and health-economic value.

Conversely, Europe, the Middle East & Africa present a mosaic of markets ranging from highly regulated Western European countries with robust pharmacovigilance systems to emerging economies contending with limited mental health resources. Regional regulatory harmonization initiatives have streamlined approval processes, yet disparities in access and affordability persist. In select Middle Eastern countries, expanding private healthcare sectors have spurred interest in advanced OCD therapies, whereas parts of Africa emphasize generic options due to budget constraints.

Meanwhile, the Asia-Pacific region exhibits rapid growth fueled by rising awareness, expanding insurance coverage, and increased local manufacturing capacity. Key markets such as Japan, South Korea, and Australia lead in early adoption of breakthrough compounds, whereas China and India focus on scaling generics and biosimilars. Across these diverse markets, cultural stigmas around mental health continue to evolve, shaping patient engagement strategies and community-based care models. Collectively, these regional insights underscore the necessity for tailored market entry plans and adaptive commercialization strategies that account for unique regulatory, economic, and cultural contexts.

This comprehensive research report examines key regions that drive the evolution of the Obsessive-Compulsive Disorder Drugs market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Insights into Leading Pharmaceutical Companies and Their Strategic Initiatives Shaping the Future of Obsessive-Compulsive Disorder Drug Development

Leading pharmaceutical companies in the OCD therapeutics space are deploying a range of strategic initiatives to fortify their market positions and capture emerging growth opportunities. Major innovators are collaborating with biotechnology firms to co-develop next-generation compounds targeting non-serotonergic pathways, thereby diversifying their pipelines. In parallel, strategic partnerships with digital health vendors are enhancing patient adherence through mobile applications and integrated telepsychiatry services.

Generic manufacturers are capitalizing on patent expirations of legacy drugs to expand their portfolios, leveraging economies of scale and optimized manufacturing techniques to deliver cost-effective alternatives. In response to evolving trade policies, both originator and generic players are investing in regional manufacturing hubs and forging strategic alliances to secure active ingredient supply. Additionally, several multinational corporations are pursuing mergers and acquisitions aimed at bolstering their presence in high-growth markets, particularly within Asia-Pacific and the Middle East.

Across the competitive landscape, differentiation hinges on a hybrid approach that blends robust clinical development with value-added support services. Companies that successfully integrate real-world evidence generation, patient-centric care models, and precision medicine frameworks will likely emerge as market leaders. Ultimately, the strategic agility displayed by these organizations–through R&D collaborations, digital health integration, and supply chain optimization–will determine their capacity to meet evolving patient needs and regulatory expectations.

This comprehensive research report delivers an in-depth overview of the principal market players in the Obsessive-Compulsive Disorder Drugs market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AbbVie Inc

- Alembic Pharmaceuticals Ltd

- Amneal Pharmaceuticals Inc

- Apotex Inc

- AstraZeneca PLC

- Aurobindo Pharma Limited

- Biogen Inc

- Dr Reddy's Laboratories Ltd

- Eli Lilly and Company

- GlaxoSmithKline plc

- H Lundbeck A/S

- Johnson & Johnson

- Lupin Pharmaceuticals Inc

- Mallinckrodt plc

- Merck & Co Inc

- Novartis AG

- Omeros Corporation

- Otsuka Pharmaceutical Co Ltd

- Pfizer Inc

- Sanofi

- Sun Pharmaceutical Industries Ltd

- Teva Pharmaceutical Industries Ltd

- Torrent Pharmaceuticals Ltd

- Viatris Inc

- Zydus Pharmaceuticals Inc

Actionable Strategies for Industry Leaders to Capitalize on Innovation, Optimize Supply Chains, and Enhance Patient Access in the OCD Therapeutics Market

Industry leaders must adopt a multifaceted strategy to navigate the evolving OCD therapeutics market and maintain competitive advantage. First, accelerating investment in next-generation formulations and novel mechanism-of-action compounds is critical to address unmet needs and differentiate product pipelines. Concurrently, firms should expand their partnerships with digital health innovators to develop comprehensive care platforms that enhance patient adherence and enable remote monitoring.

Furthermore, supply chain diversification remains imperative in the wake of recent tariff impositions; organizations should forge strategic alliances with alternative suppliers and bolster domestic manufacturing capabilities to mitigate geopolitical risks and secure uninterrupted API availability. In addition, targeted pricing strategies that reflect real-world outcomes will support reimbursement negotiations and foster trust with payers and providers. Companies should also intensify efforts in pediatric research, ensuring age-appropriate formulations and clinical data to unlock new patient segments.

Lastly, engaging with regional stakeholders through localized commercialization teams and culturally sensitive education programs will maximize market penetration across diverse geographies. By implementing these recommendations in concert, industry participants can deliver sustainable growth, elevate patient outcomes, and solidify their leadership in the OCD treatment paradigm.

Comprehensive Overview of the Research Methodology Underpinning the In-Depth Analysis of Obsessive-Compulsive Disorder Drug Market Trends

This report’s insights are grounded in a rigorous research methodology that integrates both primary and secondary data sources to deliver a holistic market perspective. Primary research entailed in-depth interviews with key opinion leaders, including psychiatrists, pharmacologists, and supply chain experts, to capture real-world nuances and emerging clinical preferences. Moreover, executive dialogues with senior representatives from pharmaceutical companies and distribution partners provided strategic context around investment priorities and operational challenges.

Secondary research encompassed a comprehensive review of peer-reviewed literature, regulatory filings, patent databases, and industry conference proceedings to validate market trends and technology trajectories. Publicly available government publications and import-export databases were analyzed to quantify tariff impacts and assess supply chain resilience. Additionally, proprietary databases were leveraged to extract historical launch timelines, approval statistics, and treatment guideline updates. Quantitative analytics were applied to synthesize this wealth of information, ensuring that findings reflect both historical dynamics and future strategic imperatives.

To ensure methodological rigor, data triangulation was employed at each stage, cross-referencing insights from disparate sources to minimize bias and enhance reliability. Finally, all findings underwent expert validation workshops, wherein stakeholders provided feedback on preliminary conclusions, resulting in a refined, stakeholder-aligned final report.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Obsessive-Compulsive Disorder Drugs market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Obsessive-Compulsive Disorder Drugs Market, by Drug Class

- Obsessive-Compulsive Disorder Drugs Market, by Distribution Channel

- Obsessive-Compulsive Disorder Drugs Market, by Drug Type

- Obsessive-Compulsive Disorder Drugs Market, by Route Of Administration

- Obsessive-Compulsive Disorder Drugs Market, by End User

- Obsessive-Compulsive Disorder Drugs Market, by Patient Age Group

- Obsessive-Compulsive Disorder Drugs Market, by Region

- Obsessive-Compulsive Disorder Drugs Market, by Group

- Obsessive-Compulsive Disorder Drugs Market, by Country

- United States Obsessive-Compulsive Disorder Drugs Market

- China Obsessive-Compulsive Disorder Drugs Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1749 ]

Synthesis of Key Findings and Insights on Market Dynamics, Innovations, and Strategic Imperatives in the OCD Pharmacotherapy Landscape

In synthesizing the multifaceted insights presented throughout this report, several overarching themes emerge as pivotal to the future of OCD pharmacotherapy. The convergence of innovative molecular approaches and digital health integration is transforming conventional treatment paradigms, offering new avenues for efficacy and patient engagement. Concurrently, trade policy developments have catalyzed supply chain realignment and underscored the importance of procurement agility.

Segmentation analysis highlights the necessity of tailored strategies across drug classes, distribution channels, and patient demographics, while regional assessments reveal that localized market dynamics demand customized commercialization roadmaps. Competitive intelligence on leading pharmaceutical companies demonstrates that strategic alliances, M&A activity, and value-added service models will serve as key differentiators. Accordingly, industry leaders must adopt an integrated approach that balances investment in R&D innovation with operational resilience and market-specific commercialization tactics.

Ultimately, the future of obsessive-compulsive disorder therapeutics hinges on the ability of stakeholders to anticipate evolving regulatory frameworks, embrace technological advancements, and deliver patient-centric solutions. This confluence of clinical, commercial, and policy drivers will define the next generation of OCD treatment successes.

Take the Next Step Toward Informed Decision-Making by Engaging with Ketan Rohom to Access the Complete OCD Drug Market Research Report

To delve deeper into the comprehensive insights and strategic intelligence articulated in this report, we invite decision-makers to reach out to Ketan Rohom, Associate Director, Sales & Marketing, who can facilitate immediate access to the full market research study. Engaging with Ketan enables organizations to obtain the detailed analyses, proprietary data, and expert commentary necessary to refine portfolios, optimize launch strategies, and harness emerging opportunities within the obsessive-compulsive disorder therapeutics space. By securing the complete report, stakeholders will equip themselves with the actionable intelligence that underpins confident decision-making and sustained competitive advantage. Prospective clients are encouraged to contact Ketan directly to discuss tailored licensing options, enterprise subscriptions, or bespoke consulting engagements that address their unique research requirements. Your next strategic breakthrough in the OCD drug market starts with this essential resource–connect with Ketan Rohom today to transform insights into impact and drive enduring growth in this dynamic therapeutic domain.

- How big is the Obsessive-Compulsive Disorder Drugs Market?

- What is the Obsessive-Compulsive Disorder Drugs Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?