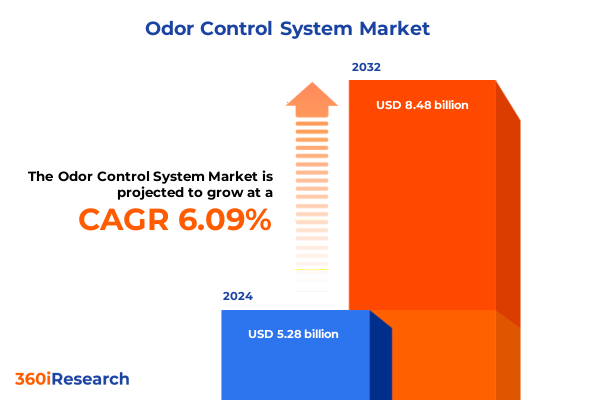

The Odor Control System Market size was estimated at USD 5.57 billion in 2025 and expected to reach USD 5.88 billion in 2026, at a CAGR of 6.18% to reach USD 8.48 billion by 2032.

Understanding the Evolving Significance of Odor Control Systems Amid Heightened Environmental and Regulatory Pressures in Global Industries

Odor control has emerged as a critical priority for industries contending with stricter environmental mandates and growing public expectations for community health protection. In recent years, regulatory bodies have intensified scrutiny of emissions and waste streams, compelling manufacturers, processors and treatment facilities to re-evaluate traditional approaches. At the same time, heightened awareness among stakeholders regarding the environmental and social impacts of odor nuisances has driven organizations to invest in more sophisticated solutions that deliver both performance and accountability.

Innovations in odor management span a broad spectrum, from advanced carbon filtration media and chemical neutralizers to biologically based treatments that leverage targeted microbial cultures. Simultaneously, digital monitoring platforms are being integrated to provide real-time analytics on emission profiles, enabling rapid response and predictive maintenance. These converging trends illustrate a market that is not only adapting to external pressures but also embracing technological breakthroughs that foster operational efficiency and sustainability.

This executive summary distills the most salient factors influencing odor control system adoption, offering decision-makers a clear understanding of market drivers, emerging challenges and strategic imperatives. By examining regulatory shifts, technological advances and industry best practices, the insights presented herein will serve as a foundational guide for executives seeking to align corporate objectives with evolving market dynamics.

Exploring the Transformative Technological Shifts and Sustainable Innovations Reshaping Odor Management Solutions Across Multiple Application Verticals

The odor control sector is undergoing a period of transformative disruption driven by converging technological, regulatory and sustainability imperatives. Traditionally dominated by chemical scrubbers and fixed-bed carbon filters, the landscape now features next-generation materials engineered at the molecular level to capture a wider range of volatile organic compounds with greater efficiency. Simultaneously, the integration of sensors and IoT-enabled platforms is reshaping service models, enabling continuous monitoring and remote diagnostics that minimize downtime and optimize maintenance schedules.

Sustainability considerations are further catalyzing change as stakeholders demand solutions that reduce energy consumption, lower carbon footprints and facilitate the circular use of spent media. Innovations in water-regenerated carbon and caustic-treated carbon exemplify this shift, allowing operators to recover and reuse filtration media rather than disposing of it. In parallel, biological odor control processes are gaining traction through aerobic and anaerobic treatments that harness naturally occurring microorganisms to neutralize odorous compounds in both air and water streams.

Regulatory tightening across multiple jurisdictions is amplifying the urgency for these advancements. Emissions standards and waste discharge limits are becoming more stringent, prompting facility managers to adopt multi-stage treatment trains that combine physical, chemical and biological mechanisms. The resulting ecosystem is one where collaboration between technology providers, regulators and end users is crucial to delivering integrated odor management strategies that are both compliant and cost effective.

Assessing the Comprehensive Impact of 2025 Tariff Measures on Odor Control System Supply Chains Operational Costs and Material Sourcing Strategies

The implementation of new tariff measures in the United States in 2025 has introduced significant complexities for companies reliant on imported raw materials and specialized components for odor control systems. Carbon media, key reagents used in chemical neutralization processes and critical electronic components for monitoring systems have all seen cost escalations tied to duties ranging from mid-single digits to more than ten percent. As a result, procurement teams are facing upward pressure on budgets and are re-evaluating supplier partnerships to manage total cost of ownership.

Supply chain strategies have adjusted rapidly in response. Some operators are diversifying sourcing footprints, shifting toward domestic or nearshoring options to mitigate exposure to tariff volatility. Others have entered into long-term contracts with international suppliers to lock in pricing before additional measures take effect. At the same time, companies are accelerating the development of alternative materials and process innovations that reduce reliance on the most heavily taxed inputs.

Financial impacts extend beyond unit costs, affecting capital planning timelines and project return profiles. Organizations with aggressive expansion or retrofit initiatives are now building tariff sensitivities into feasibility analyses and stress-testing scenarios. Meanwhile, forward-looking players are leveraging joint development agreements and strategic alliances to co-create materials and technologies that are designed to be tariff-resilient, ensuring continued access to high-performance odor control solutions under evolving trade landscapes.

Deep Dive into Market Segmentation Reveal Distinct Dynamics across Technology Types Functional Applications Deployment Models Distribution Methods and End Uses

A nuanced understanding of market segmentation illuminates the distinct demands and innovation trajectories shaping odor control solutions. Analysis by type reveals that biological odor control systems are prized for their eco-friendly footprint and ability to biodegrade malodorous compounds, while carbon-based systems command attention through variants such as virgin activated carbon, high capacity carbon, caustic treated carbon and water regenerated carbon, each engineered to address specific contaminant challenges. Chemical odor control systems, meanwhile, are tailored to deliver rapid neutralization of targeted odorous molecules, often in settings where regulatory thresholds leave little margin for error.

Functional segmentation further differentiates offerings designed for airborne odor control-leveraging aerobic treatment to oxidize odorous compounds or anaerobic treatment to capture sulfides-from those aimed at waterborne odor management within HVAC installations and stand-alone systems. Deployment considerations evaluate the relative merits of single stage arrangements favored for straightforward applications versus multiple stage configurations that deliver layered protection in complex process environments.

From an end-use perspective, odor control applications span cement and metallurgy operations, chemical and petroleum processing, food and beverage facilities, mining and metal extraction sites, power generation centers, pulp and paper mills, rubber processing plants and municipal waste treatment facilities, each segment presenting unique contaminant profiles and regulatory landscapes. Distribution channels range from direct sale models that provide tailored solutions and technical support to retail pathways that offer standardized products with streamlined access, ensuring procurement flexibility across project scales and budgets.

This comprehensive research report categorizes the Odor Control System market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Functionality

- Deployment

- End-use

- Distribution Channel

Mapping Regional Market Dynamics Highlighting Growth Drivers Challenges and Strategic Opportunities across Americas Europe Middle East Africa and Asia Pacific

Regional dynamics in the odor control industry are shaped by distinct regulatory regimes, environmental priorities and industrial end-use concentrations. In the Americas, stringent emission standards and a rapidly growing waste treatment sector are driving demand for high-efficiency carbon and advanced biological systems. North American markets are particularly notable for the pace of regulatory change, compelling early adoption of multi-stage treatment trains and digital monitoring platforms to secure compliance and reduce community impact.

Across Europe, the Middle East and Africa, a diverse regulatory mosaic coexists with concerted efforts toward circular economy principles. European jurisdictions emphasize closed-loop carbon regeneration and low-emission technologies, while Middle Eastern and African markets prioritize robust solutions for petrochemical and mining applications, often under challenging environmental conditions. Collaboration between technology providers and local operators is critical to tailoring solutions to regionally specific contaminant profiles and process constraints.

In the Asia-Pacific region, rapid industrial expansion and urbanization are fueling demand for odor control across food processing, wastewater treatment and municipal infrastructure upgrades. Regulatory frameworks are maturing alongside growth trajectories, leading to a surge in demand for cost-effective, scalable odor management systems. In markets such as China and India, domestic innovation is intersecting with imported technologies to accelerate deployment of both conventional and next-generation solutions.

This comprehensive research report examines key regions that drive the evolution of the Odor Control System market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Examining Leading Industry Players Unveiling Strategic Priorities Competitive Positioning and Collaborative Endeavors Shaping the Future of Odor Management Solutions

Industry leaders are intensifying efforts to differentiate through technology excellence, strategic collaborations and targeted acquisitions. Major players with global footprints are investing heavily in research centers dedicated to next-generation adsorbent materials and process intensification techniques. These activities are often complemented by partnerships with academic institutions and technology startups to accelerate the commercialization of novel media, such as carbon nanotube hybrids and bio-augmented filter matrices.

Several companies are extending their service portfolios to include predictive analytics and remote monitoring, deploying cloud-based platforms that gather operational data from distributed sites. This shift from transactional sales to outcome-based service models underscores a broader trend toward performance guarantees and shared risk frameworks. In parallel, forward-leaning organizations are pursuing joint ventures to establish regional manufacturing hubs, reducing lead times and curbing exposure to trade fluctuations.

Leadership strategies also encompass sustainability roadmaps that align product development with carbon neutrality goals. By integrating lifecycle assessments into design processes, key players are highlighting the environmental credentials of water-recycled carbon solutions and enzymatic odor treatment systems. This holistic approach to innovation and corporate responsibility is becoming a defining factor in competitive positioning.

This comprehensive research report delivers an in-depth overview of the principal market players in the Odor Control System market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AAON, Inc.

- Air Technology Systems Ltd.

- Anguil Environmental Systems, Inc.

- Anua International

- APC Technologies, Inc.

- Babcock & Wilcox Enterprises Inc.

- BioAir Solutions, LLC

- Catalytic Products International

- CECO Environmental Corp.

- DeLoach Industries, Inc.

- Dürr Group

- Ecolab Inc.

- ECS Environmental Systems

- Evoqua Water Technologies LLC by Xylem

- Fogco Environmental Systems

- Integrity Municipal Systems LLC

- IPEC NV by Trevi NV

- OMI Industries

- Ozone India Technology

- Pollution Systems

- Purafil, Inc. by Filtration Group

- Romtec Utilities, Inc.

- SciCorp International Corp.

- STREAMLINE INNOVATIONS, INC.

- Syneco Systems, Inc.

- TANN Corporation by Mayr-Melnhof group

- The CMM Group

- Thermax Limited

- Tholander Ablufttechnik GmbH

- Tri-Mer Corporation

Strategic Action Plan Offering Pragmatic Guidance for Executives to Navigate Regulatory Complexities Technological Advancements and Sustainable Performance Goals

To thrive in an environment defined by regulatory tightening and tariff uncertainty, industry executives must adopt proactive strategies that balance risk mitigation with growth aspirations. First, securing diversified supplier networks that span domestic and global sources will reduce exposure to localized trade disruptions and tariff escalations. Concurrently, investing in in-house capabilities for carbon media regeneration or biological culture propagation can offset material cost pressures and enhance supply resilience.

Technology adoption should be pursued with an eye toward modularity and scalability. Pilot testing of multi-stage treatment configurations and digital monitoring systems will de-risk larger rollouts and refine performance benchmarks tailored to specific operations. Executives are advised to pursue strategic alliances with technology partners to co-develop custom solutions that adhere to increasingly stringent emission limits while preserving operational efficiency.

Finally, embedding sustainability considerations into core business processes will bolster stakeholder confidence and unlock new value streams. By incorporating lifecycle and circular economy principles into product design and service delivery, organizations can position themselves as trusted partners to environmentally conscious end users. This approach not only supports regulatory compliance but also fortifies brand reputation in a market where environmental stewardship is a key differentiator.

Outlining Rigorous Research Methodology Detailing Primary Secondary Data Sources Validation Frameworks and Analytical Techniques Employed in the Study

The findings presented in this report result from a structured research methodology combining primary and secondary data sources with rigorous validation protocols. Secondary research included a thorough review of industry publications, technical journals, regulatory filings and customs data to map historical trends, tariff schedules and emissions guidelines. This desk research provided a foundational understanding of technology diffusion curves, material cost trajectories and regional policy shifts.

Primary research comprised in-depth interviews with senior executives, plant managers and technology developers across multiple sectors. These conversations yielded firsthand perspectives on operational pain points, adoption barriers and strategic priorities. Supplementing expert interviews, a series of surveys was conducted among end-users to quantify preferences related to system functionality, deployment models and service expectations.

Data triangulation and cross-validation techniques were employed to reconcile qualitative insights with quantitative indicators. An iterative review process ensured consistency across findings, while sensitivity analyses assessed the robustness of conclusions under varying tariff, regulatory and supply chain scenarios. The final report reflects this comprehensive approach, delivering actionable intelligence grounded in empirical evidence and sector expertise.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Odor Control System market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Odor Control System Market, by Type

- Odor Control System Market, by Functionality

- Odor Control System Market, by Deployment

- Odor Control System Market, by End-use

- Odor Control System Market, by Distribution Channel

- Odor Control System Market, by Region

- Odor Control System Market, by Group

- Odor Control System Market, by Country

- United States Odor Control System Market

- China Odor Control System Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 954 ]

Concluding Reflections on How Evolving Market Forces and Emerging Innovations Will Define the Next Era of Efficient and Sustainable Odor Control Solutions

As the odor control market enters a phase of rapid transformation, stakeholders must align strategic initiatives with evolving environmental and economic imperatives. The intersection of technological innovation, tightening regulations and shifting trade policies demands a holistic approach to solution development and deployment. Organizations that proactively integrate advanced materials, digital analytics and circular economy practices will be best positioned to meet stakeholder expectations and sustain operational excellence.

Emerging patterns indicate that multi-stage treatment configurations, biological process integration and carbon media regeneration will become foundational elements of leading odor management programs. Executives should remain vigilant of regional policy changes while keeping pace with material science breakthroughs that unlock new performance thresholds. Collaboration across value chains-spanning technology providers, research institutions and end users-will accelerate the translation of scientific advancements into scalable field applications.

Ultimately, the ability to adapt swiftly, innovate responsibly and execute with precision will define market leadership. This report has outlined the critical forces at play and provided a roadmap for navigating complexity. By leveraging the insights herein, decision-makers can chart a course toward sustainable growth and operational resilience in the dynamic realm of odor control solutions.

Take the Next Step by Engaging with Ketan Rohom to Secure Comprehensive Odor Control System Market Research Insights Tailored for Strategic Decision Making

If you are poised to make data-driven decisions that will define your organization’s competitive edge in odor management, the time to act is now. Engaging with Ketan Rohom, who leads Sales & Marketing as Associate Director, will ensure you gain immediate access to a meticulously crafted report that unravels the complex dynamics of odor control system innovations, regulatory trajectories and regional market opportunities. This comprehensive research collection is designed to empower executives with the strategic clarity needed to optimize procurement, accelerate technology adoption and fortify compliance frameworks.

By partnering directly, you will secure privileged insights that extend beyond high-level summaries to reveal granular intelligence on segmentation nuances, supply chain sensitivities, and tariff implications. Whether your focus is on pioneering sustainable carbon filtration solutions or advancing biologically driven odor abatement technologies, this tailored analysis is an indispensable asset. Reach out to Ketan Rohom to finalize your acquisition and position your enterprise to navigate evolving market imperatives with confidence and foresight.

- How big is the Odor Control System Market?

- What is the Odor Control System Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?