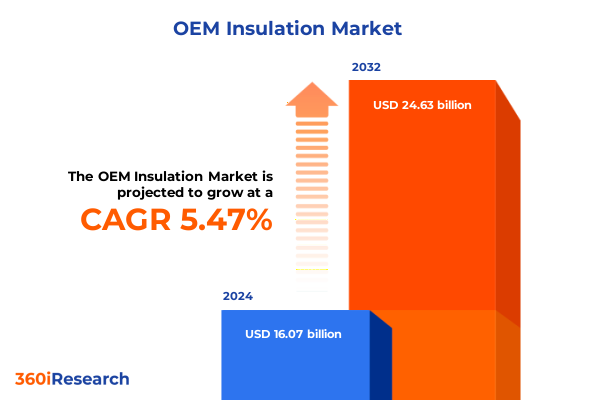

The OEM Insulation Market size was estimated at USD 16.91 billion in 2025 and expected to reach USD 17.80 billion in 2026, at a CAGR of 5.51% to reach USD 24.63 billion by 2032.

Embracing the Evolution of OEM Insulation Solutions in a Rapidly Transforming Industrial and Environmental Landscape Driving Sustainable Growth

In an era defined by accelerating environmental imperatives and intensifying competitive pressures, the role of OEM insulation within modern manufacturing ecosystems has never been more critical. This report embarks on a comprehensive exploration of insulation solutions tailored for original equipment manufacturers, delving into the multifaceted intersections of material innovation, regulatory dynamics, and end-use performance requirements. Against a backdrop of stringent global energy mandates and rising consumer demand for efficiency and sustainability, decision-makers across industries-from aerospace and automotive to electronics and construction-are reevaluating traditional insulation paradigms. Consequently, there is an urgent need to understand how next-generation materials and structures can enhance thermal management, noise attenuation, and fire resistance without compromising weight, assembly time, or cost targets.

Moreover, the scope of this analysis extends beyond pure technical attributes to encompass distribution channels, end-user industry nuances, and regional market trajectories. By weaving together insights on closed and open cell architectures, natural and synthetic fibers, and specialized foams, this introduction lays the groundwork for an integrated perspective. As we transition into detailed discussions on tariff impacts, segmentation patterns, competitive strategies, and actionable recommendations, readers will gain a holistic understanding of how to harness OEM insulation advancements as leverage for sustainable growth and operational resilience.

How Material Innovation Digital Manufacturing and Sustainability Imperatives Are Redefining the OEM Insulation Landscape for Future Competitiveness

The landscape of OEM insulation is witnessing transformative shifts driven by converging technological, environmental, and operational forces. Foremost among these is the accelerating push for sustainable material alternatives, where bio-based fibers and higher-recycled-content formulations are rapidly evolving to meet both regulatory thresholds and corporate decarbonization goals. Consequently, manufacturers are prioritizing closed-loop supply chains, investing in circularity initiatives, and collaborating with material science partners to unlock performance parity with conventional solutions. In parallel, digital manufacturing technologies-ranging from advanced process control to additive manufacturing of complex foam geometries-are enabling precise thermal and acoustic customization at scale.

Concurrently, regulatory bodies worldwide are tightening energy efficiency and fire safety standards for original equipment, prompting OEMs to reassess legacy insulation strategies. This regulatory lens amplifies the importance of comprehensive performance validation protocols and third-party certifications. Furthermore, volatility in global raw material availability, accentuated by geopolitical disruptions and fluctuating commodity prices, is compelling companies to diversify supply networks and build resilient procurement frameworks. Taken together, these shifts are fostering a new era of strategic alignment between OEMs and insulation suppliers, one characterized by co-innovation, data-driven performance benchmarking, and agile product development cycles.

Assessing the Cumulative Effects of 2025 United States Tariffs on OEM Insulation Supply Chains Costs and Strategic Adaptation

The introduction of comprehensive tariffs on key insulation inputs by the United States in early 2025 has exerted a pronounced impact on the OEM insulation ecosystem, from raw material sourcing through to end-product pricing structures. With levies targeting advanced polymer resins, mineral wool precursors, and select natural fibers, many manufacturers have faced elevated landed costs and compressed margins. In response, leading players have intensified efforts to repatriate key segments of their supply chains, forging partnerships with domestic resin producers and fiber recyclers to offset external cost pressures. Consequently, there has been a notable uptick in strategic joint ventures focusing on regionalized compounding and finished component assembly.

Moreover, OEMs reliant on cross-border supply flows have had to recalibrate inventory strategies and renegotiate long-term contracts to mitigate the risk of abrupt tariff escalations. In particular, smaller-scale integrators have explored alternative insulation chemistries-such as polymer-modified mineral wool and enhanced cellulose blends-that remain outside the scope of the latest duties. This phenomenon has accelerated the diversification of product portfolios, enabling suppliers to reprice solutions with higher value-added attributes rather than engaging in purely price-competitive battles. Ultimately, the cumulative effect of these policy measures has strengthened the strategic dialogue around cost-to-value optimization and underscored the importance of agility in procurement and design engineering.

Uncovering Key Segmentation Patterns Across Material Types Structures Applications End User Industries and Distribution Channels in OEM Insulation

Navigating the complexities of the OEM insulation market demands a nuanced appreciation of how performance and cost considerations diverge across multiple segmentation dimensions. From a material type standpoint, traditional cellulose, fiberglass, and mineral wool variants continue to serve broad applications, while emerging interest in natural fiber alternatives-spanning cotton, hemp, and wool-reflects sustainability mandates and niche acoustic requirements. In parallel, the evolution of plastic foam technologies has given rise to differentiated polyisocyanurate, polystyrene, and polyurethane offerings, each calibrated for specific thermal conductivity profiles and structural resilience.

Transitioning to the structural axis, closed cell architectures are increasingly leveraged in scenarios where moisture resistance and compressive strength are paramount, whereas open cell formulations find greater utility in airborne sound control and lightweight applications. Application-level segmentation further delineates solutions optimized for electrical insulation within high-voltage equipment from those engineered for stringent fire resistance benchmarks, while moisture mitigation products continue to gain traction in harsh operational environments. End-user industries exhibit distinct preferences: aerospace and automotive sectors prize high performance-to-weight ratios, building construction prioritizes cost and installation speed, and electronics integration hinges on flame retardancy and dielectric stability. Finally, distribution channels reveal a bifurcation between traditional offline channels favored by established OEMs and burgeoning online platforms that facilitate rapid prototyping supplies and small-batch custom orders. Together, these segmentation insights inform targeted product development roadmaps and go-to-market strategies formulated to address specific performance thresholds and procurement behaviours.

This comprehensive research report categorizes the OEM Insulation market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Material Type

- Insulation Structure

- Application

- End User Industries

- Distribution Channel

Exploring Regional Dynamics and Growth Drivers in the Americas Europe Middle East Africa and Asia Pacific OEM Insulation Markets

Regional dynamics in the OEM insulation space underscore the interplay between economic maturity, regulatory frameworks, and industry focal points across the Americas, Europe Middle East & Africa, and Asia Pacific. In the Americas, robust demand from automotive and construction integrators is anchored by retrofit incentives and sustainability targets, fostering growth in both traditional fiberglass systems and high-performance foam variants. Additionally, North American manufacturers are capitalizing on localized resin sourcing and advanced process controls to mitigate supply chain disruptions and escalate throughput efficiencies.

Transitioning across the Atlantic, the Europe Middle East & Africa region is shaped by some of the world’s most stringent energy efficiency directives and fire safety mandates, compelling OEMs to validate insulation performance against a rigorous testing regime. This regulatory rigor has accelerated the adoption of natural fiber composites in European manufacturing hubs and spurred innovative cross-industry collaborations in the Middle East’s burgeoning aerospace sector. Meanwhile, Africa’s infrastructure modernization initiatives are driving nascent opportunities for both off-grid environmental control and moisture-resistant systems.

In the Asia Pacific domain, sustained investment in large-scale electronics manufacturing, automotive assembly, and residential construction has translated into high-volume procurement of closed and open cell foams. Cost sensitivity remains a defining characteristic in many APAC markets, prompting suppliers to tailor formulations that balance minimal material usage with adequate thermal and acoustic performance. Collectively, these regional insights reinforce the importance of localized product configurations and regulatory alignment to capture growth pockets and secure long-term partnerships.

This comprehensive research report examines key regions that drive the evolution of the OEM Insulation market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Examining Strategic Initiatives and Competitive Positioning of Leading OEM Insulation Manufacturers Driving Market Advancement

Leading manufacturers in the OEM insulation arena are deploying an array of strategic initiatives to fortify their market positions and address evolving customer demands. One prominent trend is the concerted investment in sustainable product lines, where incumbents are reformulating fiberglass and mineral wool to incorporate higher recycled content without compromising thermal integrity. Parallel to this, several tier-one providers have established dedicated innovation centers to accelerate the commercialization of advanced polymer foams featuring enhanced fire retardancy and reduced global warming potential.

Furthermore, strategic collaborations between insulation suppliers and OEM platforms are increasingly commonplace, enabling early-stage integration of material properties within design cycles. This co-development model not only shortens time-to-market but also fosters the creation of modular insulation assemblies that simplify installation and improve in-service durability. On the operational front, digital twin technologies and machine learning-driven process analytics are being harnessed to optimize manufacturing efficiencies, minimize scrap rates, and ensure consistent quality across production runs. Collectively, these corporate manoeuvres underscore the competitive imperative to balance sustainability, cost-effectiveness, and technical differentiation in an industry where performance margins can be razor-thin.

This comprehensive research report delivers an in-depth overview of the principal market players in the OEM Insulation market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 3M Company

- ACH Foam Technologies LLC

- Anco Products Inc

- Armacell International S.A

- Aspen Aerogels, Inc.

- Autex Industries Ltd

- Big Sky Insulations

- BorgWarner Inc.

- Compagnie de Saint-Gobain S.A.

- Covestro AG

- DuPont de Nemours, Inc.

- Huntsman International LLC

- Johns Manville Corporation

- Knauf Insulation

- Morgan Advanced Materials

- Owens Corning

- Paroc Group Oy

- Rockwool Group

- Scott Industries LLC

- Superglass Insulation Ltd

- Tenneco Inc.

- Triumph Group Inc

Implementable Strategies and Best Practices for Industry Leaders to Navigate Evolving OEM Insulation Challenges and Opportunities

Industry leaders seeking to capitalize on the dynamic OEM insulation landscape should adopt a multi-faceted approach that aligns material innovation, operational excellence, and collaborative ecosystems. First, directing research and development efforts toward bio-based and recycled fiber systems can unlock sustainable differentiation while mitigating exposure to tariff-induced cost shocks. Concurrently, forging strategic partnerships with digital solution providers will enable end-to-end visibility over production workflows, thereby accelerating continuous improvement and reducing time-to-market.

Moreover, it is imperative to diversify raw material sources through dual-sourcing agreements and regional compounding hubs, which can enhance supply chain resilience in the face of geopolitical volatility. From a product strategy perspective, introducing modular insulation platforms that permit easy customization for targeted applications-ranging from high-temperature electronics enclosures to vibration-dampening automotive interiors-will resonate with OEMs demanding agility. Additionally, engaging proactively with regulatory bodies and certification entities can streamline compliance validation and bolster customer confidence. By integrating these tactics into a unified roadmap, organizations can navigate evolving market pressures, seize emerging opportunities, and deliver value propositions that endure beyond short-term cost considerations.

Detailing the Comprehensive Research Framework Expert Consultations Data Triangulation and Analytical Rigor Underpinning OEM Insulation Insights

The insights presented in this report stem from a rigorous multi-step research framework designed to ensure analytical depth and empirical reliability. Initially, an exhaustive secondary review of industry literature, patent filings, regulatory databases, and technical white papers established a foundational understanding of material developments, performance testing protocols, and global policy drivers. This desk research was complemented by in-depth interviews with over twenty OEM engineers, material scientists, and procurement executives, providing practical perspectives on current pain points and innovation priorities.

To validate emerging hypotheses, a structured data triangulation process was employed, aligning findings from trade association publications, customs and tariff records, and proprietary manufacturing output statistics. Quantitative insights were refined through targeted surveys of insulation integrators and distribution channel partners, ensuring a balanced representation of both large OEMs and specialized artisans. Throughout the project, a cross-functional steering committee conducted periodic peer reviews, guaranteeing methodological consistency and the elimination of bias. Finally, thematic workshops with subject-matter experts enabled iterative refinement of segmentation frameworks, regional analyses, and strategic recommendations, culminating in a research deliverable that reflects the latest industry realities and actionable intelligence for decision-makers.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our OEM Insulation market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- OEM Insulation Market, by Material Type

- OEM Insulation Market, by Insulation Structure

- OEM Insulation Market, by Application

- OEM Insulation Market, by End User Industries

- OEM Insulation Market, by Distribution Channel

- OEM Insulation Market, by Region

- OEM Insulation Market, by Group

- OEM Insulation Market, by Country

- United States OEM Insulation Market

- China OEM Insulation Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1272 ]

Synthesizing Key OEM Insulation Findings Implications and Strategic Pathways for Future Innovation Market Resilience and Sustainable Growth

As OEMs and material suppliers navigate an increasingly complex insulation landscape, several unifying themes emerge. Sustainability considerations are no longer ancillary; they underpin product roadmaps and influence strategic partnerships. Concurrently, tariff fluctuations and supply chain disruptions have highlighted the necessity for regional diversification and agile procurement models. On the innovation front, digital manufacturing and modular design approaches are accelerating the pace at which new insulation architectures transition from laboratory to production line. Taken together, these developments point toward an industry in flux but rife with opportunity for those willing to embrace cross-disciplinary collaboration and invest in advanced material platforms.

Looking forward, organizations that balance rigorous performance validation with the agility to adopt emerging chemistries and manufacturing technologies will secure competitive advantage. Moreover, proactive engagement with regulatory bodies and ecosystem partners will streamline compliance cycles and foster the co-creation of next-generation insulation standards. Ultimately, by aligning strategic intent with operational capabilities-and by leveraging the segmentation, regional, and competitive insights detailed in this report-industry stakeholders can chart a course toward enhanced energy efficiency, risk mitigation, and sustainable growth in the OEM insulation sphere.

Unlock In Depth OEM Insulation Market Intelligence by Partnering with Ketan Rohom Associate Director Sales and Marketing for a Tailored Research Investment

For bespoke insights tailored to your strategic imperatives and to gain unparalleled visibility into emerging OEM insulation trends, reach out directly to Ketan Rohom, Associate Director of Sales & Marketing. His deep sector expertise and consultative approach ensure you secure the right scope of analysis and customized deliverables that align with your organizational priorities. By engaging with Ketan, you will receive comprehensive guidance on licensing options, competitive intelligence add-ons, and ongoing advisory services to maximize the value of your investment. Initiating this dialogue is the fastest route to equipping your teams with actionable data and exclusive recommendations that drive innovation, mitigate risk, and unlock new growth pathways. Contact Ketan Rohom today to transform high-level research into tangible outcomes and to position your enterprise at the forefront of the OEM insulation market evolution.

- How big is the OEM Insulation Market?

- What is the OEM Insulation Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?